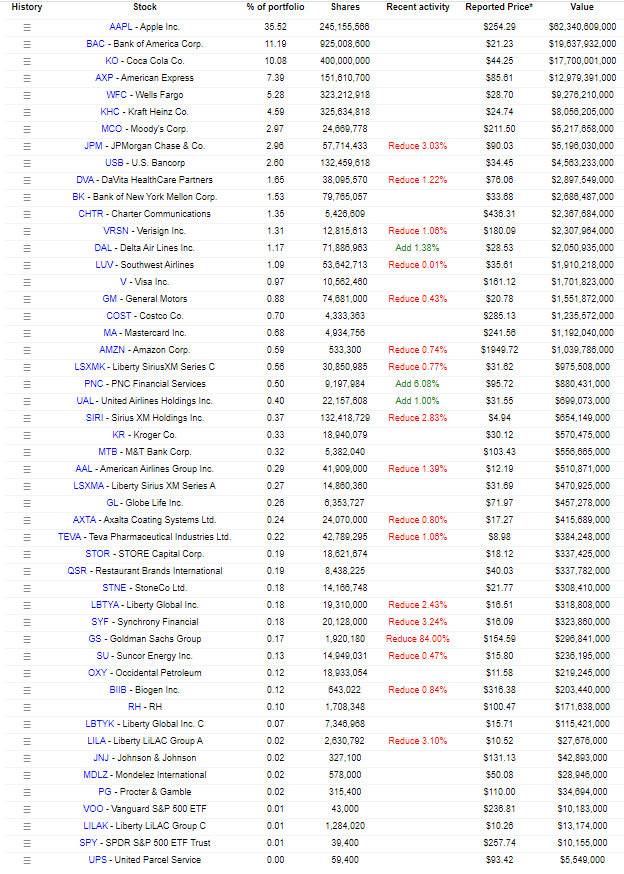

Here is the complete list of Warren Buffett’s latest 1Q20 stock holdings, disclosed in a filing yesterday.

Key stake changes

Full Exit: Travelers Cos and Phillips 66

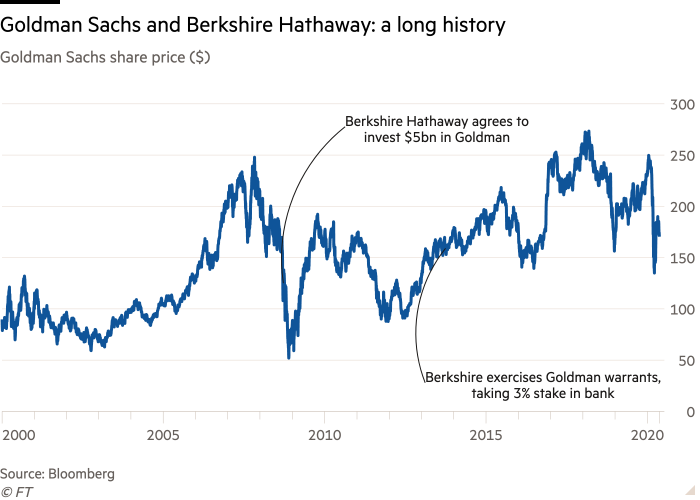

Major Reductions: Goldman Sachs Group (down 84%)

Minor Reductions: JP Morgan (down 3%), DaVita (down 1.2%), Verisign (down 1.1%), General Motors (down 0.4%), Amazon (down 0.7%), Liberty SiriusXM (down 0.8%), Sirius XM (down 2.8%), Axalta Coating (down 0.8%), Teva (down 1.1%), Liberty Global (down 2.4%), Synchrony Financial (down 3.2%), Suncor Energy (down 0.5%), Biogen (down 0.8%), Liberty LiLac (down 3.1%)

Purchases: PNC Financial Services (up 6.1%), Delta Airlines (up 1.4%), United Airlines (up 1%)

Subsequent Sale after 1Q20: Delta (full exit), Southwest Airlines (full exit), United Airlines (full exit), American Airline (full exit), US Bancorp ( down 0.3%), BNY Mellon (down 0.6%)

Warren Buffett 1Q20 Portfolio Holding

Warren Buffett sold off most of its Goldman Sachs stake in 1Q20, a long term holding that has declined by approx 32% (as of 15 May) from its recent peak. Still, Goldman Sachs stock performance is still comparatively better than JP Morgan which has declined 39% and Wells Fargo which has declined by 57%.

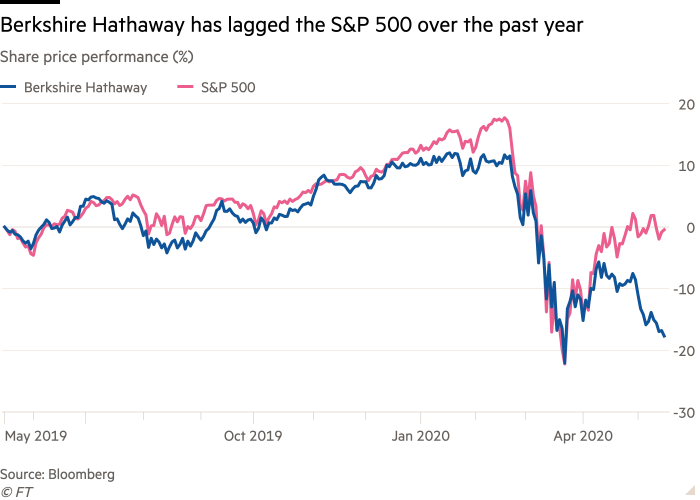

With bank stocks continuing to underperform the market in April and May, this segment of his holdings will again be the biggest drag on its performance for 2Q20 as the general market recovers. If there is going to be a second wave of market sell-down, this time likely due to the economic impact that COVID-19 has ravaged on global economies, I suspect banks will continue to take the brunt of the selldown.

“The range of possibilities on the economic side is still extraordinarily wide. We do not know exactly what happens when you voluntarily shut down a substantial portion of your society. In 2008 and 09 our economic train went off the tracks and there was some reason the roadbed was weak . . . but this time we just pulled the train off the tracks and put it on its siding . . . and I don’t know of a parallel.”

Warren Buffett

Warren Buffett also fully exited his stakes in Travelers Cos and Phillips 66 albeit they are very small stakes.

Berkshire Hathaway shares have fallen 25 per cent this year, compared to an 11 per cent decline by the broader market.

This underperformance will likely continue given Berkshire’s huge cash hoard that is not generating much return in this seemingly bullish market. Is Buffett trying to fight the Fed?

On the other hand, a second wave of selldown which takes out the March low will likely see Warren Buffett capitalizing on the market weakness this time around and put some of his US$136bn cash to work.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHAT DO NETFLIX, ALIBABA, DBS, MICROSOFT HAVE IN COMMON?

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.