uSMART review: Singapore’s first online SMART brokerage platform

Recently I was posed a question over dinner that caught me off guard.

“What do you think, are you smart?” My dinner kaki looked at me with both curiosity and a very intense level of earnestness.

I choked on my food as I had known this dinner kaki of mine for more than 2 decades and had always thought that our friendship was far beyond topics like this.

“Huh? What do you mean? You’ve always known how I feel about myself.” I responded.

Without any pause, he immediately responded, “Huh? What are you talking about? I mean what do you think about the new investing app uSMART la! Why are you always so self-conscious?”

This article is written in collaboration with uSMART Singapore. All views expressed in the article are the independent opinions of the New Academy of Finance. The information in this article is meant purely for informational purposes and should not be construed as financial advice.

New kid on the block

I immediately whipped out my phone and searched up for this apparent new kid on the block ‘uSMART’.

To be honest, had my dinner kaki not told me that it was a new investment platform, I would not have been able to tell at all from the app logo.

It didn’t help that I was naturally a skeptical person so the first thing I did while waiting for the downloading of the app to complete was to load up google and search up U SMART.

I clicked on the first populated result which was their official website www.usmart.sg and so it turns out that uSMART is Singapore’s first regulator-approved Smart Broker, a project that is helmed by a conglomerate of big boys.

They are also licensed by the Monetary Authority of Singapore (MAS) and have a segregated custodian account which in my opinion is the minimum a broker needs to have before you even consider using their platform.

The next question is, what does ‘Smart Broker’ mean?

Well, it means that uSMART integrates FinTech and Big Data technology into the world of investing which then allows its users to make more informed investment decisions. On top of that, it also has its own social media ecosystem which allows users to pick up investment knowledge in a more interactive way.

With the evolution of technology, retail investors are increasingly able to have access to more and more information and data which could help us gain an edge in the markets. However, do take note that information can be a double-edged sword because sometimes having an overwhelming level of information without the ability to unscramble that data might just confuse us further.

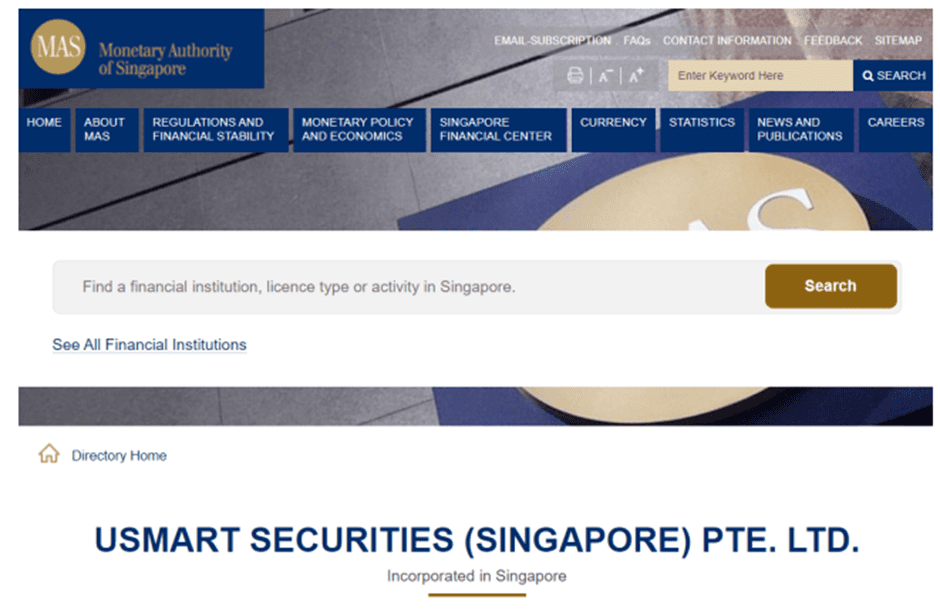

Being the typical Singaporean that I am, one final thing I had to do to determine its legitimacy was to search for uSmart on MAS’ list of licensed Financial Institutions (because anybody can claim to be regulated right) andddddd it checked out.

