Investor-One review

When investing in the Singapore market, we often place a heavy emphasis on large-cap and blue-chip counters like Banks, REITs, ST Engineering, or even Singtel. Information about these companies can be easily found in online forums as they are commonly discussed. However, most of them are past their growth stage and the chances of capital appreciation might be small! Buying matured companies may not always turn out to be a winning strategy as we’ve seen blue-chip counters phasing out due to technology and disruptors.

But what if I told you there is another side of the market where you can find hidden gems in small and mid-cap companies packed with growth potential? Companies such as iFAST and AEM that turned out to be multi-baggers? Now, what if you can easily uncover them using a single platform? That’s Investor-One!

Introduction of Investor-One

Launched in 2017, Investor-One is a one-stop platform for investors to gain access to information on SGX listed stocks. Readers are able to holistically study companies through a wide array of viewpoints such as fundamental analysis, news, public sentiment, and even one on one interviews with C-suite management.

Maintained by ShareInvestor with the support of SGX, Investor-One is an ideal platform for investors to source for new counters and lay a solid foundation through the information provided. But how do we screen for small and mid-cap stocks?

What are small and mid-cap stocks?

Firstly, here’s a quick introduction to small and mid-cap companies. As per SGX’s definition, Singapore mid-cap stocks are companies with a market capitalization of between S$1billion to S$6billion. Small-cap stocks are companies between S$100million to S$1billion. You can obtain this number from the formula below:

To plug into the formula, the total number of shares issued by a company can easily be found in their financial statements. However, most of us will find it too tedious of a process to do so. To skip right through this step, Investor-One got us covered and I’ll show you in the later section how you can obtain these figures just with a few clicks!

Expanding more into the market cap, here are two different valuations for SGX companies (as of 17 May 2021):

- DBS’ Market Cap = S$75 Billion

- Koufu’s Market Cap = S$355 Million

But what does market cap tell us and why it matters?

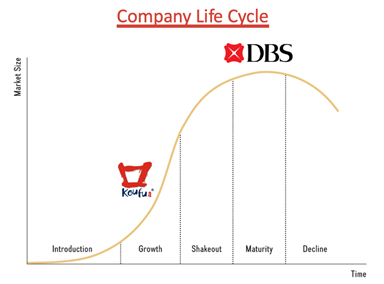

This is a typical life cycle that all businesses face.

Large companies like DBS are typically in their maturity, having established themselves as leaders in the industry. As they’ve passed the growth stage, these companies are relatively stable with limited growth prospects. There will always be companies vying to topple their position as industry leaders with innovative ideas and technology. Investing fully in these companies may not be a risk-free strategy as they are susceptible to disruption if the company fails to keep up with new players. For example, the telco and media industry has been on a downtrend over the past 5 years!

On the other hand, smaller companies like Koufu are the complete opposites of the incumbents as they carry a larger growth potential. Despite carrying a higher risk, the stewardship of the right management can guide these companies to gain a larger market share in their industry.

To elaborate further, this is what I like about small and mid-cap companies:

- A nimble reaction to market: Smaller organizational structure allows these companies to react and adapt nimbly to the everchanging market landscape or economic trends. This is one key advantage they enjoy compared to large firms where a single decision has to go through various departments and authorities.

- High and sustained growth: Smaller companies are more open to risk-taking, they have exciting growth prospects and investors can enjoy high capital appreciation compared to the benchmark of 4% to 5% dividend per year.

Personally rewarding to uncover gems: They are often unprofitable in the early years of operations and they trade at a premium based on financial metrics like P/E ratios. This makes it hard to place a valuation on them due to the uncertainty. As it carries higher volatility, investing in these companies requires conviction and belief in the particular company. However, if your conviction turns out to be accurate, you’ll bear plump fruits of your labor!

Recent success stories of Small and Mid-Cap firms

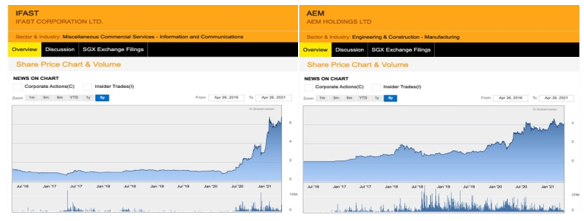

Not long ago, companies like iFAST and AEM had a market cap of less than S$1billion and were classified as small-cap firms! On a YoY basis, these companies rewarded investors for their conviction as they turned out to be multi-baggers!

