Is this cooling measure going to be like 2013 or 2018?

The talk of the town in sunny Singapore over the past couple of days has been the fact that new property cooling measures were announced by the government to cool the private residential and HDB resale markets.

With these new measures in place, should you still be rushing to buy your private property? Will prices correct significantly, thus marking the start of the next property downturn, similar to 2013? Or will it be like in 2018 where property prices continue to appreciate despite the cooling measures introduced?

I look to provide some context on the latest measures, how the conclusion might differ from the 2013/2018 cooling measures as well as my course of action as a potential property buyer.

Cooling Measures 2021

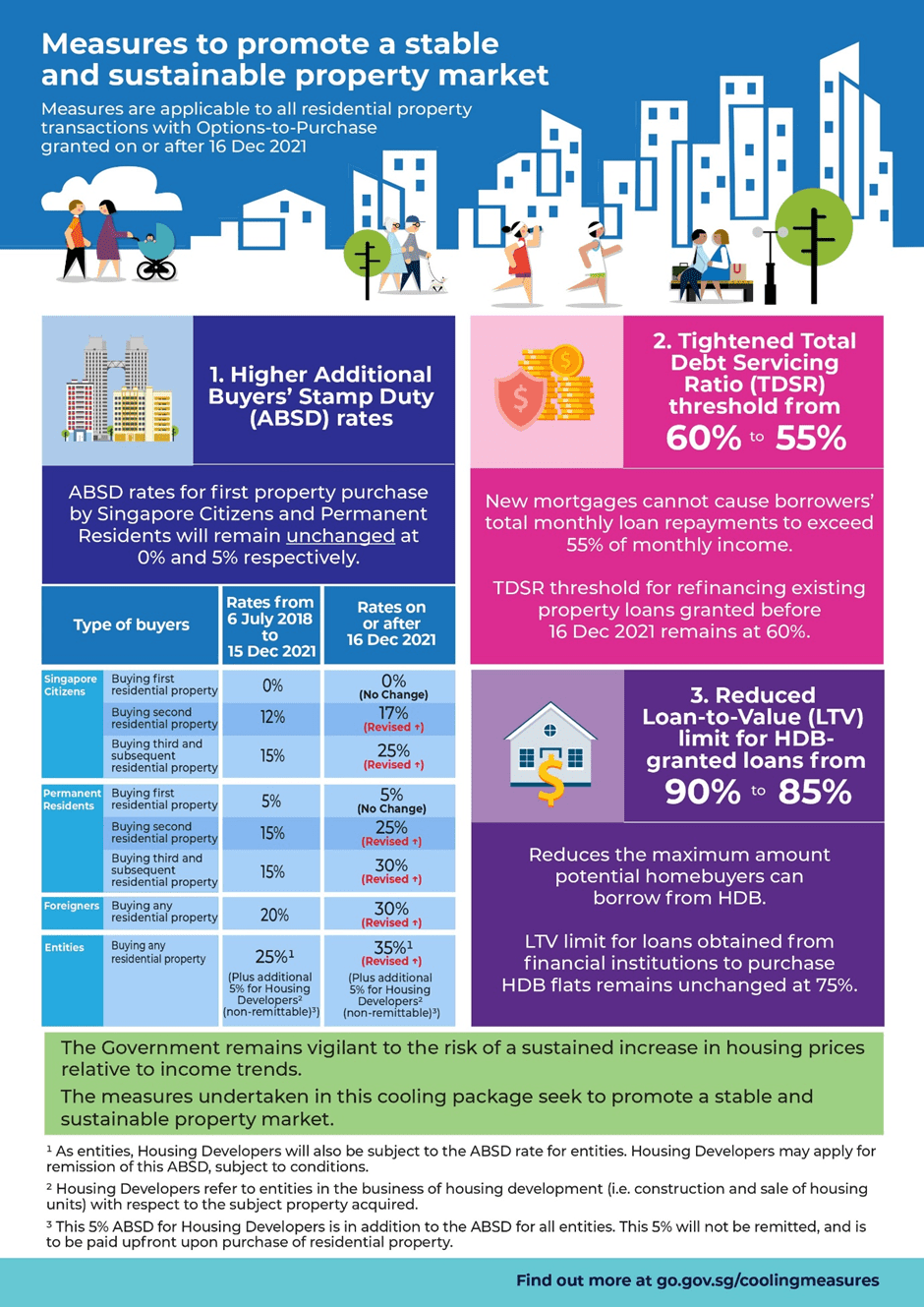

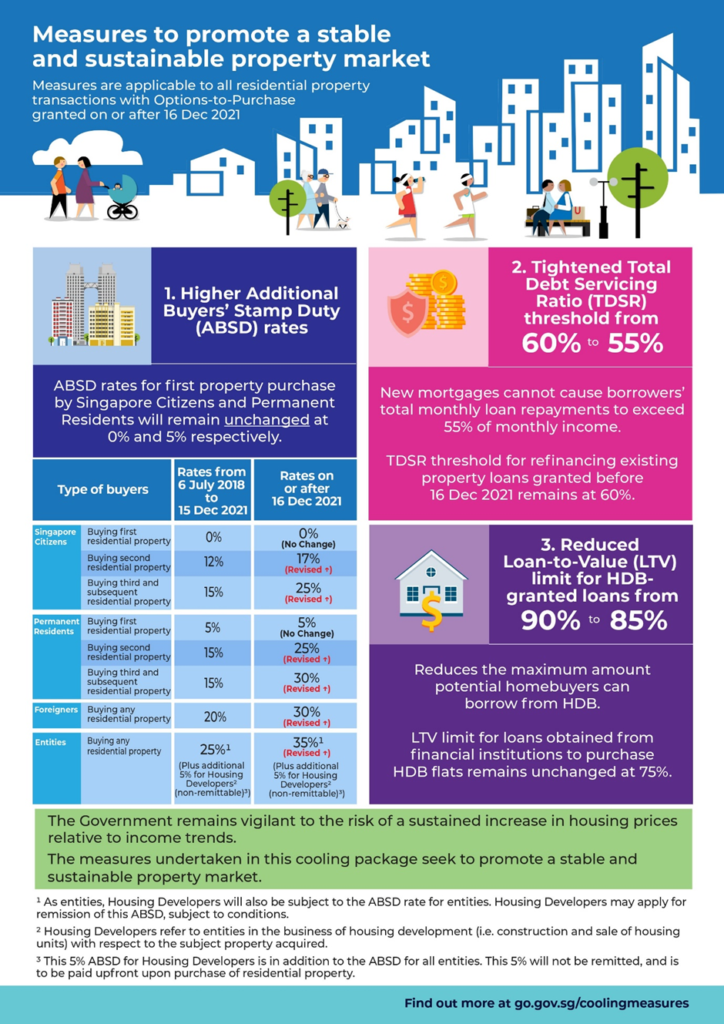

The measures are aptly summarized as:

- Higher Additional Buyers’ Stamp Duty (ABSD) rates where rates for Singaporeans looking to purchase their second property will increase from 12% to 17% and their 3rd and more properties will increase from 15% to 25%. For Singaporeans buying their first residential property, it will remain unchanged at 0%.

- The Total Debt Servicing Ratio (TDSR) threshold will decline from 60% to 55%. This means that new mortgages cannot cause borrowers’ total monthly loan repayments to exceed 55% of their monthly income. We will take a closer look at this TDSR ratio decline to see how restrictive it might be for buyers.

- Reduced loan-to-value (LTV) limit for HDB granted loans from 90% to 85%. This reduces the maximum amount potential homebuyers can borrow from HDB, where the HDB loan rate is currently fixed at 2.6%/annum. For buyers seeking loans from banks, the LTV limit for loans remains unchanged at 75%.

Do check out the infographics below from go.gov.sg

The above additional cooling measures were announced on 15 Dec 2021 just before 11.40 pm, with the late announcement likely to prevent potential buyers from rushing to exercise their OTP to meet the midnight deadline, with these measures being effective on or after 16 Dec 2021.

These measures were taken by the government to likely moderate property price increment, with private housing prices rising by 9% since 1Q21 and HDB resale values at 15% over the same horizon.

The strong rise in private property and HDB resale values have been partly attributed to the low-interest-rate environment as well as COVID-19 forcing potential BTO buyers to turn to the resale market as a result of a long lead time for new HDB completion.

The government decided that now is the right time to implement these changes in lieu of potential interest rate increment in the coming. Here in Singapore, the government typically doesn’t control interest rates but focuses solely on controlling exchange rates to regulate the country’s economic growth.

