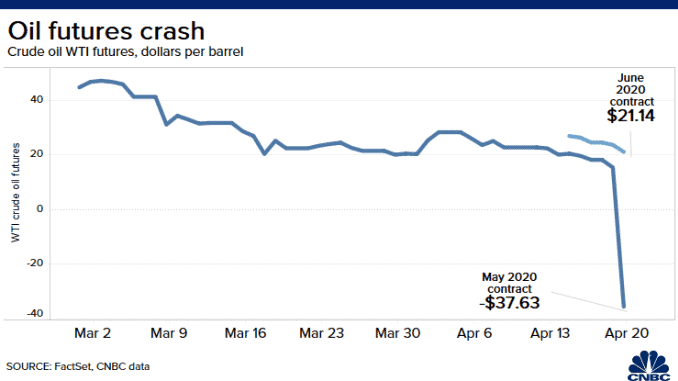

Is time running out for Keppel and Sembcorp Marine as oil collapses below zero?

This week saw an unprecedented drop in oil prices to a negative level, almost -$40/barrel to be exact. Such a phenomenon has not happened in the past and it was largely the result of paper traders and Oil ETFs dumping their expiring May contracts “by all means” as buyers disappear. Since then, WTI oil prices