With the company due diligence out of the way, I booted up the app on my phone.

Signing up process

I believe the whole idea of having an app-based investment platform is to allow potential users to be onboarded in a manner that is as smooth as possible with zero bottlenecks and uSMART does just that.

Similar to all new age brokers, it allows new users to register using their mobile numbers. The whole signing-up process will take no more than 15 minutes, although uSMART claims that the sign-up process can be as short as 5 minutes.

The reason why account opening will only take all of 5 minutes is that the process is integrated with Myinfo, which with our permission, allows uSMART to directly retrieve our information from Singpass. That was relatively easy.

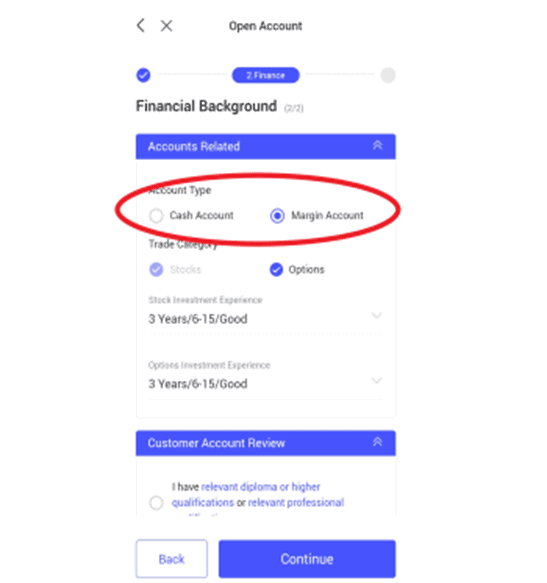

There are some sections that first-time account openers might be unfamiliar with. One example would be the section on Financial Background which would ask if we are opening a cash or margin account. For starters, I would advise that you can start with a cash account as margin accounts are for leveraged trading which poses potentially more risks.

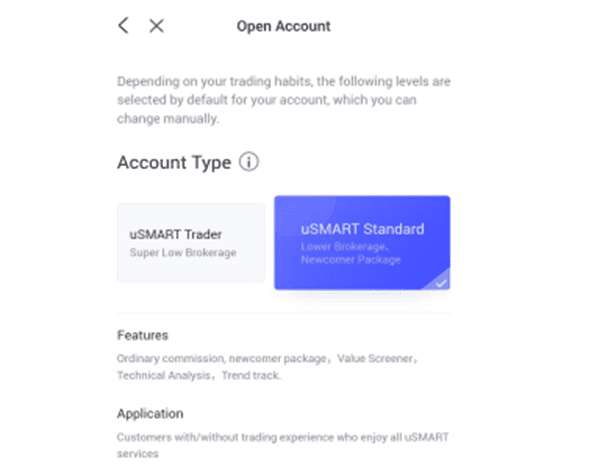

At the last phase of account opening, I was prompted with 2 types of accounts to choose from. One was uSMART trader while the other was uSMART standard. There wasn’t much information at that point of time of what exactly each option was but it seemed that uSMART trader is just flat out super low brokerage fees as compared to uSMART standard which has slightly higher brokerage fees (but still low) as compared to uSMART trader but comes with a newcomer package.

Again, my Singaporean instinct immediately kicked in and went for the uSMART standard because who in his right frame of mind would pass up on the newcomer package right.

Turns out my instinct proved to be right as uSMART trader’s super-low fees are for more experienced and higher frequency trading which is not something that I typically do. Aside from the newcomer package, the uSMART standard also allows its users to have access (limited usage) to tools for technical analysis and value screeners.

