How much is required for your child education?

For some Singaporean parents, seeing their kids being accepted into a local university is a dream come true, particularly if they themselves are not “fortunate” enough to have gone to one.

“Boy ah, study hard in University and get a good degree. Then you can find a good job”. That’s what my Mum used to tell me. I believe most of us millennials can relate to such conversations with our parents.

Being a parent myself to two young boys, age 3 and 6, such conversations are likely still pre-mature. For one, I am not exactly a strong proponent that my kids will “definitely” need to get a degree. Degree holders are dime a dozen in today’s context and likely even more so in 15-20 years time.

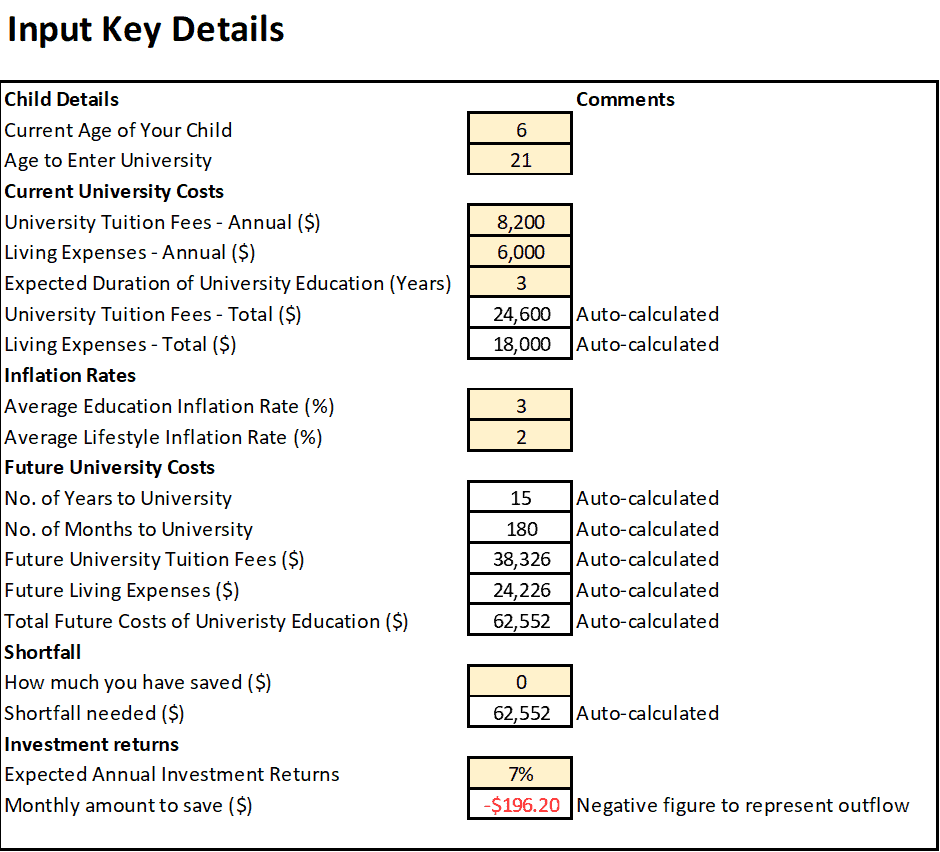

Nonetheless, most parents will still prioritize their child’s education. The big question is: If we wish to help our kids fund their university fees, how much will it cost us in the future and how much should one allocate to their child’s education fund on a monthly basis?

