Table of Contents

High Risk, High Return Stocks

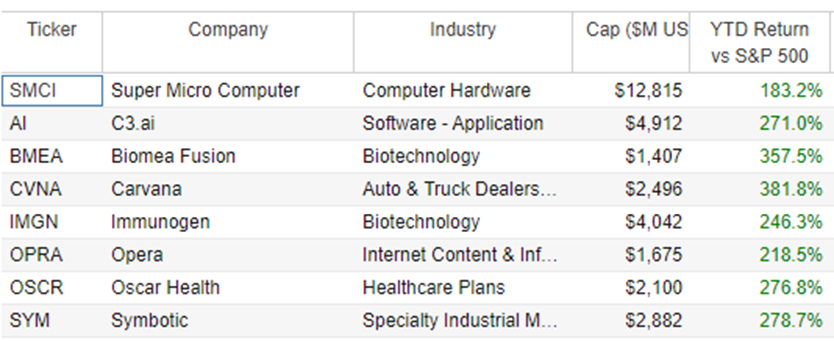

Which is the best-performing S&P 500 stocks in YTD 2023. No prizes for guessing but that honor goes to NVIDIA, a stock that has benefitted from all the hype surrounding Artificial Intelligence (AI). While not a pure-play AI stock, NVIDIA is undoubtedly one of the best blue-chip companies to play the AI theme.

As of mid-June 2023, the stock has outperformed the S&P 500 by more than 150%, making it the best-performing S&P 500 stock in 2023 thus far. Coming in a distant second is META, with an outperformance of >110% vs. the S&P 500.

However, these blue-chip stocks are not the best performers within the US stock universe (> $1bn market cap).

In this article, I will highlight 8 high risk, high return stocks that have generated over 180% outperformance vs. the S&P 500. Can that outperformance continue into 2H23?

High Risk, High Return Stock #1: Super Micro Computer (SMCI)

This stock is the largest market cap stock in our list, currently spotting a market cap of $13.6bn. Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and the “Internet of Things” embedded markets.

Its solutions include servers, storage, blade, and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions.

The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular, and open-standard architecture.

SMCI has outperformed the S&P 500 by 183% as of this writing, with the majority of those gains happening over the past 2 months. Not surprisingly, this stock has been “marketed” as a key beneficiary of the current AI trend.

High Risk, High Return Stock #2: C3.ai (AI)

A pure-play AI stock, C3.ai is an enterprise AI company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure.

I have written about C3.ai previously in an article on pure-play AI stocks. The stock generated a YTD 2023 return of 271%, with the bulk of the gain stemming from positive sentiments surrounding the AI theme after NVIDIA’s fantastic 1Q23 results, driven predominantly by AI-related demand.

This is truly a high risk, high return stock that could continue to generate strong price gains if the AI hype continues. The counter used to trade as high as $183/share back in late-2020, post its IPO. However, it has been a one-way downward trend since.

Can this pure-play AI stock continue its price dominance in 2H23? Only time will tell.

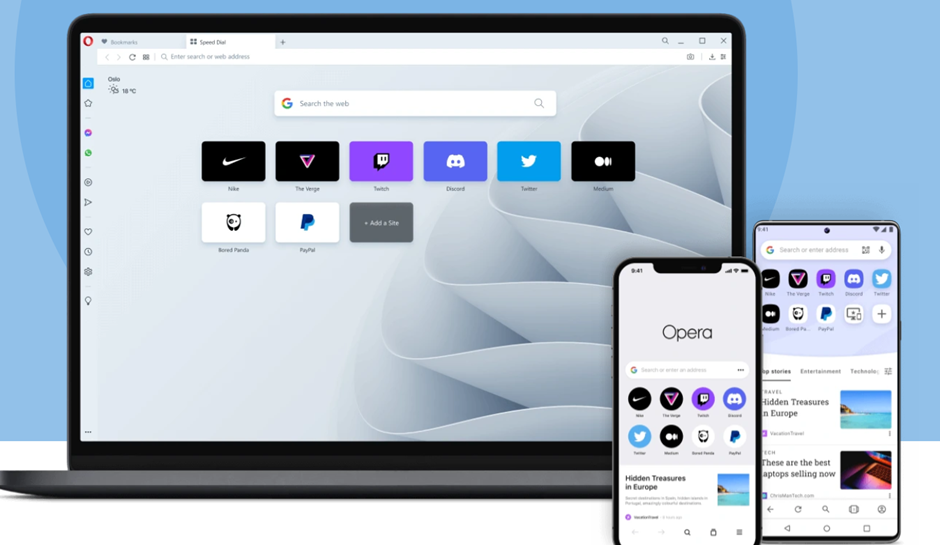

High Risk, High Return Stock #3: Opera (OPRA)

This is a stock that most investors will NOT be familiar with. Opera Ltd is a global internet brand with a large, engaged, and growing base, particularly from its gaming segment.

It offers users around the globe a range of products and services that include a variety of PC and mobile browsers, Opera Gaming portals and development tools, Opera News content recommendation products, and several e-commerce products and services.

Its features include tabbed browsing, data savings, PC/mobile sync, and numerous features focused on privacy and security, including ad-blocking and a built-in VPN. Its browser products include Opera Mini, Opera Browser for Android and iOS, Opera for Computers, Opera GX, and Opera GX Mobile, separate browsers tailored for gamers.

The newest addition of browsers is the beta release of a Web3-centric browser for PC and mobile which is tailored for crypto enthusiasts.

The company’s product is something that the man-in-the-street can easily download and test out on their mobile or PC. According to the company, Opera is the world’s most downloaded independent browser.

Being a retail-centric stock, this high risk stock fits the profile of a potential multi-bagger stock. Investors might want to take a closer look at its product to determine if it has an edge over existing incumbents such as google chrome, Mozilla Firefox, and apple safari.

High Risk, High Return Stock #4: Symbotic (SYM)

Symbotic Inc is an automation technology company that develops technologies to improve operating efficiencies in modern warehouses.

The group develops, commercializes, and deploys innovative, end-to-end technology solutions that dramatically improve supply chain operations.

Symbotic also automates the processing of pallets and cases in large warehouses or distribution centers for some of the retail and wholesale companies in the world.

The stock is currently up 240% YTD and despite its small-cap nature (market cap of $2.5bn), it has 12 analysts covering the counter, with the majority giving a Strong Buy rating.

This is one stock that could benefit from the trend of increasing warehouse automation, with the likes of big players such as Walmart being their key customers.

This is a stock that is still in its early stages of growth, with its revenue expanding by 177% YoY in its latest quarterly results. Nonetheless, this is still a loss-making high risk stock that investors need to be mindful of.

High Risk, High Return Stock #5: Immunogen (IMGN)

Immunogen Inc is a clinical-stage biotechnology company from the United States.

Its focus is an antibody-drug conjugate, or ADC, technology, which uses an antibody that fixes on a target (its antigen) found on tumor cells to deliver a specific cancer-killing agent.

The counter’s share price jumped significantly on 3rd May (> 100%) after the company announced positive trial data concerning an ovarian cancer drug the company has in its pipeline.

The huge share price appreciation is not surprising for a biotech company like IMGN that announces positive trial results for its key drug.

There are currently 9 analysts covering the stock, with the majority having a Strong Buy on the counter. Nonetheless, its fair value target price of $14.33 given by the street is approx 20% below its current share price level.

The street is also expecting the company to generate losses into 2024.

High Risk, High Return Stock #6: Oscar Health (OSCR)

Oscar health is a health insurance company. The company provides insurance plans for individuals, families, and employees.

Also, the company provides virtual care, doctor support, scheduling appointments, and other related services.

It is rather surprising to see a healthcare insurance provider company like OSCR generating such strong price gains in a relatively short period.

This is likely the result of institutional buyers scooping up the share. Some of the key insti buyers included The Vanguard Group and Millennium Management LLC.

Like most of the stocks in this list, OSCR is hugely unprofitably and that scenario is unlikely to change into 2024.

With its share price appreciating by almost 300% on a YTD basis and its current price of $9.62/share being at a significant premium to the street’s average target price of $5.94/share for the counter, one cannot be blamed for giving this stock a miss.

High Risk, High Return Stock #7: Biomea Fusion (BMEA)

Another Biotech company, Biomea Fusion (BMEA) is a preclinical-stage biopharmaceutical company focused on the discovery, development, and commercialization of irreversible small-molecule drugs to treat patients with genetically defined cancers.

The company’s lead product candidate, BMF-219 is designed to be an orally bioavailable, potent, and selective irreversible inhibitor of menin, an important transcriptional regulator known to play a direct role in oncogenic signaling in multiple cancers.

Unlike IMGN which is trading more than its fair value price as forecasted by the street, BMEA has 8 analysts all with a Strong Buy rating on the counter, with a fair value target price of $41.50 vs. its current price of $39.77.

The counter is not forecasted to be profitable into 2024.

High Risk, High Return Stock #8: Carvana (CVNA)

The last high risk, high return stock in this list is Carvana (CVNA), a counter which I have highlighted before, earning the dubious honor of being the worst-performing US stock in 2022.

This is a company with an e-commerce platform for buying and selling used cars. The reason why the company turned from being a market darling to becoming the worst stock performer in 2022, was due to its hugely leveraged balance sheet.

Its latest strong price performance was likely the result of a short squeeze, with short-seller Kerrisdale Capital saying it was short Carvana and called the company insolvent.

As of the end of May, 69% of the stock had ben sold short, setting up the opportunity for an extended short squeeze that can continue into 2H23.

Though Kerrisdale seems to think that won’t happen, Carvana bulls think otherwise, believing there is still considerable upside if the business continues to improve.

A safer way to generate higher returns

While this list of 8 stocks has been the best share price performers on a YTD 2023 basis, there is no guarantee that their price momentum can continue into 2H23.

Many of the stocks in this list are your small-cap stocks which are also loss-making in nature. While the current “positive” market environment has resulted in a “risk-on” mode, many of these high risk stocks will be swiftly abandoned by investors when the market sentiment finally turns.

While there are some interesting counters in this list which I will be taking a closer look at, stocks such as OPRA, SYM, etc, I will not be comfortable investing a sizable amount of capital into these high risk, high return stocks.

A safer way to generate higher returns will be to focus on smaller-cap stocks that have sound fundamentals.

This is where the concept taught in my Stock Alpha Blueprint (SAB) course comes into the picture. While SAB stocks are predominantly your blue-chip counters which are the market leaders in their respective industries, the same fundamental concepts used to screen for these blue-chip counters can also be used to identify their smaller-cap counterparts.

One small-cap company that fulfills the stringent fundamental criteria set up in SAB is Axcelis Technologies (ACLS), a counter that I highlighted as a small-cap semiconductor stock that one should be aware of in a previous article.

This small-cap stock has been one of the best-performing semiconductors plays YTD, with its share price outperforming the S&P 500 by more than 110%.

For readers who are interested to find out more about what the Stock Alpha Blueprint entails and how you can finally use a simplified yet systematic approach to enter and exit fundamentally strong stocks, do click on the button below.