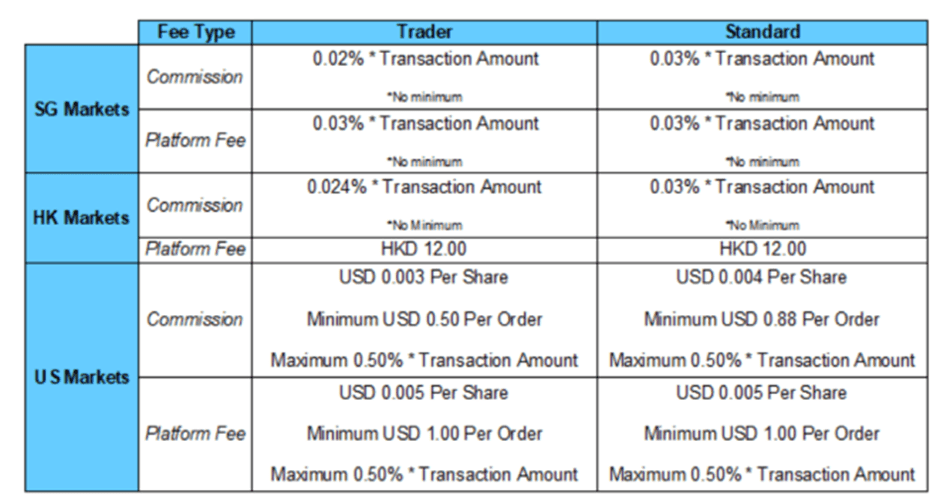

The trading fees are pretty competitive as you can see from the table below.

Support

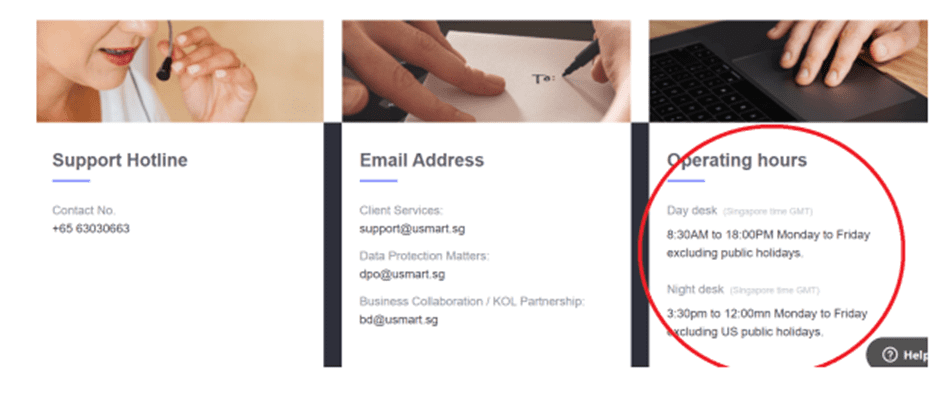

As an investor myself, one of the most important things in my opinion is the availability of round-the-clock support. The reason is simple – I am not a professional and sometimes the numbers, candles, and percentages might get confusing, especially so when the markets are live. So, the next thing I looked for was USMART’s support.

The good thing is that they do offer phone and email support and at pretty extended hours between 830am to 1159pm, Mondays to Fridays. The not-so-good thing is that you might be caught in a situation where you will not be able to find support if you happen to trade the US Markets after midnight.

uSMART users should also join their telegram group which can be accessed easily through the QR code below:

Features

Here comes the main course. The features that make uSMART smart:

