Compounder Stocks that could be the next Amazon?

Companies such as Amazon that can generate double-digit compound growth in both revenue and earnings, year after year are rarities. Growth investors looking for the next Amazon seek to identify companies capable of generating double-digit compound growth, ideally in both revenue and earnings for years to come.

I ran a quick scanner using the Stock Rover platform to find out which are the companies that have consistently generated both revenue and earnings growth over the past 5 years. This scan included 2020, a watershed year that saw companies’ earnings being decimated by COVID-19. To be able to generate both revenue and earnings growth in 2020 is no small feat.

Stock Rover

The best Stock Screening platform to identify gems to buy for your portfolio. Check out our comprehensive review on the platform below

Additional criteria also included earnings growth required for 2021 and 2022.

The 5 largest market cap companies which met these criteria are 1) Amazon, 2) PayPal, 3) ASML Holdings, 4) Adobe and 5) Netflix

All 5 companies are likely household names that the man in the street is probably familiar with, the exception being ASML, the only non-consumer focus stock in the list. For those who are not familiar with ASML, the company is a leading manufacturer of photolithography systems used in the manufacturing of semiconductors and a key beneficiary of the current semiconductor chip shortage scenario, with demand for its EUV lithography tools sky-rocketing.

However, in this article, I am NOT looking to focus on well-known stocks such as those 5 highlighted above which are already mega-cap stocks. What I will like to find are possibly 5 consumer-related stocks with a market cap below USD$13bn that fit the below criteria:

- Revenue growth for each of the past 5 years

- EPS growth for each of the past 5 years

- Double-digit revenue CAGR over the past 5 years

- Double-digit EPS CAGR over the past 5 years

- Forecasted EPS growth rate in 2021 > 10%

- Forecasted EPS growth rate in 2022 > 10%

The above screening criteria will eliminate many growth stocks which are currently loss-making or just turn profitable.

I will be focusing only on consumer-related stocks. Many of the names highlighted in the list are probably alien to most, considering that their market cap is currently < USD$13bn. However, these stocks have demonstrated that they are capable of generating compound growth in both revenue and earnings over the past 5-years, with the street equally confident that that growth can be sustained at least over the next 2 years.

Buying into these small-cap revenue and earnings compounder stocks could potentially reap strong returns over the coming years. This is by no means a recommendation to buy these stocks. Readers should always conduct their due diligence, particularly when purchasing non-blue-chip, small-cap stocks like those highlighted in the list.

Without further ado, here are the 5 revenue and earnings compounder stocks that could be the next Amazon.

Compounder Stocks #1: Baozun (BZUN)

Sales 5-year Average (%): 27.3%

EPS 5-year Average: 67.9%

EPS growth 2020 estimate: 26.4%

EPS growth 2021 estimate: 41.4%

Running a very similar business to Amazon, Baozun Inc is an e-commerce service partner that helps brands execute their e-commerce strategies in China by selling their goods directly to customers online or by providing services to assist with their e-commerce operations.

Its integrated end-to-end brand e-commerce capabilities encompass all aspects of the e-commerce value chain, covering IT solutions, store operations, digital marketing, customer services, warehousing and fulfillment. It delivers omnichannel solutions to create a shopping experience across various touchpoints online and offline.

Baozun is often seen as a smaller version of JD.com, which is one of the market leaders in the e-commerce arena after Alibaba.

Like many of the China stocks listed in the US, Baozun saw its share price crumbled of late, with its price down 36% on a YTD basis. This could be seen as an opportunity to nibble into this fast-growing earnings compounder, one where its EPS grew by an average annual rate of 68% over the past 5 years.

Looking ahead, the street remains pretty optimistic of Baozun’s growth trajectory and expects the company to continue delivering double-digit EPS growth over the next 2-years.

Compounder Stocks #2: M/I Homes (MHO)

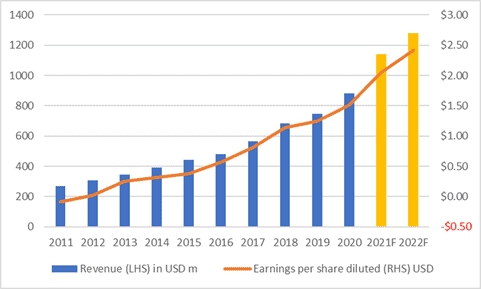

Sales 5-year Average (%): 17.8%

EPS 5-year Average: 46.1%

EPS growth 2020 estimate: 33.8%

EPS growth 2021 estimate: 10.1%

M/I Homes Inc is an American construction company that focuses on residential construction.

It consists of two distinct operations: homebuilding and financial services.

The homebuilding operations are spread into the Midwest, Mid-Atlantic and Southern regions and the financial services operations support homebuilding operations by providing mortgage loans and title services to the customers of homebuilding operations.

The homebuilding operations comprise the most significant portion of the revenue. The company builds homes and communities that target entry-level, move-up, and luxury homebuyers.

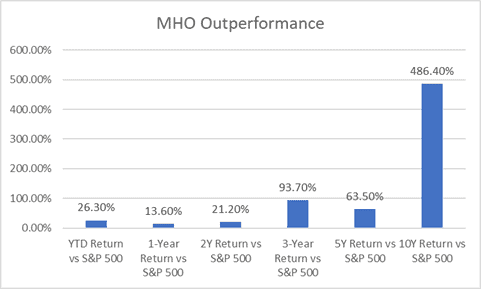

M/I Homes was listed in 1993 and over the past 10-years, this company has been a major price outperformer vs. the S&P 500, generating returns of 486% above the key US index.