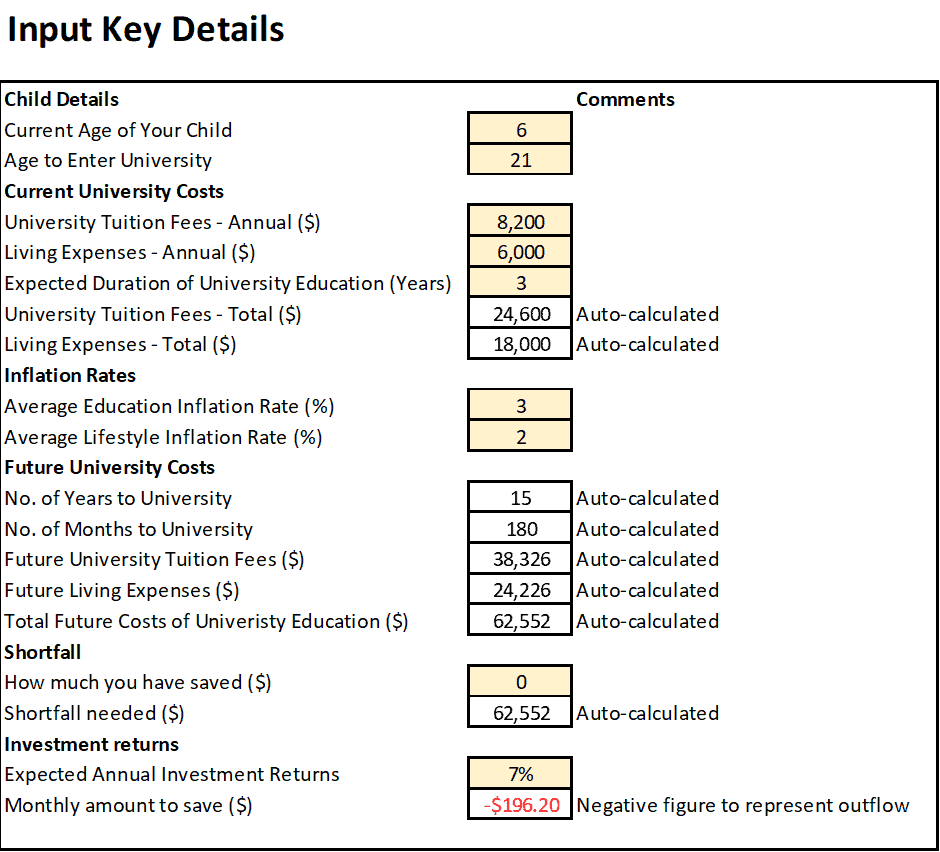

I will look to address that in this article as well as provide NAOF readers with a free download of a child education fund calculator (in excel) that is relevant for not just Singaporean parents but parents all over the world who wish to get a rough idea of their monthly allocation “outflow” to their kid’s education fund.

Do read on.

What is the cost of college/ university?

As “doting” parents, myself and my missus have been evaluating the prospect of possibly funding our kids’ college/university course. However, when we start doing our maths (thanks to my 20+ years of education, I can do some basic counting), the numbers are pretty staggering at face value. Hmm, second thoughts perhaps?

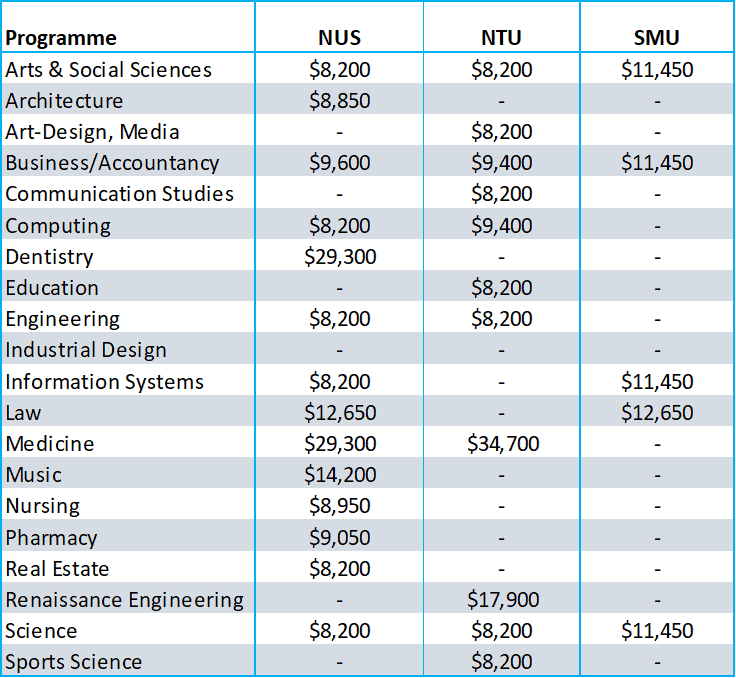

Let’s start with the basic tuition cost for college (we shall ignore the fees associated with Pre-school, Primary, Secondary, and pre-college for now) here in sunny Singapore.

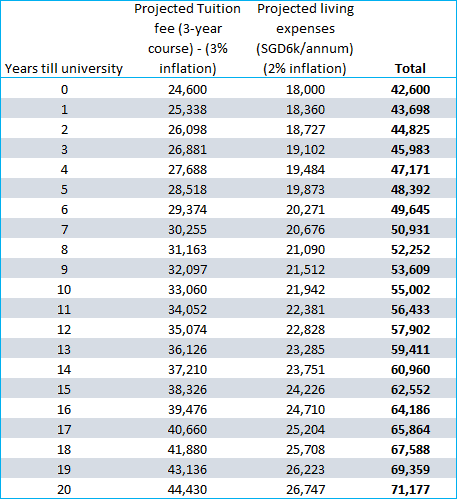

The table below illustrates the latest approx. annual fees associated with the various degrees offered by our 3 key local universities [Update Dec 2021]:

Degree course fees generally range from SGD8,200/annum in courses such as engineering etc to about SGD29,300-34,700 for dentistry/medicine.