Social Media Ecosystem

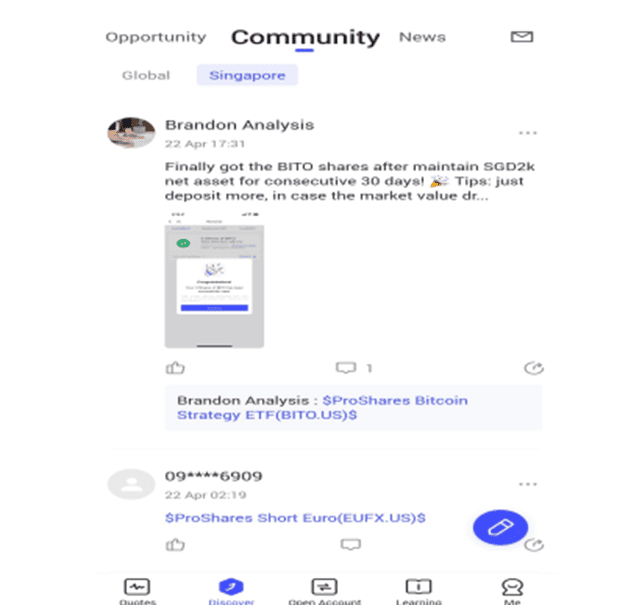

What’s unique about uSMART is that aside from the typical provision of news and market quotes, it also provides users with a social media ecosystem.

In my opinion, I think that it is a good thing because investing can be a lonely journey filled with a great amount of technical jargon. Having a community as a support system will be very helpful.

Here are the several different modules in uSMART’s social media ecosystem:

Community

The community is like a forum where users can post about anything relating to their trading, from their market views to their wins. Users can interact with one another in the community and can have discussions on their investments.

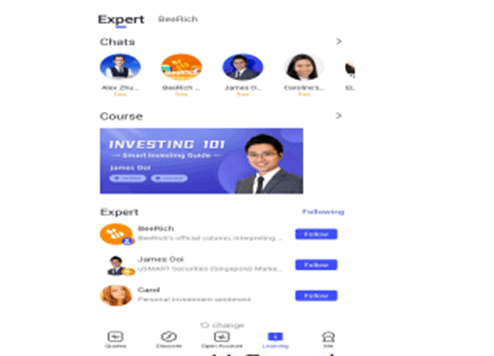

Learning from Experts

uSMART also has a learning module that offers users a chance to tap into the knowledge and expertise of market experts.

Not only will uSMART’s users be able to hear from the experts, but they can also interact directly with the expert by chatting and asking them questions. Users can also follow the experts so that they will be updated on the go. It is almost like a lesser version of a discord group for each and every expert.

Best of all, these features are free!

BeeRich

In today’s fast-moving world, the younger generation prefers information to be fast and concise and that is exactly what BeeRich does – provide short, concise, and informative reels on investment topics.

The interface is very similar to TikTok or Facebook reels, just that the content is entirely finance-related.

Research and Recommendations – uSMART Intel Subscription

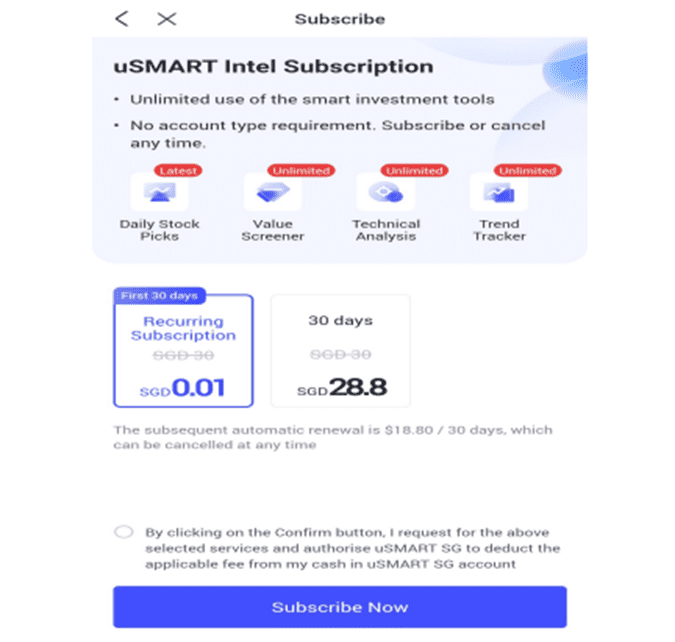

Besides the information offered by uSMART’s social media ecosystem, there is also a subscription service called uSMART Intel Subscription which offers additional features like daily stock picks and featured strategies.

