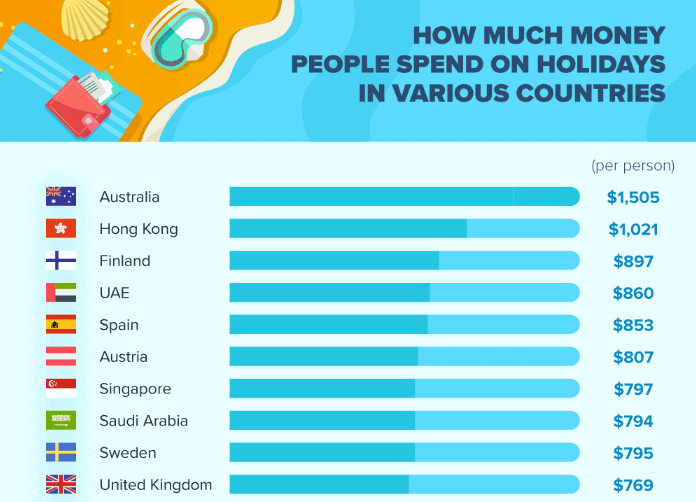

According to a survey conducted by online shopping and discount service website Picodi with 22,000 respondents, Singaporeans are the seventh biggest holiday spenders in the world, spending on average S$1,086 (USD$797) on a holiday.

How much money people spend on holidays

The biggest spenders come from Australia who spends an average of USD$1,505 per holiday per person. Hong Kongers came in second with USD$1,021 while travellers from Finland were third with an average expenditure of USD$897/pax.

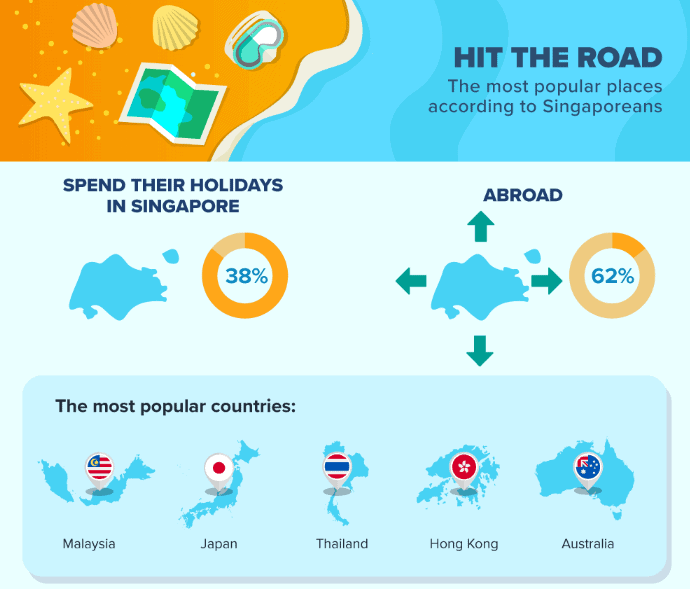

Most popular travel destinations

Among respondents who preferred to travel abroad (62% of respondents), the most popular holiday destinations were Malaysia, Japan, Thailand, Hong Kong, and Australia.

That got us thinking: How can investors invest S$1,000 effectively? We look to explore four ideas in this article.

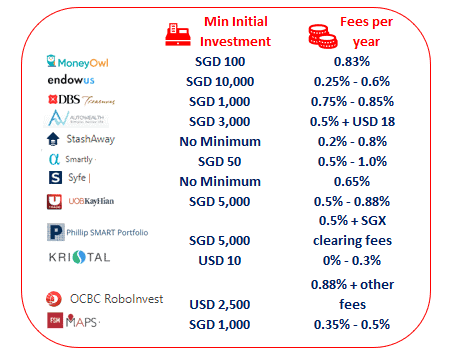

1. Start your investment journey with a Robo-advisor

I have written a number of articles on investing with Robo-advisors: 1) Ultimate Guide to Robo Advisors in Singapore, 2) DIY or Robo? The 1.6% opportunity cost dilemma. While not the cheapest form of investment due to management fees incurred, this is probably one of the easiest manners for a newbie investor to get started on his/her investing journey.

With a small monthly investment outlay that doesn’t break the bank, a young Singaporean can begin sowing the seeds for a bountiful retirement in 30-40 years’ time.

