Robo or DIY?

We have previously written articles pertaining to robo-advisors available here in Singapore as well as the ALL-IN costs of choosing robo-advisors vs. a DIY approach. While the preliminary conclusion points in favour of a DIY approach when it comes to minimizing cost, I am not dismissing the usefulness of robo-advisors as a possible investment platform.

The usage of robo-advisors is probably one of the most convenient way to invest in a myriad of investment assets, with the benefit of periodic portfolio re-balancing to ensure optimal asset allocation at all times.

Portfolio allocation by robo-advisors will take into account your risk appetite and age profile etc to make the necessary decision for you as to how best to allocate your funds (ie: % into equities, bonds, alternatives etc)

However, if you are just a beginner investor with the sole aim of reducing cost, then a DIY approach through a Regular Savings Plan (RSP) might be more suited. RSP plans offered by POSB/DBS, OCBC and POEMS are generally quite affordable from a local offerings perspective.

The problem arises when you wish to have a diversified international exposure for your portfolio. Read on to find out more.

Before we jump in to explore the various options currently available to Singaporeans for RSPs, lets just use a quick example to give us some flavour as to how “costly” one investment might be if engaging a DIY approach through RSPs.

Case Study:

Take the case study of a fictitious Mr Albert, who is currently 28 years old and earns S$3,500/month and is able to set aside S$500 for investments. This is his first investment experience but Mr Albert wishes to start investing early as he often hears of the wonders of compounding from his more experienced buddies who invest.

Regular investing through RSP

Not wanting to spend too much time and effort into researching on stocks, Mr Albert decides the best way to start off his investment journey is through a RSP which provides the discipline and consistency of monthly investing without looking to “time” the market.

He decides to go for the RSP from DBS Invest-Saver, allocating S$500/month to purchase the Nikko AM Singapore STI ETF which has a sales charge of 0.82%.

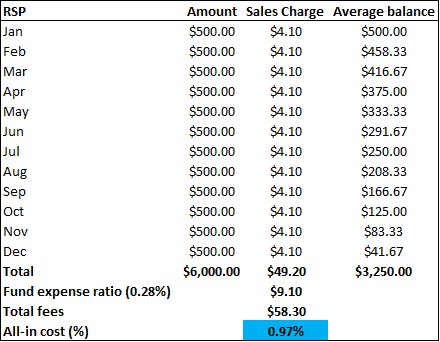

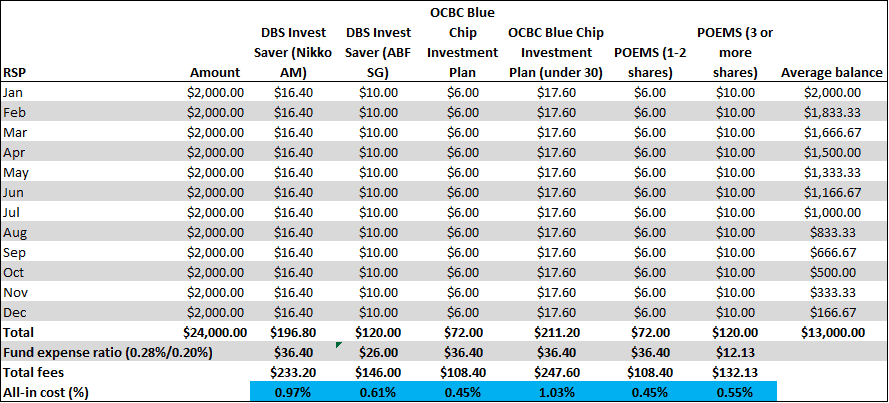

The table below illustrates the cost of such an investment.

Including the fund expense ratio of 0.28% which is calculated based on fund expense ratio * average balance of the portfolio (0.28% * S$3,250), the total fees will amount to S$58.30 or an ALL-IN cost of 0.97%

Suddenly the cost isn’t as “cheap” as what we have originally envisioned. Despite the absence of annual management/platform fees often incurred through robo-advisors, the one-off sales charge of 0.82% in this example does have a significant impact on overall portfolio cost.

