Singapore Robo Advisors: The chase for higher yield offering

In today’s low-interest-rate environment where major banks in Singapore have cut the interest rates on their high-interest rates savings accounts, some Singapore Robo-advisors have started to “fill in the gap” by offering higher cash management rate. So far, most, if not all of the articles online are supportive of the fact that retail investors/consumers can still benefit from high-interest cash management services after being “abandon” by their banks. I beg to differ.

Are Singapore Robo advisors offering higher cash management rates just a marketing ploy to get you to park your money with them? I am concern that this might turn out to become a “race” to offer the highest cash management rates to investors, which really defeat the purpose of a “hassle-free, no jumping over multiple hoops and more importantly secure place” to generate an interest amount that is higher than the normal bank savings rate.

How it all began

No one talks about cash management here in Singapore, at least within the retail scene, before the introduction of StashAway Simple which is touted as a fuss-free manner to earn a flat rate of 1.9% with no requirement for any confusing conditions attached to it. No salary credit, no credit card spending, no investments. Nothing whatsoever.

This beat having to fulfill multiple criteria set out by banks in their high-interest rates savings accounts which often involve requiring one to credit their salary as well as using their financial products in a bid to generate a higher interest amount.

StashAway Simple offering is just that simple. Unless you don’t get to earn 1.9% as I have highlighted in this article: StashAway Simple Review + Other No Frills Cash Savings [Update May 2020]

I am not going to repeat why that 1.9% rate is not achievable in this article (its probably closer to 1.66% based on my last calculation). Readers can refer to the article above if they wish to see how the computation is done.

As of today, the projected rate for StashAway Simple as advertised on their website remains at 1.9% and there is also a recent publication by Seedly re-confirming that the rate for StashAway Simple remains at 1.9%, which I am re-posting their well-summarized table content here.

I just cannot fathom how a cash management product can consistently offer such a “high-interest rate” in a rapidly declining interest rate environment (their reported rates have not changed since their launch in late 2019). Note that this is not meant to be a highly volatile product where interest rates fluctuate up and down in a heartbeat. It is supposed to mimic that of short-term interest rates.

Why so? This is because the underlying “financial products” that these cash management services invest in are Cash Funds (CF) and Money Market Funds or MMF for short. These are funds that buy into highly safe, highly liquid short-duration bond funds consisting of the highest-grade government bonds or government-linked entities for example.

To generate higher interest rates for clients vs. investing purely in a CF or MMF which probably generates c.1-1.2%% at best in today’s environment, StashAway Simple also invests in an Enhanced Liquidity Fund which takes on slightly higher credit and duration risk.

In a scenario where interest rates are declining and possible heading to zero or into negative territory, why will these high credit-rated companies and government bodies (with almost zero credit/default risk) be offering new bonds with interests any higher than 2%? It just doesn’t make sense. They are not your charity organization. This figure will continue to trend lower in today’s context, possibly below 1%. There is almost no doubt about it unless we are faced with a serious bout of hyper-inflation which forces rates to rise substantially. No one is taking that scenario seriously, at least not for the moment.

So if short-term rates are constantly being revised downwards, as we can observe in the “no-longer” high-interest savings rate account offerings by our banks, how is StashAway Simple able to offer consistently high rates?

Transparency and Trust

Don’t get me wrong. I love high rates as well. But I do value transparency even more, particularly with our local Robo Advisors which are still seen as the “new kids on the block” when it comes to providing financial solutions to the mass market.

They have yet to gain widespread trust within our local community unlike what the major US Robo Advisors have achieved. We often hear of investors not willing to invest with Robo Advisors here in Singapore if their custodian accounts are not under the individual investor’s name. It might be a huge concern for some, less so for others like me, but that is again base on one own’s risk appetite and capital management.

But the gist is that transparency and establishing trust is key to gaining widespread adoption. I hope that many of these Singapore Robo advisors will continue to thrive and provide a better alternative to bank offerings for normal consumers like you and me (not the premium High net-worth clients serviced by private banks). However, without establishing a transparent corporate policy that wins the trust of investors, product/service superiority matters little.

Are we too “hard-up” for yield?

