Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Syfe Review

I have written several Syfe reviews in the past, the first article back in early 2020 when I highlighted to my readers this up-and-coming Robo advisor which has a unique value proposition based on its automated risk-managed investment (ARI) strategy. I also highlighted how easy it was to open a Syfe account and start investing through a dollar-cost average approach with this Robo advisor.

I followed up subsequently with a few more articles on Syfe, highlighting its REIT+ offerings as well as the creation of its Equity100 portfolio back in mid-2020. Readers can refer to the various Syfe review articles in chronological order below:

- Guide to Syfe and how to open an account in less than 10 minutes

- Syfe Guide: Did Syfe’s ARI algorithm outperform in today’s market volatility

- Syfe Equity100 review: Does this portfolio make sense to you?

- Syfe Review: Which of its portfolio offering will I select?

Syfe’s recently launched Core Portfolio

Syfe recently launched its Core Portfolios back in March 2021, an attempt to provide investors with the option to invest in a more “traditional” sense but with a twist. What do I mean by that?

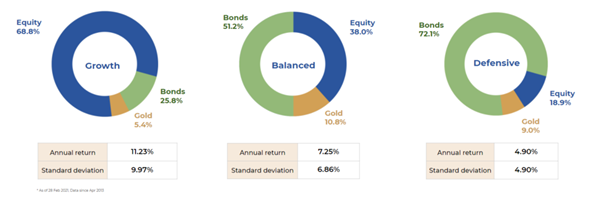

Syfe’s core portfolios consist of 3 types: Defensive, Balanced and Growth.

The key differences are the asset allocation profile, with the growth portfolio heavily geared towards equity while that of the defensive portfolio gearing towards bonds.

The equity component of the Core portfolio is essentially the replication of the Equity100 portfolio. Hence, Syfe is not looking to re-invent the wheel by selecting a different set of ETFs to represent the Equity asset class within its Core portfolio but to leverage on its Smart Beta methodology which was used to select the ETFs that encompass the Equity100.

Applying an asset class risk budgeting

Typical portfolios such as the 60/40 equity to bond portfolio engage an asset allocation structure based on capital. Take, for example, if you have got $10,000 and you wish to replicate the 60/40 portfolio, you would allocate $6,000 to equity and $4,000 to bonds.

In the event of a market correction, the equity portion might decline to $5,000 in market value while the bonds increase to $4,500, for a total portfolio value of $9,500.

The rebalancing structure will result in the sale of $700 worth of bonds and using that proceeds to purchase $700 worth of stocks, with the rebalanced structure as such: $5,700 in equity (60%) and $3,800 in bonds (40%)

The Core portfolio seeks to replicate a similar structure, but instead of rebalancing it from a capital allocation angle, it does so based on risk budgeting. Again, what do I mean by that?

Take for example Syfe’s Core Balanced Portfolio has a portfolio risk (measured by the standard deviation of returns) of approx. 6.9%. Its Growth portfolio, with greater equity composition, naturally has a higher portfolio risk of c.10% while its Defensive portfolio, with more bonds, will see a lower standard deviation of approx. 4.9%.

The goal of Syfe’s core portfolio rebalancing is to maintain these portfolio risks level for the different categories. Let’s take a look at what might happen during a market sell-off for its Balanced Portfolio:

1. Equity value goes down

2. Bonds and Gold value potentially goes up

3. Standard deviation or portfolio risk goes up.

As a result of higher portfolio risks, the equity allocation might see a slight decline from say 40% to 30% to bring the overall portfolio risk down.

However, this does not necessarily mean that the portfolio will be selling equity. Let’s use our $10k portfolio example and assume that for the Core Balanced Portfolio, it has an asset allocation profile of 50% ($5k) Bonds, 40% ($4k) Equity, and 10% ($1k) Gold for simplicity.

In a substantial market correction, the following happens:

1. Equity declines by 50% to $2k in value

2. Bond appreciates by 20% to $6k in value

3. Gold appreciates by 10% to $1.1k in value

4. Total Portfolio value = $2k + $6k + $1.1k = $9.1k

5. Portfolio risks increase to 8% from 6.9%

To bring the portfolio risk level down, it will entail reducing the equity composition from 40% to 30% while increasing the bonds and gold composition to 55% and 15% respectively, for example. Based on a portfolio value of $9.1k, below are the respective asset allocation value:

Equity (30%) = 30% * $9.1k = $2.73k

Bond (55%) = 55% * $9.1k = $5k

Gold (15%) = 15% * $9.1k = $1.37k

As can be seen, despite a lower equity allocation (from 40% to 30%), the rebalancing will translate to a purchase of $730 of equity and $270 of gold, funded by the sale of $1k in bonds.