That means for a 3-year course, the minimum college tuition fees in today’s context will amount to SGD24,600. Hmm, imagine funding a 4-years medicine course, that will amount to at least SGD117,200 (NUS course) in today’s dollar.

My missus and I agree that we should just stick with a “normal” degree for now. Shooting for the stars and wishing that my kids will be excellent medical specialists might not seem like the best motivational way to get us started in our savings journey. When something feels out of reach, humans have the tendency to not do anything, and we are only mere mortals.

How will inflation rate affect tuition fees?

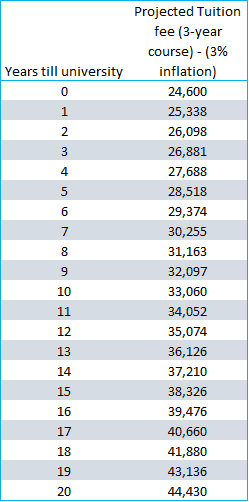

So, we decided that SGD24,600 for a 3-years degree will suffice for now. That is in today’s terms. What happens in 15 years’ time when my eldest kid is age 21.

The good news is that the Ministry of Education (MOE) has recognized the rising cost of living here in Singapore and has looked to moderate the pace of university fees increment.

For example, all six universities here in Singapore have only registered a modest rise in tuition fees since 2018, with most of the course fees staying flat over the past 2-3 years.

Courses with increased tuition fees (current vs. 2019) are Dentistry (NUS), Medicine (NUS), Music (NUS), and Renaissance Engineering (NTU)

However, I don’t think it will be realistic for fees to remain unchanged for the next 15 years. We don’t expect to have elections every year for the next 15 years, right =)

Let’s assume a 3% average inflation rate. In 15 years’ time, the 3-years course fee of SGD24,600 will balloon to SGD38,326.

So, SGD$38,326 seems to be my magic number for the cost of funding my eldest boy’s university fees in 15 years’ time. Well, some might also point out that my boy’s living expenses should also be projected into the calculation.

The missus and I have agreed that our kid will be responsible for funding his own living expenses.

Well if he does not know how to support his own living by the time he hits 21, especially after two years of national service and years of financial education from yours truly, then maybe he doesn’t deserve to go to college?

Sounds harsh? Well, I do inculcate the western education mindset of being financially independent. That’s the whole purpose of setting up this blog in the very first place.

Additional cost of living expenses

In our case, our magic number is SGD38,326. If one so wishes to input annual living expenses (let’s assume SGD500/month), the table below tabulates the total cost based on a 3% inflation rate for tuition fees and a 2% inflation rate for living expenses. In my case, the total cost of my child’s education will amount to approx $62,552 after accounting for the projected living expenses.

Singaporeans are doting parents

According to a survey done by theAsianparent in 2018, 57% of parents surveyed highlighted that they would fully fund their child’ education up till their bachelor’s degree with 53% believing that they will spend above SGD100,000 per child on their education throughout his/her schooling years (bulk likely to be in university fees).

However, 1 out of 4 has not started saving for their child’s university education. Common reasons for not starting are 1) other monetary commitments, 2) current expenses too high, and 3) haven’t started thinking about it.

Well, the SGD100,000 target might seem like an extremely far-fetch target and because of the seemingly “unreachable” goal, humans tend to procrastinate and further delay the process of savings.

Hence, we believe having a manageable “bite-sized’ savings goal is critical to kick-start the process.

So, how much do I have to save on a monthly basis to help ensure that my child education fund is taken care of in 15-years’ time? What are additional ways to help myself and my kids’ graduate from college debt-free?

4 ways parents can help their children (and themselves) to graduate college debt-free

1. Start a savings plan early

What is the amount of funding required?

Do you want to help fund your kid’s tuition fee and living expenses? In my case, I and the missus are only looking to fund my kid’s tuition portion and possibly living expenses as well, if we are feeling generous. That works out to be approx. SGD62,552 in 15 years’ time.

How much do you need to save each month?

After you have gotten a quantitative figure of your future “liability” (let’s frame it as a savings goal), the next question will be to address how much you should be saving each month to hit your target savings goal.

