How to engage both Dollar Cost Averaging and Fractional Investing the easy way

Imagine you are gifted $18,000 to invest in 2007. You are given 2 strategies. The first strategy is to Lump Sum invest your $18,000 into the S&P 500 ETF (ticker: SPY) and the second strategy is to engage a Dollar Cost Average approach by investing $100 at the start of each month into the same ETF, over the next 15 years.

Which of these 2 strategies would you select to generate the largest portfolio value?

For readers who are familiar with these 2 strategies, and with the benefit of hindsight, one would have selected the Lump Sum approach to generate the greatest returns.

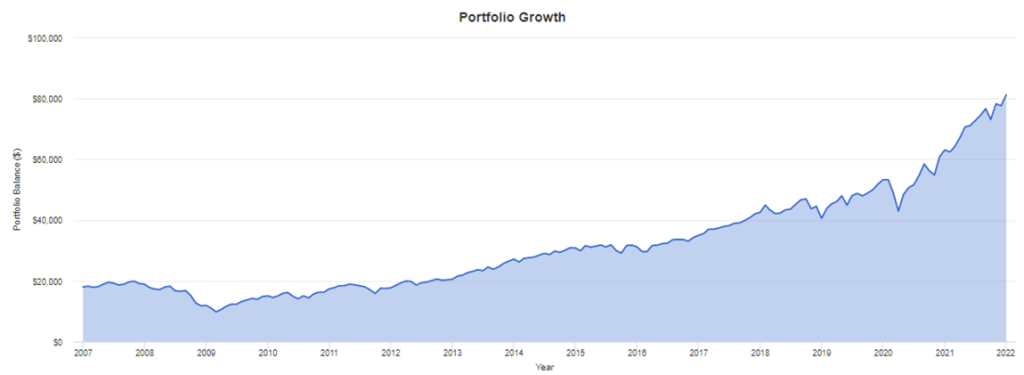

This is what your portfolio would look like at the end of 2021.

$18,000 invested in the SPY ETF would have a value of $81,257 at the end of 2021.

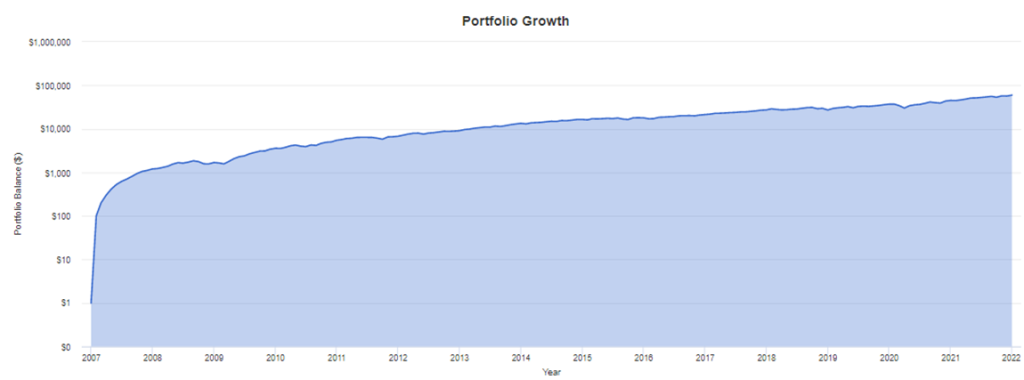

This is how much your portfolio would be worth if instead, you engage the Dollar Cost Average approach.

By investing $100/month at the start of 2007 for a total of 180 consecutive months (15 years), your portfolio would be worth slightly under $60k or $59,514 to be exact, according to data from portfoliovisualizer.

It seems like lump sum investing is “superior” over dollar cost average investing, but we are missing a few key points over here.

First, most people will not dare to risk $18,000 at the heights of what is now known as the Great Financial Crisis, or GFC for short. There is the fear that one could lose a significant portion of his/her capital if the drawdown continues.

