Is China Evergrande stock the “Lehman” moment for China?

In this article, I will not be going in-depth into China Evergrande stock problem since its debt issue has already been widely publicized and blogged about by the community. Instead, I will give my brief thoughts on whether China currently presents an opportunity from a “value” angle, with China stocks having been sold off heavily in YTD 2021 and how can one partake in the China story, if that story remains an appealing one.

The story of China Evergrande’s debt problems has been the talk of the town of late and a catalyst triggering the stock market sell-off over the past week. There are concerns that China Evergrande is going to be China’s Lehman moment, although the consensus among Wall Street analysts at present is that, despite China Evergrande’s position as one of the largest property firms in China, the situation doesn’t come close to being a “Lehman moment”.

Nonetheless, jitters around the Evergrande situation were blamed for weakness across global equities and other assets viewed as risky, sending investors into traditional safe havens such as US Treasuries.

Evergrande’s debt isn’t enough to derail the global economy on its own. The problem is if Evergrande problems lead to problems for lenders to Evergrande and then for other companies that need to borrow money from these banks. That is the credit contagion effect.

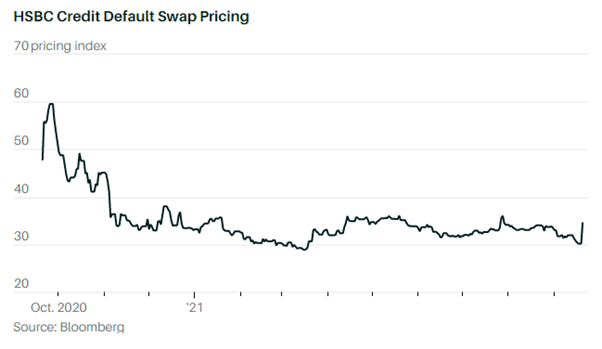

One way to note if there is a “credit contagion effect” in play is to look at the Credit Default Swaps or CDS of banks to see if there might be a real problem in the economy.

A credit default swap is one where a party swaps the risk of a debt default with another party. It is an insurance product where the buyer looks to insure itself against the possibility of a default on the company in question.

This can be used as a hedging tool, assuming that one owns bonds in the company in question, or as a speculative tool to bet on the continual credit deterioration situation of the company.

Take for example the CDS of HSBC. As noted by Barron in this article, HSBC’s five-year CDS was up 16% on Monday which is considered a significant amount but not yet a cause for all-out panic.

Market players will likely be monitoring the CDS of some of these big banks and China property players. A large persistent spike could be an early signal that the worst is yet to come and a credit contagion effect might be in play.

The consensus view currently is that the Chinese government will step in at some stage. While they may allow a temporary crisis in financial conditions, they will ultimately intervene to stabilize domestic markets in the event of a large-scale default.

That is not to say that markets will not be rattled by the “negative” events coming out of China, now almost daily, spooking even the most “die-hard” China bulls out there. The China Evergrande fiasco is coming on the back of a clampdown on China’s Internet and gaming companies that have taken the brunt of Beijing’s “wrath”, resulting in massive sell-offs in share prices of some of China’s most prominent internet heavyweights such as Alibaba and Tencent.

With all this sobering news coming out of China daily, is China still a place worth investing and if so, should we be “catching a falling knife” right now when blood is splattered all over the street, or should we wait for signs of a bottoming-out?

China Bulls vs. Bears

There is no right or wrong answer in this particular scenario and it is up to one’s risk appetite to decide if they wish to indeed partake in the current China “carnage”.