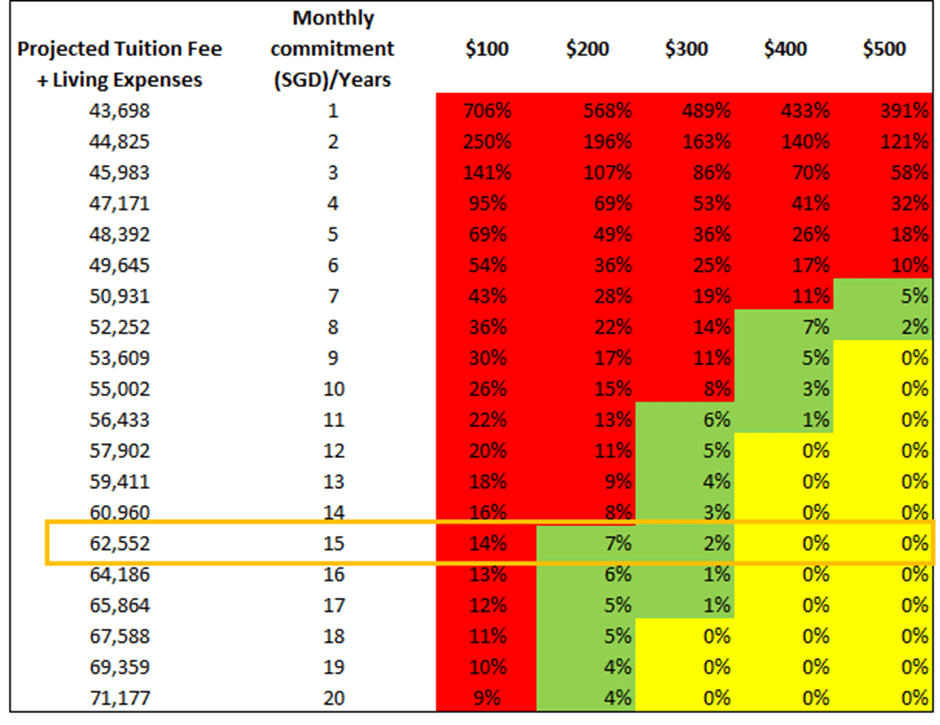

In order to achieve my desired savings target of SGD62,552, I and the missus will be required to save $200/month based on an average investment return of 7%/annum. If I am to up that figure to $400/month, I don’t even need the magic of compounding to help achieve my goal.

$400 * 12 months * 15 years = $72,000 > $62,552 required amount.

All of a sudden, that $200/month commitment to your kid’s educational future no longer seems like a daunting task.

Choose your wealth machine

Based on my personal requirement of SGD62,552 in 15 years’ time, I basically have a few options to meet this target:

- Option 1: Save SGD200/month in an equity fund which yields approx. 7%/annum. There will be greater variability associated with investing in an equity fund and while the market tends to generate c.6-7% (after inflation) long-term return, these returns are not guaranteed and risk level is relatively high

However, given that the monthly contribution amount is not excessive at “only” SGD200/month, I might be willing to take the elevated risk of an equity fund.

A viable course of action could be to either invest through a low-cost Robo advisor or alternatively through a regular savings plan (RSP). I have previously written a comprehensive guide to robo advisors here in Singapore.

- Option 2: Save SGD300/month in an extremely safe asset such as the Singapore Savings Bonds (SSBs) which yields approx. 2.0% on a long-term (10 years horizon) basis. With SSBs, I will get a coupon every 6 months. [Update Dec 2021: This might no longer be a feasible solution with SSBs yielding 1.78% for long term bonds (10 years horizon).]

These coupons serve as an added income as I theoretically do not require to reinvest them to hit my target of SGD62,552.

However, it is unlikely that I will pursue this option. For starters, the 2.0% long-term yield isn’t attractive. I could look to contribute the sum of SGD300/month into my own CPF Ordinary Account, generating interest of 2.5%/annum over 15 years. When my kid goes to college, I can tap on the CPF Education Scheme which is a loan system that allows me to use my OA savings to pay for my kid’s tuition fees.

The downside is:

1) no flexibility in withdrawal. However, since this is meant for long-term savings, I should not be looking to withdraw it even during an emergency.

2) No proper segregation of funds. There might be a risk that I could “overuse” the funds in my OA for other purposes such as buying a house. There is also no proper tracking of the exact amount that I have contributed thus far to my OA account solely for this purpose.

- Option 3: Save SGD250/month in an asset that generates around 2-4% return per annum. This could be in the form of an endowment policy offered by insurance companies.

This could be also one of the options I might pursue to diversify my portfolio of savings, given that a portion of the payout is generally guaranteed.

MoneyOwl, a Robo advisor here in Singapore, has previously written on some of the education savings endowment plans in Singapore.