Second, for someone just starting out in his/her investing journey, there might not be $18,000 just lying around. It would be so much easier to “get our feet wet” by investing $100/month vs. a lump sum amount of $18,000. Hence, with the benefit of hindsight, while we now know that a lump sum approach would have been a more profitable strategy, it is likely a dollar cost average approach that the majority will execute.

The Real “Power” of Dollar Cost Averaging

Dollar Cost Averaging aims to address the key issue of timing the market.

Psychologically still trying to time the market

Most of us know the importance of investing in the stock market, making our money work harder for us, and beating the effect of inflation. However, many are not doing so. Why? Some do not know how to invest, but more often than not, the main reason why many are not willing to partake in the market is that they are looking to find the BEST TIME to enter the market.

They believe that the best time is when the market is “cheap” or when it has fallen significantly from its peak level. The definition of “significant” here is up for interpretation. Nonetheless, for these folks, there will always be an excuse not to invest even after a significant correction because “the market has yet to bottom”.

Consequently, most people looking to time the market for the perfect entry often miss the subsequent rebound, just like what happened during the 2007-2009 GFC period.

On the other hand, some are afraid to invest because the “market has already run”. They fear that they are investing at the peak and by getting into the market now, they could suffer substantial capital losses.

This is where Dollar Cost Average comes into the picture. While we know that lump sum investing is better for us, in terms of portfolio returns, in the long run, it is engaging a DCA approach that seems more palatable to most.

By removing the psychological need to time a bottom, or the fear of investing at the peak, coupled with a manageable sum of contribution every month, an investor now gets to partake in the stock market with significantly fewer worries.

DCA Portfolio usually consists of passive ETFs

Most beginner investors who engage in a DCA approach will tend to follow a passive format by regularly investing in an index ETF like the SPY ETF which we highlighted earlier. The combination of diversification using the SPY ETF (one is investing indirectly into the Top 500 US companies through a single stock), coupled with a disciplined monthly contribution works well for most new investors.

However, for those looking to DCA into an individual counter, that’s where the problem arises.

Let’s take a look at an example. Assuming you have done your research on Tesla back in 2011 when it was a company still pretty much unheard of. You love the vision of Elon Musk and you decide to “stick with him” through thick and thin for the long run.

Instead of investing in the SPY ETF as most of your peers would have done, you invested $100/month regularly into TSLA from the start of 2011 til the end of 2021 (10 years to be exact)

Instead of $33,963 which is still a decent 2-bagger by investing passively in the SPY for over a decade, your portfolio will now be worth……. Wait for it……….

$679,616

Yes, I am not kidding you. A simple contribution of $100/month over 10 years (or $12,000 in total capital) would have translated into $679,616 in ending portfolio value!

But, the problem that comes with this idea is, that I can’t invest a fixed $100/month regularly into Tesla over 10 years.

TWO issues:

1) There is often no dollar cost average feature into individual stock, and

2) a fixed dollar cost average amount might translate to buying less than 1 share of a counter (ie 0.5 shares or what is now known as fractional investing), which most typical brokerages will not be able to provide this feature. Instead of a fixed amount (ie $100/month), most investors would have to select fixed share/s instead (ie 1 Tesla share/mth).

The issue with the latter approach is that when the price of the underlying starts to appreciate significantly, 1 share could translate to a significant dollar amount contribution each month. Before its recent share split, Tesla was trading at more than $1,200/share back in 2021. Instead of contributing $100/month, one will need to contribute $1,200 to purchase 1 share of Tesla.

That is until……

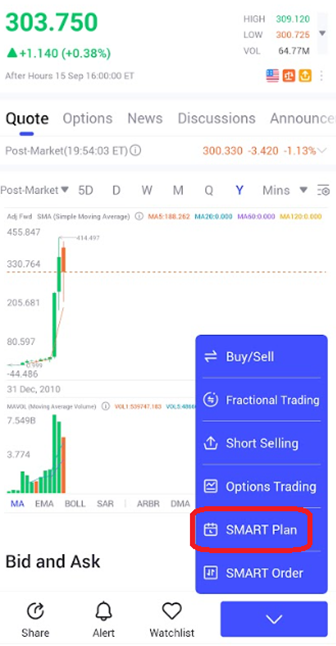

Yes, a picture says a thousand words but I’m still going to say it nonetheless – The uSMART Fractional Shares SMART plan!

uSMART combines its dollar cost averaging feature called SMART Plan with the concept of fractional investing (buying less than 1 share of stock) which makes investing in individual stock counters with a small capital each month now a breeze.

