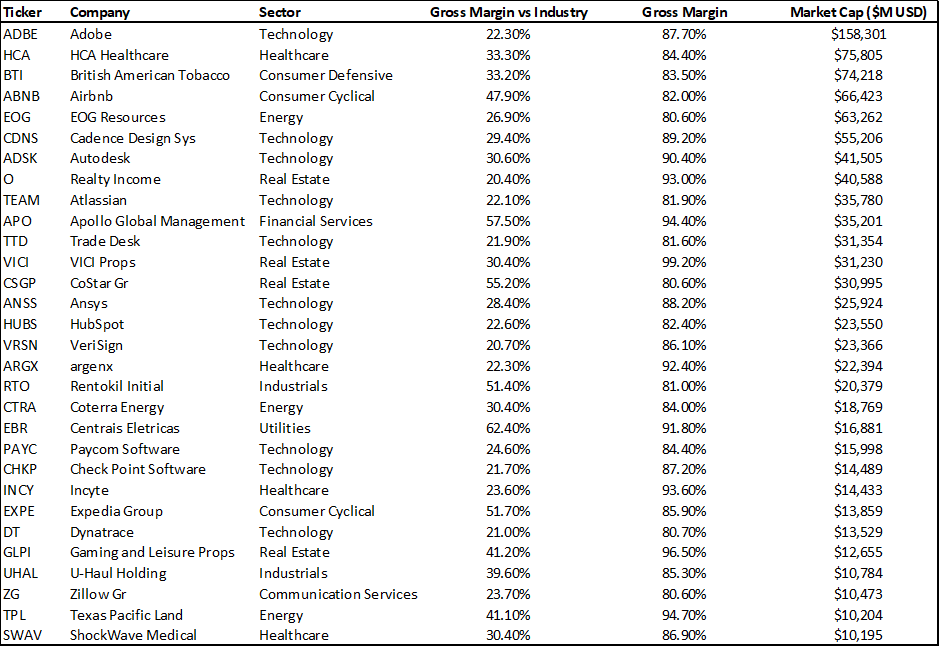

Companies with Highest Profit Margins

Here are some of the companies with highest profit margins: 1) Arista Network, 2) Cadence Software, 3) Visa, 4) Paycom Software

Here are some of the companies with highest profit margins: 1) Arista Network, 2) Cadence Software, 3) Visa, 4) Paycom Software

Here are 3 breakout stock screeners that you should know: Breakout Stock Screener #1: Koyfin. Breakout Stock Screener #2: Stock Rover

How to research a stock from scratch: A proven 7-step process. Step 1: Identify a Company for Investment. Step 2: Go to the source

Top ETF Investment Strategies that you can replicate using the following ETFs. 1) High Beta (SPHB), 2) Developed Markets with momentum (PIZ)

How to find growth stocks When it comes to investing, there are various schools of thought and different investing strategies that investors can use to make money in the stock

Small-cap semiconductor stocks The semiconductor market has always been a cyclical industry with its fair share of ups and downs. When conditions are favorable, chipmakers have trouble keeping up with

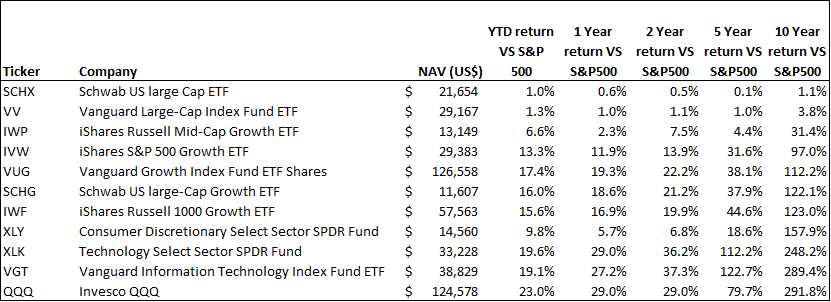

Best Performing ETFs YTD 2023: 1) Vanguard Information Technology Index Fund ETF (VGT) 20 Technology Select Sector Fund (XLK)

In part 2 of this stock valuation models guide, we will dive into the dividend discount model or DDM as it is more commonly known