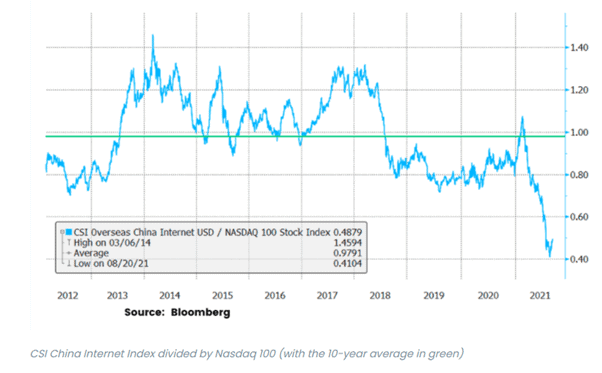

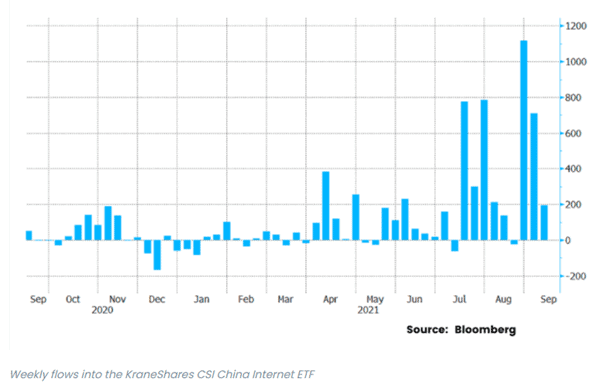

The China bull will say that tech stocks in the CSI China Internet Index have fallen drastically vs. America’s Nasdaq 100 Index and this is a massive buying opportunity. Already, despite weakness seen in the China tech counters, the KraneShares CSI China Internet exchange trades fund, ticker KWEB, which tracks the aforementioned index of Chinese tech stocks, is on course for a third straight week of inflows since the start of September.

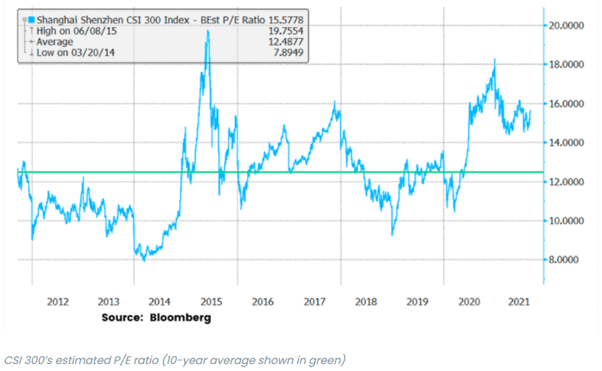

The China bear will say that despite the drop in China stock prices, valuation is still very far from distressed levels where true bargains may be found. For example, the CSI 300 Index’s P/E ratio has dropped to 15.6x from 18.3x at the end of 2020 but that is still above the average of 12.5x seen over the past decade.

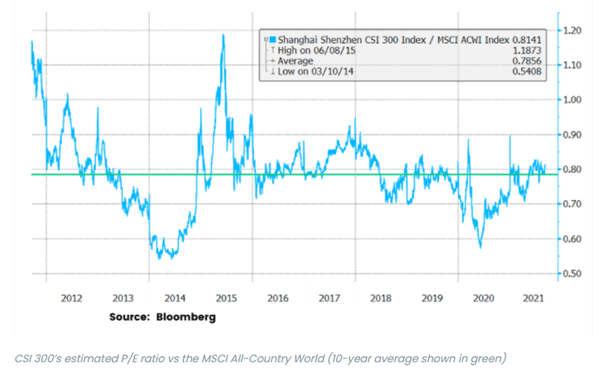

Compared to stocks globally, China’s markets hardly stand out as supremely cheap. After its recent losses, the CSI 300’s P/E valuation has dropped to about 80% of the MSCI All-Country World’s, in line with its long-term average.

How to partake in China through a diversified dollar-cost approach

As mentioned, the case for investing in China or not to invest in China at present is rather balanced, in my view. For those who remain steadfast in their belief that China is an economy that cannot be ignored, one could engage a dollar-cost-average approach to gain exposure in China without looking to catch a bottom.

