Table of Contents

What if we as investors could identify a list of high-beta stocks that can outperform the market in both bull markets and bear markets?

Will that be of interest to you?

But before I disclose the list of 15 best high beta stocks that have managed to achieve that feat consistently over the past 5 years, let me briefly explain what exactly are high and low beta stocks anyway.

What are High Beta Stocks?

High-beta stocks are those that tend to be more volatile than the benchmark index.

Say, for example, you are a fan of Elon Musk (who has recently been dethroned as the world’s richest man by Bernard Arnault) and consequently in the Tesla stock as well.

Owning Tesla stocks is unlike owning say, McDonald’s stocks. Your heart needs to be able to withstand the larger price movement (be it up or down) associated with TSLA stock’s volatility.

Tesla thus is a high beta stock. It currently has a beta of approx. 1.7.

This means that on average for any given day if the benchmark index (say the S&P 500) goes up by 1%, Tesla’s stock price movement that same period will be +1.7%. Again, this is all based on averages. Some days those numbers will be greater than 1.7x magnitude, some days lower.

On the other hand, investors in MCD are likely those who are more “risk adverse” and do not wish to see higher risk and substantial price movement associated with their stock. MCD has a beta of 0.5 and is thus classified as a low-beta stock.

One would expect a high beta stock to outperform the benchmark (S&P 500) in a bullish market and underperforms in a bearish one, where the magnitude of the downside movement is theoretically larger in a bear market, for a high beta stock.

Make sense?

Is investing in high-beta stocks a good investment strategy?

This depends on one’s risk tolerance. In general, as the long-term direction of the stock market tends to be UP, buying into high-beta stocks will tend to result in longer-term outperformance.

I have written about some of the best factor investing strategies and a strategy focused on High-beta stocks have done relatively well over the past 10 years. Check out the article below:

Additional Reading: Top ETF Investment Strategies

However, as highlighted earlier, a bear market could result in these high-beta stocks underperforming the overall stock market.

But is there a situation where we are able to enjoy the “best of both worlds”? What do I mean?

What if we could find a list of high-beta stocks that can do well (ie outperform the S&P 500) in both a bull and bear market?

In this article, I will be identifying for you a list of high beta stocks (with beta > 1.5) that have substantially outperformed the overall market during a bull run and continues to do so even during a bear market (like in 2022), which is rather unusual.

These stocks likely possess certain strong fundamentals that the market favors investing in even during a bear market, which might explain that “discrepancy”.

The bigger question then is, can this list of high beta stocks continue to maintain their outperformance vs. major market index, the S&P 500, as we head into a possible earnings recession in the coming quarters?

List of High-Beta Stocks that consistently outperform the S&P 500

I use the Stock Rover screener to screen for this list of high-beta stocks.

Here are the screening criteria:

1. Beta (1 year) > 1.5

2. 1-year return vs. S&P 500 > 0

3. 2-year return vs. S&P 500 > 0

4. 3-year return vs. S&P 500 > 0

5. 5-year return vs. S&P 500 > 0

6. YTD return vs. S&P 500 > 0

The table below shows the 15 stocks that fulfill the above criteria.

Source: Stock Rover

The highest beta stock on the list is NVDA, a company which many of us are extremely familiar with. It has a 1-year beta value of 2.06. It is also the best-performing high beta stock based on YTD 2023 price outperformance vs. S&P 500.

Many of the stocks in this list are associated with the semiconductor industry, them being a major beneficiary of the COVID-19 disruption. Even in the current semi-industry weakness, these high beta semi-plays continue to demonstrate their resilience.

The smallest market cap name in this list of high beta stocks that have consistently outperformed the S&P 500 is Diodes (DIOD).

DIOD is likely a name most people are unfamiliar with. It also operates within the broader market of the semiconductor industry, a leading global manufacturer and supplier of high-quality application-specific standard products.

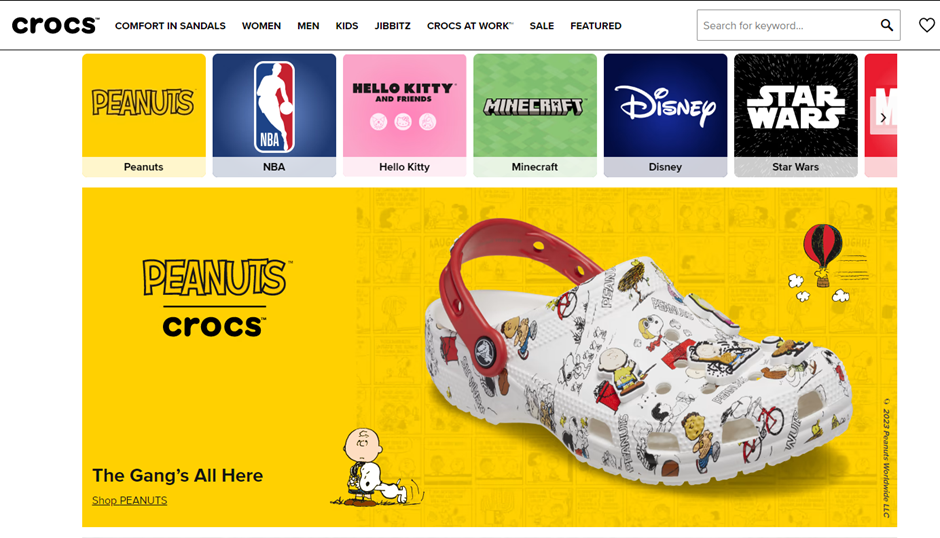

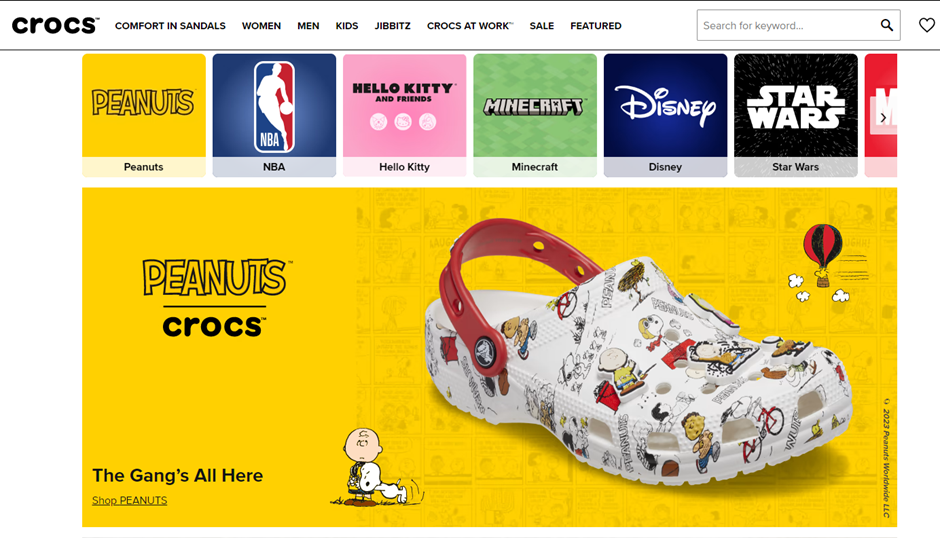

While there might be a handful of familiar names in this list, I would like to point out Crocs (CROX), a consumer brand that most of us can relate to (I am currently wearing Crocs sandals. No judgment please).

CROCS: A standout High Beta Stock

Source: Crocs

Crocs operates a simple business selling sandals. Nothing fancy. So why has it been such a consistent price performer?

Take a look at the above picture. It is not just a plain sandal. It has become some sort of a fashion statement.

If you are a lover of the Peanuts cartoon, you will probably get a pair, maybe just for the collection’s sake.

How about if you are a Hello Kitty fan, or Minecraft, or Star Wars, etc. would you consider buying it to make a statement? Possibly, especially if you are also a fan of Justin Bieber.

This list is endless and while the sandals might not be the most comfortable and wearable, it will continue to appeal to a growing consumer base due to their customizable designs.

Is this just a fad? Well, only time will tell, but so far, this high-risk, beta consumer stock has been executing well, as evidenced by its share price.

Interested in High-Quality Growth Stocks?

Many of the names in the list of high-beta stocks above resonate with my own Stock Alpha Blueprint counters, which seek to identify high-quality growth stocks.

Some of the large-cap (market cap > $10bn) high beta stocks that are also Alpha Blueprint Stocks include counters such as Nvidia, On Semiconductor, Lattice Semiconductor, etc while some of the smaller cap names (< $10bn) include Axcelis Technologies, Skyline Champion, etc.

For those who are interested to learn a simple technique to identify high-quality growth counters and invest in them at the right time, do check out the link here