That means that interest rates here in Singapore typically mimic the movement of foreign interest rates, particularly that of US interest rates. That means that if the Fed intends to raise interest rates aggressively in 2022, with the latest Fed announcement committing to raise the Fed fund rates three times in 2022, it is highly likely that Singapore rates will follow suit as well.

This means that the days of getting < 1% interest cost on your property loans are likely over, with future rates likely to be closer to 2% (or more).

Higher mortgage rates could translate to lower affordability and project profitability, ultimately crimping demand.

How restrictive are the current cooling measures?

ABSD

The higher ABSD will undoubtedly look to reduce demand for 2nd property purchases, particularly for foreigners where the ABSD is now at 30%. Noted, however, that foreign purchases account for a smaller percentage in terms of demand vs. local purchases.

For Singapore and PRs, the increase in ABSD for 2nd property purchases and more increase from 42%-67%, which is pretty substantial.

However, for most Singaporean couples, a key strategy has been to “decouple” to avoid paying this ABSD in the first place.

This is something that their property agent would have highlighted to them to avoid paying the 12% ABSD. Let’s look at a quick illustration.

Let’s take, for example, a couple just sold their BTO and decide to upgrade to private property. Instead of purchasing the private property as a joint owner (aka 50:50 ownership), it can be structured as an owner: occupier structure where the husband can be the owner and the wife the occupier.

Thus effectively, only one name is being used in this purchase and the wife is free to use her name to purchase a second private property (her first under her name), thus the couple can effectively own 2 private properties without the need of paying for the 12% ABSD.

Such a structure can potentially also allow both husband and wife to use both their CPF monies to fund the 1st property (under the husband name) as well as co-finance the mortgage loan, before the purchase of the 2nd property.

Hence, while the ABSD increment might have some impact on private property demand from an investment angle unless this “loop-hole” is closed to prevent a couple from “going around” the payment of ABSD, it might not be that effective as a cooling measure.

Overall, I sense that the higher ABSD will likely curtail some foreign buying demand on high-end properties but unlikely to have that much of an impact on locals, particularly the savvier ones which have already “decoupled” to avoid the ABSD payment.

TDSR

The TDSR might be slightly more restrictive vs. the ABSD as a form of cooling measure in my humble view. The TDSR ratio is now reduced to 55% from the original 60%. This means that the borrowers’ monthly loan repayments now cannot exceed 55% of their monthly income.

Let’s take for example that the wife (from the previous example) is now looking to purchase their 2nd property and her monthly gross income is $5,620. Assuming she has no other loans besides this mortgage loan.

Using the following assumptions:

- Mortgage cost at 3.5% (interest rate for TDSR computation)

- Loan horizon 30 years

- No other outstanding loans

- 75% loan amount

Under the previous TDSR of 60%, her income of $5,620 has a TDSR limit of approx. $3,372 (60%) and this will allow her to purchase a $1m property with a maximum loan amount of $750k.

However, under the new TDSR ratio of 55%, her TDSR limit is now $3,091 (55%) and this will allow her to purchase a property worth c.$917k with a maximum loan amount of approx. $688k. This is approx. a $62k reduction in the loan amount. For her to purchase a $1m property, that means she is required to fork out this $62k in cash.

This additional cash requirement, on top of the 25% down payment plus buyer’s stamp duty is likely to add on to her upfront capital requirement and might be restrictive in a sense.

This new TDSR might be more restrictive for someone who is earning approx. $6k on a monthly gross income basis, like in this example, where the max property value amounts to only $1m.

Most private properties in Singapore of a decent size are now priced over $1m.

For an investor who is generating a higher income such as closer to $10k on a gross monthly income basis, he/she can afford a max $1.78m property based on the 60% ratio, dipping to max $1.63m based on the new 55% ratio, still having the option to purchase a wide variety of properties.

If he/she is looking to purchase a $1m quantum property, there is essentially ZERO impact based on the change in the TDSR rule for him/her (more on this later).

Hence, this TDSR adjustment will be more sensitive for a middle-income earner vs. a high-income earner.

LTV decline for HDB loans

While the government has “tampered” with the ABSD and TDSR numbers in previous cooling measures, this is the very first time in a long while that revision were made to the LTV for HDB loans.