The two key advantages of investing with a Robo-advisor vs. a DIY approach, in my view, are 1) allows for portfolio diversification and 2) periodic rebalancing of the portfolio.

The cost to get started is generally pretty affordable for most Robo-advisors, with some having no minimum initial investment criteria like StashAway and Syfe.

While some Robo-advisors like Endowus has a pretty high minimum initial investment threshold of SGD$10,000, it is the first Robo-advisor in Singapore to allow Singaporeans to invest using their CPF funds.

Instead of parking your money in CPF OA, generating a guaranteed return of 2.5%/annum, one can invest the funds through Endowus, potentially generating an annualized return of 6-8% over the next 30-40 years.

Leaving SGD$100 in your CPF-OA will turn into SGD$210 at the end of 30 years. That same SGD$100 will translate into SGD$761 at the end of 30 years if one invests in the capital market generating a net return of 7%/annum.

Of course, investing in the market has its risks where returns are not guaranteed, unlike leaving it in your CPF OA account where the 2.5%/annum returns are almost a surety.

For a young Singaporean with a long horizon to retirement, he/she can be more aggressive when it comes to investing. Setting aside a small sum of SGD$250/month or SGD$3,000/year could result in a retirement fund in excess of SGD$300k (assumed 7% annualized return) at the end of 30 years.

Price for an initial investment through Robo-advisor: SGD$250

2. Cost-effective investing through ETFs

If one wishes to minimize his/her investment cost, a DIY approach by investing in ETFs could be a potential solution.

What are ETFs? An ETF, short for exchange-traded fund, is a type of security that involves a collection of securities – such as stocks – that often tracks an underlying index. ETFs are listed on exchanges and ETF shares trade throughout the day, just like an ordinary stock.

In short, buying an ETF counter is like buying a basket of stocks. Instead of the hassle of buying into multiple individual stocks to achieve diversification, one can just buy an ETF to achieve that same result, at an affordable cost for new investors.

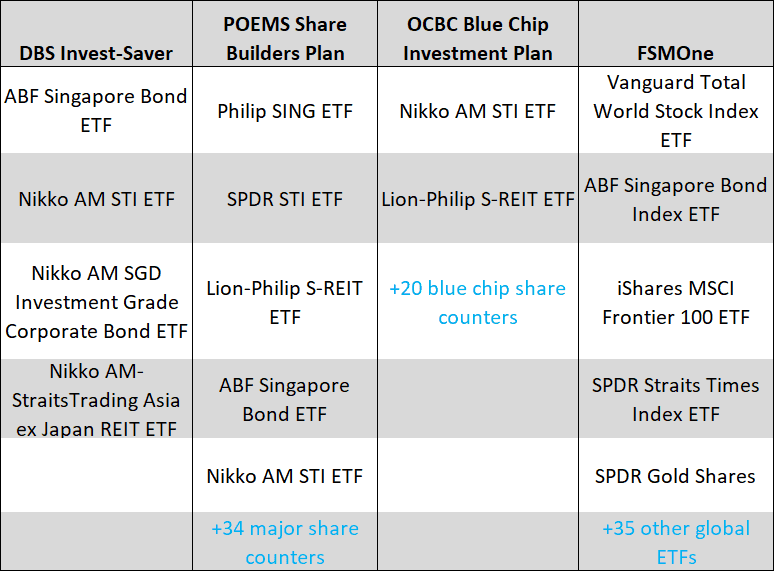

The most cost-effective way of investing regularly in ETF is through a Regular Savings Plan, or RSP for short, offered by FSMOne. I have previously written an in-depth article on FSMOne being the cheapest RSP platform in Singapore.

The FSMOne platform provides an investor with the option of investing in 40 local and global ETFs. This is the widest offerings among the local brokerage houses (DBS, POEMS, OCBC) offering RSP options.

Again, setting aside a sum of SGD$250 to invest in an ETF like the SPDR Straits Times Index ETF might be a viable option to get exposure to a basket of blue-chip Singapore listed stock.

For investors looking at generating higher income, investing in a REIT ETF like the Nikko AM-Straits Trading Asia ex Japan REIT ETF might also be a viable solution. I have written an article on “Why I am still buying REITs even when they look expensive” with the conclusion that the lower for longer interest rate environment will serve to benefit REITs as an investment asset.

