Show me the money!

These are the star-making four words made popular by the 1996 film Jerry Maguire that still resonates within us after more than 2 decades. Let’s admit it. These are the words that we have always want to spew it to our bosses. ” You want me to work Overtime, SHOW ME THE MONEY!”, ” You want to stay on, SHOW ME THE MONEY!” But alas, it takes some real iron-clad balls to do just that, something I have always wanted to grow (pardon my punt).

Let’s welcome the sharks! (Not the ones featured in Shark Tank)

When $$$ is an issue and your banks turn into your fair-weather friends, some of us desperate enough will turn to the illegal money lenders, commonly known as loan sharks or Dai Yi Long (in hokkien, a dialect). Everyone stays chummy when they dish out the money to you.

The problem usually arises when they forget to mention that your loan will cost you 10%, a MONTH!!!! What happens when you fail to repay your loan plus interest? The usual props will now be in use: red paint, pig’s head, thick metal chains, kerosene, lighter. Sounds familiar? But let’s refrain from going into details. DAMAGE: 10% a month!

A second option would be to approach the licensed moneylenders. Basically loansharks who are legally allowed to burn down your house if you don’t pay up. Just joking. These lenders can disburse out the loans on a secured or unsecured basis, with a monthly interest cost cap of 4%, which still translates to a simple annual interest cost of 48%!

According to the Ministry of Law, there is a total of 157 licensed moneylenders as of October 2019. DAMAGE: 4% a month (phew much lower than 10)

A third option is to take whatever remaining valuables we own and head down to the nearest pawn shops. In Singapore there are a few household pawnshop chains which always seem to be beckoning to us.

Valuemax, Moneymax and Maxi-cash are the 3 largest pawnshops chains in Singapore and they are listed on the Singapore exchange. Pawnshop as the word implies, require you to pawn something of value, usually in the form of jewellery or gold as a collateral for the fund you borrow. DAMAGE: 1% a month (that looks reasonable? Or is it)

Enough of all the storytelling, our company focus this month is on one of the 3 companies we just mentioned above: Valuemax

Summary:

– Pawnshop a recession-proof business?

– Awarded money lending license in late 2014. This division to spearhead future earnings growth

– Cheap valuations trading at 8.6x trailing PER

– Returns excess cash to shareholders in the form of dividend payments. Current yield at 3-4%

– One major risk associated with unsecured lending

A recession proof business model

We have always thought of pawnshops as a recession proof business. These businesses naturally flourish during downturns.

Unemployment goes up ==> more people require cash financing to make ends meet ==> more frequent trips down to the pawnshop to “monetise” my assets ==> pawnshops make more money as pledges increases ==> if pledges are not redeemed, the shop takes the pledge, refurbish them and resell at retail prices, usually a sizable premium relative to the loan amount.

Such a fantastic business model, isn’t it?

But wait, what happens when the economy is doing well, you say? That’s when pledges start to stagnate and earnings for these businesses decline amid cost inflation.

Reality sets in when Valuemax stock price peaked at SGD0.55 in 2013 when the market realize the folly of paying earnings multiples in the high teens when the business has in fact stagnated.

The stock was punished, not because it was a loss-making entity but solely on the fact that it was not growing as per market expectations. Share price took a long descend and finally bottomed at SGD0.23 in mid-2016.

Since then, its price has not done much despite improving business fundamentals. This could be due to a lack of awareness of the change in business structure of the Group as well as the lack of proper analyst coverage from the street. Or maybe sentiments were just depressed due to weak gold prices. Are things set to change?

Start of a new business entity

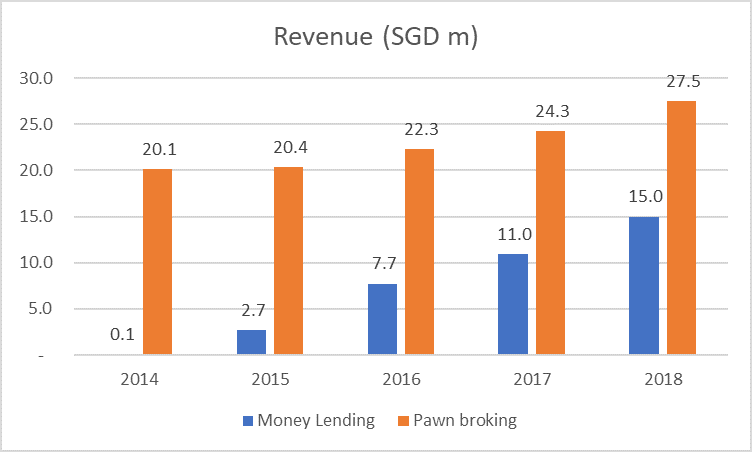

What the market hasn’t realize was that a new moneylending business entity was formed after the company was approved a money lending license from the authority in late-2014. This division currently contributes 31.5% of Group’s segmental profit in 2018 vs. 8% back in 2015.