Back in 2010 where the first cooling measures were introduced to the public, no changes were made to the LTV for HDB loans (remains at 90%) while loans disbursed by financial institutions saw their ratio dropping to 80% in early 2010.

This is hence the very first time that changes were made to the HDB LTV amount where the maximum loan amount is now capped at 85% vs. the original 90%.

This is likely to address the fact that HDB resale prices have been escalating rather quickly in 2021, with news of million-dollar HDB resale transactions hitting the headlines almost every month.

By reducing the loan amount that an HDB buyer can borrow, this might have the effect of slowing down the rapid HDB price increment seen in recent months.

The 5% impact, however, is unlikely to be very significant in my view, with the more restrictive measure being the mortgage servicing ratio (MSR) which caps the monthly loan repayment amount to 30% of the borrower’s gross monthly income.

Is this going to be a repeat of 2013 or 2018?

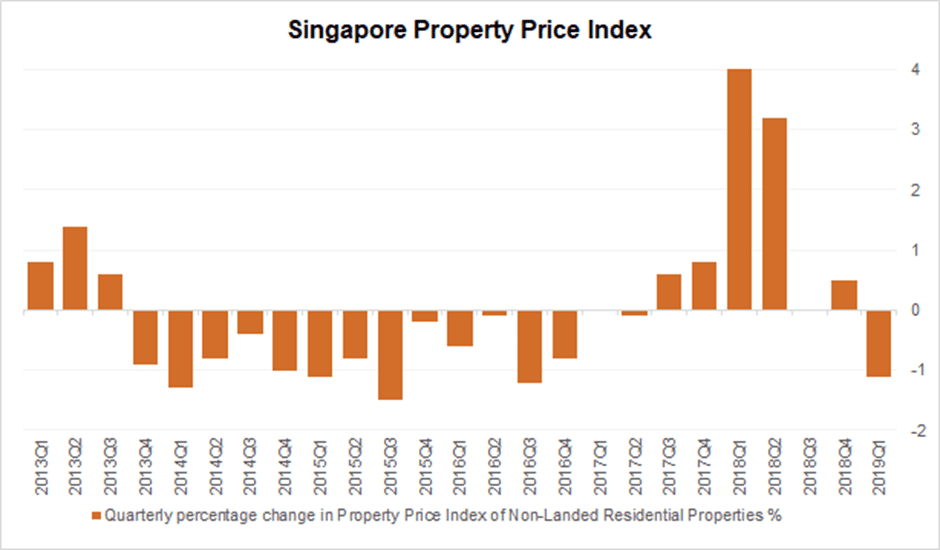

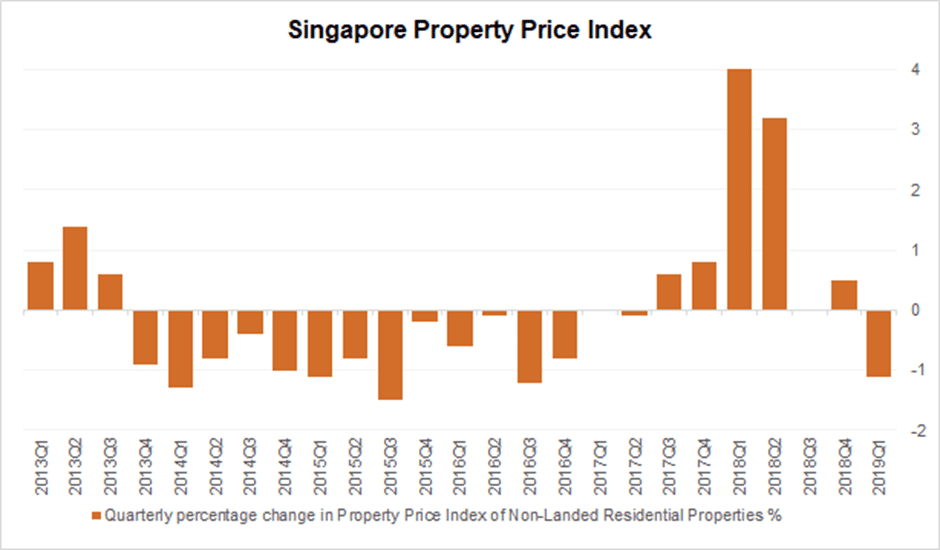

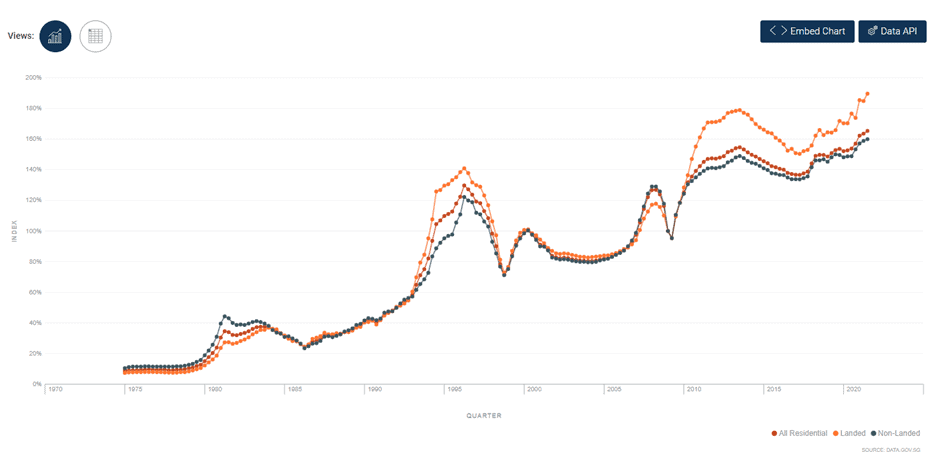

The cooling measures that were introduced in 2013 and 2018 led to very different conclusions. The 2013 cooling measures resulted in property price declines almost every quarter till it bottomed out in mid-2017 whereas the 2018 cooling measures (introduced in 2Q18) only impacted property prices for 3 quarters before rebounding strongly in 2Q19.

2013 Cooling Measures

Clearly, the 2013 cooling measures achieved their impact while the 2018 measures did not. Why was there such a discrepancy?

To be honest, I have got no clear answers to that question. The TDSR was first introduced in 2Q13, limiting borrowers’ monthly debt repayments to no more than 60% of their gross monthly income.

That had an impact on limiting the leverage amount for private property prices. Similarly, for the MSR (Mortgage servicing ratio) which impacts HDB and ECs, those ratios were progressively reduced from 40% to 30% in 2013.

The introduction of the TDSR plus more stringent ratios for MSR had a detrimental impact on both HDBs/ECs and private property prices which lasted for 3-4 years.

2018 Cooling Measures