Price for an initial investment through ETF investing: SGD$250

3. Buying an SG blue-chip stock

Perhaps one will like to buy an SG blue-chip stock with huge upside potential with very little downside risks? Just like the one that Leonardo DiCaprio’s character, Jordan Belfort, proposed in the show, The Wolf of Wall Street?

I am not here to pull a fast wolf on you. The blue-chip stock that I am proposing does, however, has some similarities to the penny-stock that Leonardo’s character recommended in the show.

The company that sells the “Next-generation radar/satellite equipment”

The company that I am talking about is none other than ST Engineering, a company with an SGD$12bn market capitalization, not a penny-stock in any way.

For those who are unfamiliar with the core businesses of ST Engineering, they are 1) Aerospace, 2) Electronics, 3) Land Systems and 4) Marine. The company’s satellite business is housed under its Electronics division.

ST Engineering bought Newtac, a Belgium satellite communication firm, for SGD$383m back in March 2019. This was followed by a smaller acquisition of SGD$20m for Glolink, another satellite service company in September 2019. The integration of these two businesses might have a short-term negative impact on its Electronics division margins. However, its robust satellite communication services will serve to beef up its global smart city solution offerings in the long-term.

ST Engineering benefits from major tailwinds across all 4 of its key divisions. In its Aerospace division, the recent acquisition of MRAS will allow the company to ride on the tailcoat of A320neo aircraft production. Its Electronics division will benefit from increasing smart city adoption in the region, which is aided by its top-of-the-line satellite communication services. It’s Land Systems division will benefit from the gradual adoption of autonomous buses in Singapore. Lastly, it’s Marine division, will witness a strong rebound in divisional profitability for 2019 and beyond, backed by a strong order backlog for this division.

ST Engineering has been a consistent payer of dividends over the past 5 years, with DPS payment of SGD$0.15 per annum. At a DPS of SGD$0.15, the company spots a respectable dividend yield of 3.75%.

Price for 100 shares in ST Engineering: SGD$404.

4. Investing in education through good reads

Investors, like anyone else, need to constantly read to succeed. Warren Buffett is a voracious reader, allegedly devouring up to 500 pages a day.

One of my favorite investing classics of all-time is Peter Lynch’s One Up on Wall Street. The key takeaway from this book is that one should ignore the ups and downs of the market and focus on the long-term returns to get a handsome reward on your investments. Your long-term should be anywhere between 5 to 15 years.

Alternatively, one can look to read the biography of Mr Jims Simons: The Man Who Solved the Market. Mr Jims Simons is probably the most profitable fund manager that you have not heard of. His Medallion Fund achieved a track record that bested Warren Buffett by 200x over the last 30 years.

While it is highly unlikely that you will be able to replicate his success, I am certain that one will benefit immensely just by learning about his thought processes.

Price for both books: SGD$38.70

That leaves you with about SGD$57 leftover. Keeping some cash on hand is always a good idea as an investor as well as a traveler to capitalize on opportunities ahead. If the holiday spirit moves you, consider making a donation to your favorite charity.

Let’s get ready for X’mas!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “The average Singaporean spends $1,000 per holiday. Here’s a smart way to invest that amount.”

ST Eng has increased pretty significantly throughout the year. Do you think it’s still a good purchase at $4.10?

Hey Xavier,

Thanks for stopping by. Yes, the counter has appreciated quite a fair bit but this is probably one of the very few blue-chip SGX companies that have a decent level of earnings visibility ahead.

As mentioned, all 4 core divisions have decent catalysts in the coming year/s. Aerospace with its recent MRAS acquisition will continue to demonstrate earnings growth ahead. Electronics tend to be lumpy on a quarterly basis but should still benefit from increasing smart city traction ahead. Land System should do well in the coming quarters due to the delivery of the Next-Generation Armored Vehicle for SAF and last but not least, the marine division, a problem child for the past few years, should generate a strong profit rebound due to existing order backlog (excluding the impact of the recent provision).

Valuation wise it is trading below 20x forward PER and spotting a 3.7% yield. So I believe it is decent. Not an aggressive buy but with a longer horizon, it should do well.

Investment takes a lot of discipline. It’s a form of delayed gratification. And the earlier we start the better because it takes time to grow.