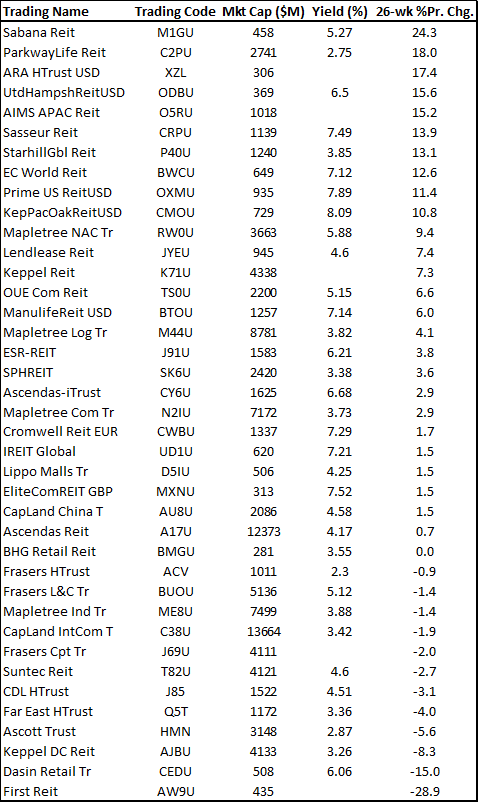

Amid the current market turbulence, which is the best performing Singapore REITs? The table below provides a quick snapshot of the performance of the Singapore REITs, sorted based on its YTD Price performance (Update on 28 June 2021). There are quite a number of REITs that generated positive returns so far on a YTD basis. This is based on data derived from the SGX Screener. Which are the Top 5 best-performing REITs so far in 2021 and which are the Top 5 worst-performing REITs?

Note that this list might not be comprehensive.

Best Performing Singapore REITs (Update June 2021)

The honor of best performing Singapore REITs belong to:

- Sabana REIT (24.3% YTD returns)

- Parkway Life REIT (18% YTD returns)

- ARA Hospitality Trust (17.4% YTD returns)

- United Hampshire REIT (15.6% YTD returns)

- AIMS APAC REIT (15.2% YTD returns)

It is quite surprising that Sabana REIT is the best-performing Singapore Reit in YTD 2021 with a return of 24.3% thus far. Not many brokerage covers the counter, with DBS the only brokerage firm that actively covers this small-cap REIT counter (market cap of $458m) with a BUY call and a target price of S$0.45. However, do note that the house last update was back in January 2021.

Parkway Life REIT is the second best-performing Singapore Reit YTD 2021 with a return of 18%. This defensive REIT has been consistently ranked among the best-performing Singapore Reits, generating double-digit returns back in 2020 as well. CIMB is most positive on the REIT, with a target price of S$4.80.

The other REITs which make up the Top 5 list are also pretty surprising candidates, with ARA Hospitality Trust (17.4%) coming in 3rd, United Hampshire REIT (15.6%), and AIMS APAC REIT (15.2%) rounding up the Top 5. DBS had a timely initiation report on ARA Hospitality Trust back in early 2021, believing that the counter would be a beneficiary of a travel recovery in the US. What is interesting with ARA is that the brokerage house believes that its forward yield could be a decent 5.9% in 2021F, rising to double-digit 12.8% in 2022 based on the assumption that RevPar normalizes.

United Hampshire REIT was listed back in March 2020, hence its track record as a listed REIT on the SGX is pretty short. Only UOB has active coverage on the counter, with a 12-month target price of US$0.95 for the stock. Their BUY thesis premises on a recovery in US domestic consumption, as well as resilience seen in its key sectors of Grocery and Home Improvement, which together account for 54% of their rental income. UOB forecast that its forward yield could be as high as 8.8%.

There has been a major shift in the best-performing Singapore REITs in 2021 vs. 2020, with the latter consisting of blue-chip REITs such as Keppel DC REIT and the Mapletree family of REITs, all of which has underperformed in 2021. On the other hand, ARA US Hospitality Trust which was one of the worst-performing Singapore REITs in 2020, has seen a strong rebound in investor sentiments.

Worst-Performing Singapore REITs (Update June 2021)

The honor of the worst-performing Singapore REITs belong to:

- First REIT (-28.9% YTD returns)

- Dasin Retail Trust (-%15 YTD returns)

- Keppel DC REIT (-8.3% YTD returns)

- Ascott Trust (-5.6% YTD returns)

- Far East Hospitality Trust (-4% YTD returns)

The key surprise is that the best-performing Singapore REIT in 2020, Keppel DC REIT, is one of the worst-performers in 2021 YTD as investors likely took the opportunity to take profit off the table. The REIT is the 3rd worst performer in 2021, after First REIT (-28.9%) and Dasin Retail Trust (-15%).

Another surprise is that hospitality trusts/REITs have continued to underperform the overall REIT sector, with counters such as Ascott Trust (-5.6%) and Far East Hospitality Trust (-4%) rounding up the Top 5 worst-performing Singapore REITs in 2021. Other Hospitality Trusts such as CDL Hospitality Trust as well as Frasers Hospitality Trust also generated mediocre returns in 2021 YTD.