In 2018, the key cooling measures were the increase of the ABSD by 5 percentage points as well as tightening the LTV limits for housing loans granted by financial institutions by 5 percentage points.

The 2018 cooling measures did indeed “cool” the market, as sales volume plunged by almost half over the next 12 months and price appreciation tapered significantly in 2H18 vs. 1H18.

However, from 2Q19 onwards, property prices started to recover. The “downturn” this time round seems relatively non-consequential vs. what happened back in 2013.

This seems counter-intuitive to what the government’s intention was, where they introduced the cooling measures to cool the market (particularly the red-hot en-bloc market happening at that time), not accelerate its price appreciation.

There were reports however which stated that if the government did not step in with its 2018 cooling measures, the price increase would have been even more pronounced, according to Lawrence Wong.

A key difference between both the 2013 and 2018 cooling measures was that the 2013 cooling measures were introduced when the property market was at all-time high (just like the current situation) whereas the 2018 cooling measures were introduced nearer to the trough in 2017 (although the prior 2 quarters saw strong price appreciation)

The price appreciation continues to gain momentum in 2Q19 with strong take-up from new launches such as Amber Park and Coastline Residences.

The fact that even COVID-19 did not derail the rise in property prices could potentially be attributed to the low-interest rate environment encouraging “cheap” mortgage loans as well as limited completed projects entering the market (greater demand vs. supply) as I have blogged about previously.

So, is these latest cooling measures going to be like 2013 or 2018?

2021 Cooling Measures

While there is no adjustment made to the LTV for loans for private property (remain at 75%) this time around, the reduction in TDSR will also have a similar effect of reducing the leverage amount.

Take for example a $1m property which I highlighted earlier, the TDSR reduction from 60% to 55% will reduce the loan amount by $62k. If the LTV is to be reduced to 70%, the loan amount would decline by only $50k. So, the new measure changing the TDSR might be more restrictive vs. directly affecting the loan amount through the LTV.

