Shareholder Yield vs. Dividend Yield

Most investors would be familiar with dividend yield. It is simply the notional amount of dividend issued by the company divided by its market capitalization. It is often easier to calculated dividend yield on a per-share basis.

For example, if a company pays a dividend of $1/share and its current share price is $100/share, this company has a dividend yield of $1/$100 = 1%.

A shareholder yield is a ratio that shows how much the company is sending back to shareholders through a combination of dividend payments as well as share repurchases.

Shareholder yield provides a more complete “picture” vs. dividend yield when evaluating if shareholders’ return is positive. What exactly do I mean by that?

Shareholders are often only interested in dividend payments which is a DIRECT manner of returning capital to shareholders as this is money that a shareholder can “feel and touch”. On the other hand, share repurchase is an INDIRECT manner of also returning capital to shareholders. However, in this instance, shareholders typically do not feel that POSITIVE impact.

It is important to assess a dividend-paying company on its shareholder yield rather than just its dividend yield.

Let me illustrate this concept with a simple example.

How Shareholder Yield Might Differ

Take for example Company A and B both pay dividends to their shareholders and their dividend yield is both 3%.

However, for Company A, it funds its dividend payment by issuing more shares in the company, resulting in a dilution.

Company B pays for its dividend using its cash on hand. On top of its dividend payment, the company also buys back 3% of its outstanding market capitalization. For example, Company B is worth $1m in market cap before the share repurchase. It uses its cash on hand to repurchase $30k worth of shares ($30k/$1m = 3%)

Which company’s shareholders are better off? In this case, both dividend yields are 3% but Company A has a lower shareholder yield due to negative buyback yield while Company B has (3% dividend yield + 3% share buyback yield) = 6% shareholder yield.

While it might not be obvious, but Company B’s shareholders definitely are way better off vs. Company A’s shareholders despite both companies’ shareholders receiving similar dividend payments/yield.

Shareholder Yield = Dividend Yield + Buyback Yield

Shareholder Yield can be summarized by the above equation. For a company like Company A in the above illustration, buyback yield can be NEGATIVE when the company issues more shares than it repurchases. This will result in a company’s shareholder yield being lower than its dividend yield.

How to calculate Shareholder Yield

The simplest way to calculate the shareholder yield of a company is to dig into the Cash Flow Statement of the company. There are 3 steps you need to take to calculate the shareholder yield.

Step 1: Find the amount paid in dividends + amount paid towards shares repurchases (both outflow to the company)

Step 2: Find the amount derived from shares issuance (inflow to the company). Subtract the figure found in step 1 (outflow) to the figure found in step 2 (inflow). The net outflow is the total amount spent on dividends and net share repurchases.

Step 3: Dividend this net figure by the market capitalization of the company. This resulting percentage is the shareholder yield of the company.

For example, if a company spent $4m on dividend payments and $3m on share repurchases but issued $5m worth of shares, then the total net amount spent is $4m + $3m – $5m = $2m. If the market cap of the company is $100m, then the shareholder yield would only amount to 2% vs. the 4% dividend yield which most shareholders would focus their attention on.

On the other hand, if a company spent $4m on dividend payments and $3m on share repurchases, funding both payments through its operational cash generated, then the shareholder yield of this company is a hefty 7% (assuming also a market cap of $100m), a significant increase over the 4% reported dividend yield amount.

Shareholder yield, in my opinion, is a more important metric to look at for dividend payment companies vs. solely dividend yield.

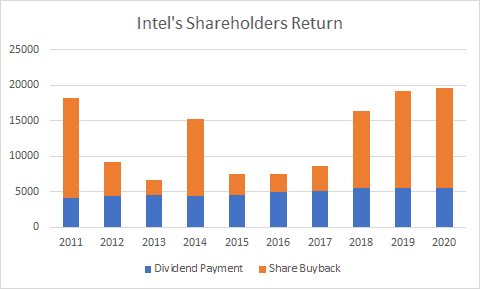

An example of a company that has been “flying under the radar” as a result of its low dividend yield but is in fact a gem when viewed from the lenses of shareholder yield is Intel Corp.

Intel pay’s a dividend of $1.32/share in 2020, worth a total of $5.6bn translating to a dividend yield of 2.5% based on its current share price. Decent but not incredibly sexy.

However, in the same year, the company also bought back $14.1bn worth of shares. Including the dividend payment of $5.6bn, the total shareholders’ return equates to $19.7bn or a total shareholder yield of 9.1% based on today’s price. This figure now looks a lot sexier.

As can be seen from the chart above, Intel’s dividend payment is a lot more consistent than its share buyback program.

Why do companies do share buyback?

1. Return excess capital to shareholders

Companies do share buyback for a multitude of reasons. The first one is as highlighted above, to return excess capital to shareholders indirectly. This is a more subtle way vs. dividend payment which is often publicized and tracked. If a dividend-paying company lowers its annual dividend payment, that is often seen as a big deal whereas if the buyback figure drops or ceases, the market doesn’t pay much attention to such corporate details.

Hence, it pays to be more “conservative” and ensure a sustainable annual dividend increase, with excess capital returned through the form of share buybacks.

2. Improve EPS

The second reason is to reduce the outstanding share base which translates to a higher Earnings Per Share or EPS figure even if the absolute net profit figure might be constant.

For example, Company A might earn the same amount of net profit of $100 in both Year 1 and Year 2. However, in Year 2, the company uses excess cash on hand to reduce its outstanding share base from 100 shares to 90 shares.

EPS in Year 1: Net profit of $100 / Outstanding shares of 100 shares = $1 in EPS

EPS in Year 2: Net profit of $100 / Outstanding shares of 90 shares = $1.11 in EPS.