In a nutshell, the Core portfolios are more suitable for an investor who wishes to engage in a dollar cost average approach with a long horizon in mind. During market dips, it potentially allows one to accumulate more of the investments that have been sold off substantially at lower prices so you end up averaging out your overall investment costs.

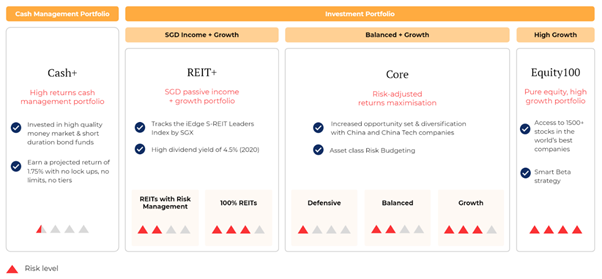

I summarized the key portfolio offerings of Syfe below:

Global ARI

Focus on risk management vs. maximizing returns. In a market sell-off, this portfolio will increase your portfolio allocation towards “safer” asset classes.

The portfolio will tend to outperform other fixed asset allocation strategies during a prolonged market sell-off but will underperform when the market starts rebounding.

You would expect the Global ARI portfolio to have underperformed the other Robo advisors here in Singapore in 2020 as a result of the swift market rebound following the COVID-19 pandemic sell-off in Mar/Apr 2020.

REIT+

This is one of Syfe’s unique portfolio offerings, being the only Robo advisor here in Singapore to offer a REIT-focused allocation structure.

This portfolio tracks the SGX iEdge S-REIT Leaders Index and compose of 20 blue-chip REITs such as Ascendas REIT, Mapletree Commercial Trust, and the recently formed CapitaLand Integrated Commercial Trust.

This is ideal for investors who love to invest in high-yielding blue-chip REITs in Singapore (average yield of 4.5% in 2020) with the convenience of a single portfolio. Syfe’s REIT+ portfolio is an ideal passive alternative method for an investor vs. investing in individual REIT counters or through an SG REIT ETF.

Unlike an ETF, there are no expense ratios when investing in the REIT+ portfolio. Neither are there commission charges for each transaction. An investor only has to pay the platform charges associated with Syfe (0.40-0.65%/annum).

2020 has not been an ideal year for REITs in general as a result of COVID-19. However, REITs might be primed for a rebound in 2021 as global vaccination efforts scale up.

Core

I have briefly highlighted Syfe’s Core portfolios earlier. The Core portfolios are categorized into 3 offerings: Defensive, Balanced, and Growth. The different portfolio asset allocation ratios are highlighted in the diagram below:

As highlighted earlier, this is a better alternative for an investor looking to dollar cost average as compared to the Global ARI offering. The asset allocation ratios for Core portfolios are relatively stable, even during different market climates.

The Core portfolios consist of 18 different ETFs, held in different ratios for each portfolio type: (Defensive, Balanced, Growth). The key ETFs are shown below.

The equity component of Core portfolios will track the allocation of Equity100 as well.

Equity100

Equity100 is a portfolio that consists of 100% equity. Similar to the 100% REIT portfolio, Equity100 allows an investor with an aggressive risk-taking profile to allocate 100% of his/her funds into equities.

Equity100 uses a dynamic smart beta strategy to invest based on three classical factors: Large Cap, Growth, and Low-volatility. There has recently been a rebalancing made to the Equity100 portfolio which I will elaborate on in more detail in the following segment. Following the rebalancing, the factor tilts are now towards China Exposure, Growth, and Low Volatility.

Equity100 is likely suited for a young investor who has a high-risk tolerance, given the likely volatility seen in a 100% equity portfolio. The investments in Equity100 are also geared towards growth stocks which are inherently more volatile vs. their value counterparts.

Cash+

The Cash+ portfolio is Syfe’s cash management services, offering clients a place to park their cash to generate higher returns in today’s low-interest-rate environment.

The projected return is currently around 1.5% where returns are accrued daily. Your money in Cash+ will be invested in the 3 underlying funds:

- LionGlobal SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund SGD

- LionGlobal Short Duration Bond Fund

Investments in these funds incur a 0% management fee, hence one gets to enjoy the full projected amount of 1.5%.

Cash management services by Robo-advisors like Syfe adds an element of value-add for clients but this should never be seen as a Core product feature, in my view.