However, for a high-income earner generating $10k/month who is also looking to purchase that same $1m property, the TDSR is not a limiting factor as his/her TDSR limit is more than the monthly mortgage payment on that $750k loan. In this case, there is no decline in leverage ability (can still get $750k loan for a $1m property) vs. a direct reduction in LTV ratio (loan amount reduced to $700k in the event LTV drops from 75% to 70%).

I sense that this time around, the uptrend in property prices might face slightly greater headwinds vs. 2018 although I am not implying that an outright correction is going to happen like in 2013. It might be something in-between those two scenarios.

Let me share my rationale. Let’s take a look at the potential “negatives”.

First off is the fact that interest rates are definitely on the rise and could rise pretty quickly if inflationary pressure rears its ugly head. This might be the “black swan” event that is likely understated.

While the Fed has committed to raising interest rates 3x in 2022, this is not because the economy is growing “fantastically well” which justifies the rate increment but more because it needs to tame the inflation beast, a faster than expected rate increment (4 or more times in 2022) could translate to higher mortgage commitments and taper demand for property purchases here in Singapore as well.

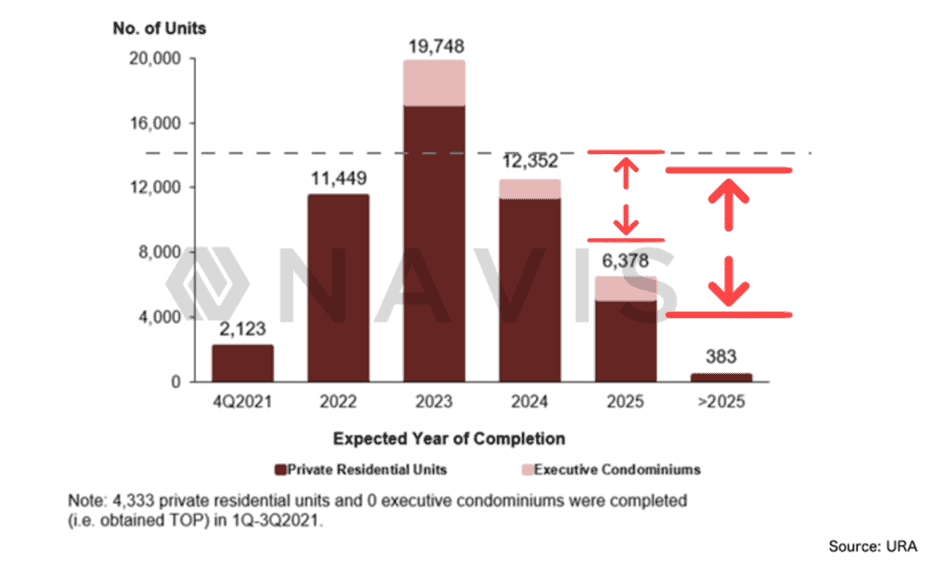

Second, the number of completed projects coming on-stream will likely start increasing, with 2021 likely marking the bottom in terms of completed projects. This will have the impact of increasing the overall supply.

According to Navis Research projections using data from URA, the total number of units achieving TOP in 2022 and 2013 will likely amount to a massive 11,449 and 19,748 respectively, vs. the 4,000-5000+ units in 2021.

That could trigger some concerns over short-term over-supply, particularly in the private property arena although Navis Research believes that the medium-term supply outlook remains positive for the private property market.

Third, I believe that the government is very clear in their intention that they do not want to see prices appreciating like what they have been over the past 3-4 quarters. Hence, one should not be expecting a similar magnitude of price increments like what we have witnessed over the past year.

If prices continue to increase “aggressively”, you can be sure that they will step in with more cooling measures.

A gradual appreciation of 1%/quarter is likely still acceptable and probably the ideal scenario.

Next, let’s take a look at the “positives”.

One of the major reasons why the property market has done so well over the past 1-2 years is due to supply/demand mismatch.

Completion of projects (both HDB and private) has slowed down significantly as a result of COVID-19-linked labor shortages. This has resulted in a mismatch of supply vs. demand, although the limitation of foreigners into Singapore has helped moderate that skew to some extent.

