Table of Contents

Syfe Equity100 review

Syfe has just launched its Equity100, a portfolio that is 100% allocated to global equities. This is quite different from its Syfe Global offering which consists of equities, bonds & gold, one that is dynamically positioned based on its automated risk-managed investments (ARI) strategy.

For those who are not familiar with the ARI model, it is a proprietary investment methodology that combines two leading approaches – Global Market Portfolio (GMP) and Risk Parity Portfolio (RP). In layman terms, what sets ARI apart from other investment methodologies is that it places the focus primarily on risk management using some sort of smart beta strategy.

If you have a maximum risk appetite of 15% drawdown on your core portfolios, ARI’s primary focus is to ensure that this critical ratio is not breached, come what may. That could mean significantly increasing the bonds/gold allocation in your portfolio during periods of high volatility.

While the smart beat strategy has proven to outperform the market and other relevant benchmarks significantly during a market sell-off, such as the one we have seen in March 2020, it has likely underperformed during the subsequent rally in April-June 2020 as ARI is “slow” to increase the portfolio weighting of equities.

According to Syfe, the reason why it still maintains such a heavy/”safe” allocation to bonds is that volatility in the market remains elevated, hence some caution remains appropriate.

For those who are interested, you can refer to this article: Guide to Syfe and how to open an account in less than 10 minutes on my thought process on its original strategy and how easy is it to open an account with Syfe, with the whole account opening process taking less than 10-minutes. Do note that the funding process might take 1-2 days to be completed.

For those who are interested, here are some other Syfe review articles that I have written:

- Syfe Review: Which of its portfolio offering will I select?

- Syfe Review: Is this now the most comprehensive Robo Advisor in Singapore?

- Syfe trade Review: Fractional Investing Suited for Beginner Investors

Equity100

The Equity100 portfolio is somewhat different from the original Syfe core Global offering in the sense that it is 100% exposed to equities. Since it is a long-only investment style, there are no short strategies to hedge against a market downturn, unlike its original portfolio where bonds and to a certain gold are asset classes that can protect one’s portfolio from a significant market sell-off.

What Equity100 does is deploy a strategy that involves global diversification plus factor strategies which are termed as Smart Beta Strategy.

Will such a strategy help an investor to outperform a passive investment strategy?

Strategy 1: Global market exposure and international diversification via broad-based ETFs

Equity100 will be invested in equity ETFs such as the iShares Core S&P500 UCITS ETF which holds the 500 largest US-listed companies, iShares MSCI EAFE ETF which holds 900+ large and mid-cap stocks in Europe, Australia, and Asia such as Nestle, AstraZeneca, Toyota, LVMH, etc and iShares Core MSCO Emerging Markets ETF which holds 2000+ large, mid and small-cap stocks from various emerging countries such as China, South Korea India, Brazil, etc. Top holdings in this ETF include Alibaba, Tencent, Samsung, etc.

This strategy is nothing unique and one can typically deploy a DIY strategy to purchase these broad-based ETFs based on their risk appetite.

Strategy 2: Smart beta strategy factor tilts to optimize Equity100 for better risk-adjusted returns

This is where things start to get a little more interesting with the usage of factor-based investing. Factor-based investing itself is nothing new and this strategy was conceptualized by two University of Chicago professors, Eugene Fama and Ken French, in 1993 as an extension of the Capital Asset Pricing Model (CAPM).

Factor-based investing is also the core principle behind certain funds such as Dimensional Funds which I have written in this article: Dimensional Funds. Are they worth their weight in Gold?. Dimensional funds focus their investment strategy around 3 key factors: 1. Small market cap, 2. Value stocks based on low price to book ratios and 3. Companies that generate above-average profits.

While Dimensional believes that such an investment methodology surrounding the above 3 key factors will outperform in the long-term, as illustrated by their historical track record, the past decade has no doubt been “unforgiving” for such a strategy. Their underperformance is likely to be continued, particularly in the depth of the COVID-19 market sell-down where value and small-cap have continued to underperform their growth and large-cap counterparts.

