Investor Education Series: Network Effect

What exactly is a network effect and why does a company which possesses a network effect, thought to be the most powerful form of an economic moat, has a greater potential to become a multi-bagger play? Which are the companies with network effect that you ought to know?

The term economic moat was popularized by Warren Buffett. It is essentially a company whose business model can sustainably maintain a competitive edge over its peers for a long period. A moat is essentially a structural and sustainable competitive advantage that can drive long-term earnings and market share, which in turn translates to higher share prices.

Types of economic moats

According to Morningstar, these are some of the attributes that can give companies economic moats:

Network Effect. The network effect occurs when the value of a company’s service increases for both new and existing users as more people use the service. For example, millions of buyers and sellers on eBay give the company an advantage over other online marketplaces. The more sellers there are on eBay, the more likely buyers are to find what they’re looking for at a decent price. The more buyers there are, the easier it is to sell things.

Intangible Assets. Patents, brands, regulatory licenses, and other intangible assets can prevent competitors from duplicating a company’s products, or allow the company to charge a significant price premium. For example, patents protect the excess returns of pharmaceutical manufacturers such as Novartis NVS. However, do note that when patents expire, generic competition can quickly push the prices of drugs down 80% or more.

Cost Advantage. Firms with a structural cost advantage can either undercut competitors on price while earning similar margins, or they can charge market-level prices while earning relatively high margins. For example, Express Scripts controls such a large percentage of U.S. pharmaceutical spending that it can negotiate favorable terms with suppliers like drug manufacturers and retail pharmacies.

Switching Costs. When it would be too expensive or troublesome to stop using a company’s products, the company often has pricing power. Architects, engineers, and designers spend entire careers mastering Autodesk’s ADSK software packages, creating very high switching costs.

Efficient Scale. When a niche market is effectively served by one or a small handful of companies, an efficient scale may be present. For example, midstream energy companies such as Enterprise Products Partners enjoy a natural geographic monopoly. It would be too expensive to build a second set of pipes to serve the same routes; if a competitor tried this, it would cause returns for all participants to fall well below the cost of capital.

Network Effect: The most powerful economic moat

Based on their compounding nature, network effects are often recognized as the most powerful economic moat. Network effects are present for many businesses of the digital economy. Social media or e-commerce platforms for example are often recognized as businesses greatly benefiting from such moats.

However, not all network effects are born equal. They can take different “shapes and sizes”. Within the digital economy, there can be 4 different types of network effects which I will like to discuss more in today’s article.

Network Effects of the Digital Economy

As mentioned, there are 4 different types of network effects of the digital economy, and every one of them is a powerful economic moat that will allow businesses that possess these moats to enjoy a strong and sustainable competitive advantage over their peers.

The 4 network effects are 1. Direct, 2. Market Place, 3. Platform, and 4. Data

Direct network effects

Direct network effects are products or services that get better in terms of user or product experience as more people around you start using them. You immediately benefit from an increase in usage from other members.

Social media platforms and messaging apps are the core of this category. They serve different purposes but end up benefiting from the very same moat. More users attract even more users because of the personal nature of these platforms. Each user has an interest in seeing more people join to derive more value for themselves.

Personal social network: Facebook and Instagram are the two most popular entities that exemplify the power of network effect as more and more people use their platform. More people will want to join their platform to enjoy access to more information from a bigger user base. They are proof that there is virtually no ceiling for the platforms that reach a critical mass and know how to continually engage their users. However, this spills out new risks over data privacy.

Professional social network: LinkedIn is a good example of a professional social network that allows one to interact and engage with other professionals which could aid in one’s professional and career development. Slack is another enterprise solution focused on collaborative work. According to Slack, among its paid customers, users spend more than 9 hours per working day connected to their service, including spending about 90 minutes per working day actively using Slack.

As their network gets increasingly entrenched with employees, users who move from one company to another become ambassadors of the service and thus bring more people into the Slack community.

Discovery: Pinterest is a great example of a platform that benefits from direct network effect due to the discovery effect. If you have ever planned a wedding, baked a cake, or undertaken an ambitious DIY project, Pinterest is likely one of the first places you have looked to for inspiration. When inspiration browsing online, most consumers don’t know what they’re looking for until they see it, or they don’t have the words to describe it via a traditional search.

Enter in Pinterest. A visual tool that can help people who may not have the right words to describe what they’re looking for, but they may know it when they see it. Again, the more users on the platform, the more inspirational ideas can be created which will benefit all users on the platform.

