Marco Polo Marine: Taking a Look Beyond its 1HFY2023 Reported Numbers

Marco Polo Marine 1HFY2023 reported numbers might not paint a pretty sight but investors should look beyond that for its strong operating performance

Marco Polo Marine 1HFY2023 reported numbers might not paint a pretty sight but investors should look beyond that for its strong operating performance

NIO listing on SGX NIO is today creating history by being the very first company in the world to be listed on 3 stock exchanges, namely US, HK and SG. The SG listing will happen on 20th May 2022, which will allow Singapore investors an easier avenue to partake in this fast-growing EV play. The

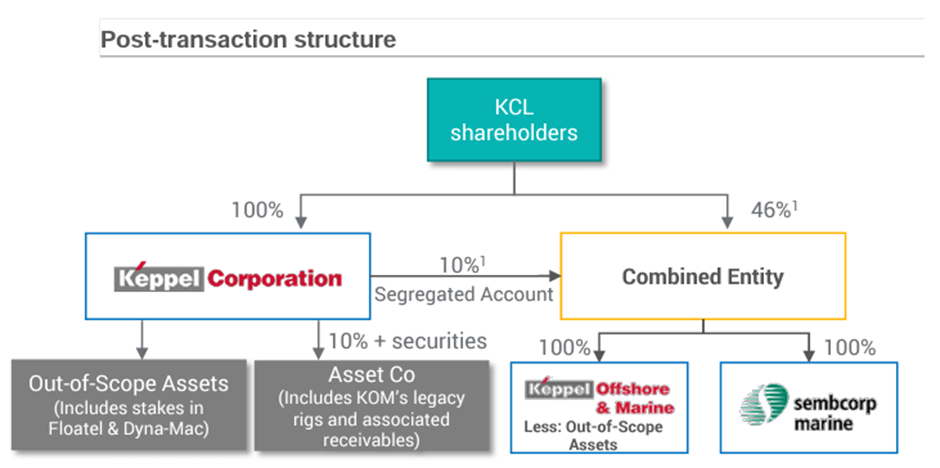

Keppel and Sembcorp Marine signed a definitive agreement for merger Keppel and Sembcorp Marine announced this morning that they have entered into a definitive agreement for the proposed combination of Keppel O&M and Sembcorp Marine to create a new entity that will be focused on offshore renewables, new energy and cleaner O&M solutions. This merger

Singapore Banks benefitting from Fed tightening? For the first time since 2018, Jerome Powell (Chairman of The Fed) raised interest rates for the US by 25 bps (0.25%) to 0.25-0.50%. In addition, The Fed is looking to increase the pace of its tightening by increasing interest rates by 50 bps (0.50%) in May as part

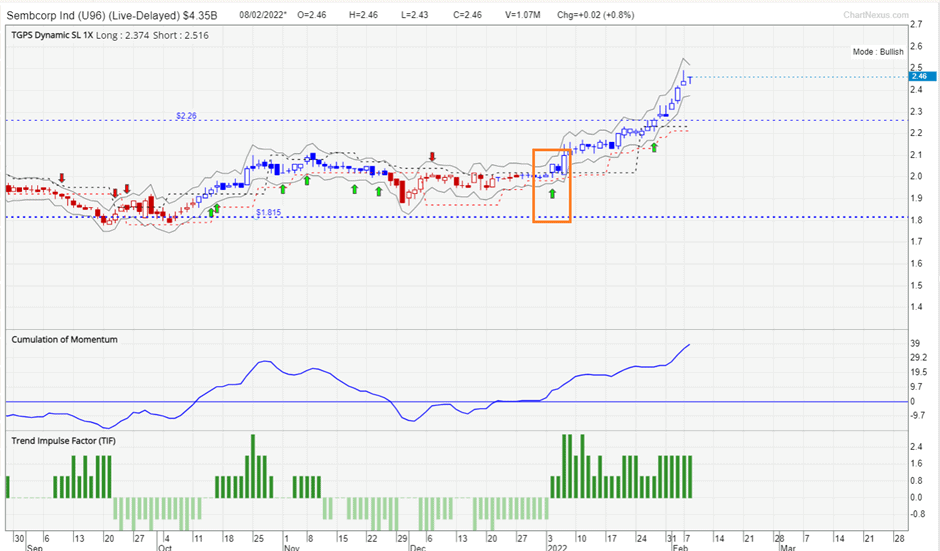

Singapore Blue Chip Stocks to capitalize on rising momentum Singapore stocks have been one of the more resilient performers since the start of 2022, with the Straits Times Index (STI) STI up a commendable 8%, one of the best stock market performers not just in the region, but on a global scale, an achievement that

