S-REITs are in the spot light again today, with SPH REIT surprise DPU cut as well as the government enacting a new law to be passed in mid-April, granting restaurants and other commercial tenants that are unable to pay rent due to COVID-19 be able to hold off such contractual obligation for at least six months. This is definitely negative for retail REITs, some of which such as FCT has fallen by more than 10% today.

For now, let’s take a look at SPH REIT.

SPH REIT 2QFY20 review

SPH REIT announced a “shocking” 78.7% YoY decline in its DPU for 2QFY20, from 1.41 cents a year ago to just 0.30 cents.

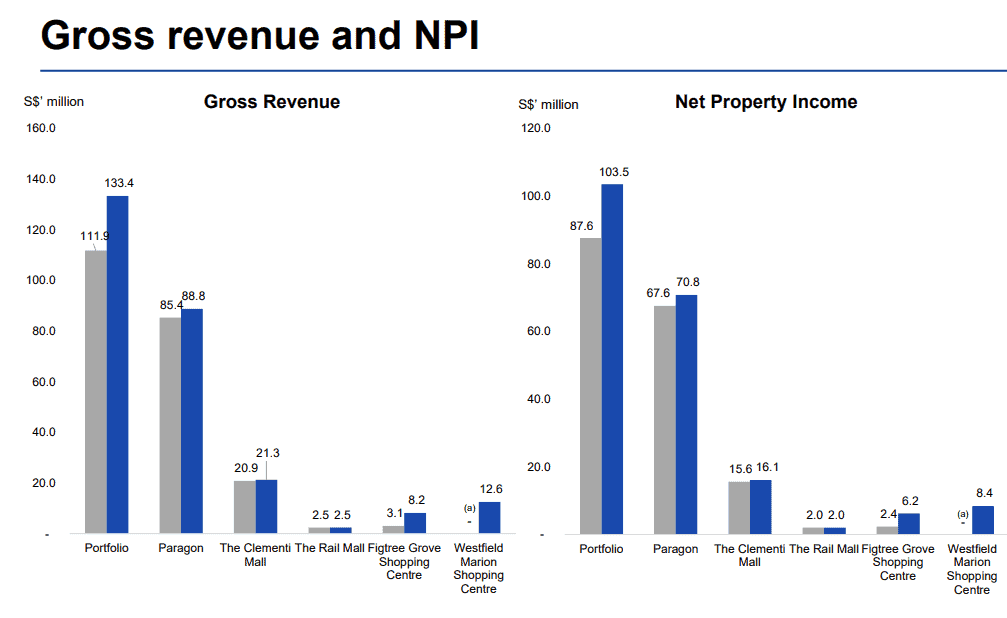

The decline comes in spite of a 23.3% increase in its net property income (NPI) to S$56.5m from S$45.9m in the same period last year. The higher NPI was due to decent contributions from its Australian properties: Figtree Grove Shopping Centre and the newly acquired Westfield Marion Shopping Centre. Its two Singapore properties, Paragon and the Clementi Mall also recorded higher NPIs.

Despite the strong performance seen for the quarter (ended in Feb), SPH REIT is clearly preparing for things to get rougher and tougher in the coming quarters.

As announced on Feb 27, the REIT has been rolling out a tenants’ assistance scheme. In February and March, it granted rebates to its tenants of S$4.6m which will be extended into the months of April and May. The company is also evaluating the need for a support package to help tenants in its two Australian assets.

The hefty drop in DPU definitely came as a surprise to the market. Some might find it surprising that SPH is only paying out such a small amount in DPU despite its strong distributable income growth for the quarter. However, despite the mandated 90% payout, REITs do have the flexibility to adjust their payout on a quarterly basis. The 90% payout rule is typically based on full-year distributable income.

Should one be buying SPH REIT?

