Hyphens Pharma: Singapore’s leading specialty pharma and consumer healthcare group

Hyphens Pharma (Hyphens) is Singapore’s leading specialty pharmaceutical and consumer healthcare group. The company operates in three business segments:

- Specialty Pharma Principals which is the largest contributor of both revenue and earnings to the Group. The company boasts more than 30 products in its portfolio and this figure is consistently increasing.

- Proprietary Brands currently comprise of dermocosmetic products marketed under Ceradan® and TDF® brands as well as health supplement products marketed under their Ocean Health® brand. While this segment generates the lowest profitability among the three segments due to heavy investments in brand building, it has the highest revenue growth potential as well as earnings longevity.

- Medical Hypermart and Digital is a B2B model where the company engages in the wholesale of pharmaceuticals and medical supplies in Singapore through Pan-Malayan. This segment is the second-largest revenue and earnings contributor to the Group but we note the potential lumpiness in revenue/earnings from one-off large tenders.

The company was founded in 1998 and was listed on the Singapore Exchange’s Catalist board back in 2018. Hyphens’ share price performance was rather lackluster since its listing, hovering significantly below its IPO price of S$0.26 and hit a low of S$0.18 during the recent March COVID-19 pandemic driven sell-down.

However, following a strong set of 1Q20 results, the company’s share price subsequently rebounded to hit an all-time high of S$0.39 in June 2020. Is there potentially more share price upside for the company? Let’s take a closer look.

Steady financial performances over the past 3 years

Income statement

The company’s past 3-years financials painted a picture of earnings stability but not one that is truly exciting. While its reported net profit declined from S$6.1m in 2017 to S$5.4m in 2018, this was due to one-off IPO expenses amounting to c.S$0.9m. Its adjusted net profit was S$6.3m in 2018, representing a 3.6% YoY growth. In 2019, earnings grew by a similar 3.5%, a rate likely deemed too low by the market to justify a share price re-rating.

However, despite widespread business standstill in 1Q20 due to COVID-19, the company reported a strong set of 1Q20 financial results with Group revenue growing by 16.4% YoY, spearheaded by its proprietary brand segment. Coupled with slower growth in expenses, Hyphens’ 1Q20 operating margins improved by 1.6ppt and consequently grew its net profit by 48.6% YoY to hit S$2.1m.

The million-dollar question is whether this growth should be taken as a one-off event or might there be sustainable strong earnings growth in 2020 and beyond. I look to address that in the next segment. But before that, let me briefly touch on Hyphens’ balance sheet strength and cash flow positioning.

Balance Sheet

The company has a rather pristine balance sheet where the company is in a strong net cash position. As of 1Q20, the company grew its cash and cash equivalent to S$27.8m. With total bank loans of $0.7m, net cash was S$27.1m as of end-1Q20 which amounted to approx. 30% of its current market cap.

Cash Flow Statement

With a low CAPEX requirement, Hyphens consistently generates free cash flow (FY2019: S$9m) which adds to its strong cash hoard to buffer against periods of economic uncertainties like the current one as well as capitalize on opportunistic acquisitions when viable. The current trailing 2019 free cash flow yield is at an attractive 10%.

The company has a formal dividend policy to distribute at least 30% of net profit to shareholders as it wishes to reward Shareholders for participating in the Group’s growth.

2018 dividend of 0.55 Singapore cents and 2019 dividend of 1.0 Singapore cents translate to a payout ratio of 30.5% and 46% respectively.

The Group’s strong cash flow position will likely support the continued payment of dividends. Coupled with its strong balance sheet position, I see little risk of the Group cutting its 1.0 Singapore cents DPS in 2020 absence of a large acquisition.

Growth Potential

COVID-19 could potentially derail Hyphens’ operational growth momentum in 2Q20 (full impact of Circuit Breaker). Nonetheless, one should focus on the bigger picture of Hyphens’ growth potential beyond 2Q20.

Specialty Pharma Principals

The largest contributor to Group’s revenue and earnings, this segment could scale up further as the company further penetrates its existing markets in Southeast Asia, especially the currently smaller contributors of Malaysia, Indonesia, and the Philippines.

In a previous video interview, Hyphens’ CEO Mr. Lim See Wah highlighted that Hyphens’ geographical presence in large markets such as Malaysia, Indonesia, and the Philippines is still relatively small and growth in these markets should outpace that of more established regions such as Singapore and Vietnam in the coming years.

Vietnam accounts for the bulk of revenue recognition in this segment. While there are concerns over potential sales loss stemming from the Pharmacy law in Vietnam which aims to prioritize the purchase of locally-produced products, management commented that branded products from Europe such as those distributed by Hyphens remain highly sought after due to their stringent-quality control and product demand will remain resilient.

As the company continues to add new principals, such as H.Lundbeck A/S Group and Syntellix AG which the company announced back in May and June 2019, that will further bolster Hyphens’ leading specialty pharmaceutical distributor status in the region as well as enhance its product offerings to the various markets in which the company has a presence.

I believe this is a segment that is underappreciated by the market. Hyphens’ specialty pharma principals are mostly reputable European pharma companies with products that are well-recognized in the market.

More importantly, Hyphens has exclusive distributorship rights to these products in the region. Nonetheless, I acknowledge concerns over distributorship rights termination which is a key reason why Hyphens is aggressively growing its proprietary brand segment.

Proprietary Brands

I believe it is critical that Hyphens progressively built up its suite of proprietary brand offerings which will ultimately reduce its reliance on specialty pharma principals.

Currently, this segment has the lowest revenue and profit contribution to the Group with sales mainly concentrated in Singapore and the ASEAN region. However, the management has the intention to actively pursue export opportunities to countries in ASEAN and outside ASEAN to supplement its existing marketing and distribution network. If the company is successful in launching its key proprietary products overseas, this might represent strong earnings growth potential for this segment in the years ahead.

Not resting on its laurels, management recognizes the importance of R&D spending in product development to supplement its existing product catalog as well as to further bolster its brand equity.

Take, for example, its Ocean Health supplements where sales momentum was declining back in 2018 (which resulted in goodwill impairment that year) saw a “revival” in demand in 2020 as the company introduces a new brand packaging and roll out a new product: High Strength Omega-3 & Vitamin D3 Enriched which is met with 5* reviews on multiple online platforms. The company is also preparing to launch a Ceradan-branded hand lotion sanitizer that kills germs while protecting skin from alcohol’s drying effect in the coming months.

Partnership with A*STAR bearing fruits

Back in 2019, the company highlighted that its collaboration with A*STAR through its MOU with A*ccelerate (A*STAR commercialization arm) could potentially see new and innovative products in the space of dermatology being introduced as early as 2020.

Hyphens might finally reap the rewards of this collaboration as the company announced plans to launch several new products under its existing brands in 2H20 which will aid in further brand recognition.

Coupled with the effective use of various sales channels to promote its products, that will help the company boosts not just its brand presence, but also overall product sales.

Increasing physical and online sales channel

For example, the group launched Ceradan® Advanced in 2019 through the medical channel and decided to extend the existing Ceradan® range to be sold in retail pharmacy channels such as Guardian, Watson, and Unity. This marketing outreach enables the company to enhance brand awareness to consumers and gain more traction in the retail market space.

Recognizing the importance of online distribution channels, the company has also stepped up marketing efforts in promoting its products through major online marketplaces such as Qoo10, Lazada, Shopee, etc.

New product acquisition

Lastly, with a strong cash hoard of $27m, the company can comfortably fund new product acquisitions to further strengthen its proprietary brand segment without the need to get into excessive debt.

Medical Hypermart and Digital

This segment has been a steady revenue contributor to the Group, hovering at approx. S$40m/annum. This is a wholesaling model leveraged by a B2B digital hypermart platform that allows the Group, under its Pan-Malayan brand, to market its more than 4,000 products to more than 3,000 customers which include private clinics, pharmacies, polyclinics, and nursing homes.

Management has highlighted that sales in this segment have seen an uplift in 1Q20 due to higher demand for personal protective equipment such as medical gloves, face-mask, etc.

The company also benefited from a huge tender which was mostly fulfilled in 1Q20.

While the strength of its sales in 1Q20 might not be entirely replicated for the rest of 2020, I believe demand for personal protective equipment will remain resilient amid fears of a “second wave” as more countries report a “relapse”, with an uptick in new cases.

With the company continuing to engage its medical professional customers via video conferencing, the ability to carry on its business effectively through digitalization will set Hyphens apart from the competition and maintain its market-leading position in this arena.

Valuation

I believe the company does have several growth catalysts, which I have highlighted above, to sustain a high earnings growth beyond 2020.

Effective control of operational expenses (particularly in administrative expenses) could see the company benefiting from operating leverage amid consistent growth in revenue.

According to RHB, which actively covers the company, Hyphens is forecasted to generate S$7.6m in net profits for 2020 which translates to a forward PER of 12x.

While the company has indeed seen a fair bit of re-rating in the past month, I believe the successful execution of its strategy to expand its increasing portfolio of product offerings beyond its 2 key markets, Singapore and Vietnam, could drive sales substantially higher over the coming 1-2 years. Coupled with better operating cost control, Hyphens might well be only a handful of companies in SGX that can demonstrate rising revenue growth + stronger margins amid COVID-19.

This will warrant substantially higher earnings multiple, in my view.

Peer comparison

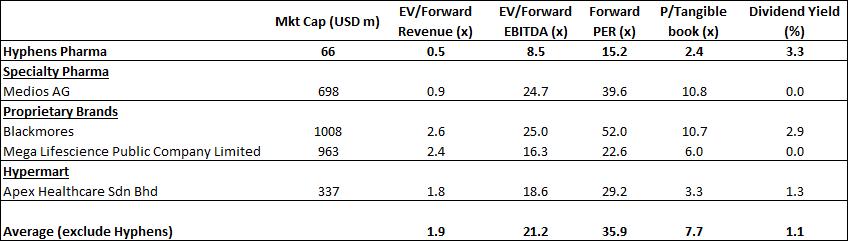

When compared with peers, the company is trading at a 50% discount on almost all valuation metrics while yet spotting a higher dividend yield.

Potential Fair Value

Using the peer comparison table above as a possible benchmark, I look to derive a fair value for Hyphens.

Ignoring its cash value at the onset, I value Hyphens’ 3 key divisions based on valuation multiples relative to its peers.

For its Specialty Pharma business, I ascribe a 10x forward EV/EBITDA multiple which is more than a 60% discount relative to Medios AG, a specialty pharma player based in Europe. I believe that the market is significantly under-estimating the value of its specialty pharma division as can be seen from the huge valuation disparity relative to European players.

Do note that many of these specialty products which Hyphens carry in its portfolio originate from Europe itself, where their principals are mostly established pharma companies. Hyphens also has exclusive distributorships to these products in the region. Hence, I see a 10x forward EV/EBITDA multiple as very reasonable.

Specialty Pharma: S$7m (forward EBITDA assumption) * 10x = S$70m

For its Proprietary Brand business, I ascribe a 1.5x forward revenue multiple, a 40% discount to the average of Blackmores and Mega Lifescience multiples, taking into consideration Hyphens’ smaller market cap, but partially offset by strong growth potential in this segment.

Proprietary Brand: S$17m (forward revenue assumption) * 1.5x = S$25.5m

For its Hypermart business, I ascribe only an 8x forward EV/EBITDA multiple, with my normalized forward EBITDA assumption at S$2m. This segment should have a lower multiple vs. the specialty pharma segment due to lower margins and significant variability in sales from the lumpiness of tender contracts. At 8x forward EV/EBITDA, it is a massive 60% discount vs. its closest listed peer, Apex Healthcare in this segment.

Hypermart: S$2m (normalized EBITDA level) * 8x = S$16m

I add in the net cash of S$27m to the above sum-of-the-parts and ultimately derive a fair value of S$139m for the company. This is an implied fair value of S$0.46/share which represents a more than 50% upside from the current share price level.

Key risks

Reliance on brand principals: This is a major risk for the company because its specialty pharma principal is the largest revenue and earnings contributor to the Group. A loss of any key brand principals might translate to a substantial decline in sales and profitability.

As highlighted, it is therefore critical that Hyphens grow its proprietary brand’s segment where sales variability is low and not subject to the unfortunate circumstance of contract termination by its principals.

Failure to develop new products: The company needs to constantly spend on R&D for new product development. However, there is no certainty that such R&D spending will result in the successful “formulation” of a new product nor guarantee its sales success. Hence, R&D spending, which is currently a key reason accounting for the low net profit nature of its proprietary brand segment, might continue to be a heavy burden on its bottom-line without a corresponding rise in revenue in the same period.

Failure to launch in other markets: Product registration must be granted by the relevant regulatory authority in its respective jurisdictions before Hyphens can start marketing and selling them. This process is often a lengthy one.

In the event that Hyphens is not able to onboard new/existing products into new geographical markets, that will adversely impact its forward growth potential.

This article is written in partnership with Hyphens Pharma

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 1Q 2020 TOP HEDGE FUND LETTERS TO SHAREHOLDERS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.