We won’t know exactly if the information might be helpful for us until we try it so uSMART is smart to offer us the first month practically free at 1 cent.

Subsequently, if you’d like to continue, it will be $28.80 per month. If it can enhance your trading and give you that extra couple of percent returns, it might be a great tool to have. I will be doing an in-depth feature video for its uSMART Intel Subscription, s do look out for that content.

Once you subscribe to the service, you will have access to Daily Stock Picks, Value Screener, Technical Analysis, and Trend Tracker.

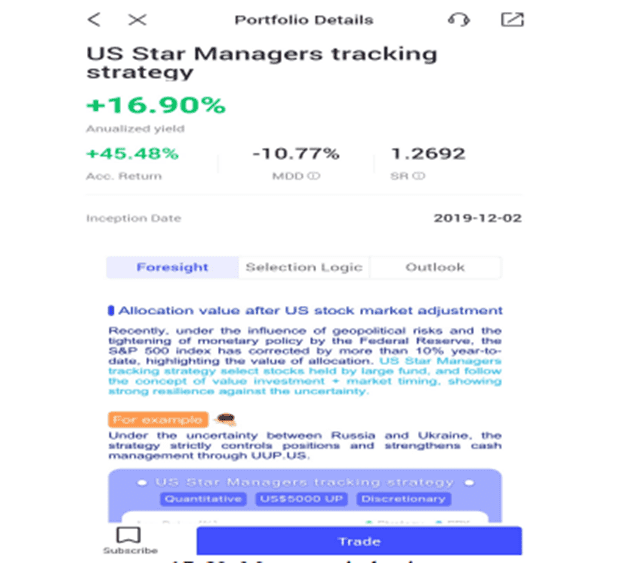

You will have access to strategies like the US Star Managers Tracking Strategy where details like the strategy’s annualized yield and max drawdowns are currently available. Upon subscription, the assets constituted in the strategy will then be unlocked.

Order Types

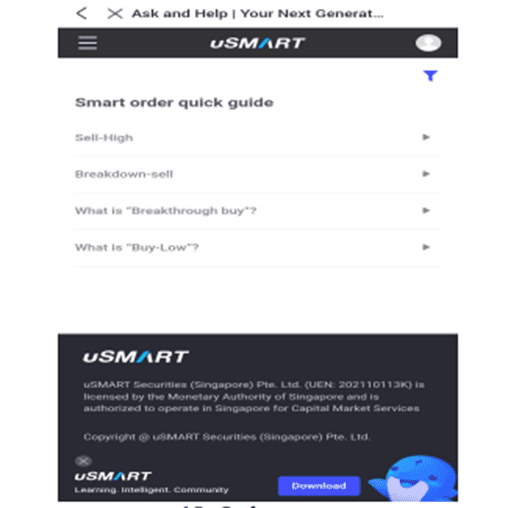

One of the other features that I felt was quite interesting was uSMART’s order types. What they did with these order types was to simplify them for retail investors.

Sell High – This allows users to set a take-profit price on their investments so that once the price is reached, the sell trade will be automatically triggered.

Breakdown Sell – This allows users to set a stop loss and trigger a sell at a certain price or percentage point.

Breakthrough Buy – This allows users to trigger a purchase when the investment he or she is following breaks through a particular price point. This is usually placed at a point where the user finds that breaking through these price resistance points means that the investment will have the momentum to continue going upwards.

Buy Low – This allows the user to trigger a buy when the desired price point is reached. For example, if Tesla is trading at $1,000 currently and I find that it instead should be valued at $800, I can set a Buy Low and leave it there for up to the next 90 days. Anytime the price reaches this level, a purchase of Tesla will be triggered.