Additional Reading: Singapore Robo Advisors. High cash management rate just a marketing ploy to get your money?

Equity100 rebalancing

I have written about Equity100’s dynamic smart beta strategy in my previous review article. This is where the portfolio is being rebalanced when the “smart beta” factors that drive the portfolio’s performance reach the end of their respective cycles.

The rebalancing cycle is relatively long and hence one should not expect the rebalancing of Equity100 to be done more than twice a year.

Dynamic Smart Beta is thus key to Equity100’s outperformance in the long term. By being able to recognize that the tide has turned on some factors and it is hence time to “jump ship” and move onto the next voyage, this is where I think Syfe’s real value proposition is.

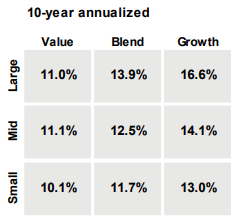

Equity100 was constructed initially with factor tilts towards growth, large-cap, and low volatility. Over a 10-years horizon, the combination of growth and large-cap factors have resulted in the highest annualized returns of 16.6%, according to research done by JP Morgan.

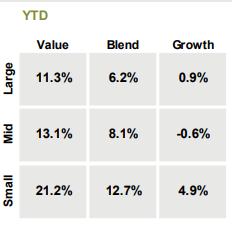

However, the tide seems to have turned in 2021, with Large Cap + Growth factors returning one of the lowest returns on a YTD basis (as of 31 March 2021).

Instead, Value + Small Cap seemed to have taken the spotlight away from their Large Cap + Growth counterpart.

After a decade of underperformance, is it finally time for value and small-cap investing to take center-stage in the coming decade?

The latest rebalancing done for Equity100 seems to suggest that the dominance of Growth + Large Cap factors are going to be more muted ahead but not “dead in the water”.

Syfe’s Head of Portfolio Construction, Mr. Richard Yeh has done a nice write-up on Value vs. Growth which is definitely worth a read.

Equity100 made two key adjustments to its portfolio:

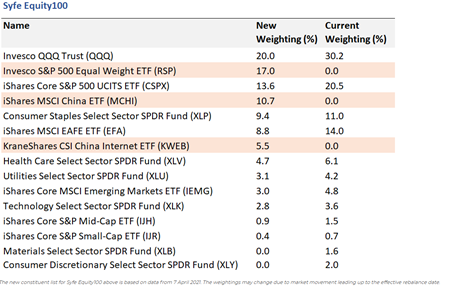

1. Increase its Value + Small cap tilt with the addition of the RSP ETF. The RSP ETF is an equal-weighted ETF that tracks the S&P 500 index. This means that every stock held by the ETF has the same weight, regardless of how large or small (in terms of market capitalization) the company is.

The addition of RSP, which now compose 17% of portfolio holdings, adds a size factor biased towards small-cap stocks. At the same time, it also adds a value (vs. growth) factor tilt as many of the smaller cap stocks in S&P500 seem to fall under the “value” category.

2. Addition of MCHI and KWEB, which encompass 10.7% and 5.5% of portfolio holdings respectively. These 2 ETFs mainly invest in China-domiciled and tech stocks and the addition into the portfolio enhances its exposure to China and Chinese tech stocks which was previously not a significant component of the portfolio.

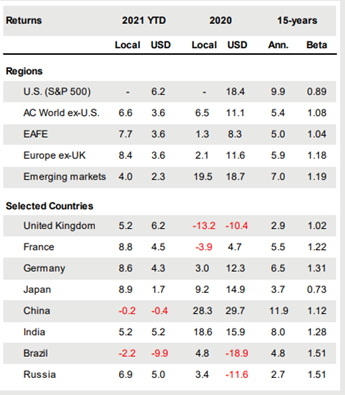

As can be seen from the table below taken from JP Morgan analysis, China has strongly outperformed key markets in 2020, with its 15-years annualized return outperforming even that of the US. However, that outperformance has seemingly reverted at the start of 2021 (as of 31 March 2021), with the market being one of the worst-performing market YTD.

The table below shows the latest ETF composition of Syfe Equity100. As mentioned, key additions are the RSP ETF (value + small-cap factors tilt) and the MCHI and KWEB (China and tech tilt) ETFs.

In my honest opinion, while the addition of RSP has added an element of “value” into the portfolio, it is still focused on the 500 largest market capitalization companies in the US, hence the “small-cap” tilt might not be that evident.