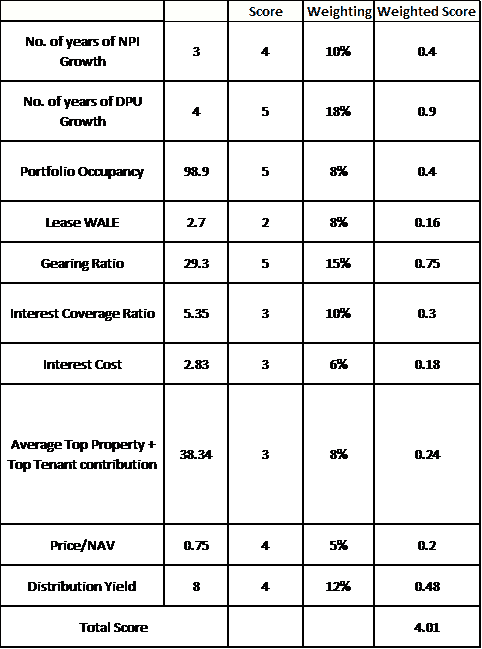

SPH REIT scores fairly well in our REIT screening filter with a score of 4.01 out of a maximum of 5 points. We talked about this screening filter in this article: How to buy REITs in Singapore. 10 key S-REIT quantitative filter (Part 1) which is an easy first step to sieve out some of the REITs which meet our quantitative filter.

However, this was NEVER meant to be a 100% fool-proof way of identifying a good REIT to purchase. That is why we introduced 8 additional less-quantitative factors for consideration in this article: How to buy REITs in Singapore. 8 additional factors to consider (Part 2).

Let’s take a look at SPH based on these 10 quantitative factors and 8 additional factors to decide if one should be buying the REIT at the current level.

SPH REIT – 10 key quantitative filter

As highlighted earlier, SPH REIT scored well in our quantitative filter metric with a score of 4.01 points. Let’s take a quick look.

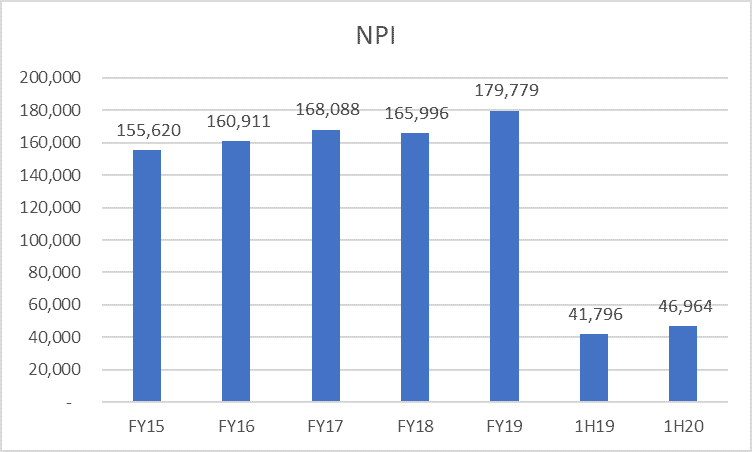

Metric #1: No. of years with NPI Growth

SPH REIT has been demonstrating pretty resilient NPI growth over the past 4 years, with just a slight dip in NPI in FY18.

For that, it scores 4 points out of 5.

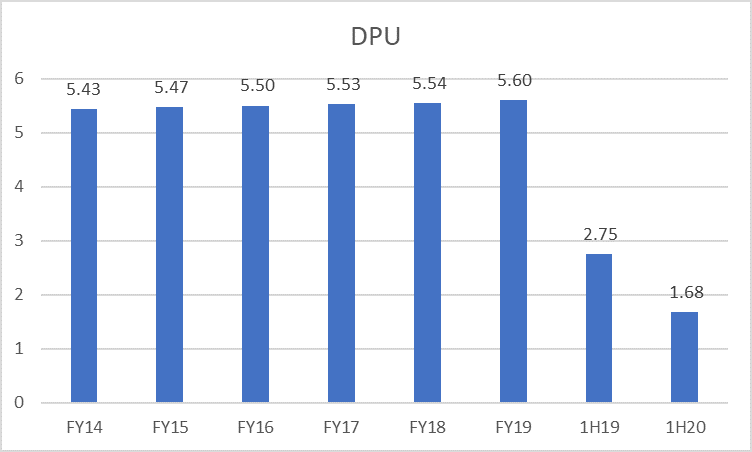

Metric #2: No. of years with DPU Growth

Its DPU growth has been even more impressive, with consecutive DPU growth witnessed since FY14.

However, do note that this will likely come to an abrupt end in FY20.

SPH REIT scores 5 out of 5 points for this metric

Metric #3: Portfolio Occupancy

Committed portfolio occupancy remains strong at 98.9% as of 1HFY20.

For that, it scores 5 out of 5 points.

Metric #4: Lease WALE

Based on Lease WALE by gross income, its WALE is only 2.7 years as of 1HFY20.

For that, it scores only 2 points out of 5 points.

Metric #5: Gearing ratio

SPH REIT has one of the lowest gearing ratios among the S-REIT community at just 29.3%.