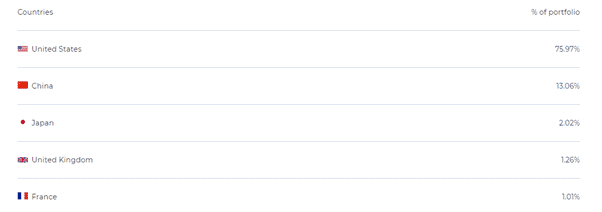

This can be done by say using a Robo Advisor such as Syfe’s Core Equity 100 portfolio which has exposure to China’s stocks through its stake in the MCHI and KWEB ETFs. While this portfolio is likely to underperform other non-China equity-focus funds/portfolios in the short-term, by investing in this portfolio which is purchasing China stocks now “at the cheap” (do note that it can get cheaper), a China rebound ultimately could result in substantial outperformance in the long-run.

Note that as of 31 August, the Core Equity 100 has approx. 13% of its portfolio vested in China. This percentage might or might not change upon portfolio rebalancing by the Robo Advisor.

Again, investing in China now is suitable only for those who believe that the “common prosperity” theme will aid the Chinese economy more in the long-term as a result of wealth distribution vs. the current short-term headwinds (which could be viewed as a buying opportunity) as a result of corporates’ relentless pursuit of profits being crimped.

How I am invested in China right now

For those who wish to capitalize on the current price weakness seen in China’s stocks while yet not take a direct exposure, one way could be through the usage of options, particularly by selling put options on China-linked ETFs such as the KWEB.

A word of caution, such a method of using options is not suitable for everyone despite my view that it is a “safer manner” to get paid while waiting for the China market to bottom out.

Trade example

My approach to taking a stake in China companies is through selling put options. For those who are interested to know more about the strategy of selling put options and what it is all about, you can refer to the article below:

Additional Reading: Selling Put Options. Sell Puts to win in any scenario

The ETF that I am looking at is KWEB which has been one of the worst-performing China-linked ETFs on a YTD basis and is currently trading at a price of around $46, close to its 52-week low price of $43.40. On a YTD basis, this ETF has declined by close to 40%.

Assuming I hold the notion that KWEB is a good long-term buy at a price of $40/share, I will be looking to sell a 24-days put option of KWEB at a strike price of $40/share, which is approx. 15% downside from its current share price level.

If KWEB’s share price drops below $40/share upon expiration, as a put option seller, I am obligated to purchase the counter at $40/share.

This 15% downside “protection” is my margin of safety or MOS. This means to say that within the duration of the next 24-days, even if KWEB’s share price is to decline by 15%, I will still be profitable from this trade execution.

The premium I received as a put option seller is $83/contract (as of 20 Aug 2021). This translates to a breakeven price of $40 – $0.83 = $39.17/share. Only if KWEB’s share price decline below $39.17/share will I start to lose money on this trade. Of course, the maximum risk is if KWEB’s share price decline to $0 within the next 24-days, by which I would have lost $3917.

By executing this put option selling strategy, I would have generated $83 in premium, translating to an annualized ROI of 32%. I get paid to wait for signs that the Chinese market has bottomed out. I also get to enjoy a “safety net” of 15% downside protection through this trade.

This simple strategy of selling put options allows me to have indirect exposure to the Chinese market. While I might be wrong in calling for a “bottom”, there is still a 15% MOS protection in this case.

This is an options strategy where you get to make money even when you are WRONG and there is not a lot of trading strategy that allows you to do that.

Conclusion

Investing in China’s stock market might not be everyone’s cup of tea at present. There is risk involved, one that is currently elevated. One could choose to stay away until the storm is over or see the current sell-off as an opportunity (of a lifetime, perhaps?)

Again, there is no right or wrong answer to choosing whether to stay away or jump on board this ship. For those who hold the conviction that China will remain a relevant and quintessential market that cannot be ignored, one can start to dip his/her toes into this arena by purchasing China-linked ETFs such as the KWEB/MCHI on a dollar-cost-average approach through a simple Robo Advisor platform such as Syfe.

Additional Reading: Syfe Select Review. Should you be investing in it?

Alternatively, one can engage an options approach to “get paid while you wait” for the storm to blow over. Again, a word of caution. Options trading is not a strategy that is suitable for all investors and one must be aware of the risk involved in an option trade such as put selling.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only

1 thought on “China Evergrande Stock blowout: How to still invest in China?”

Thanks, Royston.