Company A’s EPS has increased from $1 in Year 1 to $1.11 in Year 2 even when the absolute net profit is the same.

This gives the impression that the company is faring better in Year 2 vs Year 1.

Is share buyback to increase shareholder yield always a good thing?

US companies have been actively engaging in share buyback as a way to increase shareholder yield as well as to give the “illusion” that the company is doing better in terms of a bigger EPS figure even its absolute net profit might have stagnated.

Using share buyback to boost EPS is nothing unethical although not widely adopted in Asian companies. However, it is the usage of debt to buy back shares (at whatever price it might be) that might become a major problem down the road.

This is what happened to many airlines companies who borrowed heavily as debt financing is cheap to finance their share buyback regime. This is Ok in a normal operating environment where tourism used to be a “blue-sky” industry benefitting these airline companies.

Not anymore with the onset of COVID-19 and that was when many of these airline companies had to be bailed out by taxpayers’ money, after enriching their shareholders for years.

Funding share buyback with excess capital on its balance sheet or strong operating cash generation in a bid to increase shareholder yield is a more appropriate and conservative action that management should take vs. the debt route.

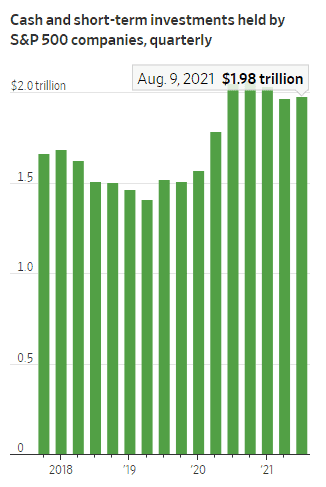

US companies are currently cash-rich

According to a Wall Street Journal report, the S&P 500 companies are sitting on a strong cash hoard, with cash and cash equivalent hitting $1.98trn as of August 9, according to data from Dow Jones Market Data – an increase of more than 30% from the end of the 3rd quarter of 2019.

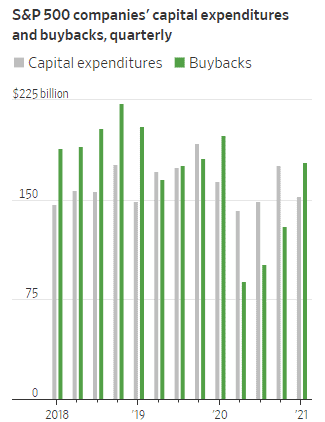

Companies have authorized more than $680bn in stock repurchases through July 2021, a figure exceeded only by 2018’s record in data going back to 2000. Now flush with cash in a rebounding economy, companies are announcing plans to increase spending broadly on both capital expenditures as well as on buybacks.

Many thus believe that companies engaging in share buyback using their existing cash alongside a glut in household savings will help power the indexes to new highs for the rest of 2021.

Goldman Sachs, for example, last week lifted its target for the S&P 500’s year-end level to 4700 from 4300, citing factors including higher corporate investment and greater capital returns to stockholders.

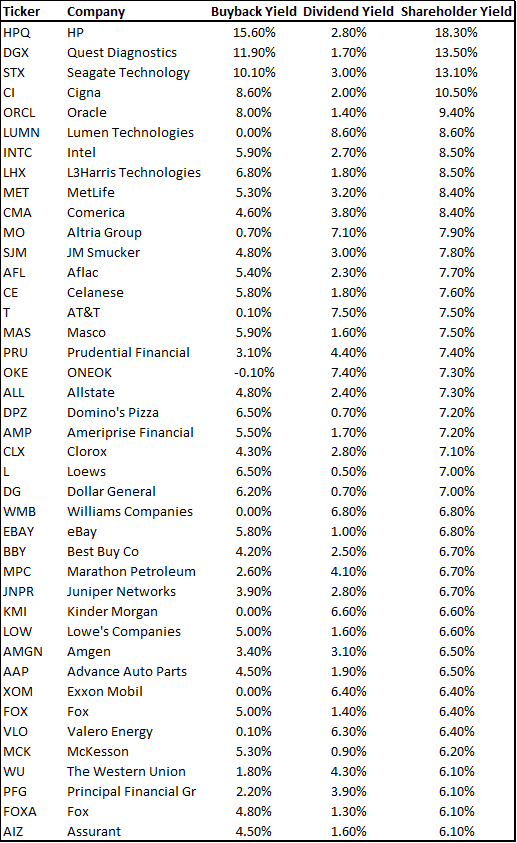

Which are the companies with high shareholder yield?

The table below identifies the S&P 500 stocks that have a shareholder yield above 6%. Top of the list is HP which has a total shareholder yield of 18.3%, which is broken down into 2.8% in dividend yield and 15.6% in buyback yield.

There is however no certainty that these companies with high shareholder yield will result in strong share price performances. Many of these companies have underperformed the S&P 500 substantially over the past decade due to the lack of operational growth in the past decade where growth companies reign supreme.

Nonetheless, these are companies that are often viewed as stable stocks and while there might not be strong price appreciation potential, the downside risk associated with these counters is typically also on the lower end of the spectrum, in my view.

Conclusion

Shareholder yield, simply defined as dividend yield + buyback yield, is a better representation of total shareholders’ return vs. purely looking at a company’s dividend yield.

Many of the highlighted companies which have high shareholder yields over 6%, typically sport an unexciting dividend yield of < 2%.

However, as highlighted, having a high shareholder yield does not necessarily translate to better share price performance. A major concern pertaining to high buyback yield is companies funding these buybacks using cheap borrowings, a form of “financial engineering”.

Nonetheless, for companies generating tons of operational cash and are “cash-rich” in nature, engaging in share buybacks typically translates to better share price performance over time.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only