Lump sum RSP

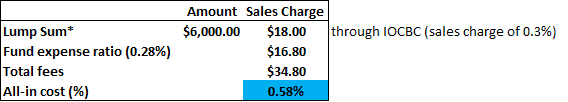

What happens if Albert decides to do a Lump Sum Investing of c.S$6,000 instead of through a recurring RSP? In this case, to minimize one-off commission charges, it will be more ideal to purchase the counter Nikko AM ETF through OCBC RSP which has a total fee of 0.3% which makes sense for larger purchases.

He can choose to invest for the first month and then terminate his RSP (while still keeping the units in the ETF). This is a cheaper alternative as compared to purchasing directly through a brokerage which will incur a min commission charges of S$25 for online trades.

He can choose to resume his RSP the following year and repeat and wash this process.

His All-in cost will reduce from 0.97% to 0.58% on this DIY approach. This is just for illustration purpose and not meant to conclude that one should not engage in a regular RSP-approach because of the higher associated cost. Regular RSP has the benefit of dollar-cost averaging which reduces the impact of volatility as compared to lump sum purchases.

It could be penny wise pound foolish to engage in the above approach of manual RSP just to save on some commissions. Again, this varies from person to person.

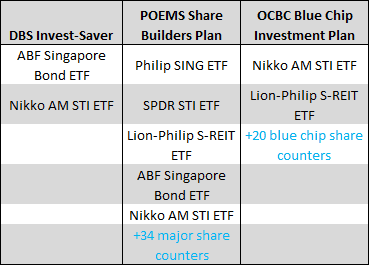

With that in mind, let’s take a look at the various costs associated with RSPs available in Singapore through DBS Invest Saver, OCBC Blue Chip Investment Plan and POEMS.

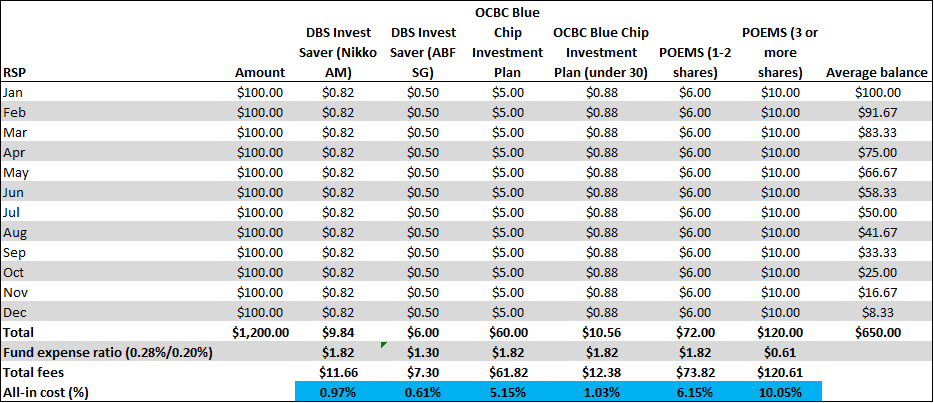

For S$100/month regular savings

The cheapest RSP plan is DBS Invest Saver where the ALL-IN cost is slightly less than 1%, as we previously demonstrated. Assuming one is investing in ABF SG ETF, that will incur the lowest cost through DBS Invest Saver.