We expect contributions from this division to continue rising in the coming years, particularly if Singapore does in fact enters into a recession.

Let’s drill a little deeper into this exciting new development. The company’s main clientele are business owners who require short term working capital funding that is unavailable to them through banks due to the urgency of the funds required (banks require 2-3 months for customer due diligence checks while the company only requires 2 weeks).

The company requires a private residential/commercial property as a collateral (property has to be unencumbered) and will disburse out the funds based on a loan-to-value ratio of 60%. A company personnel will also inspect the sale ability of the property. In the event of a default, the company has got a 40% buffer when selling the property out in the open market.

Why is this new business arm so complementary to the company’s existing pawnshop business? Well there are always requirements for business loans, more so during good times when expansion makes sense. Hence the group can now grow its business, in good or bad times.

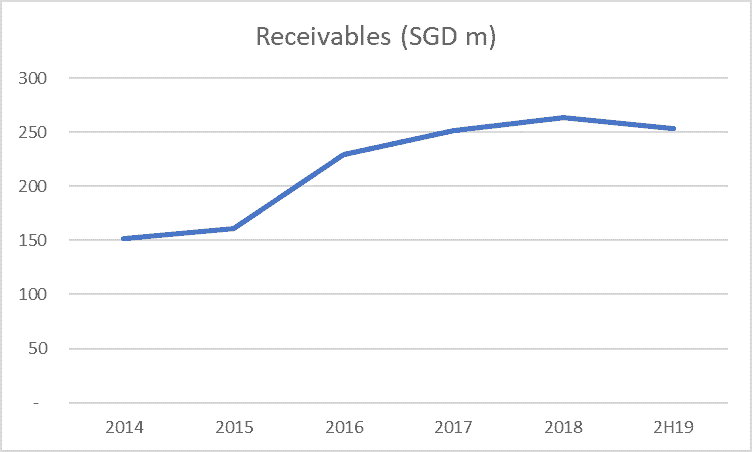

For both its pawnshop and moneylending divisions, the company funds customers’ loans by getting financing from banks and generates profit through the spread. More bank borrowings = more receivables = more profits.

For such businesses, you wish to see receivables growing in conjunction with greater bank borrowings. The more levered the entity, the better their future prospects will be. Sounds counter intuitive?

Such is the beauty of the lending business.

Past 5 Years Financial Performance

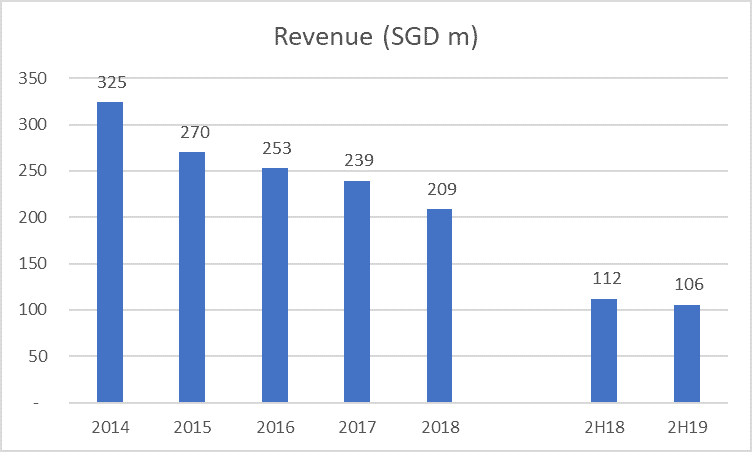

On the surface, the company doesn’t seem to be doing well at all, with Group’s revenue showing a steady decline over the past 5 years. However, this is mainly attributable to lower “retail and trading” revenue, an extremely low-margin segment (less than 0.5% operating margins).