For that, it scores 5 out of 5 points.

Metric #6: Interest Coverage Ratio

According to our data, SPH REIT has an interest coverage ratio of approximately 5.35x.

For that, it scores 3 out of 5 points.

Metric #7: Interest Cost

According to its latest 1HFY20 results, the company has an average cost of debt of 2.83%

For that, it scores 3 out of 5 points.

Metric #8: Average of Top Property and Top Tenant Contribution

Based on our calculation, SPH REIT has quite a sizable amount of revenue contributed by its top property, which in this case is Paragon. This asset alone contributes more than 70% of its FY19 revenue.

With an average property and tenant contribution of close to 40%, SPH REIT scores 3 out of 5 points.

Metric #9: Price/NAV

The company’s current Price/NAV is at around 0.75x. For that, it scores 4 out of 5 points.

Metric #10: Distribution Yield

Lastly, the distribution yield of the company based on last year’s result is at 8%. For that, it scores 4 points out of 5.

However, based on the hefty cut in its latest DPU, its FY20 yield will no longer be as attractive.

Assuming a constant 0.30 cents for each of the next 2 quarters, a total FY20 DPU will translate to 2.28 cents.

At a share price of S$0.71, that translates to a forward yield of just 3.2%.

The table below provides a quick summary of SPH REIT scores based on the 10 quantitative factors

Key risks:

At this stage, the key risk of SPH REIT is the concentration risk in Paragon which will significantly affect its forward operating performance, given that it is a high-end mall that caters to tourists.

The cut in DPU is also pretty alarming which will translate its forward yield to just slightly more than 3%. Even if we reduce its distribution yield score to just 1 point, SPH REIT will still make the cut with a total score of 3.65 points.

Let’s move on to our second part of the evaluation.

SPH REIT – 8 additional factors to consider

Despite scoring well on our screening filter, we want to evaluate SPH REIT based on 8 additional less quantitative factors which we detail below.

Key factor # 1: Benefits of a strong sponsor

SPH REIT is sponsored by Singapore Press Holdings Limited or SPH, Asia’s leading media organization with publications across multiple languages and platforms.

SPH is also a listed company here in Singapore. However, its operating performance is less than ideal with its share price being eroded consistently since peaking back in 2013 at almost S$5 vs. current share price level of S$1.67.

In this perspective, we are pretty wary of its sponsor and its ability to continuously provide support for its REIT.

Verdict: FAIL

Key factor # 2: Sustainability of DPU growth/DPU Support

Clearly, it is shown that SPH REIT DPU will not be sustainable in FY20 based on the latest hefty DPU cut. However, having said that, this is a “black swan” event that should not be seen as a structural deterioration in SPH’s business model. We also should give it credit for its strong DPU growth performance over the past 5 years.

Unfortunately, its high concentration towards Paragon (approx. 70% of NPI) is a risk that we simply cannot ignore, given our belief that Singapore tourism will remain significantly impacted for the rest of the year.

Verdict: Fail

Key factor # 3: REIT managers remuneration scheme

SPH REIT’s asset management fees as % of distributable income from operations (FY19) at 12% is within the acceptable range of 10-15%. I do not think that the asset manager is overpaying themselves. However, with the bulk of its remuneration being paid in units, SPH REIT has little scope to buffer its DPU (factor 2) ahead.

Concurrently, despite the hefty decline in DPU this quarter, a large chunk of manager’s fees is still pegged to NPI performance. As such the manager’s fees in this quarter is a sizable S$5.45m vs. S$4.47m. This will be paid in units.

For now, we give management the benefit of the doubt in this category but we will be keeping a close eye on it.

Verdict: Pass

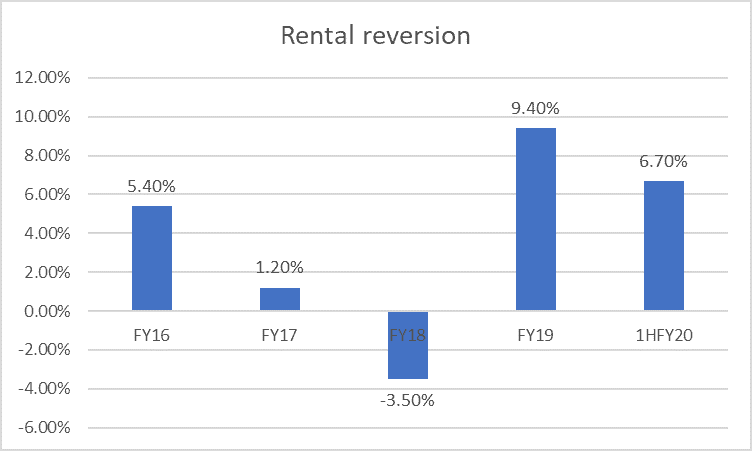

Key factor # 4: Rental reversion trend

How SPH computes its rental reversion is based on the average rents of the renewed and new lease terms vs. the average rents of the preceding lease terms that are typically committed 3 years ago.