Equity100 looks at 3 different factors: 1. Growth, 2. Large-Cap and 3. Low-volatility

The fund’s largest holding is in Invesco QQQ ETF which comprise 100 of the largest US and international non-financial companies listed on Nasdaq, with some of its top holdings vesting in Apple, Microsoft, Amazon, Facebook, and Alphabet, all very large-cap names and are likely falling within the classification of “growth” stocks.

It also selects ETFs which has a focus on low-volatility stocks, such as those in the consumer staples, healthcare, utilities, and materials industry. These sector ETFs collectively generate better risk-adjusted returns for the low volatility on a portfolio basis.

As can be seen from the table above, the largest holding of the portfolio currently is in QQQ with 43% allocation followed by Consumer Staples Select Sector SPDR Fund which holds 19%. The top 5 ETFs have a combined allocation of 92%.

So theoretically, a DIY approach purchasing these 5 ETFs can essentially replicate the bulk of what this portfolio does.

Again, I don’t think the uniqueness of Syfe’s Equity100 stems from selecting these factor ETFs. While Growth, Large-cap stocks, etc might be the flavor of the month or decade, there is no certainty that they will continue to remain popular in the next decade.

By sticking to the same factor or factors, the portfolio could risk significant underperformance when these factors ultimately “revert to the mean”. As the saying goes, what goes up will come down. A popular factor such as “Growth” might be the obvious choice to select in today’s climate but at some point in time, their popularity will decline and be overshadowed by its “Value” counterpart.

Value proponents have been beating the drum for a while now, highlighting that the disparity between value and growth is at its largest in decades.

For those interested in value investing, I have also written on value investing in Singapore as well as provide 10 SG value stocks that might make sense.

Should you thus be reverting to a value approach-style of investing now? Despite being at its cheapest relative to its growth counterparts, can the relative cheapness of value stocks continue over the next 1-2 years?

No one can say with certainty until it happens. And when that reversion happens, you must be there to capitalize on it.

Dynamic Smart Beta Strategy

That is where Syfe’s Equity100 shines in my opinion, assuming it can capture that turn-in trend early enough. According to Syfe, the portfolio is rebalanced when the “smart beta” factors that drive the portfolio’s performance reach the end of their respective cycles. The rebalancing cycle is relatively long and hence they do not expect to rebalance Equity100 more than twice a year.

Dynamic Smart Beta is thus key to Equity100’s outperformance in the long-term. By being able to recognize that the tide has turned on some factors and it is hence time to “jump ship” and move onto the next voyage, this is where I think Syfe’s real value proposition is.

How is Syfe able to recognize that the tide has truly turned?

This of course is the crux of dynamic smart beta. You want to stay vested with strong factors while their momentum remains strong but consider switching to other factors only at the right time when these factors start to demonstrate weakness, which in their option, could signal the end of a cycle.

Syfe monitors the various Fama French Factors. In the above chart, SMB represents Small minus Big. So when the trend is down, that means that small-cap is underperforming big cap.

HML represents value stocks (low price-to-book ratio) over growth stocks (high Price to book ratio). Again, when the trend is downward sloping, it means that value stock is underperforming growth stocks.

Both Small-cap and Value stocks have significantly underperformed their respective large-cap and growth counterparts as seen from the chart above.

When the tide turns, the trend line will start to move up and that could be an early indication that the cycle might have ended for the respective factors. However, there is of course no certainty as demonstrated in late 2016 when there was a brief revival of Value vs. Growth stocks. Alas, that outperformance was pretty short-lived, with the trend reverting down by early 2017.

Intuitively, it seems like a dynamic smart beta makes a lot of sense, assuming that one can accurately capture that turn in the tide. The downside, if not done well, could be frequent portfolio turnovers that will increase the execution/trading cost of the portfolio.