On the other hand, Valuemax’s core segments (pawn broking and money lending) has in fact been witnessing a steady increase in revenue.

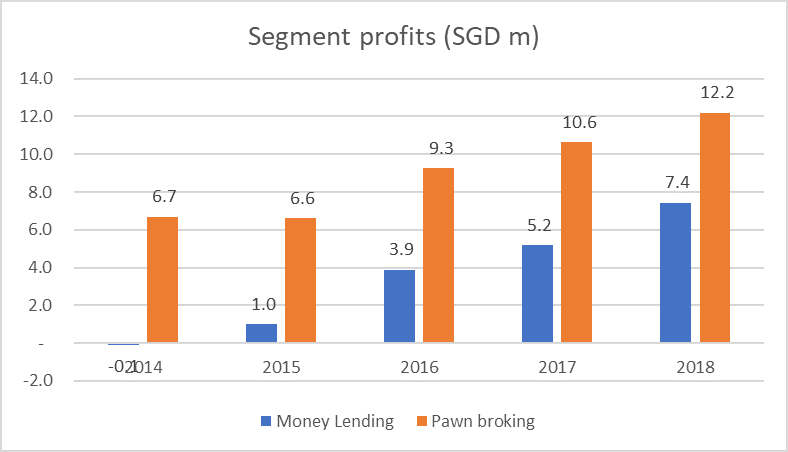

Segmental profits from these two core segments have also been rising.

Can the trend continue in 2019?

Based on 2H19 performance, its does seem like Valuemax is on track to generate another record performing year, with 2H19 earnings up 15.3% YoY to SGD12.2m vs. SGD10.6m in 2H18.

Management has done a good job thus far growing its core pawnbroking business as well as money-lending business. With gold prices now breaching the USD1,500/oz level, this is definitely a major tailwind for Valuemax’s pawnbroking business.

However, we do see ONE risk in its upcoming 3Q19 results.

Lending to un-securitised clients

The company has likely been slowing increasing its exposure to the riskier un-securitised segment, which commands higher returns but correspondingly has higher associated risks as well. This is one area which we are rather cautious about and there is good reason to be.

Honestbee, a local grocery food delivery company that was once the poster child of fintect start-ups here in Singapore, announced on 4 August 2019 that it has applied to the Singapore High Court for a moratorium to restructure its business which has come under financial difficulties.

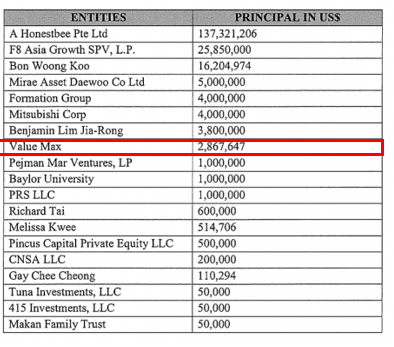

What has Honestbee got to do with Valuemax? Well according to the court document, Valuemax is one of the top 10 largest unsecured financial creditors of Honestbee, with an outstanding loan amount of USD2.9m (or c.SGD4m)

It is probably still early days to conclude if the money owing to Valuemax by Honestbee can be fully repaid in due course. The latter owes its creditors more than USD180m in total!

Valuemax might have to address the issue of this un-secured lending in its upcoming 3Q19 results announcement which is sometime in mid-November.

Valuation

Based on a market cap of SGD175m and 2018 earnings of SGD20.3m, the company is trading at a trailing PER multiple of 8.6x while concurrently yielding 4%. Not too bad for a recession-proof company.

This is likely one stock that I will consider a small stake (due to low liquidity) in my portfolio but preferably after more clarity pertaining to its exposure on the unsecured lending side.

Conclusion

Valuemax is a recession-proof company (see our other article on 4 recession-proof US stocks) that is also a cheap way to play the rise in gold prices. With a dividend yield of 4% and trading at single-digit PER multiples with decent earnings growth potential, this is one stock for serious consideration.

However, as highlighted, we see one major risk pertaining to its unsecured lending business, which if not properly managed, could risk blowing up the company’s whole money-lending business model.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- 4 RECESSION-PROOF US STOCKS IN MY WATCH LIST

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- BUFFETT SERIES: DISNEY

- 46 STOCKS IN BUFFETT PORTFOLIO

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.