SGX top gainers over the past 1 month Investors who are interested in SG counters can use the SGX stock screener function to identify stocks that meet certain criteria. In this article, I look to identify which are the SGX top gainers over the past 1 month and to evaluate if that momentum can be

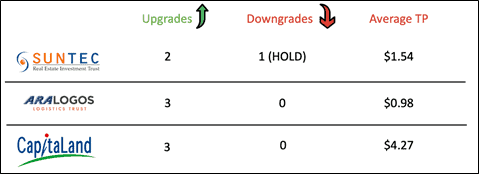

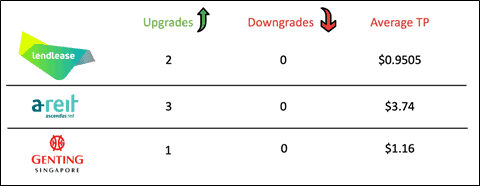

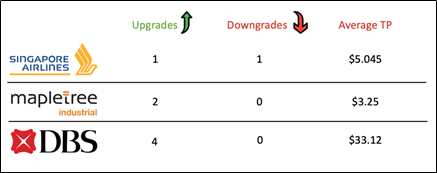

SG Stocks to buy in August – Analyst upgrades Can we trust analysts’ reports? Throughout the years, we occasionally see analysts flip-flopping between buy and sell calls within several weeks. As investments are highly subjective to one’s view, the difference in perspective is understandable. However, it led to certain controversies as investors argue that there

SG stocks to buy: Upgrades/Downgrades by analysts Can we trust analysts’ reports? Throughout the years, we occasionally see analysts flip-flopping between BUY and SELL calls within several weeks. As investments are highly subjective to one’s view, the difference in perspective is understandable. However, it led to certain controversies as investors argue that there may be

Amid the current market turbulence, which is the best performing Singapore REITs? The table below provides a quick snapshot of the performance of the Singapore REITs, sorted based on its YTD Price performance (Update on 28 June 2021). There are quite a number of REITs that generated positive returns so far on a YTD basis.

Merger between Keppel Corp and Sembcorp Marine finally taking place Both Keppel and Sembcorp Marine requested for their share prices to be halted before the start of market trading on 24 June. According to the Straits Times report quoting sources from Reuters, both companies are in the process of kicking off talks to explore combining

SG Blue Chip Stocks which analysts are most bullish on Which are the top SG blue-chip stocks that have the highest number of BUY calls from analysts? We identify 3 SG Blue Chip Stocks which the street is most positive about, with upside potential close to 40%? These SG Blue Chip Stocks also currently yield

Best ETFs in Singapore You might not know but there are many Singapore ETFs that you can use to structure a resilient inflation-proof passive portfolio. Out of the 43 ETFs currently trading on the Singapore Stock Exchange (SGX), we will highlight 4 ETFs that we believe are the best-in-class that an investor can purchase directly

SIA recently announced a disastrous set of FY2021 financial results, which should not come as a surprise. They also announced a massive “recapitalization” in the form of raising funds through its second tranche of Mandatory Convertible Bonds or SIA MCB for short. Watch the short video to find out why I think this is an

The STI index is one of the best-performing market indexes globally on a YTD basis (pretty surprising, but more on that later), currently up more than 11% since the start of 2021, based on data from Factset. This compares favorably vs. regional peers such as Malaysia (down 3% YTD), Indonesia (down 1%), Philippines (down 8%),

Singapore Blue Chip Stocks with notable upgrades/downgrades by analysts Can we trust analysts’ reports? Throughout the years, we occasionally see analysts flip-flopping between buy and sell calls within several weeks. As investments are highly subjective to one’s view, the difference in perspective is understandable. However, it led to certain controversies as investors argue that there

Small-Cap Singapore Dividend Stocks In the pursuit of dividends, many investors fall into the trap of purchasing stocks purely on a dividend yield basis. Many of these “high-yielding” stocks generated negative TOTAL returns (capital appreciation + dividend returns) over the mid to long-term horizon. In this article, we will be exploring 5 Undervalued Small-Cap Singapore