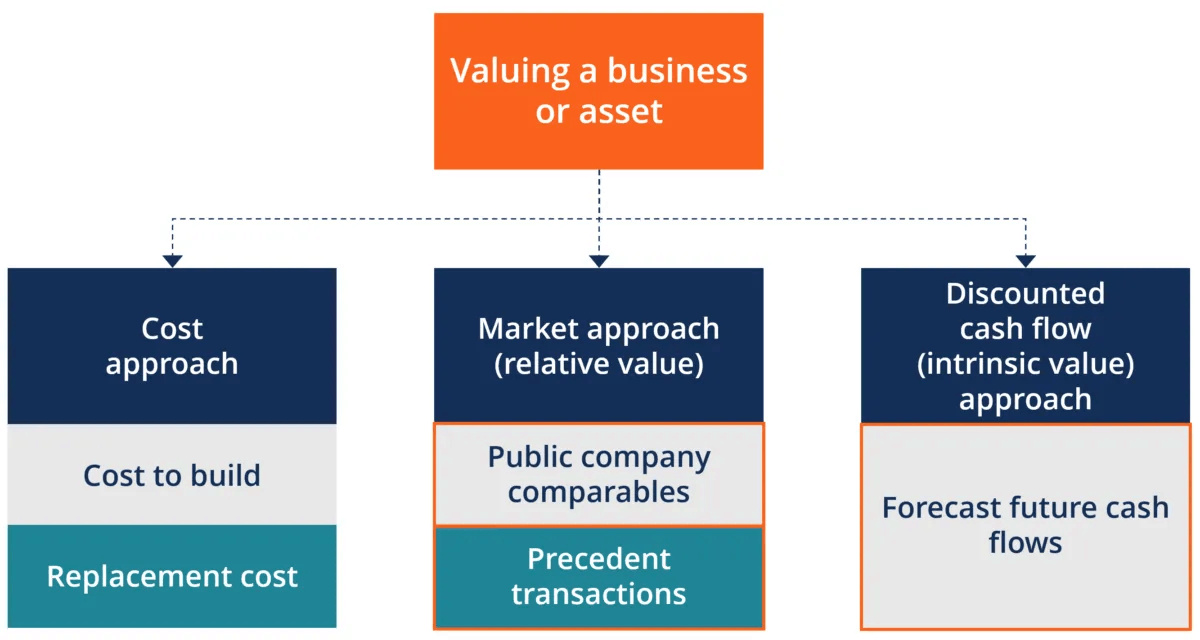

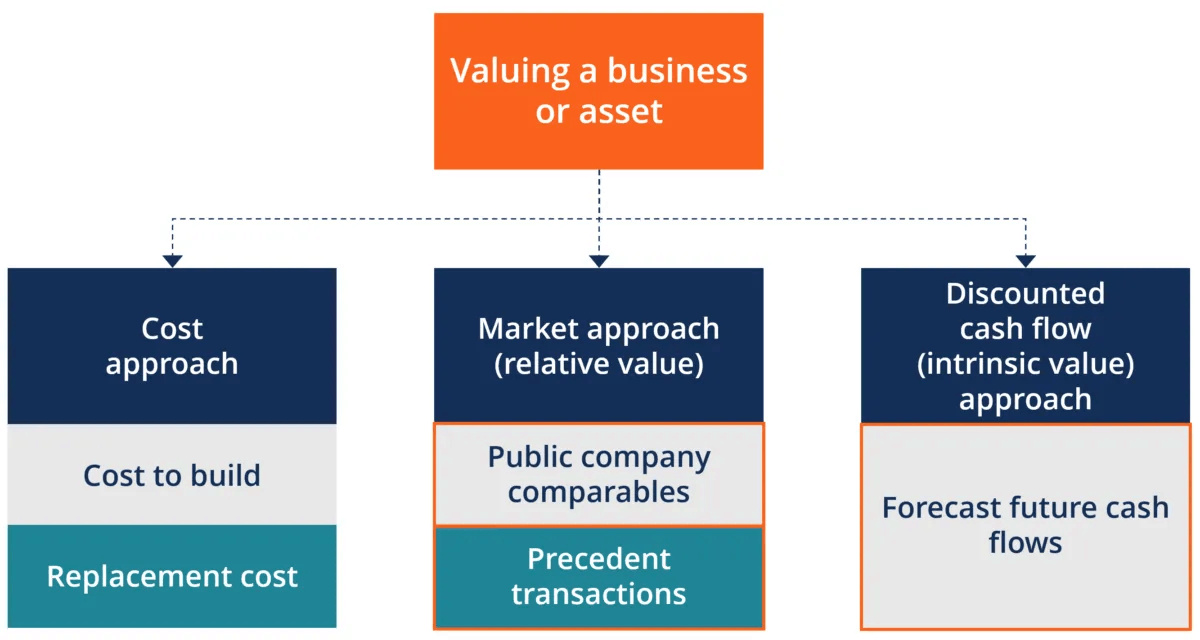

The Discounted Cash Flow model is one of the most popular stock valuation models used by analyst to determine the intrinsic value of a company

Some option strategies are safer than others. I detailed 3 safe option strategies you can consider to boost your trading income in this article.

How do you use the Poor Man’s Covered Call strategy to effectively generate a steady stream of recurring passive income?

Here are 5 ways to make money in a bear market: Strategy #1: Invest in the right asset. Strategy #2: Opportunistic short term opportunities

Find out why a passive investing strategy using the S&P 500 index funds will no longer work as well in the coming decade and what you need to do now

What is the difference between good share buyback and bad share buyback? In this article, I will highlight 4 companies that are engaging in share buyback the right way

How would you look to invest when all asset classes are falling? Amid the current Great Market Sale which is still ongoing, how should we look to invest?

Master the market cycle to supercharge your returns There is a famous saying that goes: “It is futile to time the market. It is time in the market that matters.”