Unlike my example above which assumes a premium contribution duration for the entire period, these education endowment policies generally have a lower premium duration period (5 or 10 years, etc) with multiple pay outs at different stages of your kid’s education process.

Time to start saving is now

Investing in your kid’s future education need not be a daunting task as seen from my own personal example above. The trick is to start early, start easy and automate with a manageable goal in mind.

For those who are interested, do enter your email in the box below and you will be given the link to download the child education fund calculator as seen in the picture above.

2. Teach good money habits to your kids

There might be occasions that even with our ability to start savings for our kids early, we are still not going to have enough to help them graduate college debt-free.

That’s why it is critical that I want my kids to understand that they are part of this whole education equation as well.

While my kids might still be on the young side, I am beginning to develop a system that encourages both my younger and elder kids to help out at home with a variety of simple household-related chores.

![Child Education: How much do you need to save to fund your kid's college fees? [Plus Free Child Education Fund Calculator] 1](https://newacademyoffinance.com/wp-content/uploads/2019/10/uni-6.png)

In return, his efforts will be rewarded in a monetary way where his “income” that he earns can be split into a number of money jars:

1) Save, 2) Spend, 3) Invest (long-term), 4) Charity.

If he so wishes to put his income into either of the Invest or Charity jar, we will match his contribution.

Such a system also encourages my elder kid to understand the importance of money, that not everything can be funded by his “Dad and Mum” bank and that if they choose to spend on short-term incentives(such as sweets and snacks), they might be losing out on the chance to save for longer-term rewards.

We will also reward them through Screen times where he will be able to enjoy watching his favorite kids’ program.

By giving them these choices, they will learn to prioritize and make smart financial decisions which will go a long way in their university years and beyond. This is also a way of character building which is an important life lesson not often taught in schools.

Talk about money

When my kid is old enough, I will look to introduce the concept of compound interest and the wonders it brings. This is a “curriculum” that I believe should have stronger weightings when it comes to family planning and the kid should definitely be part of the education process.

My parents did not explain this concept to me when I was young. Talking about money is generally a taboo issue among Asian families and parents tend to avoid such topics with their kids.

While I personally don’t advocate “Keeping up with the Joneses”, being transparent about my money is part of my financial journey process that I hope to blog about more often. I hope that this blogging platform will be an avenue where my kids can get their financial aspirations in the future.

Don’t forget, they have got to earn their own living expenses while in college. By inculcating important money practices from young, I hope that they will have saved enough to fund this expense category by the time they enter college.

3. Try the Polytechnic route

Not getting into one of our local universities does not mean the end of the world. I personally don’t feel there is anything wrong with going the polytechnic route.

First, the cost of polytechnic is way lower than that of university fees. For three years of studies in polytechnic, the total tuition fees amount to SGD8,700. At a 3% inflation rate after 15 years, that amounts to c.SGD13,500 for polytechnic vs. SGD38,400 for university. That is almost one-third the cost!

Second, how many of us know exactly what we want to do with our life at the age of 19 (for girls) or 21 (for boys, 2 years difference due to national service)?

Personally, I have got no clue what I really wanted to do at 21 years old (Frankly, I am also a little lost now). The point is why are we spending top dollars for our kids’ education process when they are clueless about what they really want to achieve in life?

I believe that our society is changing. With the increasing adoption of automation, the risk of many traditional jobs becoming obsolete is increasingly real.

What we need are kids with soft skills, entrepreneurial skills, not one who is book smart. Well, that is at least my own humble opinion.

4. Working part-time during college

It is critical that my kids get a job by the time they are in college if they have not already done so. This does not have to be a full-time job. A part-time job or an internship will prepare them for the challenges of the working world. Life ain’t a bed of roses in this dog-eat-dog corporate world and our kids need to realize that they are no longer under the protection of their parents.

This is an experience that school alone cannot provide.

So if they have not already saved up the c.SGD24,000 meant for 3-years of living expenses, now might be the time to get their asses moving. Again, if they wish to stay in boarding houses “for the experience” the cost will amount to an additional c.SGD3,000/annum.

Having the kids work while in college not only helps to defray part of the financial liabilities but gives them a head start over their peers in terms of real-life working experience, a win-win situation for all.

Conclusion

Funding your kid’s education fees should not take priority over your own retirement savings. Nonetheless, it will not be as stressful on your pocket as you might think it will be if you start early.

Do not just focus on the quantitative number, like how much it will cost you in x number of years time.

Pay attention to the qualitative aspect as well, such as nurturing your kids to grow up with “Money Sense”. This area has tremendous value to a household’s financial well-being in the future but is often one that is neglected in today’s society where good grades and a successful career hold greater importance.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!