Singaporeans love our yield. We are a smart (and often too hardworking) bunch of consumers who will “account hop” to bank accounts which provide us with the highest yield. Nicely worded, we are savvy. Not so nice, we are cheapskates. Why focus on a single tree when you can potentially grow your forest empire? Meaning instead of choosing to chase the additional 0.5% rate, why don’t we improve our financial knowledge and invest to get 5% more, for example?

Sure, that 5% in this example is not guaranteed but so is your additional 0.5% when financial institutions start to revise that figure lower. Some will argue that the latter is capital guaranteed, super safe. Well, as the popular saying goes, nothing in life is guaranteed except for death and taxes.

By choosing the safer “capital guaranteed” route, we subject ourselves to the full impact of high inflation, which I believe will come, sooner or later.

Singapore Robo advisors heading down the wrong route?

So, we come to the crux of this article. Why are Singapore Robo advisors “competing” to offer higher cash management products? To be fair, not all Singapore Robo advisors are competing. Some such as MoneyOwl WiseSaver is just providing a vanilla CF product, resulting in a gross yield of just 0.79%. Hardly enticing. The last I check, FSMOne AutoSweep (both CF and MMF) account rate is at 0.99% as of 29 June and POEMS’ excess fund management is at around 1.04%.

Will these Robos or brokerage firms ultimately be enticed to offer higher cash management products?

I can’t be certain, but for now, they are sticking to their core product, which is to invest investors’ excess cash into CF and MMF that is liquid and ultra-safe. That to me should be the true purpose of cash management, at least for the retail context. We are not talking about HNW, financially savvy folks who know exactly the kind of risks they are getting into to achieve higher yields.

It is unrealistic, in my opinion, to expect to get higher interest rates, without taking on higher risks, especially when global interest rates are spiraling towards negative territory.

Endowus new cash management products

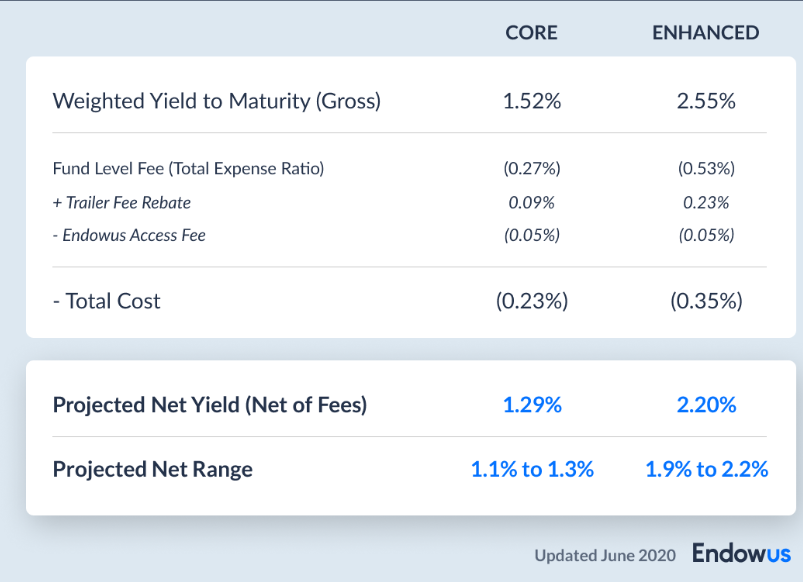

Endowus recently launch its cash management product. Endowus Cash Smart Core offers a rate of 1.1% to 1.3% pa while Endowus Cash Smart Enhanced offers 1.9% to 2.2%. I believe that there are already several financial bloggers who have provided a summary of their cash management services, hence, I won’t be doing it here in this article. Below is the table from Endowus’ website.

For those who are interested, you can read more about their cash management product offering here.

From my understanding, these rates will be updated weekly for existing users of their cash management and core product services as well as the public to provide transparency pertaining to their latest available rates, just like what FSMOne has done in their cash management aka auto sweep website.

Again, let me reiterate that I have nothing against providing cash management services. It is great for consumers who now have an easy way to partake in money market funds which in the past ain’t well known. Their popularity has indirectly escalated with cash management offerings by Robos.

Cash management should just be one of the many holistic offerings by Robos

However, cash management, even if they are done transparently, should be just one of the many value-added offerings that a Robo advisor provides and should not be the key reason why one is investing with them.

Look at the best US Robo advisors. Take WealthFront for example, one of the largest fintech Robo Advisors in the US. It used to be offering high cash management rates back in early 2019, slightly north of 2% when interest rates then were comparatively higher. The latest figure now is 5x the national average. Guess how much that amounts to? A grand total of 0.35% (national rate is 0.06%)!

That is the reality of a global declining interest rate environment. You can’t expect high-interest rates without taking on more risk. The US Robo advisors are not offering that, of course in their marketing pitch, the 6x higher than national rate still sounds attractive.

What they are focused on is improving their core fundamental service offerings to consumers/ investors. Keeping fees as low as possible, providing great educational resources for the masses, an extremely user-friendly platform with plenty of useful information on one’s investment, for example, the trend in the dividend received, etc. This is what our local Robos should be focused on delivering.

Is this all a marketing ploy?

So for Endowus and StashAway to offer a higher interest rate “option”, is that a marketing “ploy” that will ultimately kick-start the race towards higher interest cash management account at the possible expense of the safety of our cash?

As highlighted previously, the only way of generating higher interest in today’s low-interest-rate environment is to take on higher risk by vesting in corporate bonds for example vs. say Singapore government bonds.

In normal circumstances where volatility is low and the economy is growing its GDP, the probability of a credit default by large organizations which issue these investment-grade bonds is generally low to nil. But we are not in normal times and the current recession triggered by COVID-19 could become a long battle for survival for many large corporations and individuals alike.

To take on higher risk and packaging it as a cash management service for the retail masses just doesn’t seem like it is going to be in the best interest of retail investors in the long-run. Sure, the 100-120bp increase in rates might sound wonderful on the surface. Slowly as the race for yield intensifies, retail investors will “benefit” from even higher-yielding product offerings.

Until the house of cards collapses. Not saying that will happen but just highlighting a possible black swan scenario.

I know that I am being critical here but my core intention ain’t malicious. At the end of the day, it is still buyers beware. The robos are just providing the supply to where the demand is. No one is forcing you to use their cash management services. But Singapore Robo advisors should also have the courage and responsibility of not following the herd and offer a cash management product that is highly popular for obvious reasons but no longer sticking to the product’s core purpose.

In this case, a fuss-free cash solution that offers higher rates than normal bank savings account but yet still provides the “capital guaranteed” safety that retail investors should come to expect. Singapore Robo advisors and other financial institutions should educate consumers/retail investors and manage their expectations in today’s low-interest-rate context.

Conclusion

This article might seem like I am against Singapore Robo advisors. Quite the contrary. I believe that they are a good investing platform for new and young investors to use when starting their investing journey. Yes, there is the additional platform fees that one will have to pay vs. a DIY basis but for those who do not have the time nor knowledge to invest on a DIY basis, then robos are an ideal one-stop-shop platform to get started on, with the fees paid generally still reasonable.

For those interested, do read this ultimate guide to Robo advisors in Singapore

As their AUM grows, that could translate to lower platform fees for consumers as well.

However, the race to provide a higher interest cash management solution is not one that I feel is in the best interest of both investors and the Robos themselves in the long run. Robos are setting themselves a high benchmark that has a reasonable chance of failure and ultimately losing the trust of their investors when reality sets in.

Once again, this article is solely an opinion piece. I like to reiterate that I am a Robo supporter and I hope that their core product offerings will one day match that of their US peers. I do intend to open an Endowus account, not so much to capitalize on their high cash management offerings but purely for my own investment diversification purpose as well as potentially “bottom-fishing” on the mean-reversion of value investing. If you are interested in value investing, you can also check out this article: VALUE INVESTING IN SINGAPORE: 10 SG VALUE STOCKS THAT MIGHT MAKE SENSE

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- STASHAWAY SIMPLE REVIEW + OTHER NO FRILLS CASH SAVINGS [UPDATE MAY 2020]

- ULTIMATE ROBO ADVISORS SINGAPORE GUIDE. KEY FACTS YOU NEED TO KNOW (2020)

- DIY OR ROBO? THE 1.6% OPPORTUNITY COST DILEMMA

- CREATING THE BEST TAX EFFICIENT ETF PORTFOLIO TO INVEST IN?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.