It will not make sense to invest through POEMS RSP based on S$100/month as your all-in cost could be as high as 10.05% (assuming you invest in Nikko AM + 2 other stocks, fund expense adjusted to account for a 3 stocks portfolio)

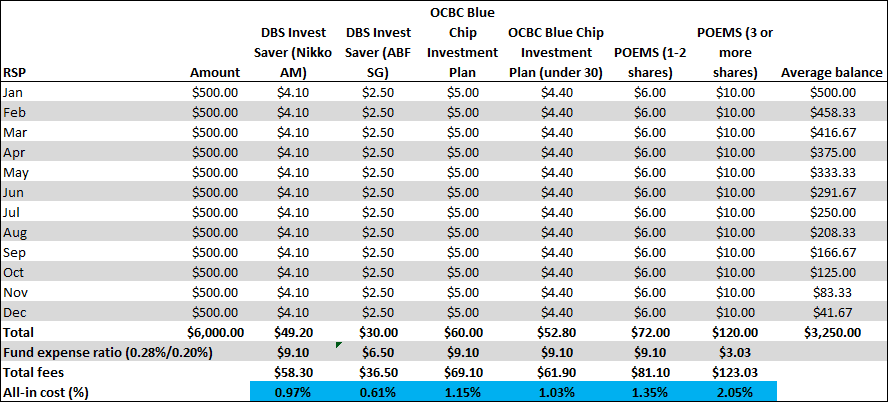

For S$500/month regular savings

Again, investing through DBS Invest Saver will be the ideal cost-saving choice if you have a monthly budget of S$500/month for investing. However, the differences in cost have now shrunk substantially between DBS and OCBC.

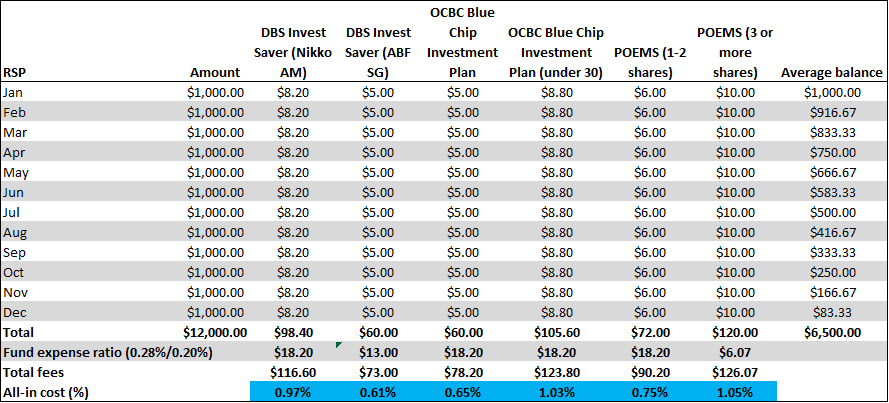

For S$1,000/month regular savings

If you have a budget of S$1,000/month, then investing through OCBC will be the ideal choice. POEMS (1-2 stocks) cost of 0.75% is now also lower than that of DBS (with the exception of ABF SG).

For S$2,000/month regular savings

This is a tie between OCBC (standard) and POEMS (1-2 stocks) where sales charges are now pretty affordable at approx. 0.45%. For OCBC (under 30) it becomes the costliest. Hence for 30 years old and below, don’t engage in RSP through OCBC if you are a high-flyer with plenty of cash for regular savings!

Quick summary:

For those who budget S$500/month and below for RSP, stick with DBS Invest Savers. As your amount approach the S$1,000 mark, look at the option of OCBC or POEMS.

For regular savings of S$2,000/month, using POEMS could be the ideal choice given the fact that you can split your investment amounts into different products and yet enjoy a very competitive fee.

What are the available products for these 3 RSP platforms.

Taking it all in

Investing through RSPs is a disciplined manner to partake in the stock market and to let the wonders of compounding work in your favour.

However, the cost of DIY investing through RSP is not as cheap as what we have previously alluded in our article on DIY vs. Robo due to one-off sales charges that becomes a recurring event.

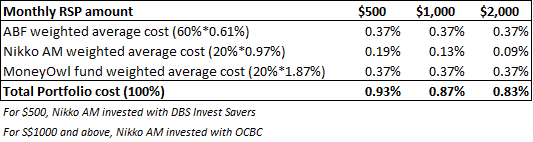

Using our “Pseudo Portfolio” as an example, where we invest 60% of our funds into ABF Singapore Bond ETF, 20% of our funds into Nikko AM STI ETF and 20% of our funds into IWDA, our preferred choice of RSP platform will be DBS Invest-Saver (local exposure) and Standard Chartered Bank (for investment into IWDA) based on available capital of S$500/month.

