Stocks that consistently outperform the market tend to have a few common characteristics. In Part 1 of our article, we highlighted 4 Outperforming stocks that have consistently beaten the market over the last decade. These 4 stocks are Apple, Adobe, Clorox, and Fastenal.

8 Outperforming Stocks to buy now (Part 1)

We identified that all 4 stocks have high ROE/ROIC as well as strong free cash flow generating capabilities.

In this article, we will reveal the remaining 4 Outperforming stocks on our list. Investors should consider strategically adding these stocks into their portfolio when the opportunity arises.

I will end the article by summarizing the few common traits that these 8 Outperforming Stocks exhibit which might be useful in finding the next multi-bagger stock.

Outperforming Stock #5: Fortinet

Business Summary

Fortinet is a cybersecurity vendor that sells products, support, and services to small and midsize businesses, enterprises, and government entities. Its products include unified threat management appliances, firewalls, network security, and its security platform, Security Fabric. Services revenue is primarily from FortiGuard security subscriptions and FortiCare technical support.

At the end of 2019, products were 37% of revenue, and services were 63% of sales. The California-based company sells products worldwide, with the Americas representing 43% of sales in 2019.

While Fortinet’s core cybersecurity business might not be immune from the COVID-19 outbreak, cybersecurity is undoubtedly a growing business over the coming decade and is mission-critical for any enterprise, no matter what’s happening in the world.

The company announced its 1Q20 results on 7 Feb which handily beat the street’s estimates, propelling the stock up by c.20% the following day.