MCHI and KWEB have a huge tech (and hence growth) component in them. While the overall exposure of QQQ (which tracks the 100 largest tech companies) has been reduced from 30.2% to 20% in the new weighting, I would argue that the overall tech and hence growth exposure of Equity 100 has increased, with the focus shifting from US tech to China tech.

For example, the top 3 holdings of MCHI ETF are Tencent, Alibaba, and Meituan and these 3 counters encompass 33% weighting in the ETF.

It is still early days to determine if Syfe’s dynamic smart beta strategy is working and more time is needed to ascertain its effectiveness in achieving “beta” for investors. For those who prefer to have an additional “China” element to potentially capitalize on short-term weakness seen in the China tech sector, investing in Equity100 will provide you with that exposure.

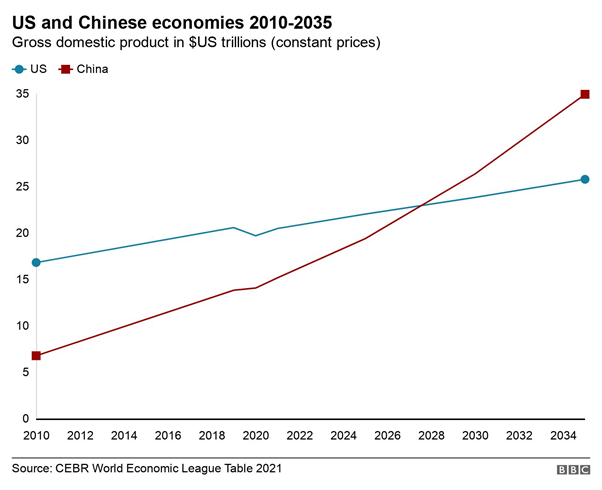

I, for one, am bullish on the long-term potential of the China market. While I concur that political and regulatory “interference” often cast a shadow over China-based stocks, I don’t think it is the Chinese government’s intention to stifle the long-term growth potential of their corporates.

Many of these companies such as Tencent are now standing head and shoulder vs. their US counterparts and are also at the forefront of innovation to structurally change not just the industry which they are in, but the entire world.

According to a report by BBC, using data from the Centre for Economics and Business Research (CEBR), China is set to overtake the US to become the world’s largest economy by 2028, five years earlier than the previous forecast.

Despite the “stigma” still associated with China-related stocks, I believe it will be a huge mistake to ignore the growth and innovative potential of Chinese corporates.

Chinese equities currently make up 17% of the Equity100 portfolio. For those interested to take an exposure into the Chinese market, the Equity100 portfolio provides a convenient “entry point” for you to do so.

Conclusion

In my previous Syfe review article done in late 2020, I highlighted that I will stick to Syfe’s 100% REIT offering as well as its Equity100 offering.

I recognize that with both its 100% REIT and Equity100 portfolios, I am taking on substantial equity-related risks, with no fixed-income component to buffer any market sell-off.

With the introduction of the Core portfolios, I might switch my Equity100 holdings to its Core Growth Portfolio to add a fixed-income element that will help to moderate the drawdown of the portfolio in the event of a market sell-off.

Syfe’s Core portfolio is something which I am comfortable in dollar-cost averaging into, taking advantage of any market weaknesses to purchases more units in the 18 ETFs found in the Core portfolio.

For a new investor just starting his/her investing journey, Syfe provides a low-cost, low capital for one to get started. There is no minimum investment and no lock-in to get started, although technically it makes sense to invest at least $100/month.

The key to long-term investment success is to start early and take a disciplined/consistent approach to invest passively in a low-cost product. With fees typically from 0.4-0.65%, Syfe’s Robo advisory platform is one of the lowest cost platforms to get started on your investing journey, even with minimal capital on hand.

The Core portfolio offerings nicely complement Syfe’s suite of existing investment products. With this addition, the Robo-advisory might now be seen as one of the top SG fintech players having the most comprehensive suite of investment product offerings for retail investors.

What might still be lacking, however, is the ability for Singaporeans to invest using their SRS or CPF funds.

PROMOTION BY SYFE

I hope I have presented the relevant information in an unbiased format with my own opinion for you to make an informed decision. You might agree or disagree and the decision to invest with Syfe is totally up to you.

Syfe has kindly reached out to NAOF readers and you can choose to sign up through this affiliate link where I may receive a share of the revenue from your sign-ups.

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.

Whether you decide to use my link to get started on the Syfe Robo Advisor, you are invited to access my FREE Video Tutorial Robo Advisor Guide which will highlight to you the best Singapore Robo Advisors to use based on your investing style (passive, dividend income, international etc).

This article is written in collaboration with Syfe.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.