To illustrate the magnitude of returns, here are the 5 year capital gain from various companies:

- DBS = 83.3%

- iFAST = 394.4%

- AEM = 4,975%

Of course, not all companies will turn out like iFAST or AEM and investing in companies with a smaller market capitalization carries higher risks! In the next section, I’ll share on the checklist I have to gain conviction of these companies.

Personal checklist for small and mid-cap stocks

- Potential of Industry and operations: Before assessing the company, it is vital to understand the potential and growth of the industry they are operating in. Apart from understanding the global economic trend, one key local indication can be the yearly budget by the Ministry of Finance. For example, it was announced that the Singapore Government is looking to set aside S$30million for EV-related initiatives. Coupled with the global shift towards EV, this niche industry would be more attractive than others such as Telecom!

- Company’s management and insiders trade: If you’re satisfied with the industry, the next task would be to study the management team. An innovative management team is pivotal to the company’s success. To understand the team, you can look at the management’s past experiences and interviews he attended. Further, one can look at any insider trades made by the company. When shares are bought by the management, it is a sign of confidence in the company’s direction.

- Low dividend: As small-cap companies are more volatile in nature, it is often more expensive for them to raise funds compared to established firms. Therefore, I would prefer companies to retain their earnings and reinvest them into the business instead of distributing them back to shareholders as dividends. Hence a high dividend yield is not a key criterion for me.

- Strong Balance Sheet: These companies tend to operate in a cash-intensive environment and some may run the risk of excessive leverage. Therefore, it is ideal for them to have a healthy level of cash to prevent any financing problems.

- Rising profits and projected growth: Since small and mid-cap companies might still be generating losses during their initial growth stages, it is important to study the company’s earnings and revenue growth. An incremental improvement in these numbers would mean that the company is heading in the right direction in terms of operational scale.

- Social Sentiment: Lastly, I would look at the social sentiment of the public towards these small and mid-cap companies which I am interested in. In this age of technology, discussions over social media can play a huge role in the momentum factors of these companies.

With different factors to study, screening out undiscovered small and mid-cap gems may seem daunting, especially when information is scattered all over the internet.

However, Investor-One allows you to tick all the checklists mentioned above just in one site! Let me show you how I do it.

Step by step guide with Investor-One

1. Search/Screen for your company of choice

Even if you do not have a Singapore-listed small and mid-cap company in mind to invest in, Investor-One provides a handy tool to screen for one!

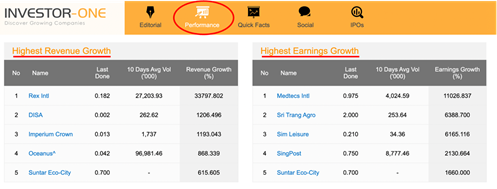

In order to screen for shares, you can assess the site’s performance tab as circled below! In this tab, you are able to screen for companies based on a myriad of metrics provided. Personally, I like to look at the highest revenue growth and top active counters over the past two weeks!

Once you have a company in mind, you can easily do a search through their Quick Facts tab! For my example, I will be using Boustead Singapore Limited.

2. Deep diving into the company

By entering the company of your choice, you’ll be greeted with a variety of information. On this page, it serves as your one-stop site as everything you need to know can be found here! Here’s how I navigate to tick my checklist for small-cap counters.

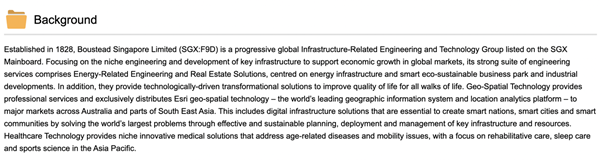

Understanding the company’s sector and background

Apart from providing details of the company’s sector and industry, you can find a concise yet comprehensive background of the company on the portal too! Below is a snapshot of the information.

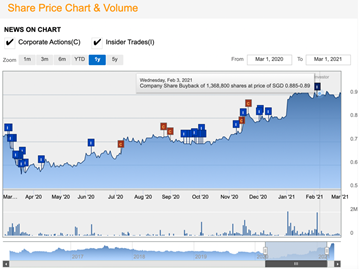

Insider’s trade

Scrolling down on the site, you’ll be able to find the share price and volume chart. By ticking the box for insider trades, you’ll be able to see all buy and sell transactions made by the management. To access the size of the trade, just hover your mouse over the boxes as shown below! Personally, I find this incredibly useful as it is simple and easy to understand. This is something I’ve always had issues finding online and I enjoyed this feature.

Company’s Management Team

To further understand the management team, you can find one-on-one interviews conducted with the management teams of these companies! These articles come in handy to learn more about the management team and their vision for the company.

Financial Performances

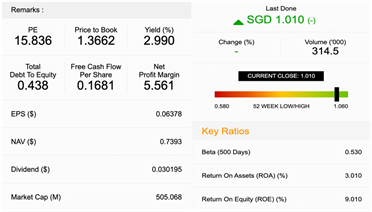

As for the financial performance of the firm, the portal provides you with a snapshot of its financial metrics. In reference to Boustead, you’ll be paying 15.8 times the company’s earnings at the current market price. Personally, I tend to look at the debt-to-equity ratio as it allows me to understand the company’s debt profile. A high number might serve as a red flag due to a higher possibility of over leveraging.

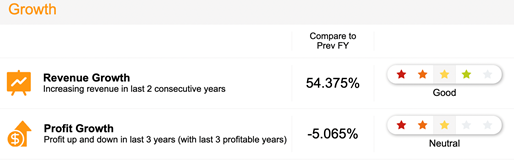

Not only does it provide you with the company’s financial, you’ll be able to find its revenue and profit growth over the past few years! The snapshot below is what you’ll find on their site. By looking at the numbers, you’ll have a top-level understanding of the company’s top and bottom-line growth trajectory.

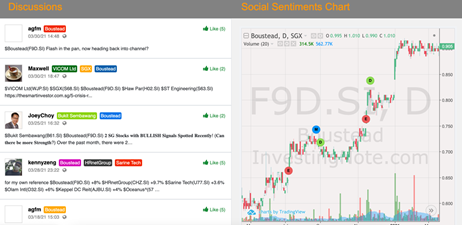

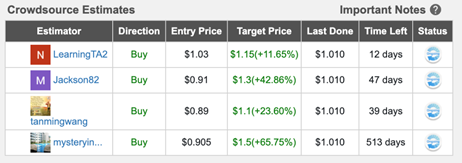

Social Sentiments

The picture below is what you’ll find for the public’s sentiment of the company. Although the estimations should be taken with a pinch of salt, it is important to expand your perspective of the company!

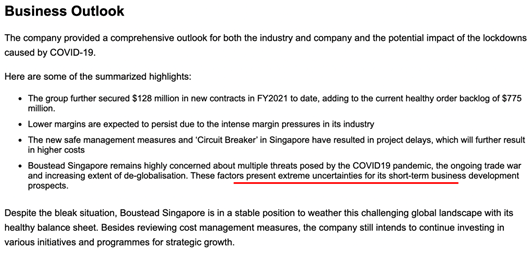

Analysis of company’s performances

Lastly, Investor-One provides financial analysis and review of the company’s results too. These articles are comprehensive and it provides you with a clear idea of the company’s operations. For example, Boustead recorded a -5% profit growth on a YoY basis. However, I also learned that it was due to Covid-19 and the global political climate. There is a healthy backlog of orders and Boustead will continue to invest in its future.

3. Company Features

Investor-One also does a comprehensive overview of small and mid-cap companies in their Company Features segment.

This is where the site seeks to introduce potential interesting small and mid-cap stock candidates, which majority of the time, are flying under the radar.

What is interesting is that the company feature write-ups are not solely focused on detailing the companies in question, but also to provide an educational angle behind it.

Take for example, one of its latest Company Features is on Chip Eng Seng. Investor-One seeks to highlight the prospect of the company using 4 financial metrics which provides an easily understandable article that is suitable for investors to comprehend and if they are interested based on these preliminary numbers, they can seek to investigate further.

I have also contributed to Investor-One’s website with a featured article on this interesting small-cap company.

Conclusion

Investor-One should provide you with ample information and knowledge to build a strong foundation on Singapore-listed counters! With their tools and features, the site works as a handy tool for you to uncover hidden gems within the market!

If you enjoy what Investor-One provides as I do, you can consider joining their telegram group to get timely updates by clicking on the image below!

This is an article written in collaboration with Investor-One.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Dollar Cost Averaging vs Lump Sum Investing. Which is more suitable for you?

- Stocks vs Bonds vs ETFs vs Mutual Funds: A Beginner Primer

- 4 Most Favoured Types Of Investment In Singapore For Inflation-beating Returns

- Cash Secured Put: Generating passive income the right way

- 4 Steps to understanding your Investment Time Horizon

- Beginners Guide to CryptoCurrencies and how to get started in 2021?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.