Can a 27-year old hit his Full Retirement Sum at age 55?

Back in early 2020, I wrote an article about our CPF Full Retirement Sum or FRS for short, potentially hitting a figure of more than $400,000 by 2050 ($412,000 to be exact), based on a 3% growth rate.

Following the recent announcement on the CPF Basic Retirement Sum (BRS) appreciation rate, the forecasted Full Retirement Sum is now expected to be $100,000 more in 2050, or a total of $500,000.

Is there a need for our Retirement Sums to be growing at such a rapid rate?

How realistic is it for a typical 27-year-old generating a median income today to achieve that figure in his/her CPF Retirement Account in 2050?

We will explore that in this article.

Changes to the Basic Retirement Sum appreciation rate

The Full Retirement Sum (FRS) in 2022 is at $192,000. This means that if you hit Age 55 in 2022, this is the amount you NEED to set aside in your CPF account to contribute to CPF LIFE when you hit Age 65.

As most Singaporeans would already have noticed, the Full Retirement Sum has been steadily increasing. From S$80k in 2003, that figure is now at S$192k in 2022. That is a CAGR of 4.7% over this period.

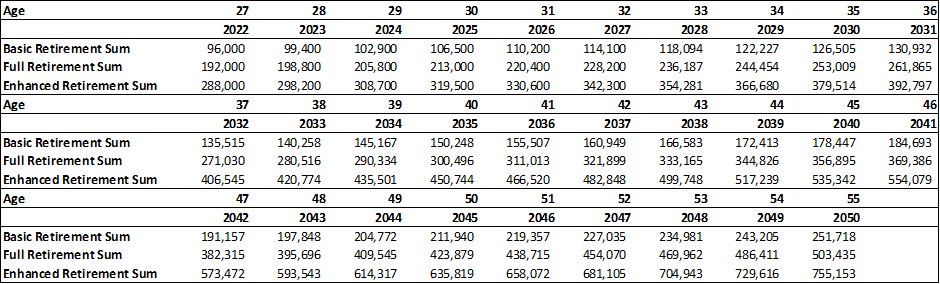

The government has already stipulated that the Basic Retirement Sum (BRS) will increase from $96,000 in 2022 to $99,400 in 2023, $102,900 in 2024, $106,500 in 2025, $110,200 in 2026, and $114,100 in 2027.

Correspondingly, the Full Retirement Sum (FRS), which is essentially BRS X 2, will be $192,000 in 2022, $198,800 in 2023, $205,800 in 2024, $213,000 in 2025, $220,400 in 2026 and $228,200 in 2027.

The Enhanced Retirement Sum (ERS), which is BRS X 3, will be $288,000 in 2022, $298,200 in 2023, $308,700 in 2024, $319,500 in 2025, $330,600 in 2026 and $342,300 in 2027.

If one assumes that the current 3.5% appreciation rate “sticks” from 2027 to 2050, the below table represents the ending BRS, FRS, and ERS amount in 2050.

Well, your Full Retirement Sum has now “magically” increased from the previously calculated figure of $412,000 to the current figure of $503,000, an almost $100k increment.

Someone who is 27 years old today (In the Year 2022), should expect that when he/she hits the ripe old age of 55 years old (In the Year 2050), the Full Retirement Sum required would be approx. $500,000, based on a constant appreciation rate of 3.5% from hereon. For myself, who is 39 years old this year, my expected Full Retirement Sum when I am at 55 years old in 16 years-time is approx. $333k.

What is the expected payout like?

If you are a 27-year-old today, the “sad” reality is that approx. half a million dollars of your CPF funds will be “locked” up when you hit 55 years of age to contribute to your CPF LIFE funds if one is targeting to reach his/her Full Retirement Sum.

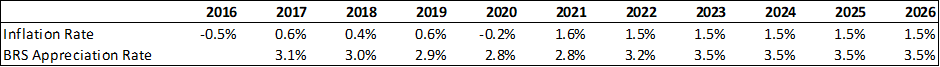

This is based on a constant 3.5% appreciation rate. A quick question that comes to mind is: Why is this appreciation rate persistently higher than the inflation rate since 2016? The inflation rate vs. BRS appreciation rate comparison since 2016 can be seen from the table below. Inflation rate data sourced from Statista

From 2016 to 2020, the inflation rate in Singapore has been pretty negligible but the BRS appreciation rate has been hovering at about 2.8-3%. Forecasted inflation from 2022 to 2026 is estimated to be around 1.5% based on the data from Statista but the BRS appreciation rate has been increased to 3.5%.

Well, the government might have better “foresight” that the inflation rate will be trending at a much higher rate than the implied 1.5% figure which explains why they are pre-empting this scenario by increasing the BRS appreciation rate over the coming years?

An appropriate question after “realizing” that a huge chunk of your money is locked up would be, how much will the CPF LIFE payout be like?

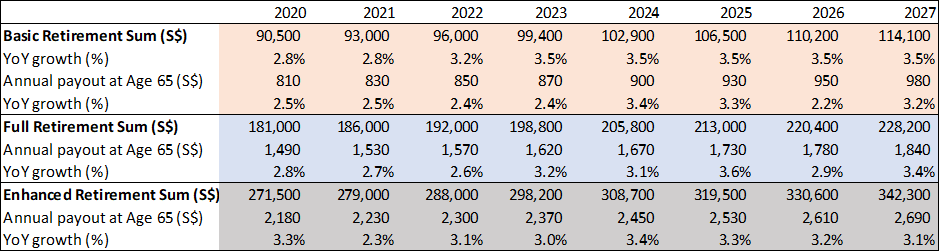

As can be seen from the table above, the estimated payouts every month based on the new forecasted Retirement Sums are typically growing at a slightly slower pace vs. the 3.5% rate at which the Retirement Sums are expected to grow at.

Payout not proportionate

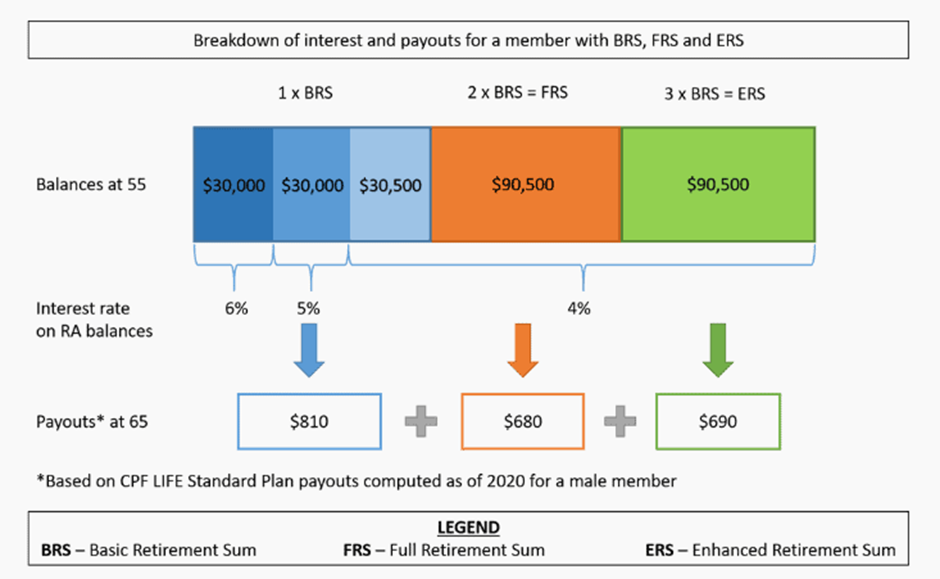

At this juncture, one might notice that the payout amount for the Full Retirement Sum and the Enhanced Retirement Sum is not a simple X2 or X3 of the Basic Retirement Sum amount. For example, the Basic Retirement Sum expected payout is S$850 in 2022. “Theoretically” the Full Retirement Sum payout should be X2 of this amount (S$1,700) since the Principal amount is 2x right.

However, that is not the case, with the projected amount only at S$1,570 vs. S$1,700.

CPF explained that this is due to the difference in the interest rate that your savings are accruing.

For the first S$30k, it is generating interest at 6%. The next S$30k generates interest at 5% and the remaining at 4%. Hence due to the higher interest amount generated for the first S$60k (at 5-6%), the comparative payout amount for Full Retirement Sum and Enhanced Retirement Sum is not a simple multiplication (x2 or x3) of the Basic Retirement Sum payout amount.

Can the average Singaporean now meet the “revised” Full Retirement Sum?

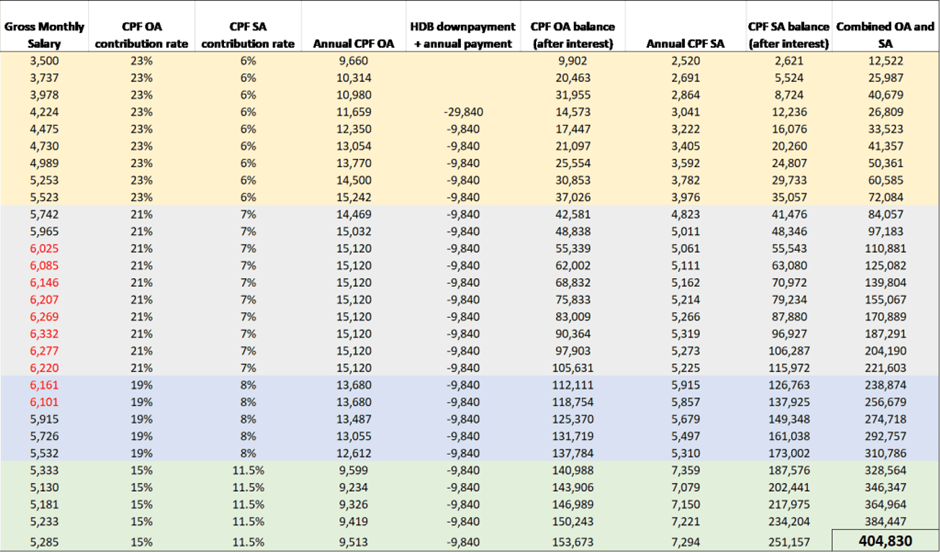

Our previous conclusion was that the average 27-year old Singaporean generating a median income would come close to meeting the Full Retirement Sum of $412,000 when he/she hits Age 55.

This is based on a few assumptions:

Assumption 1: Full Retirement Sum increasing at a rate of 3% from 2020 to 2050. To Hit $412,000 in 2050

Assumption 2: Starting median salary of $3,500

Assumption 3: Median salary adjusted for 1% inflation rate

Assumption 4: Median salary to peak at approx. 40-44 years old (in-line with national median)

Assumption 5: CPF OA to be used to finance a $400k HDB flat purchase (split between husband/wife) at the age of 30

Based on the above assumptions, a typical man-in-the-street will see his/her gross salary peaking at about 40-45 years old, thereafter a decline in salary drawn.

Nonetheless, even with a lower drawn salary, he/she will be able to end up with a Full Retirement Sum of slightly more than $400,000 and just below the required sum of $412,000 when they reach 55 years old.

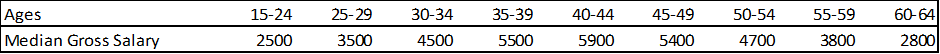

Median Salary (2022)

I have made some adjustments to the above figures, taking into consideration the new estimated median salary figure by Age Group using the latest available data from MOM. Do note that the figures below are based on an approximation using data sourced from the link above.

From here, I derived the inflation-adjusted median salary figure.

Based on these assumptions, the gross salary will peak at Age 44 at almost $7k for the average Singaporean. This figure is estimated to decline to approx. $6k at Age 55.

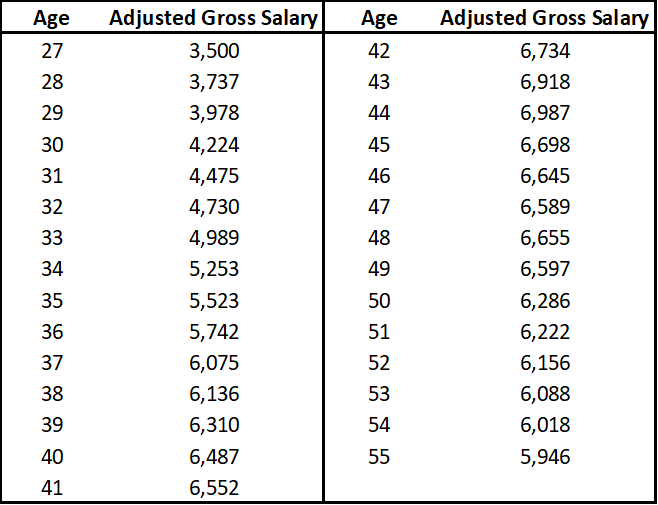

HDB house purchase (2022)

With the rise in HDB housing cost, the estimated “starter” flat for a newly-wed is assumed to be at $500k. Assuming 10% downpayment and the remaining on HDB loan at an annual interest cost of 2.6%, a couple will have to fork out $50k in downpayment, with the remaining $450k loan (over 25 years) translating to a monthly mortgage payment of $2,042 between the couple

This will mean an individual will require to fork out $25k in downpayment from his/her CPF OA and monthly installment payment of $1,021 (assume payment from CPF OA).

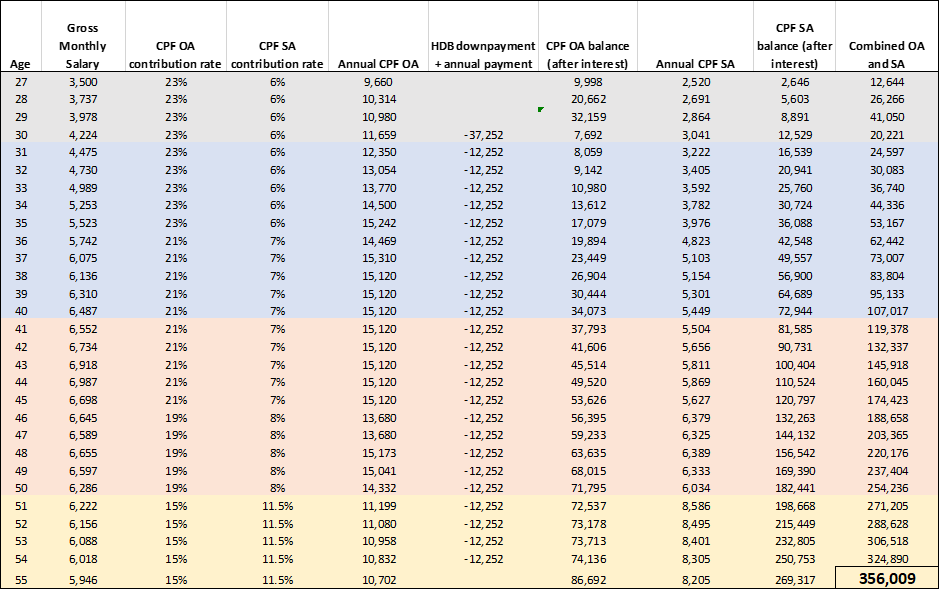

Putting it all together

Using a new set of assumptions

Assumption 1: Full Retirement Sum increasing at a rate of 3.5% from 2020 to 2050. FRS to hit $503,000 in 2050

Assumption 2: Starting median salary of $3,500 at age 27

Assumption 3: Individual to draw median salary adjusted for 1% inflation rate

Assumption 4: Median salary to peak at approx. 40-44 years old (in-line with national statistics)

Assumption 5: CPF OA to be used to finance a $500k HDB flat purchase (split between husband/wife) at the age of 30

The table below shows the breakdown

Despite a higher gross monthly salary, the new result, after taking into account the higher annual mortgage cost associated with a more expensive HDB purchase ($500k vs. $400k in our previous assumption), the final figure turns out to be significantly lower (almost $50k lower) at $356k.

This is a huge gap vs. the expected Full Retirement Sum of $503k in 2050.

Where is the difference?

Unlike our previous article where we derived a conclusion that an average 27-year-old Singaporean will be able to come close to the Full Retirement Sum in 2050 when he/she hits 55-years old, with a combined OA and SA account slightly more than $400k, the conclusion is somewhat different in this article.

With the government now stipulating a higher growth rate in the BRS at 3.5% over the next 5-years, we have assumed that this higher growth rate will be maintained over our forecasted 25-years period.

Consequently, we have derived a Full Retirement Sum figure of $503k in 2050, almost $100k more than our previous assumption.

While our median salary assumption has also increased, that is insufficient to compensate for the higher cost of living as reflected by a higher housing cost.

This translates to an end combined CPF OA/SA figure of approx. $356k for the average 27-year-old (current) Singaporean drawing a median salary when he/she hits 55-years of age in 2050, a far cry from the forecasted Full Retirement Sum of $503k. To hit the required half a million figure, at least 50% of the annual mortgage payment has to be funded by cash, ie approx. $500 each month of mortgage payment has to be cash-funded.

Conclusion

The Basic Retirement Sum and consequently the Full Retirement Sum seems to be an ever-increasing figure and that rate of increment seems to be faster than what actual inflation seems to imply.

It is thus normal for Singaporeans to have the “feeling” and probably some resentment that they are never going to be able to “cash-out” their CPF monies after working hard for a good 30-40 years of their life.

If I am to render a guess now, I suspect that the ultimate Full Retirement Sum in 2050 will be a figure between $400k-$500k. We can see that even in a “low-interest-rate” environment witnessed over the past few years, the BRS growth rate has been “capped” at a floor of around 3%, which implies a base figure of $400k in the FRS calculation.

In my opinion, it will be hard to achieve the required half a million dollars in one’s CPF Retirement Account if his/her CPF OA is used to fund the bulk of their mortgage liabilities.

Even if that $500k Full Retirement Sum figure is met in 2050, the payout then, expected to be around $3,800/month based on an average growth rate of 3.2%, will only have the same equivalent purchasing power of approx. $2k in today’s dollars.

That is not likely an amount that will be sufficient for a “comfortable retirement”. While CPF LIFE helps to provide a buffer for our future retirement expenses, to retire “worry-free”, one will need to grow his/her wealth more “efficiently” by investing.

For those who are interested to get started on your investing journey, with a goal of generating a healthy portfolio size come retirement to supplement your CPF LIFE income, do check out the NAOF Quick Start Video Series.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.