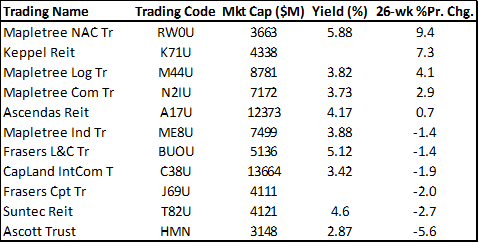

Blue Chip REITs performances (Update June 2021)

Among the Blue-Chip REITs with market cap above S$3bn, the best-performing blue-chip Singapore REIT is currently Mapletree NAC Trust, I counter which I previously highlighted as one of the 5 high-yielding Singapore REITs in my consideration list for 2021.

The other Mapletree family of REITs, which were among the best performers in 2021, saw rather mediocre, but still positive performances YTD, with the exception of Mapletree Industrial Trust which is just slightly underwater.

Ascendas REIT, one of the largest REIT in Singapore, which I recently featured in this video: Top 3 SG Blue Chip Stocks which the street is most positive on is just barely treading above water in 2021. Another blue-chip REIT which was featured in that video is Frasers Centrepoint Trust, which is currently down 2% YTD. The street remains very positive on both REITs, with more than 5 brokerage houses having BUY calls on them. Are they primed for a rebound in 2H21?

We briefly summarized the best-performing Singapore REITs and the worst-performing ones amid the current market volatility. Below I will present my top 5 Singapore REITs for consideration.

4 “still” high-yielding Singapore REITs in my consideration list for 2021 (Update June 2021)

As much as I love some of these defensive REIT names such as Mapletree Industrial, Keppel DC and Parkway REIT, they are yielding way below 5% at present which is not enough to get me excited. Unless these counters correct significantly in the next downcycle, resulting in a dividend yield beyond 5%, I probably will not be looking at adding on to my existing positions in them.

For REITs to fit my consideration list for further investigation, they need to be:

- Yielding above 5% at present

- Demonstrate consistent revenue growth over the past 3 years prior to the onset of COVID-19

Among the Blue-chip names, I consider to favor the following counters

- Mapletree North Asia Commercial Trust (5.9%)

- Frasers Centrepoint Trust (5.1%)

- Frasers L&C Trust (5.1%)

Among the smaller cap names, I favor

- Manulife US REIT (7.1%)

I will be looking to do a more in-depth review of these 4 REIT counters in due time but for now, here are my current thoughts for the individual counters above.

1. Mapletree North Asia Commercial Trust (5.9%)

Mapletree North Asia Commercial Trust or Mapletree NAC for short is a counter that has seen its share price fell from a peak of S$1.48 back in June 2019 to a low of S$0.70 in late March 2020 before rebounding back to the current level of S$1.04.

Hit by continual protest issues in HK which halted operations at its key asset, Festival Walk for 1.5 months back in 2019, the REIT reported dismal operating performance for its FY2020 results. The street is however expecting revenue to rebound relatively strongly in FY2021 with an 8.35% YoY growth.

The Street is still generally positive on the counter, with the average street rating at S$1.13 for the counter which implies an upside potential of c.9% from the current share price level. Add its forward yield of about 6% and the total return potential could be a decent 15% from the counter.

The counter recently reported that it will be adding an office property in Japan, which CIMB believes it is a DPU-accretive acquisition, helping the counter to diversify its exposure away from Festival Walk in Hong Kong which remains its key revenue contributor.

Despite a credible performance in YTD 2021, appreciating by 9%, Mapletree NAC could be one of the blue-chip REITs that can continue to outperform the overall SG REIT sector in 2H21. With a decent yield of 5.9%, this is one counter that remains an interesting REIT candidate for consideration.

The REIT is among OCBC’s preferred pick for a recovery play.

2. Frasers Centrepoint Trust (5.1%)

Frasers Centrepoint Trust as I previously highlighted, is one of the stock that analysts are most positive about, with majority of the brokerage houses annoucing a BUY call on the counter.

Despite its retail exposure which is one of the hardest hit as a result of COVID-19, FCT’s malls are generally pretty resilient due to their sub-urban nature. According to OCBC, recovery is nearly back to pre-COVID-19 levels for suburban malls. The brokerage house expects a firm recovery in FY21 and believes FCT’s portfolio of suburban malls in Singapore is relatively more defensive and resilient in nature given their dominant positions in their respective catchment areas.

The addition of the PGIM ARF portfolio on a 100% basis has also boosted FCT’s scale and profile within the Singapore retail landscape. FCT has also been active on the asset recycling front, divesting away smaller properties and reinvesting the capital into larger properties with better forward yield potential.

FCT remains a solid stock with good fundamentals on a long-term basis. On a short-term basis, I am also attracted by the fact that there could be a trading opportunity in the counter, with a positive BUY entry at S$2.43/share based on the TradersGPS system.

Coupled with a forecasted yield of around 5.1% for 2021, this is a decent REIT to play the COVID-19 recovery in Singapore.