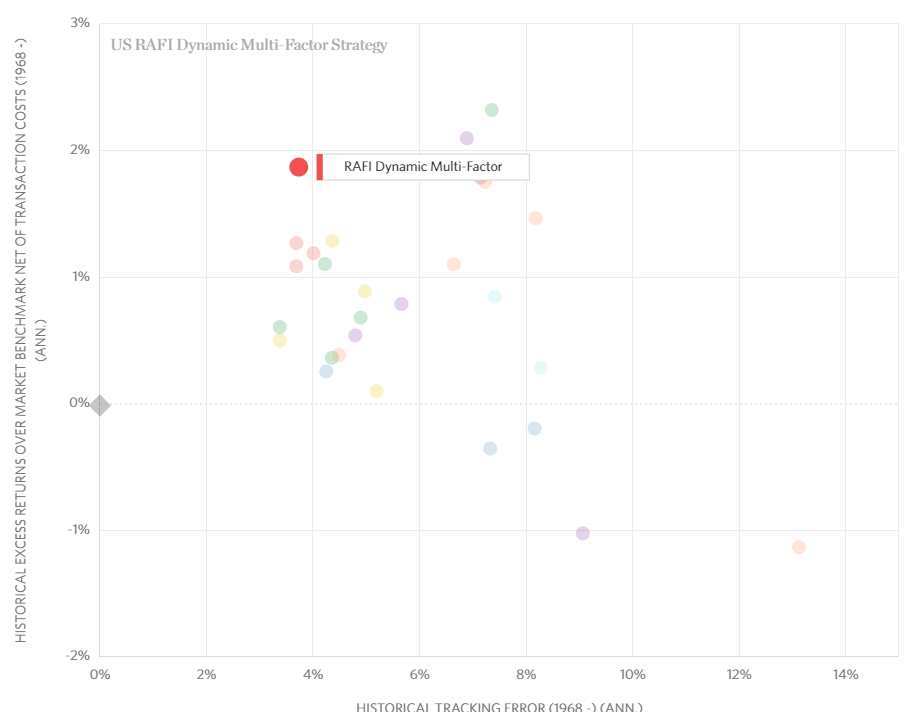

According to Research Affiliates, they have a Smart Beta Interactive platform that tracks the historical performances of the various factors since 1968.

According to their model, the Dynamic Multi-factor strategy is the one that has one of the highest historical excess returns over market benchmark while yet exhibit one of the lowest tracking error. This is for the US market

The Dynamic Multi-Factor strategy dynamically weights the Value factor, Quality factor, RA momentum factor, and Size factor based on long-term reversal and short-term momentum. Such allocations are adjusted quarterly.

Hence, one can see that such a method, if timed well, can result in substantial outperformance. Of course, some might argue that timing the market, or the entry into any particular asset class, or industry, in this case, is a fool’s game and cannot be done effectively and consistently over the long-term.

I don’t know if Syfe’s Equity100 can do that well. Time will tell. For now, such a smart beta strategy sounds intuitively appealing to me. For those who prefer a fixed asset allocation, ie 60:40 equity to the bond portfolio for example, which will tend to “buy low and sell high” during the rebalancing process, then such a portfolio might not be exactly suitable for you.

For those who wish to have 100% equity exposure and believe that Syfe core can execute on its dynamic smart beta methodology, then investing in its Equity100 portfolio is the way to go.

PROMOTION BY SYFE

I hope I have presented the relevant information in an unbiased format with my own personal opinion for you to make an informed decision. You might agree or disagree and the decision to invest with Syfe is totally up to you.

Syfe has kindly reached out to NAOF readers and you can choose to sign up through this affiliate link where I may receive a share of the revenue from your sign-ups.

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.

Whether you decide to use my link to get started on the Syfe Robo Advisor, you are invited to access my FREE Video Tutorial Robo Advisor Guide which will highlight to you the best Singapore Robo Advisors to use based on your investing style (passive, dividend income, international etc).

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Syfe Equity100 review: Does this portfolio make sense to you?”