If you are just starting on your investing journey and wish to engage a simple 100% passive allocation into SPY or any other index ETFs, no problem at all.

On the other hand, if you are a more experienced investor and have done your numbers on a couple of counters that you would like to purchase slowly over the long run, that is now no longer a problem as well!

All you have to do is to set up the SMART plan and it will purchase based on your allocated budget. With fractional shares, you don’t have to worry about having to top up or calculate how many units to buy at all.

Let’s say we go back to the example where I have $100 per month to buy into Tesla.

With it trading at around $303.75 right now, I will be able to buy 0.33 shares of Tesla (fractional investing) with my capital of $100/month, instead of having to save up for 3 months before I can buy 1 single share of Tesla and potentially missing out on the gains in the 3 months while I am saving up.

Fantastic, isn’t it?

So, Is the SMART Plan difficult to set up? Not at all

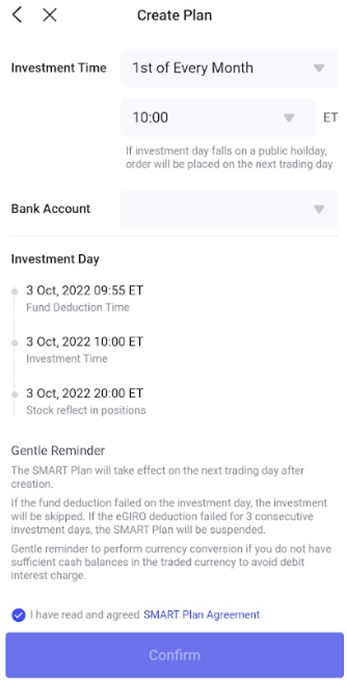

One thing that is great about setting up a Fractional Shares SMART plan is that I can do it on my phone while lying down on my bed in literally 4 simple steps.

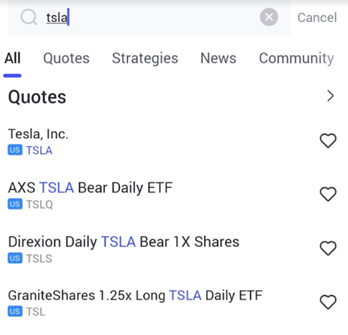

Step 1: Look for the counter that you are going to buy

Step 2: Select SMART Plan

Click on the Buy/Sell tab and you will be given the option to select Smart Plan

Step 3: Select your parameters and e-GIRO account and you are good to go!

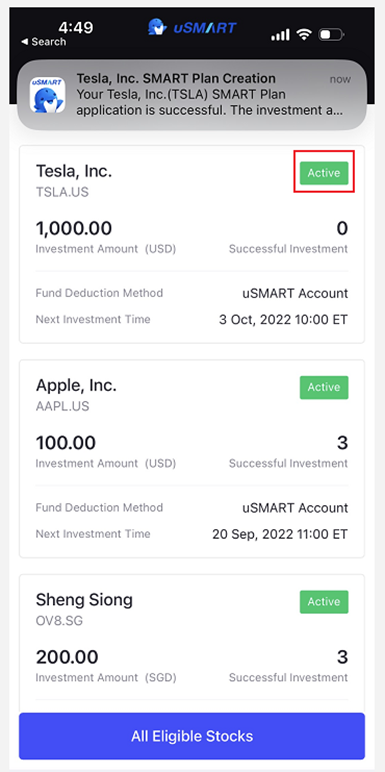

Step 4: Check that your status is “Active”

That is how easy it is to get started.