Financial Statement Summary

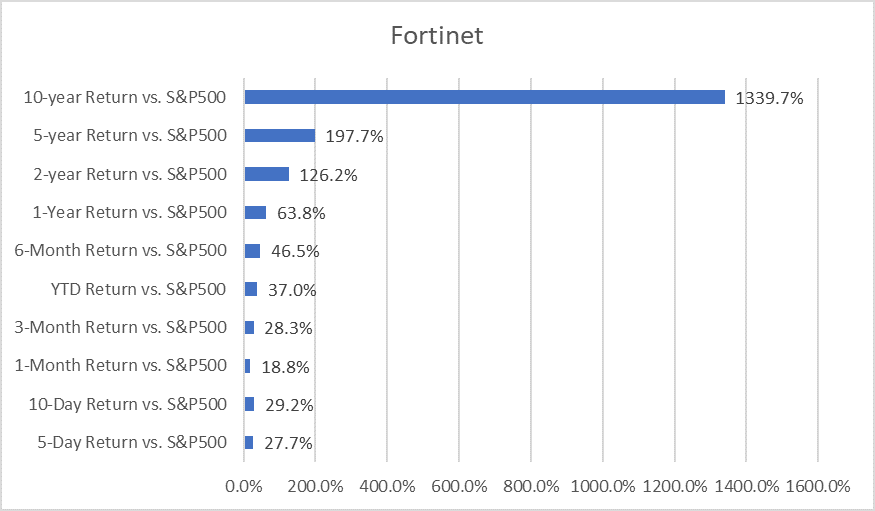

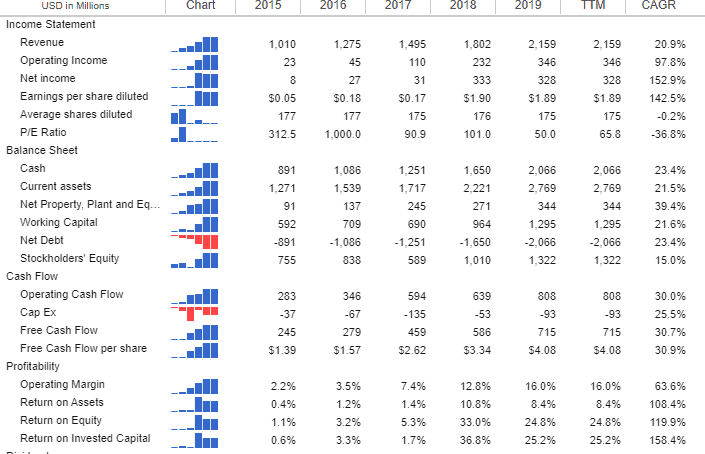

Fortinet has a fantastic business that is seeing its revenue growing by a CAGR of 20.9% over the past 5 years. EPS, on the other hand, has skyrocketed by a CAGR of 142.5% during the same period as the company achieves significant operating leverage in the past 3 years. Observe that the company’s operating margin increased from 2.2% in 2015 to 16% in 2019.

I noticed that companies that can achieve significant operating leverage tend to demonstrate strong share price appreciation. Fortinet is clearly one of them.

The company has a fortress-like balance sheet, with cash increasing from $891m in 2015 to $2066m in 2019. The company has absolutely ZERO debt. Its founder and CEO, Ken Xie doesn’t appear to believe in debt since the company has been debt-free since 2009.

With a free cash generation of $4.08, the company is trading at a trailing-Price/FCF of 34x. While not a low multiple, it is definitely more palatable than the 46x forward PER that it is currently trading at. Based on its 1Q20 free cash flow generation of $292m vs. 1Q19 free cash flow of $191m, Fortinet looks to be on track to generate $1bn in free cash flow for 2020. That will value the company at c.23x forward Price/FCF which is very good for a company growing its free cash flow by c.31%/annum over the last 5 years.

Again, this is another company that has a high ROIC of 25.2% and this has been achieved without significantly reducing its equity due to share buybacks.

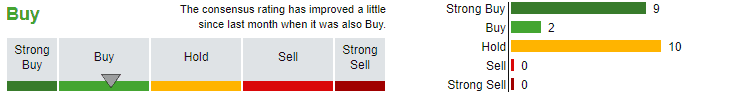

Analyst Consensus

The overall street consensus is a BUY for the counter, although 10 analysts are instituting a Hold call on the stock, likely due to valuations where Fortinet’s EV/EBITDA, P/E, P/S multiples, etc are on the high side vs. peers.

This is however more than compensated by its strong historical and forward growth profile.

Outperforming Stock #6: IDEXX Laboratories

Business Summary

Idexx Laboratories primarily develops, manufactures, and distributes diagnostic products, equipment, and services for pets and livestock. Its key product lines include single-use canine and feline test kits that veterinarians can employ in the office, benchtop chemistry and hematology analyzers for test-panel analysis on-site, reference lab services, and tests to detect and manage disease in livestock.

Idexx gets about 38% of its revenue from outside the United States.

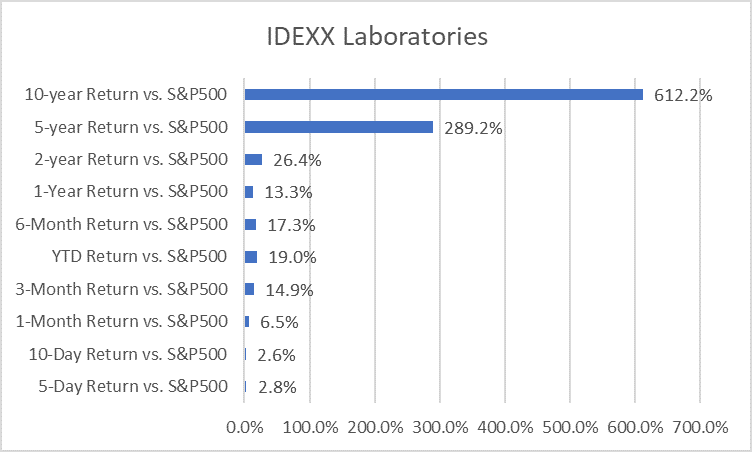

This was a stock that I previously analyzed using Buffett style of investing in this article: Buffett Series: Idexx Laboratories back in Oct 2019 with the conclusion that while the share price seems elevated at that point of time (trading at US$272/share; current share price at US$299/share), Idexx is a recession-proof business that can generate an after inflation CAGR of 7.6% over the next 10-years and that there is a business case to take a position in that counter.