While the government has committed to increasing the supply of BTO flats over the coming years to address supply issues, this is unlikely to be a short-term “problem solver”. Immediate demand for new BTO flats will still be very strong and if this demand cannot be met, they will likely turn to the resale HDB market (which they have done for the past year), thus bolstering prices in that segment.

Second, why I think the probability of a 2013-like downturn is low is because there are plenty of “heating” measures to reinflate the property market when the government finds it appropriate. Compared to the stock market which is pretty much “out of their control”, the government now has plenty of ammunitions to “heat-up” the property market if required.

It is not their intention to see a sizable correction in the property market which might be another problem for Singaporeans, many of whom are still struggling with the effect of COVID-19.

Time will tell if this new round of measures will spur a greater price increase or will it cause the current robust property market to lose steam and mark the start of a new property downcycle.

My spidey senses tell me that prices could remain stagnant, with minor price movements (either up or down) in 2022 as demand for housing remains strong vs. supply. However, that situation could change in 2023 with a more downside bias as supply ramps up significantly (particularly on the private front) and with interest rates likely being at a much higher level.

A drastic spike in interest rates in 2022 will likely be pretty detrimental to the Singapore property market. That to me is the “black swan” event that has seen its probability spike of late.

I might, however, be wrong in my assessment here, particularly if demand for housing remains extremely robust and an interest rate hike is slower than initial expectations.

What is my course of action as a potential property buyer?

I am hoping that a major price correction happens (please don’t stone me) that will allow me to buy my next property at a better price.

However, realistically, I believe that a major price correction of 15-20% in the Singapore property market is highly unlikely. While the current market peak resembles more of the 2013 scenario vs. the 2018 scenario, there are more stringent cooling measures now vs. 2013 which ensures an over-leveraging scenario does not happen.

Singaporeans are also more well-off now although the counter-argument could be that property prices are also much more expensive now vs. in 2013.

My expectation is for some price weakness to materialize over the next couple of years. I might be wrong and the price could continue to appreciate over the coming quarters. However, I believe that the government will step in with more cooling measures if prices continue to appreciate unabated.

As my next property is likely one with an investment angle, I will want to make sure that my rental yield can more than offset my mortgage payment. This can be done by taking a fixed-rate loan (visibility over monthly mortgage payments over the next 3-years) while rates are still low for resale units.

For new developments which are on variable loans, there is a risk that the interest rate could sky-rocket significantly over the next 2-years. Noted that most agents will recommend getting a new development since everyone is essentially “starting on the same base” and that price appreciation is more “guaranteed”.

Other considerations are the potential of the property’s location in terms of future developments.

Conclusion

This round of cooling measures might have a greater impact on mid to high-end segments where there is a larger portion of investors and foreign buyers who will be impacted by these new measures (particularly ABSD) vs. the mass-market housing who are still mainly first-time buyers although they do also get impacted by the lower TDSR.

While I have got no crystal ball in front of me, it is prudent to say that these measures will result in much lower transactional volumes in the coming quarters as well as a significantly slowdown in the robust price increment seen in both private and HDB resale properties of late.

Will it however mark the start of a new property downcycle where prices could decline by 15-20%? As a potential property buyer, I do hope so. However, realistically I believe that might not happen as the cooling measures in place can be easily removed to provide support to the market in the event of such drastic price declines.

In addition, the demand/supply mismatch is likely still present for 2022. With COVID-19 still impacting the completion of projects (BTO and private), this will likely help to moderate the actual physical supply over the coming 1-2 years and possibly prevent an outright supply glut from taking shape.

A worsening of the COVID-19 situation here in Singapore as a result of Omicron vs. the base case of gradual reopening could help support the case of higher property prices as supply continues to get impacted.

I will likely provide more of my insights in the latter part of 2022 or when I do purchase my next property and my rationale for it.

Again, I believe it is never the intention of the government to collapse the property market but to ensure that its citizens are not over-leveraged and that price appreciation is gradual and still affordable by the masses.

Nonetheless, that does not mean that buying property is a “sure win” strategy.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Ultimate HDB BTO Guide and tips for an ideal flat selection in 2021

- Executive Condo Singapore: Which is the best performing ECs of all time?

- 12 Tips To Select A Good Unit At A New Launch Project

- Selling your EC Right after MOP or upon Privatisation? Which is better?

- Is Tengah a good home and investment? A comprehensive guide to Tengah

- The average salary in Singapore 2021: Can you afford a condo with your income?