Compounder Stocks #3: Medifast (MED)

Sales 5-year Average (%): 36.2%

EPS 5-year Average: 54.9%

EPS growth 2020 estimate: 57.9%

EPS growth 2021 estimate: 21.1%

Medifast Inc is a US-based company that produces, distributes and sells products concerning weight loss, weight management, and healthy living.

The company generates its revenue from point-of-sale transactions executed over an e-commerce platform for weight loss, weight management, and other consumable health and nutritional products.

In addition to being a consistent revenue and earnings compounder, the company has also been steadily growing its free cash flow, with its free cash flow CAGR at close to 29% over the past 10-years.

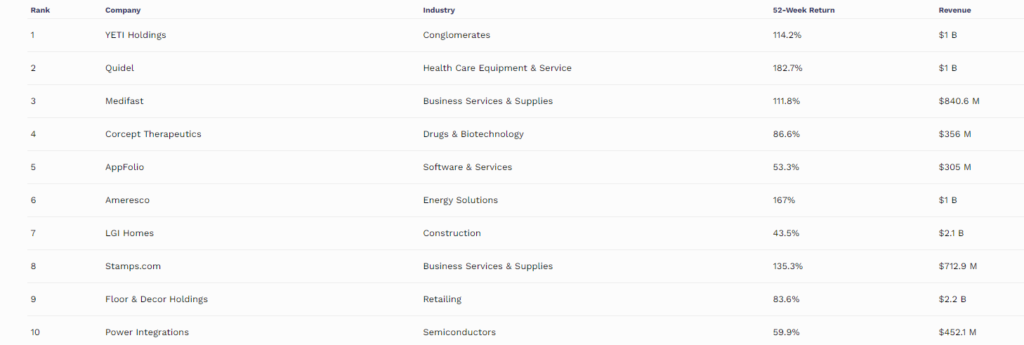

Being a multi-level marketing company, there might be a “stigma” associated with such companies as being “scams”, one where the company is not product-focus but sales-focus. Nonetheless, this is a company that was ranked as 2021 3rd best mid-size companies in America by Forbes, with the first 2 being YETI Holdings and Quidel.

Compounder Stocks #4: Innovative Industrial (IIPR)

Sales 3-year Average (%): 154.1%

EPS 3-year Average: 107.7%

EPS growth 2020 estimate: 43.6%

EPS growth 2021 estimate: 37.4%

Innovative Industrial Properties Inc is a real estate investment trust engaged in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities.

It conducts its business through a traditional umbrella partnership real estate investment trust, or UPREIT structure, in which properties are owned by Operating Partnership, directly or through subsidiaries.

IIPR is the only stock in this list with less than 5-years of operating track record, with its IPO in late 2016. Nonetheless, this is one stock that has generated a return of 1300% since its listing, crushing the S&P 500 returns of 123% over the same horizon.

For investors looking at a “safer” alternative to gain exposure in the fast-growing cannabis market in the US, this counter might just be the right one for you.

Compounder Stocks #5: Trex (TREX)

Sales 5-year Average (%): 17.1%

EPS 5-year Average: 28.1%

EPS growth 2020 estimate: 34.9%

EPS growth 2021 estimate: 18%

Trex Co Inc is a manufacturer of wooden alternative-decking products.

The company offers outdoor products in the decking, railing, porch, fencing, trim, steel deck framing, and outdoor lighting categories. Its products are sold under the Trex brand and manufactured in the United States.

Further, the company licenses its Trex brand to third parties to manufacture and sell products under the Trex trademark. The distribution is focused on wholesale distributors and retail lumber dealers, which in turn sell Trex products to homeowners and contractors, with an emphasis on professional contractors, remodelers, and homebuilders.

TREX is also one of the companies identified by Forbes as American’s best mid-sized companies to own, ranked 12th in the list.

TREX is likely a beneficiary of the current housing boom in the US, which has helped the company to grow its EPS by 22% in 2020, a year where many companies saw substantial earnings decline as a result of COVID-19. The street expects another strong EPS growth (> 20%) performance by the company in 2021.

Conclusion

If one has a crystal ball and bought into these 5 stocks since the start of 2017, one would have generated a return of 648% over this period vs. the S&P 500 return of 117%.

Nonetheless, these 5 stocks, which are all trading at less than $13bn market cap, can continue to witness stronger share price appreciation over the coming years if they can maintain their revenue and earnings compounding performance.

Except for Baozun (impacted by China negative sentiments), the remaining 4 small-cap compounder stocks in this list have managed to outperform the S&P 500 on a YTD basis, with MHO generating an outperformance of 26% vs. the S&P 500.

MHO is also a counter that currently has a positive GAT signal by the TGPS platform. For those who are interested in finding out more about the TGPS proprietary trading platform developed by Collin Seow, there is a free upcoming online session where Collin will demonstrate how to select strong trending counters to trade using the TGPS platform.

The Systematic Trader

Ranked as the best trading course by Seedly, The systematic Trader uses the proprietary platform, TradersGPS to identify for you the RIGHT stock to buy at the RIGHT time.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only