Financial Statement Summary

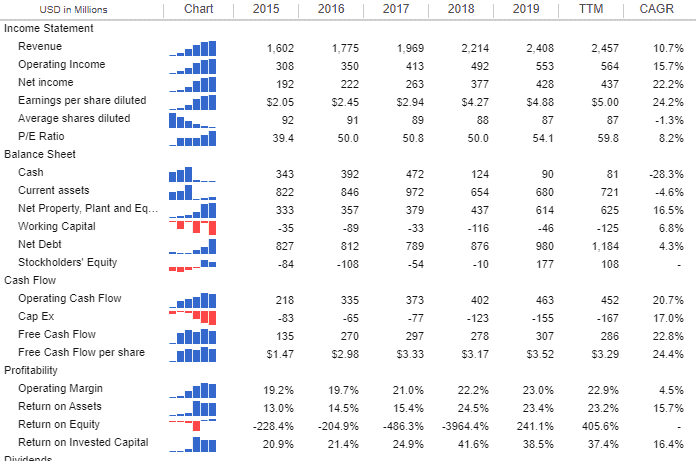

Another steady grower of its revenue with a CAGR of 10.7% over the past 5 years. EPS grew by 24.2% as a result of a combination of both operating leverages as well as a declining share base. Currently trading at a forward PER of 51x, Idexx has not de-rated due to the COVID-19 pandemic.

Idexx’s balance sheet is not as strong as our previous candidates, with a net debt balance of $980m as of end-2019. With equity of $177m, net debt to equity was at over 8x which seems excessive at first glance, but that was mainly due to years of share buyback that has decreased its equity base, very similar to stocks such as McDonald and Disney.

What is more meaningful is looking at the amount of operating cash flow that the company generates each year. That has been showing a very consistent uptrend alongside profit growth, the ideal scenario we will like to observe. The company also generates a decent amount of free cash flow.

On an ROIC basis, Idexx generates an ROIC of 38.5% in 2019, an incredibly high ratio.

Analyst Consensus

Idexx is not covered by many analysts (only 5) but out of the handful of analysts covering the stock, 80% of them rated the counter a Strong Buy.

Outperforming Stock #7: Market Axess Holding

Business Summary

MarketAxess Holdings Inc is a United States-based company engaged in operating an electronic trading platform.

The platform enables fixed-income market participants to trade corporate bonds and other types of fixed-income instruments using patented trading technology.

It also provides related data, analytics, compliance tools, and post-trade services.

The key trading products are U.S. High-Grade Corporate Bonds, Emerging Markets Bonds, U.S. Crossover and High-Yield Bonds, Eurobonds, U.S. Agency Bonds, Municipal Bonds and others.

The business operations of the company carried in the United States, the United Kingdom, and other countries, of which a majority of the revenue is derived from the United States.