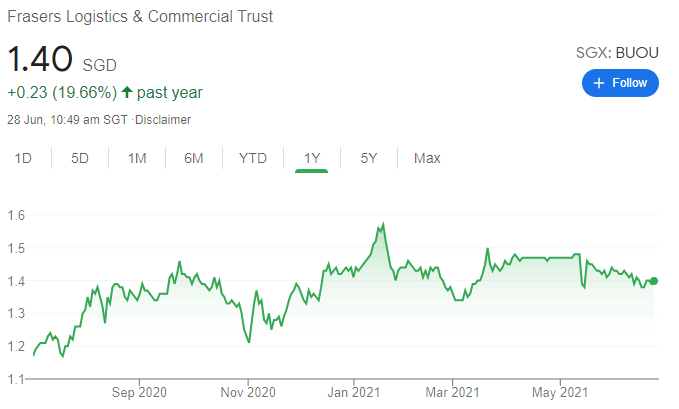

3. Frasers L&C Trust (5.1%)

The merger of Frasers L&I Trust and Frasers Commercial Trust, now called Frasers Logistic and Commercial Trust, will become the Top 10 largest REIT in Singapore, with a diversified portfolio of office, retail, business parks, logistics, and industrial assets.

Since the merger, Frasers L&C saw its share price appreciating strongly, with the REIT ranked as No.3 in our list of best-performing REITs based on its YTD 2020 performance. However, its performance in 2021 has been rather lacklustre, with a return of -1.4% YTD.

Frasers L&C’s forward yield of 5.1% is very much comparable to the “market leader” in the industrial S-REIT arena. What i like about Frasers L&C is its relatively high Occupancy Rate as well as Long WALE of about 5 years.

There are 3 analysts covering this counter with an average target price of S$1.68, implying an upside potential of 20% from the current share price level. Coupled with a yield potential of about 5% and the total return for Frasers L&C over the next 12 months could be approx 25%.

Its a close fight between Frasers L&C and Ascendas REIT. I am tempted to bottom-fish Ascendas REIT’s recent share price weakness as well. However, I believe both Frasers L&C and Ascendas REIT will do relatively well in 2H21.

4. Manulife US REIT (7.1%)

![Best Performing Singapore REITs [Update June 2021] 1](https://newacademyoffinance.com/wp-content/uploads/2021/06/image-173.png)

Manulife US REIT generated a return of approx 6% on a YTD basis, with its share price rebounding strongly from the lows hit in March 2021.

The counter has been on my watchlist since 2020 and I am keeping it in this list due to the following reasons:

- The counter currently spots a forward yield of approx 7.1% which is extremely attractive relative to the US 10-year yields and one of the highest among this list of recommended REITs. I believe that its DPU payment moving forward is sustainable.

2. Manulife US REIT provides good diversification from your typical S-REIT. With a long WALE of > 6 years with gradual rental escalation clauses built into its leases, the revenue visibility for Manulife US REIT is significantly higher vs. most S-REITs.

3. I believe that the prospect for stable organic NPI growth is decent due to the rental escalation clause build in for most of its leases, taking into account that for the bulk of their properties, Manulife US REIT’s rental rate is still lower than the market rate.

4. Manulife US REIT has 7 analysts covering it and all 7 analysts are recommending a BUY on the counter with an average target price of US$0.90 which represents approx 12.5% upside from the current level. Even if the share price does not materialize, investors in Manulife US REIT are still paid a decent 7.1% yield.

There are however a couple of key risks associated with this counter. Number 1, the market remains concerned over the prospect of office properties in the US although the worst is likely over. Number 2 is the weakness of USD which will result in lower returns to SGD investors.

Conclusion

While I believe it is safe to stick with some of the more defensive S-REIT counters such as Ascendas, Mapletree Industrial, Keppel DC, and Parkway Life, etc amid the current market uncertainty, these counters’ yields are not attractive, currently below the sector average. Many of these REITs have underperformed in 1H21 with the exception of Parkway Life which has been one of the best performing Singapore REITs in the past decade.

On the other hand, I have presented a list of 4 REITs for consideration which I believe has a decent forward yield (>=5%)and a reasonably sound operating outlook ahead. These REITs are not heavily geared ( all have < 40% debt to asset ratio) with a relatively low cost of debt funding with scope for a further downward revision in interest costs.

Out of these 4 REITs, 2 of them have their assets based overseas (Mapletree NAC and Manulife US REIT) while 1 (enlarged Frasers L&C) have assets that are more geographically diversified locally and overseas, and 1 with its assets focused in Singapore (Frasers Centrepoint Trust)

Foreign asset exposure tends to be associated with FX risk. This should also be taken into consideration when investing in these counters, especially Manulife US REIT where a Singaporean investor will have double exposure to the USD in the form of its operating assets (generation in USD) as well as its US-denominated share price. This is something to be aware of.

In time to come, I will be looking to do a more in-depth analysis on these 4 individual REIT counters.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- 4 WAYS PARENTS CAN HELP THEIR CHILDREN (AND THEMSELVES) TO GRADUATE COLLEGE DEBT-FREE

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- PRE-PAYING YOUR HDB LOAN? THINK AGAIN

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.