S$300 allocated to ABF ==> ALL-IN costs of 0.61%

S$100 allocated to Nikko AM ==> ALL-IN costs of 0.97%

S$100 allocated to IWDA ==> ALL-IN costs of 10.725% (based on minimum commission fee of S$10)

Total portfolio costs = 2.7%!

From our calculated portfolio cost of 0.35% based on a DIY approach, the costs have now ballooned to 2.7% due to the high sales charge associated with investing in IWDA through Standard Chartered (unless you are a priority client which will not incur any minimum fees)

Hence while on paper, a DIY approach sounds logical for a low-cost passive investment into ETFs, the cost of international exposure will deem such a strategy infeasible from a cost perspective.

Potential solution

A potential solution to work around the high one-off costs associated with international exposure (particularly if your investment quantum is small) is to use a combination of both RSPs (for local exposure) and Robo-advisors (for international exposure).

In this case, I will invest S$400 using DBS Invest-Savers, with S$300 allocated to ABF and S$100 allocated to Nikko AM. Total portfolio (local) cost will be 0.56% (calculated as 60%*0.61% + 20%*0.97%)

I will use a robo-advisor, for example like MoneyOwl which has a minimum investment sum of S$100 (monthly RSP basis, min sum is S$50) to invest my remaining S$100. However, the idea here is to choose a 100% equity international exposure.

Based on my selection criteria, I was allocated the Dimensional Emerging Markets large Cap Core equity Accumulating Fund (SGD). Total fees according to MoneyOwl is 1.20%. However, we have previously calculated (in our DIY vs. Robo article) that withholding taxes could add a further 0.65% to the cost of a Dimensional Fund, hence total ALL-IN cost will be approx. 1.85%.

Total Portfolio (local + International) cost will now be 0.56% + 20%*1.85% = 0.93%.

While no longer as cheap as what we have previously calculated (ignoring sales charges) of 0.35%, this method of RSP based on a monthly budget of S$500 will now have an ALL-IN Portfolio cost of 0.93%. This cost will be even lower as the budget amount gets higher (however there is the hassle of using 3 accounts instead of 2).

The above example is based on a high % allocation for the ABF bond ETF which reduces the overall weighted average cost of the portfolio. For a portfolio with a higher equity allocation, the total portfolio cost figure will be higher.

Conclusion:

A RSP is an ideal method to get started on investing with a small and manageable investment amount. However, due to the associated one-off sales charges, the total fees are no longer as “affordable” as what we previously calculated using a DIY approach. This is particularly the case if we choose to have “international equity” exposure that will raise the commission cost rather substantially.

A solution is to use a combination of RSPs offered by the local brokerages for local exposure (local equities + local bonds) and a robo advisor like MoneyOwl for international equity exposure.

Such a combination can still reduce overall ALL-IN cost of the portfolio to less than 1% vs. a standalone robo-advisors solution where total costs will come close to 2.0%.

This is our cheapest solution for our Pseudo Portfolio based on a Regular Savings Plan approach. Are there any other cheaper methods? Will love to hear it.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- DIY OR ROBO? THE 1.6% OPPORTUNITY COST DILEMMA

- ULTIMATE GUIDE TO ROBO ADVISORS IN SINGAPORE

- HOW YOU CAN MAXIMIZE TAX BENEFITS THROUGH STRATEGIC SRS CONTRIBUTION AND WITHDRAWAL

- CAN A YOUNG COUPLE EARNING MEDIAN INCOME AFFORD TO SAVE?

- PRE-PAYING YOUR HDB LOAN? THINK AGAIN

- AVERAGE SINGAPOREAN MEDIAN INCOME. WHERE DO YOU STAND?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Cheapest way to invest through RSP. Show me how.”

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is needed to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 certain. Any recommendations or advice would be greatly appreciated. Cheers