Such a method of computing rental reversion is more aggressive than the other alternatives and not fully reflective of the cash flow situation of the company.

Nonetheless, at 6.7% in the latest quarter, it is generally still decent.

Its Singapore malls have shown positive rental reversion trends over the past 4 years, except FY18 which was hit by negative rental reversion seen for Paragon.

A major concern for me is the reliance on Paragon as its key asset. If the rental reversion trend of Paragon is to slip, which I expect they will in FY20 and possibly into FY21, that will have a significantly large impact on SPH REIT as a Group.

Verdict: Fail, we prefer to err on the side of caution.

Key factor # 5: Frequency of equity raising vs asset recycling

Back in Nov 2019, the company launched a private placement to raise S$161m to partially fund its proposed A$670m acquisition of a 50% stake in Westfield. Given the lack of portfolio assets in SPH REIT and the need to further diversify its reliance on Paragon, I believe there will be a need for future equity raising for acquisition.

Acquisitions will however not be the prime focus of the REIT manager as of now, with a key focus likely be on tenant retention.

The need for hefty fundraising will be partially offset by its strong balance sheet with a low net gearing profile. For now, we don’t see this factor as a major concern.

Verdict: Pass

Key factor # 6: Access to cash and line of credit

For now, with its low debt gearing profile of 29.3%, we believe that SPH REIT still has plenty of scope to raise cash (S$1.1bn debt headroom) before hitting the mandatory 45% threshold.

Verdict: Pass

Key factor # 7: Tenants profile

While the concentration risk to a single tenant is low (top tenant only encompass 3-4% of revenue), SPH REIT’s tenants are all retail tenants, with quite a fair chunk likely to be significantly impacted by COVID-19.

While retail tenants at Clementi Mall are seen as more resilient given their sub-urban nature, they only consist of approx. 15% of Group’s NPI. On the other hand, high-end retailers and medical suites situated at Paragon, which composes c.70% of Group’s NPI, will see their business significantly impacted by the drop in footfall from both tourists and medical tourists alike.

We don’t foresee a single key tenant risk, but given the large exposure to high-end retail and medical tenants, we believe this warrant a fair bit of caution.

Verdict: Fail

Key factor # 8: Specific Industry Outlook

SPH REIT’s industry outlook is not rosy. The high-end retail segment will likely see prolong weakness due to a slow recovery in tourism even after social distancing measures are being removed.

We have seen that China has closed up its borders to tourists as they are concern over a “re-lapse” in COVID-19 cases and this protectionist stance will be taken by countries all over the world even after the worst of the COVID-19 issue is over. Hence instead of a quick V-shape recovery in tourism, the recovery pace will be relatively slow and moderate and probably drag into 2021.

Verdict: Fail

Conclusion

SPH REIT scores fairly well in our 10-factor quantitative screening filter with a score of 4.01. That qualifies it to be considered for the second evaluation phase.

Out of the 8 additional factors, SPH REIT only scores a PASS in 3 of these factors. Hence despite it passing our first line of screening criteria, it fails to meet our more rigorous assessment when it comes to other less quantitative measures.

SPH REIT, in my opinion, is a decently-run REIT that has demonstrated a good track record of NPI and DPU growth. However, given its sizable exposure to the high-end retail mall industry, concern over its business operational outlook over the short-term is warranted.

While its share price has dropped from a recent peak of S$1.16 to the current level of S$0.67 (or a 42% decline), we are NOT tempted to enter into this counter base on the poor visibility of its DPU.

With the significant drop in DPU, the forward yield of SPH REIT might just be north of 3% which is not exactly attractive.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HOW TO BUY REITS IN SINGAPORE. 10-KEY S-REIT QUANTITATIVE FILTER (PART 1)

- WHICH ARE THE BEST TAX-EFFICIENT ETFS TO INVEST IN?

- ARE YOU OVERPAYING YOUR REIT MANAGER? WHICH S-REITS HAVE THE “HIGHEST” MANAGEMENT FEES?

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.