For more information on funding methods for Smart Plan, cancellation of Smart Plan, amendment of Smart Plan, etc, one can refer to the link below:

https://www.usmart.sg/faq?id=9

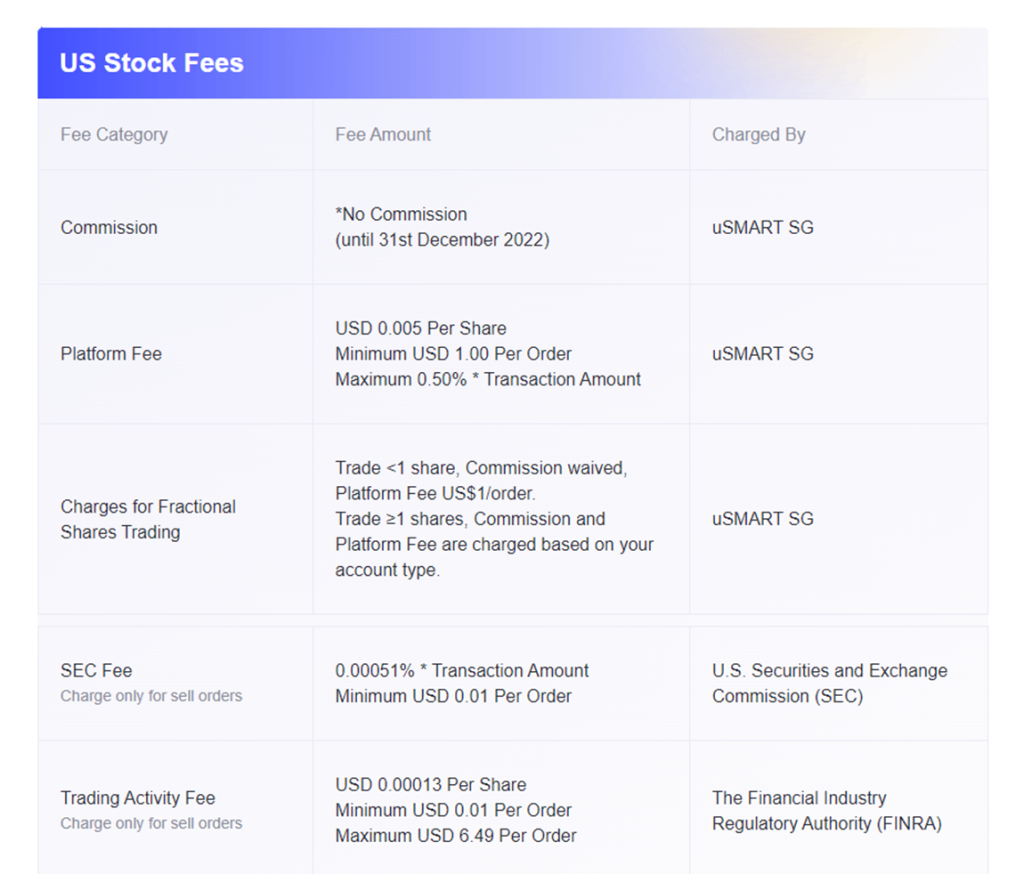

Cost for fractional investing using Smart Plan

Currently, there is no commission cost associated with fractional investing using Smart Plan if the number of shares is < 1. The only cost is likely the platform fee which amounts to US$1/order.

Conclusion

uSMART has significantly reduced the barrier of investing for beginners with the introduction of its Smart Plan alongside fractional investing.

By engaging a disciplined dollar cost averaging investing approach, a beginner investor will no longer need to “time the market” nor commit a “significant amount of capital” which can be a psychological barrier.

With just $100/month, a beginner investor can select to invest consistently in the “next Tesla” and “reap the significant rewards” 10-20 years down the road through this disciplined yet affordable investment approach.

[Update: From now till the end-2022, uSMART is having a promotion where there are $0 commission charges for all 3 of its markets. Users will just need to pay for the platform fees.]

P.S If you have found this article to be helpful, you can use my referral link to sign up. On top of you receiving the Welcome Package, I will be entitled to a $88 stock voucher.

Get started by signing up for a uSMART account today by clicking on the link below:

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats