Supplementary Retirement Scheme (SRS)

Plenty has been written on the Supplementary Retirement Scheme (or SRS for short). This is a voluntary scheme that complements one’s CPF savings for retirement. You can contribute any amount to your SRS account, subject to a cap of S$15,300 for Singaporeans and $35,700 for foreigners, as many times as you wish within the year.

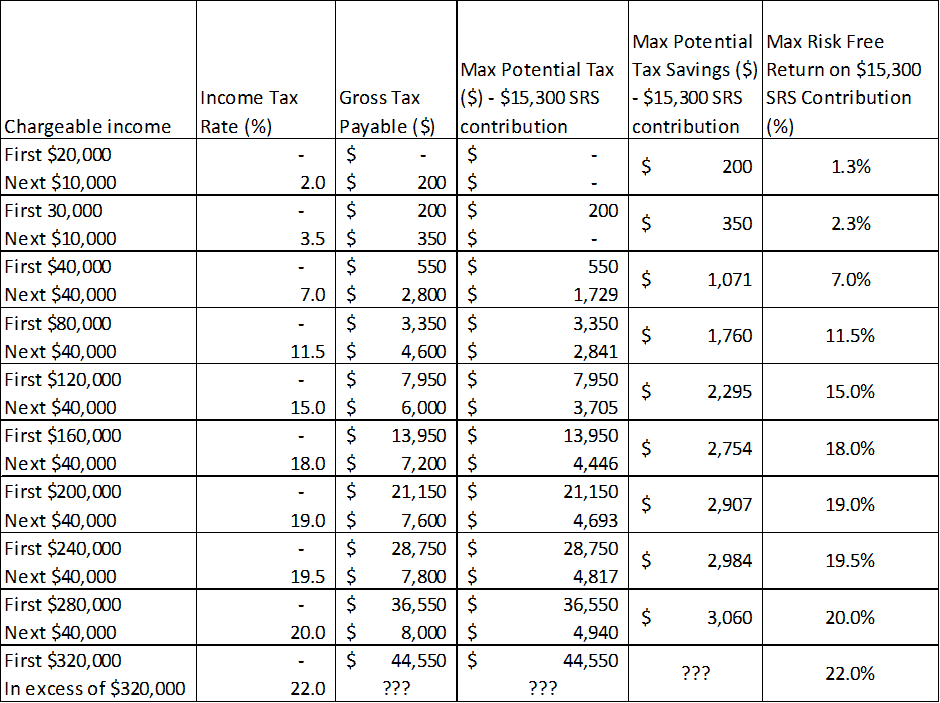

The main benefit of SRS is the tax savings that one can accrue from the contribution which goes towards reducing the assessable income. For example, for a Singaporean, John, whose take-home pay is $80,000/annum and he contributes the full $15,300 to SRS, his assessable income where tax is payable is ($80,000-$15,300=$64,700).

In this example, John immediately falls into a lower tax bracket. Previously, his $80,000 annual assessable income is subjected to $3,350 in tax. Now, his $64,700 will result in only $2,279 ($550 on first $40,000 and 7% on the remaining $24,700) in tax or a savings of $1,070.

If we wish to take this one step further using an investment analogy, his $15,300 SRS contribution generates a “guaranteed return” of $1,070 or 7% “risk-free” return.

This $15,300 SRS contribution will generate different “risk-free” returns, depending on the tax bracket that one falls into. Generally, the benefit is higher for those in a higher tax bracket, based on the total amount of tax savings as a % of $15,300 but not so in terms of the total amount of tax paid.

Some might, however, argue that the current tax savings are not exactly “realized”, due to the tax treatment upon withdrawal. At the age of 62, SRS account holders are allowed to withdraw their SRS monies but HALF of the withdrawn sum will be subjected to tax at the prevailing income tax rate.

Let’s use an example:

John started contributing the maximum amount of $15,300 to his SRS account from Age 35 to Age 62 (27 years). Assuming that his take-home salary is stagnant at $80,000/annum over this 27-years period. His tax savings are calculated as $1,071/annum in our example.

Over the course of 27 years, his total tax savings is $1,071*27 years = $28,917

His contribution of $15,300/annum amounts to $413,100 at the end of 27 years, assuming zero appreciation (let’s not even account for the negligible interest rate of 0.05% for cash).

His total “assessable income” if he wishes to withdraw out this amount on a lump-sum basis come Age 62 = $413,100/2 = $206,550.

According to the respective income tax rate, he will be liable to pay $21,150 in tax for the first $200,000 and another $1,245 for the next $6,550 (taxed at 19%) for total tax payable of $22,395.

In this case, the amount of tax savings over the course of the 27 years is pretty much “negligible” at $6,522, if one would say the least.

The tax treatment upon withdrawal is one of the common complaints against the SRS scheme and why most Singaporeans are not actively contributing to this scheme despite the “obvious” tax benefits from the get-go.

Should one still be contributing to SRS despite this obvious drawback?

I believe the answer is Yes and No.

Yes because of 2 primary reasons:

1.There is a workaround pertaining to the 50% tax payment drawback upon withdrawal and that is to stagger the SRS withdrawal amount over the duration of 10 years or more such that one pretty much pays zero or minimal tax. This is a nifty trick that most will be aware of, which I will elaborate in the later segment.

2.If you do not fall in a low tax bracket, then the “risk-free returns” warrant such a contribution. So which tax-bracket you might ask. Personally, I find generating a “risk-free” return of 7% in today’s context is extremely attractive, hence if your assessable income for tax is above $55,300 (that is when you generate at least 7% savings on each dollar you contribute to SRS), that is when you should look towards making some contributions to SRS (not necessarily the full amount).

No also because of 2 primary reasons:

1. You require the funds for other immediate purposes. Note that SRS also functions as a retirement supplement. While funds contributed to SRS can be prematurely withdrawn before the statutory Age of 62 currently, the amount withdrawn will be subject to tax and a 5% penalty, except in certain specific circumstances such as death and medical grounds. The penalty imposed negates the tax savings. However, this is likely the “lesser of two evils” option vs. contributing to one’s CPF SA which is locked up till Age 55.

2.You fall in a low tax bracket with an assessable income of less than $40,000. This is when the amount of “risk-free” returns from the tax savings is pretty low between 1.3-2.3% (assuming full $15,300 contribution). One should just pay the income tax amount (max of $550 on $40,000) and retain the ability to use your money as you might deem fit.

Should you be investing your SRS Funds?

One common “grouse” by financial bloggers is that Singaporeans should not leave their funds in SRS idle, aka in cash, generating a pathetic 0.05%. According to Finance Ministry data, about 34% or about $2.34bn of SRS funds is lying idle as cash (data sourced from Retire Smart by Lorna Tan).

However, one should not forget that by contributing x amount to his/her SRS account, that fund is already generating a “risk-free” return of at least 7% based on our standard.

Having the fund in cash ready to be deployed in the event of a market downturn is a very powerful option to have. A downside would be that the funds in cash are “losing value” due to inflation.

Alternatively, a potential better option will be to park the funds in Singapore Savings Bond (SSB) which is another risk-free option, generating 1.75%/annum over 10 years. Over a 1-year horizon, that still generates interest of 1.54%, which is sufficient to keep pace with the recent trend in inflation. I have written about Singapore inflation in this article, where I highlighted that the forecast average inflation rate (based on data from statista) is only going to be 1.2% from 2019-2024.

This option of using SRS funds to invest in SSB was only made available back in late-2018. To apply for SSB using SRS funds, investors may apply through the Internet banking portals of their respective SRS operators which are local banks DBS, POSB, OCBC, and UOB. As with cash applications, the minimum application amount is $500 and a $2 transaction fee will be deducted from the SRS account for each application.

Investment options for SRS

There are other articles such as this one written by Dollar and Sense which talks about the various SRS-approved investments that one can make with your SRS account.

These SRS approved investments include:

- Stocks

- REITs

- ETFs

- Bonds

- Singapore Savings bonds

- Regular Saving Plans

- Robo-advisors

- Unit Trusts

- Insurance Products

- Fixed Deposits

I have written about some of these investment categories such as REITs, Regular Savings Plans, Robo-advisors, etc in previous articles. On a long enough horizon, these are all great investment assets to own.

However, for the context of this article, I will be touching a little on the Insurance Product category, particularly on annuities as a means to further increase one’s tax savings upon withdrawal.

I have previously written about maximizing tax benefits through strategic SRS contributions and withdrawals.

In that article, I talked about how to minimize the tax impact by spreading out the SRS withdrawal over a 10-years horizon. Let me look to re-cap the key points in this article.

How to go about withdrawing your SRS funds

Let’s assume you have S$500,000 in your SRS account when you hit age 62.

SCENARIO 1: TOTAL WITHDRAWAL OF FUNDS

If you choose to withdraw the full S$500,000, then S$250,000 will be subject to tax. You will fall under the 19.5% tax bracket where the first S$240,000 will be taxed at a flat S$28,750 amount and the subsequent S$10,000 will be taxed at 19.5% to bring your total tax payable to S$30,700.

Assume that this S$500,000 took you 32 years to accumulate based on a max annual contribution rate of S$15,300/annum, meaning almost zero appreciation (choose not to invest your SRS funds).

Again assume that you fall under the 7% marginal tax rate with a max tax saving of S$1,071/annum, you would have paid a total of S$1,071 * 32 years = S$34,272 in total tax during this period.

The tax benefit will hence be rather marginal and not worth locking up your funds for.

SCENARIO 2: WITHDRAWING S$40,000 EACH YEAR TO AVOID PAYING SUBSTANTIAL TAX.

You can instead choose to withdraw S$40,000 each year without paying tax for the first 10-years. Subsequently, assuming the remaining fund is S$100,000, your taxable amount will then be S$50,000 (50% subject to tax), with a total tax payable of S$1,250 (S$550 fixed for first S$40,000 + 7% of S$10,000).

Compare this tax amount of S$1,250 in scenario 2 vs. S$30,700 in scenario 1 and it is clear as day and night that you should not be withdrawing a lump sum from your SRS account.

SCENARIO 3: SPREADING THE S$500,000 INTO 10 EQUAL PAYMENTS

Instead of withdrawing S$40,000/annum to not pay tax for each of the next 10-years, assume that you choose to withdraw S$50,000/annum for 10-years. This will imply that S$5,000 will be subject to tax each year (2% * S$5,000) = S$100 in tax payable.

Total tax payable after 10-years is S$1,000 with no remaining value in your SRS account. Scenario 3 will result in slightly higher tax savings compared to Scenario 2 but the difference of S$250 over 10 years is generally negligible.

SCENARIO 4: SPREADING THE S$500,000 INTO 11 EQUAL PAYMENTS.

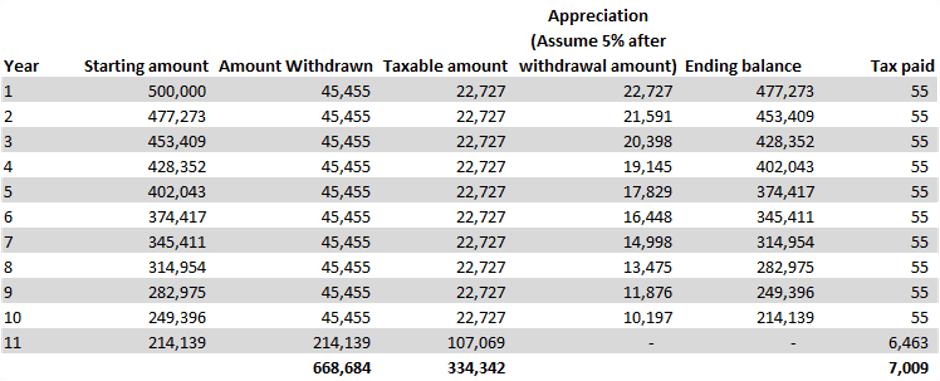

Compared to Scenario 3, this scenario will result in an ending balance in your SRS account. By splitting S$500,000 into 11 equal payments, this will result in S$45,454 in annual withdrawal rate. Out of this amount, you will be paying a total tax of (2% * S$2,727) = S$54.54/annum.

Total tax payable after 11 periods = S$54.54*11 = c.S$600.

By spreading out your payment into 11 periods (with ending cash balance in SRS) instead of 10 periods (no ending cash balance in SRS), you will be able to generate some cost savings of S$400.

However, the above scenarios assume a rather simplistic view that your SRS funds do not generate any appreciation over the 10-years horizon when you are drawing down on your fund (ie: SRS fund decline only by the amount you withdraw). However, that is unlikely to be the case if you vest your funds in an investment product.

This could result in your ending SRS amount being significantly larger than what you might have previously expected and hence resulting in a higher tax amount to be paid at the end of the period.

SCENARIO 4B: TAKING INTO ACCOUNT PORTFOLIO APPRECIATION

Using Scenario 4 as a base example, if your SRS funds appreciate at a rate of 5% per annum, you might end up paying a total tax amount of c.S$7,009 vs. S$600 in tax.

Your tax liabilities could be higher than expected due to SRS funds appreciation

Of course, you would have gladly paid that additional S$6,400 in tax, given that your portfolio value increased by c.S$168,684 over the 10-years horizon.

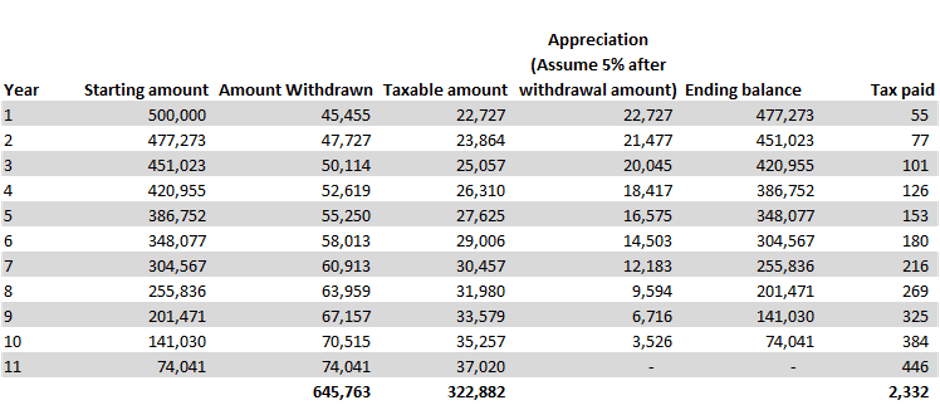

However, you can actually further reduce your taxes if you take some time to divide the total amount to be withdrawn each year by the number of periods remaining as illustrated in the table below.

SCENARIO 5: ANNUAL WITHDRAWAL AMOUNT BASED ON REMAINING PERIODS

Ideal strategy of reducing your tax liabilities by strategic withdrawal

Your tax amount will be reduced from S$7,009 to S$2,332! That’s a significant tax savings reduction. However, a savvy saver will note that the total amount withdrawn of S$645,763 in Scenario 5 is actually S$22,921 lower than Scenario 4b.

Scenario 5 however, takes into account the cost associated with higher inflation for each year.

Based on a “realistic” scenario taking into consideration portfolio appreciation potential, it will seem like a fixed amount withdrawal will maximize total income potential while a rule-based (depending on the remaining period) withdrawal will maximize tax savings while also accounting for income appreciation to counter the effect of inflation.

Is there a way to enjoy the best of both worlds? Meaning to maximize both our total income potential as well as minimize tax payment based on the assumption used above? Might purchasing a term annuity be the solution?

SCENARIO 5B: Purchasing an annuity

Let’s assume that John is currently at the start of the 7th year of his SRS withdrawal (Scenario 5). Based on the ending value for Year 6, he will have a portfolio value of $304,567 in his SRS account.

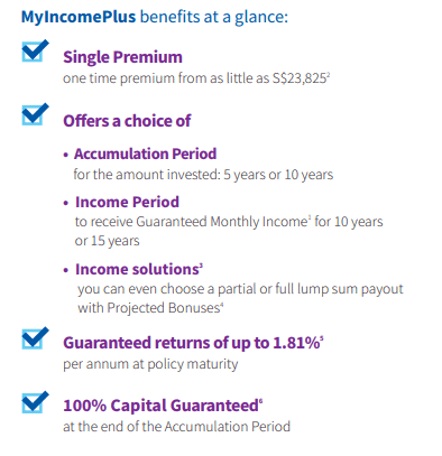

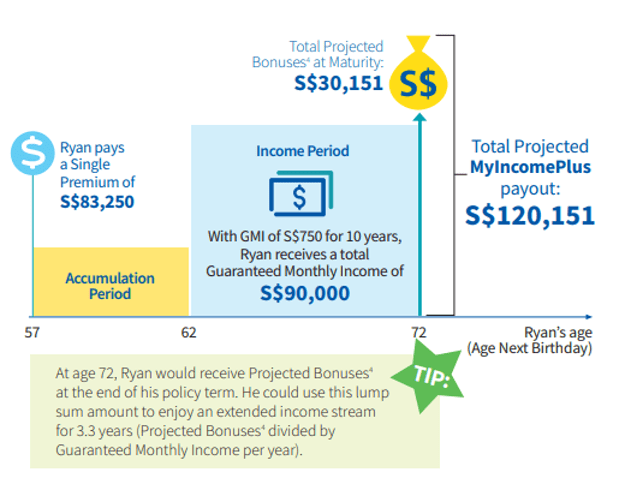

John decided to purchase a single premium annuity such as the one offered by Aviva MyIncomePlus. The benefits of this annuity are illustrated below:

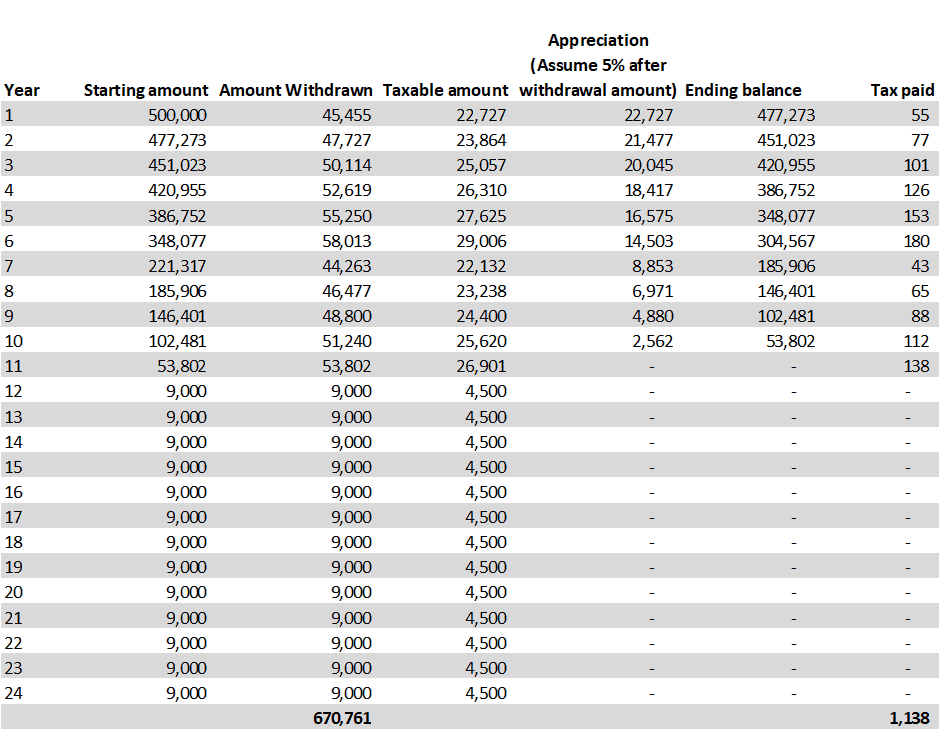

The idea is that he will use $83,250 out of his $304,567 SRS capital to purchase MyIncomePlus at the start of the 7th year. There is an accumulation period of 5 years and he will start receiving his monthly payout from the start of Year 12 which provides him with another continuous stream of income (albeit at a much smaller value) after the original balance has been depleted.

He will receive $750 each month for a duration of 13 years (including the bonus amount). The benefits are illustrated in the table below:

Based on this payment profile, he would have withdrawn a total of $670,761 over the course of the 24 years which is higher than that of the $668,684 generated in Scenario 4B (ignoring the impact of time value). At the same time, the total amount of tax paid is only $1,138, substantially lower than in both Scenario 4B and Scenario 5.

The surrender value of insurance policy

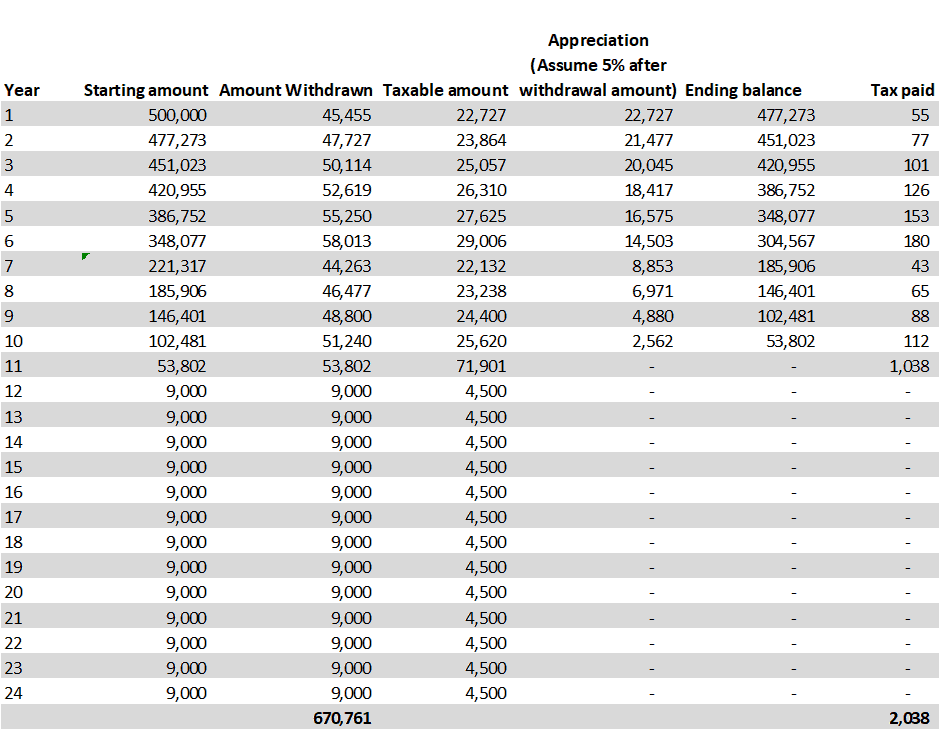

However, there is another tax component that is not taken into account from the example above. When a term annuity is purchased, the value of the insurance policy, in this case, the surrender value of the term annuity (as determined by the insurance company), will be deemed to be withdrawn on the 10th year. The SRS operator will report 50% of such balance to IRAS and this is subject to tax in the following year.

In our above example, the surrender value of the term annuity policy will likely be in the region of $90k at the end of Year 10 (Recall that the policy was purchased at a cost of $83,250 at the start of Year 7). Hence, approx. $45,000 will be subjected to a tax payment which means that tax payable will be $900.

This will bring the total amount of tax paid to $2,038, comparable to Scenario 5 but with a total withdrawn amount that is $25,000 higher.

Should the logical conclusion then be to purchase a term annuity product to reduce both our tax liabilities as well as increase the income potential? The above is a simple analogy that disregards the impact of time value. The value of $670,761 generated over the course of 24 years (bulk from Year 1-11) will have a lower present value vs. Scenario 4B where the value of $668,684 is generated over 11 years.

However, it does present an alternative solution for one’s consideration, particularly if he/she does not require a large amount of annual income (in excess of $60k/annum as demonstrated in Scenario 5 from Year 7-11) in addition to their CPF LIFE contribution where the payout could also potentially be deferred to Age 70.

The term annuity can hence be used to supplement the CPF LIFE contribution once the funds in the SRS account is fully depleted by Year 11.

Do note that all the above illustrations are based on the assumption that the SRS portfolio will appreciate by 5% per annum which is not guaranteed in any form. An annuity, on the other hand, provides a guaranteed payment, in this case of $750/month.

Conclusion

The SRS scheme is a useful tool for both retirement planning as well as immediate tax savings potential.

However, the tax treatment upon withdrawal is one which I believe is a potential stumbling block for investors considering to fund their SRS account. This is particularly true if the bulk of the SRS portfolio value is generated through investment appreciation, which by itself is not liable to tax but because it is parked under SRS and consequently 50% of the SRS withdrawal is subjected to tax, it does seem like the government is indirectly taxing our investment profits.

Nonetheless, we have highlighted a number of methods to reduce our tax payment, predominantly through progressive withdrawal. The purchase of a term annuity could further help to maximize our tax savings while increasing the overall income potential of our SRS portfolio.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Generating “risk-free” returns using SRS and the art of withdrawal”

An great and interesting post. But I have a query. If we compare the strategy to a time deposit, the high risk free interest of 7% is attained if one “invest” and can take out the capital sum of $15300 after one year. But since we cannot take out the capital in SRS, it will become a non-interest bearing account from 2nd year onwards.

Another way to look at it is that on the subsequent years that you want to have risk free of 7%, you need to keep pumping extra $15300 per year, making your capital bigger every year, resulting in diminishing the risk free interest rate.

Example: On the 20th year, you already have a capital of $306,000 just to save tax of $1070. The interest rate will be measly 0.35%.

Hi Dennis,

The way that i calculate the return is based on the amount of capital injection which in this case is $15300 every year.

Not right to calculate it based on the accumulated capital. If we can get 7% “risk-free” return on accumulated capital then there will really be no need for any form of other investments.

Yes, we cannot take out the capital and therefore returns are only generated based on the market performance of the investment assets and this is definitely not risk-free. Alternatively, if you want risk-free returns, then the SRS capital can be invested in products such as SSB which yields 1.6-1.7% currently.

So based on your calculation, on the 20th year, you will have tax savings of $1,070 plus $5,200 in interests income for a total return of S$6,300 equating to a risk-free return of c.2%.

Comments are closed.