Financial Statement Summary

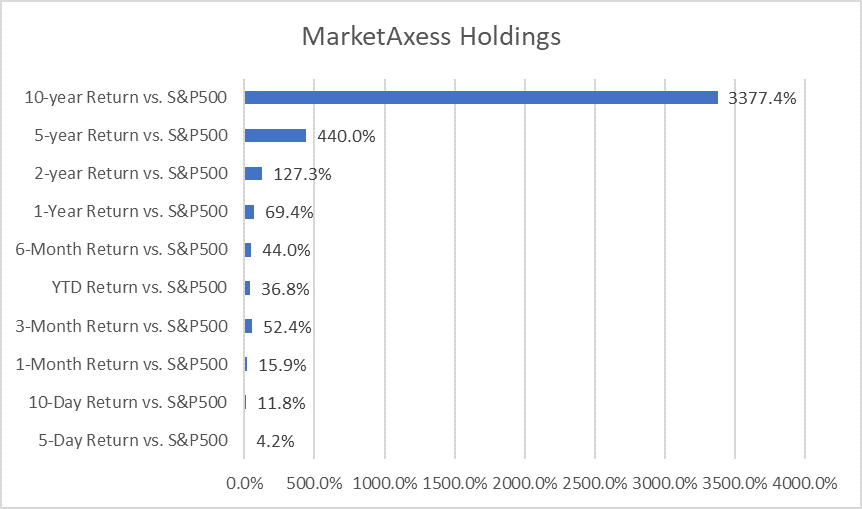

One of the best stocker performers of the decade, Market Axess holdings is a counter that most people will not be overly familiar with. The counter grew its revenue by c.15% over the past 5 years while EPS grew by c.24% mainly due to improvement in its operating margins.

The counter has seen a huge re-rating in its PER multiples, almost doubling from 5 years ago. This is likely due to the market perception of a strong demand for bonds trading.

Market Axess has a pristine balance sheet where its current assets mainly comprise of cash. The company has very little debt and is in a net cash position.

The company generates strong free cash flow and is again another company that has a high ROIC multiple of c.27.5% as of end-2019.

Lastly, the company is a very strong dividend growth counter, with its dividend growth at 20% for the past 5 years. Despite that, its yield is currently at a paltry 0.5%, due mainly to the counter’s strong share price appreciation.

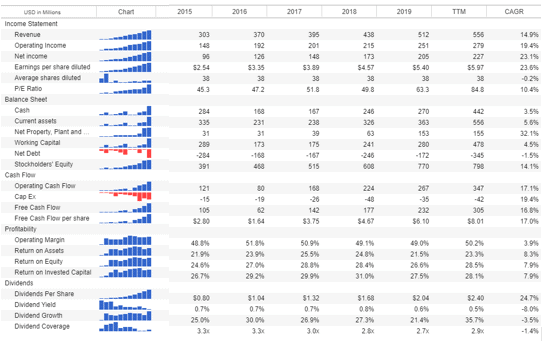

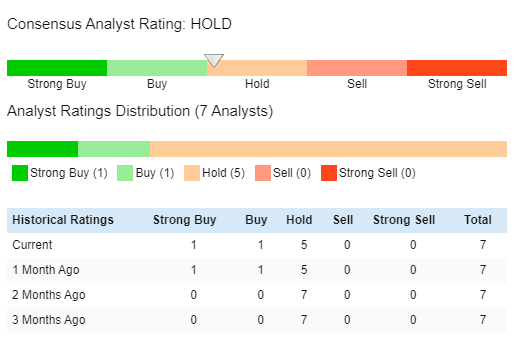

Analysts consensus

Out of the 7 analysts covering the counter, most of them have a HOLD rating on the counter. However, the stock has continued to outperform the market’s expectations in terms of share price performance.

Outperforming Stock #8: Microsoft

Business Summary

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite.

The company is organized into three overarching segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

Through acquisitions, Microsoft owns Xamarin, LinkedIn, and GitHub. It reports revenue in product and service and other revenue on its income statement.

Microsoft is the only company that has remained in the Top 10 largest market cap company in the World consistently since 2000.

Financial Statement Summary

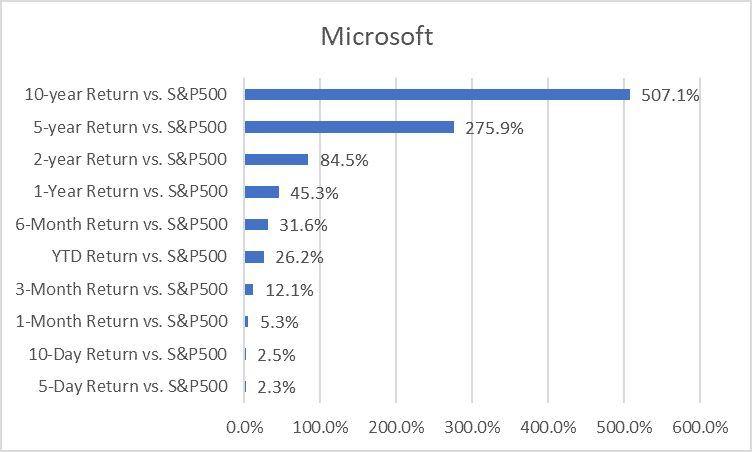

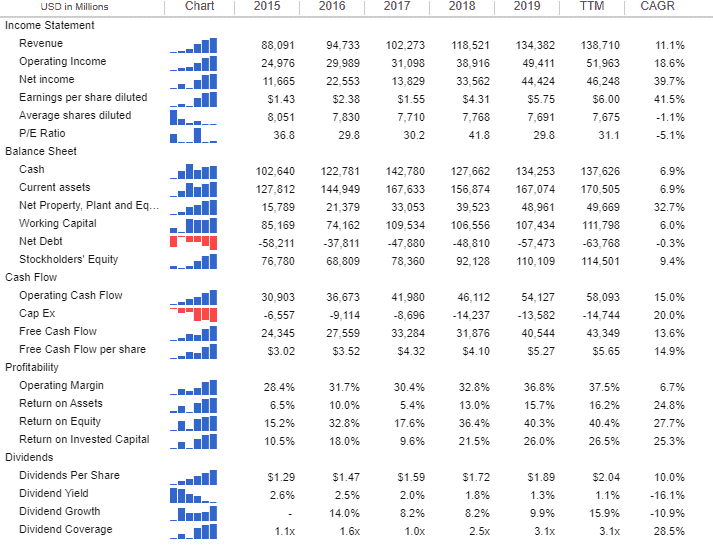

Consistent revenue growth (5-years CAGR at 11%) with a growing operating margin and a reduction in outstanding shares, ultimately translating to a 41.5% EPS CAGR over the past 5 years seem to be Microsoft secret recipe to being the largest (if not second largest) market cap company in the world at present.

The company is a cash-generating monster with c.$134bn in cash as of end-2019 and a net cash position of $57bn. This can only be achieved due to its strong free cash flow of c.$40bn in 2019 which has been growing at a CAGR of 13.6% over the past 5 years.

A company with an ROIC of 26%, Microsoft is also a consistent dividend payer with dividend growth almost hitting 10%/annum.

All-in-all, Microsoft seems to be hitting the right button in all operational areas which is the reason why its share price has been consistently outperforming over the past decade.

Analyst consensus

With 24 analysts covering the counter and 22 issuing a Strong Buy, Microsoft is well-loved by the street.

Conclusion

These 8 Outperforming Stocks have been the most consistent share price outperformer, not just over the past decade but during the recent health pandemic as well.

Most of them exhibit certain common characteristics of a good company which I will like to briefly summarize:

- Consistent growth in revenue and EPS

- Consistent Share Buyback

- High ROIC above 20%

- A strong balance sheet with marginal net debt exposure

- Positive and often strong free cash flow generation

- Operating leverage

- For Dividend Payers, dividend growth of close to 10%/annum

Interestingly, the PER multiple seem less relevant as growth precedes value. A major concern of growth companies is often the fact that when growth in these companies starts to decline, they might get into credit-related issues as most would have been growing through the usage of debt or issuing new equity.

On the other hand, a growth company such as those above which demonstrates the ability to consistently generate free cash flow to internally fund their growth through both organic or inorganic means, instead of turning to the capital market for funds, will be favorably viewed upon.

For those who have not read Part 1 of this article on Outperforming Stocks, do check out the link below:

8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHAT DO NETFLIX, ALIBABA, DBS, MICROSOFT HAVE IN COMMON?

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “8 Outperforming stocks to buy now (part 2)”