Although these features are neither state of the art nor revolutionary, I will still give uSMART credit for renaming them to make them more understandable for the retail investor.

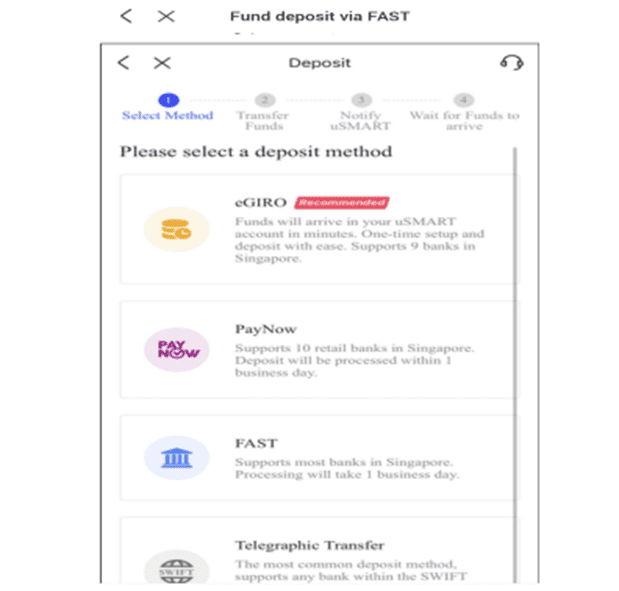

Funding Your Account

For most parts, the funding methods are the same except for e-GIRO which is the first time I’ve seen it.

According to the table, the funds will reach your account within minutes of your e-GIRO transaction. This is awesome because my experience with brokers is that it takes usually at least 1 working day and we all know that 1 market day sometimes can feel like an eternity so I give this feature a thumbs up.

Another thing to note is that since most of the more efficient funding methods are in Singapore Dollars, you will have to keep a lookout on the conversion rates if you are trading foreign markets.

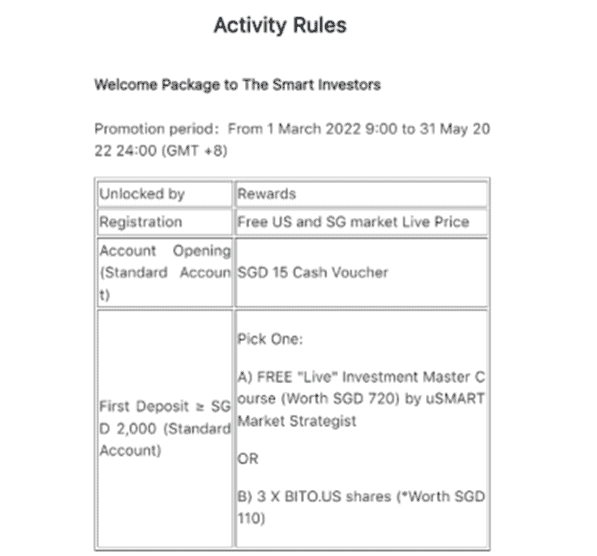

Promotion

From now until 31st May 2022, if you sign up with uSMART and fund your account with SGD$2,000, you will receive:

These are pretty awesome start-up gifts considering you don’t have to put in any trades to get them.

The BITO.US shares is a Bitcoin futures ETF so if you have been wanting to get your first ever exposure to something crypto-related, you can start here for free!

P.S If you have found this article to be helpful, you can use my referral link to sign up. On top of you receiving the Welcome Package, I will be entitled to a $88 stock voucher.

Conclusion

In conclusion, I feel that the app is innovative because of the proposition of its Smart technology. This is in my opinion especially suitable for people who are starting or want to get their feet wet because the features are well sufficient and they can fall back on the community and experts if they have any questions. If one is not ready, he or she does not even need to fund the account but just lurk around in the community and BeeRich module to level up on their knowledge before diving in.

Get started by signing up for a uSMART account today by clicking on the link below:

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats