Facebook metaverse story. Social media giant transiting to the virtual world

Metaverse has been the “buzz” word of late and the company spearheading this trend is none other than Facebook, the world’s biggest social network company that has officially changed its name to Meta Platforms Inc.

The company’s sudden pivot into the metaverse world, where it sees a new iteration of the internet, with avatars of ourselves living, working and playing together in the not-too-distant future, is a bold bet undertaken to diversify itself away from its current advertising model (which currently accounts for almost 98% of the company’s top-line).

The big question is whether such a switch will ultimately prove to be a masterstroke (like how Google position itself to be more than a search engine when it rebrands itself into Alphabet back in 2015) or a rebranding disaster waiting to happen.

Some might view the rebrand as an effort to distance the company from its original Facebook product, a social network that has of late, come under intense scrutiny and negative publicity, with society branding its product equivalent to tobacco addiction for the masses.

It is still early days to assess if Facebook’s latest gamble is going to become a massive success story.

Zuckerberg could go down in history as a visionary who saw the potential of the metaverse before other leaders or a cynic who changed the company’s name to avoid the negative publicity associated with his social media business at present.

Nonetheless, here are 7 things that you need to know about Facebook. How is Facebook making its billions of dole and how you can look to take advantage of that.

Facebook Metaverse: 1) You might already be an owner of Facebook

Whether you believe in the Facebook story or loath the company (some sees it as a vermin to society and refused to use any of its associated products Facebook, WhatsApp, Instagram, etc), you probably are a minor shareholder of the company if you invest in passive index ETFs such as SPY, VT, etc.

Facebook’s largest shareholders are exchange-traded fund providers such as Vanguard and pension managers like Fidelity, both of whom owned more than 10% of the company. So, if you are one of the millions who invest through their ETFs or unit trusts products, you would already own a small slice of Facebook. And as any good investor knows, it is always important to know what you are vested into.

That is why in the remaining portion of this article, we will highlight how Facebook makes its billions, the challenges and opportunities ahead for this social media company that is looking to rebrand itself, and how you can assess for yourself if this company is the right investment fit for you.

Facebook Metaverse: 2) Facebook is the largest social media company in the world

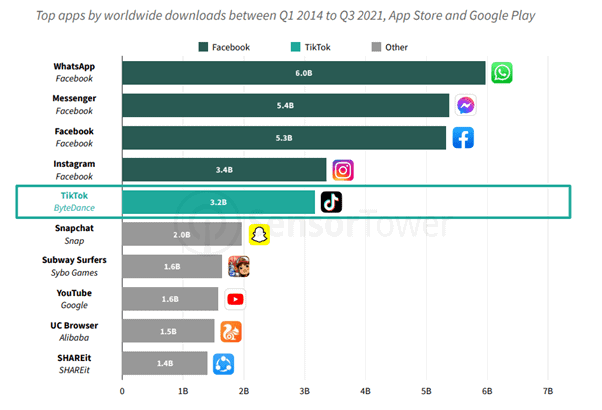

Most people will probably associate the Facebook app to Facebook (or now called Meta Platforms). However, Facebook is also the company behind uber-popular apps such as Instagram, WhatsApp and Messenger, which together with Facebook, have combined downloads of more than 20bn times since 2014.

The top 4 most downloaded apps in the world all belong to Facebook, with WhatsApp taking pole position with approx. 6bn downloads since 2014, according to data tracked by Sensors Tower.

However, Facebook is not making money from WhatsApp at present and there are still no plans as of yet to monetize WhatsApp massively over the next few years.

As a user of its WhatsApp product daily, I hope that day does not come but even if Facebook so decides to monetize WhatsApp through ad product placement or a subscription model for ad-free usage, I will likely still use this messaging app due to its massive network effect (the fact that all my network and contacts are using its product makes it difficult for me to pivot away to another messaging platform seamlessly).

There will likely be a major uproar and likely “boycott” of WhatsApp when that day happens but given WhatsApp’s huge impact on our daily lives, it is likely difficult for the masses to wean away from using this app, even if a small cost might be involved.

Facebook Metaverse: 3) Facebook makes 98% of its revenue by selling ads to you

Facebook’s current business model is one where it is essentially an ad seller. Advertisers aka business owners want to publish their products/services on Facebook through ads. Facebook charges them a fee for advertising on its platform.

The more businesses that choose to advertise on its platform, the more Facebook makes. In turn, Facebook can also look to raise the price of ads that will further boost its top-line generation. Those ads are, however, valuable to the businesses only if people see them.

Hence, what drives Facebook’s business is, in fact, the volume of users and their price.

Volume is tracked as daily active users (DAUs). In its latest 3Q21 results, Facebook highlighted that it has 1,930m DAUs, a 6% increase on the year before. Do note that these metrics exclude WhatsApp and Instagram users who don’t also use Facebook or Messenger.

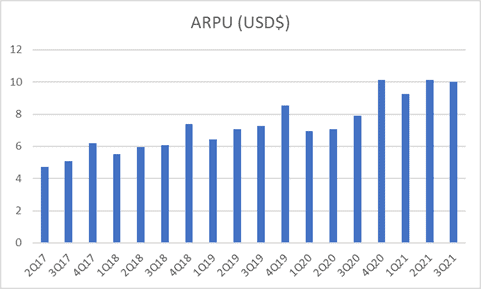

Price is calculated as the average revenue per user of ARPU. Facebook can boost this in one of two ways: by charging more for each advert or by showing users more ads.

There is typically some seasonality factor for Facebook’s ARPU, with the company generating the highest ARPU in 4Q and lowest in 1Q. In general, the ARPU for Facebook has been heading higher since 2017.

Currently, Facebook makes the bulk of its revenue from its Facebook product vs. Instagram. The problem is that Instagram usage is on the rise while time spent on the main Facebook app is declining.

Facebook will thus need to optimize its Instagram platform for better advertising opportunities to ensure that its ARPU trend remains a positive one, amid headwinds for its flagship Facebook app.

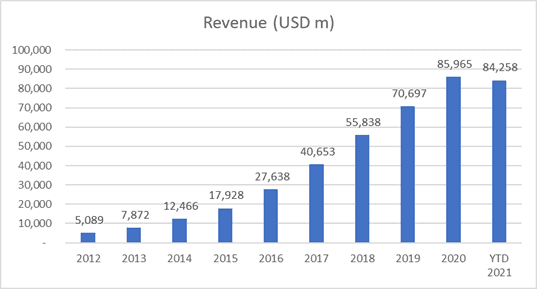

In 2020, Facebook’s total revenue was $86bn, a massive increment from its 2019 level despite COVID-19. The company is on track to generate more than $100bn in revenue in 2021.

The bulk of that revenue remains centered on its advertising business model where the company currently generates approx. 98% of its top-line from advertising. Despite the company’s aim to pivot into metaverse over the coming decade, it will still be heavily reliant on advertising for years to come.

This is where the risks are lurking on the horizon.

Facebook Metaverse: 4) The challenges facing Facebook

Buying Facebook a decade ago has been a great investment. However, despite its “too-big-to-fail” size today, the company still faces big challenges like any other business.

First off there are always ongoing concerns over antitrust regulation. If the government thinks Facebook is so big it is stifling competition, they might force it to split into pieces as a result. For example, the social media giant bought into this VPN tracking tool called Onavo back in 2013 for a princely sum of $200m to track people’s app usage and subsequently acquired companies that might pose a threat to its wellbeing, such as WhatsApp in 2014.

Facebook decided to shut down Onavo in 2019 due to backlashes from nations concerned over how Facebook is using this data snooping app.

Second, in what is now known as the Facebook Files/Papers, a consortium of 17 US news organizations has published alarming findings of Facebook which provide rare, vivid insight into the business practices of CEO, Mark Zuckerberg who “repeatedly prioritized profits and growth over user safety”.

Third, there are concerns over serious privacy issues, leading the company to shut down its facial recognition system recently and delete a billion faceprints. This is not the first time that Facebook is facing privacy issues and have been forced in the past to “collect less data” to appease both users and regulators. This has big implications for the company’s business model which is built entirely around the collection of data.

The reason why Facebook can chare so much for its ads is because they are highly targeted to each user. Without as much data to go by, Facebook won’t be able to target as effectively and hence runs the risk of making less money.

These are all ongoing concerns that are forcing Facebook to rethink its business model and hence, its latest decision to diversify into the metaverse. But is replicating the business model of Google going to be a smooth sailing journey for Facebook?

Facebook Metaverse: 5) Pivoting to become like Google

Back in 2007, Google was predominantly an advertising company, generating 99% of its revenue from ad sales. However, by 2018, Google’s revenue mix has changed, with “only” 85% of its revenue now coming from advertising.

The company has successfully diversified its revenue stream beyond just advertising, with the other 15% coming from ventures such as cloud computing, hardware sales, etc.

Facebook is now looking to replicate what Google has done successfully and it is making big bets to becoming a more well-rounded platform, with its latest venture into the metaverse.

However, there are other business ventures which the company is also embarking on that might be worth a mention.

Facebook is venturing into commerce with its Facebook and Instagram Shops where users can create free storefronts where they can sell their goods directly to consumers. There are also checkout features that allow users to make purchases without leaving the app. This foray into retail could help it snag some of the billions of ad revenue currently dominated by Amazon.

The social media giant has also been experimenting with payments, with WhatsApp Pay being available in certain countries such as India. This allows people to send money between each other easily and to businesses.

This is essentially what major payment apps are all aiming to achieve and that has huge market potential for Facebook if the company can partially monetize the most downloaded app in the world.

And of course, Facebook’s latest focus on the Metaverse could become a substantial revenue and profit generator over the coming decade, if done right.

While there is plenty of hype surrounding the metaverse universe at present, it remains to be seen if Facebook can successfully pivot its existing advertising model to benefit from the rise of the virtual reality world in the coming decade. This is based on the premise that you “buy into” Zuckerberg’s premise that we are at the beginning of the next chapter of the internet in the first place.

We have gone through the major risks involved with Facebook as well as opportunities that might turn Facebook into the next trillion-dollar Google.

Let’s take a look at what is Facebook worth at present.

Facebook Metaverse: 6) Does the company’s current valuation warrant the risk?

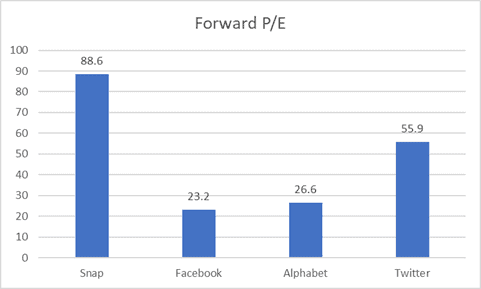

A way to look at Facebook’s valuation is to compare the company against some of its closest competitors that are highly dependent on ad revenue, such as Snap, Google, and Twitter.

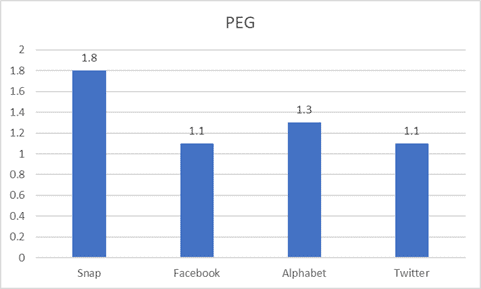

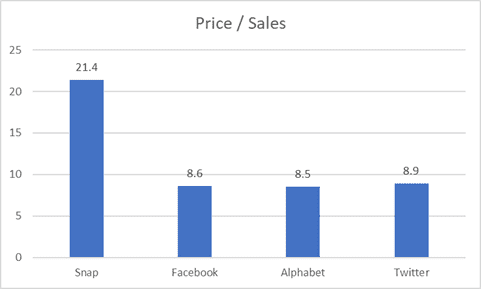

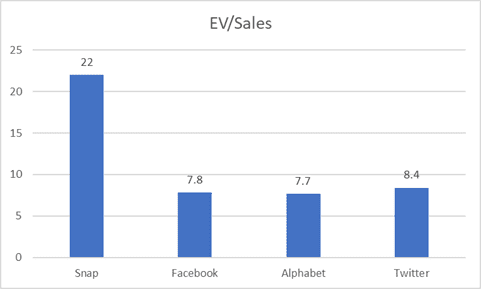

Let’s take a look at 3 different metrics: 1) Price/Earnings, PEG 2) Price/Sales, Enterprise Value/Sales and 3) Price/FCF. Data here is derived from Stock Rover.

Price/Earnings and PEG multiples

Facebook is currently the cheapest when it comes to evaluating the company based on a forward P/E multiple, with SNAP being the most expensive. We come to a similar conclusion when we used the PEG model which incorporates the forward growth potential of the companies into its P/E multiple.

Facebook’s 1.1x PEG multiple puts it on par with Twitter, the latter sporting a higher forward P/E ratio but that is “justified” based on its higher earnings growth potential.

Price/Sales and Enterprise Value/Sales

Many growth companies (without earnings) are often evaluated on a Price/Sales basis. Facebook’s P/S multiple of 8.6x is pretty comparable with Google and Twitter, with SNAP being the most expensive using this valuation metric.

Another way to evaluate a company based on sales is Enterprise Value/Sales, one where the company’s net debt structure is being accounted for. A company with a significant amount of net debt will translate into a higher enterprise value/sales multiple, making it more expensive vs. a company with lesser debt.

Again, both Facebook and Google trade at pretty similar EV/Sales multiples.

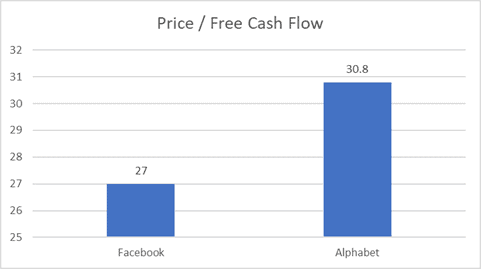

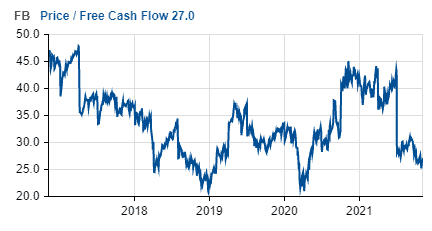

Price/FCF

Arguably, a better way to compare Facebook against its peers is to see how much it generates in terms of free cash flow vs. its market cap.

Given that SNAP and Twitter currently do not generate much free cash flow, a direct comparison would be with Google and in this arena, Facebook is slightly “cheaper” even though the differences might not be substantial.

Using Price/FCF as a basis, the company has an average 5-year historical Price/FCF multiple of 35x. If Facebook is to trade back to that average Price/FCF multiple, that will imply a fair value target of $433/share, a substantial upside from its current price level of $334/share.

So, all signs are pointing to the fact that on a valuation basis, Facebook is indeed a better buy, albeit just slightly compared to its closest peer, Google. The latter, however, is not facing the kind of negative publicity that Facebook is facing at the current moment.

What are the pros thinking about Facebook and what is the average fair value price they believe the counter is worth?

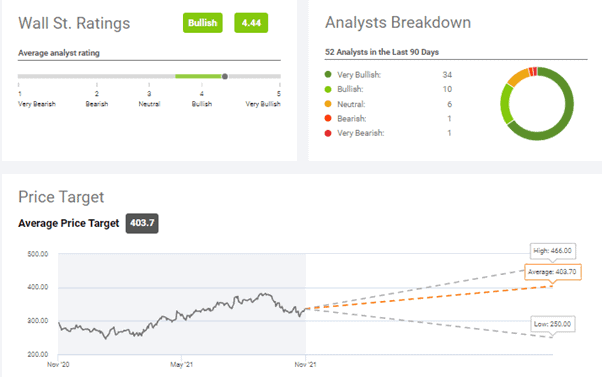

Facebook Metaverse: 7) Street is overwhelmingly positive on the counter

It is important to make your assessment of what a company is worth based on certain key financial metrics, such as those highlighted in the previous segment or based on valuation methods such as Discounted Cash Flow, etc

But it can also be helpful to see what other people think and this can be done easily by looking at the street’s estimate of Facebook.

Using Seeking Alpha’s estimate we can see that the street is pretty bullish on Facebook, with an average target price of US$404/share based on estimates from 52 analysts, representing an upside potential of >20% from its last traded price of $335/share.

Analysts from Morningstar believe that Facebook is worth $404/share, representing a 2022 EV/adjusted EBITDA multiple of 14x. The firm believes that Facebook’s revenue growth will be driven primarily by online advertising and increasing allocation of online ad dollars toward mobile, video and social network ads.

According to Morningstar, Facebook is a wide moat counter with a 4-star rating at present. Morningstar believes that Facebook has a solid network effect and intangible assets as economic moat sources. As users on Facebook and Instagram continue to grow, they expect advertisers will keep coming.

E-commerce, a business segment that Facebook intends to diversify into, could further drive top-line growth.

Conclusion

Facebook seems like a decent counter at present to dip your toes into based on its valuation vs. peers as well as looking at the street’s consensus. Do however take the street’s forecast with a grain of stock: analysts are incentivized to be optimists.

Nonetheless, you have seen in this article they might have good reasons to be positive. Based on its network effect moat source, Horizon (its metaverse project) should be a step ahead of competitors in attracting users and quickly building virtual environments, which should attract more users, content creators, businesses and ultimately advertisers and the cycle continues.

It is however not blue skies ahead for the company, with Facebook dogged with negative publicity/controversies that might hurt its business model in the long term.

Its ability to diversify its business model beyond just a social media platform depending on advertising revenue, something which Google has managed to do, is critical for the counter’s long-term success and its share price to continue appreciating over the coming decade.

I do think that Facebook is a counter worth considering at its current price. The company has demonstrated its ability to rebound from a crisis on multiple occasions and if it can sufficiently address some of the key risks factors highlighted in this article, this might become a $400/stock in 2022.

Do note that this is not a recommendation to buy or sell Facebook shares. Please do your due diligence when trading/investing in this counter.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- How much will $1,000 be worth if you invested in one of America’s best fast-food restaurants 10 years ago?

- Pricing Power: Stocks that can do well amid inflation concerns

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only