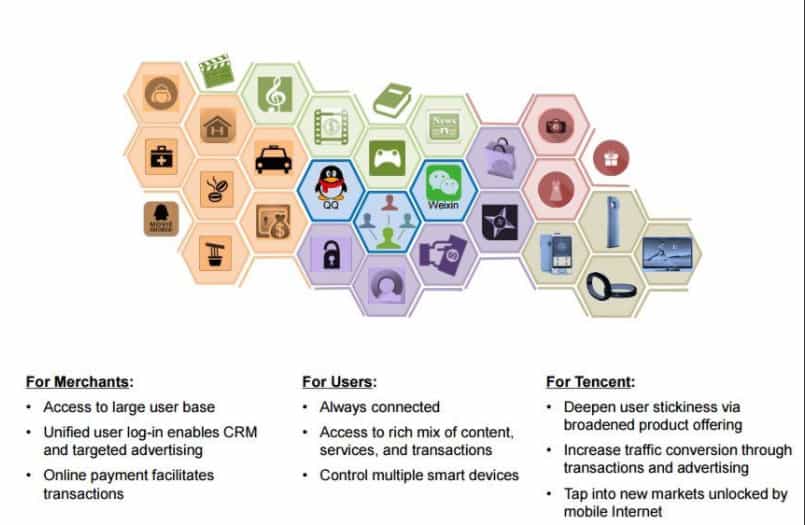

Messaging: Some of the most successful businesses of the 21st century have been focused on the most basic aspect of online interaction: messaging. Whatsapp, owned by Facebook, is the most well-known messaging platform today, used by billions around the world. Within the Chinese speaking community, Tencent’s WeChat platform has become part of much larger ecosystems that tend to be at the top of the food chain today. It is not solely a messaging tool, but a purchasing tool, an entertainment tool, etc.

Platforms benefiting from direct network effect have some of the strongest network effects of all. They tend to be able to engage the masses (instead of a niche pool of people) and thus have the greatest ability to scale. They are often intertwined with our personal lives which makes it all the more difficult for us to “abandon” them.

Marketplace network effect

More and more people today are accustomed to purchasing online vs. 1 decade ago. COVID-19 has driven the value proposition of the marketplace. How else do you purchase products when you are “stuck” at home? Consumers who previously have been less inclined of doing their purchasing online are now forced to do so due to COVID and are loving the convenience of such a purchasing option, thus turning them into long-term converts.

Marketplace network effects come into play when a company derives its business from bringing together demand and supply between customers and suppliers.

Horizontal: A horizontal marketplace can be described as more of an “All-in-one” online medium to purchase all your different products. It is a congregation of different suppliers providing a wide variety of products and services to consumers. Amazon is the clear market leader in this field. Its ability to attract more and more people to use its platform thus encourage more and more suppliers to provide their services/products on its platform and thus achieving that ultimate network effect. Other examples are Alibaba as well as JD.com which are popular marketplace serving the massive Chinese community.

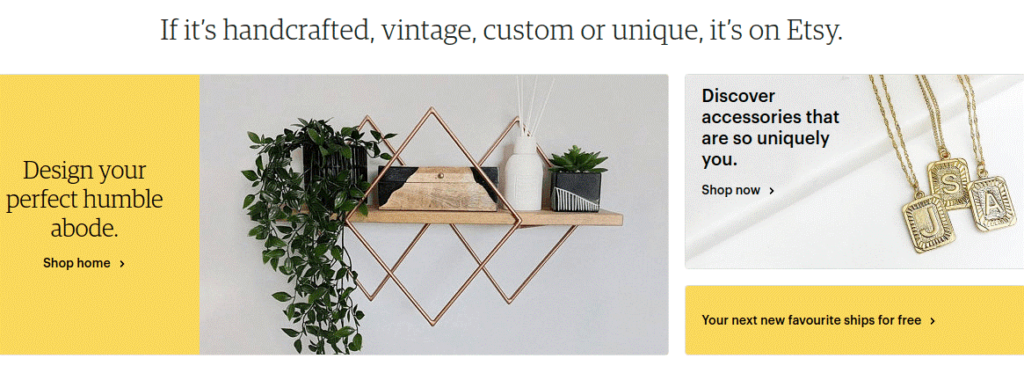

Vertical: A vertical marketplace is more niche. Etsy is one rich example that follows the vertical marketplace concept of the eCommerce business model. This Brooklyn-based online artisanal marketplace typically focusses on art & crafts to sell. Thus, it now becomes one of the leading marketplaces for handcrafts & vintage items.

Undoubtedly, vertical marketplaces have to focus on a specific market, you will have a small customer base that may limit the potential customers who are interested in your brand. So, if you are sure that the market you choose has much scope of its growth in the future, you can go for it.

Payments: Card payments are a textbook example of a network effect. Visa and Mastercard are undoubtedly the market leaders in this arena. More people owning their credit cards will thus encourage more merchants to have a payment system that allows the usage of these credit cards. Beyond visa and MasterCard, Paypal and Square are the two payment marketplace that could see tremendous growth with the proliferation of online payment. Paypal in particular focuses on online transactions and has seen rapid growth in users due to COVID.

Platform network effects

Platform network effects occur when a company can keep a user engaged in its product ecosystem. Products and software are increasingly seen as a commodity. The real value is in creating an entire ecosystem revolving around that product or software.

Content: When you want to find information. What is the first thing you do? You Google for articles that provide you with that information. When you want to learn about “how to …..”, where do you go to watch educational videos? Youtube. Platforms that enabled content creators to build an audience effectively can truly shine.

Video has been the strongest medium to acquire, retain, and monetize users. Once a platform has the most engaged audience, influencers come in droves and the virtuous cycle kicks in. Here again, first movers have a tremendous advantage. In this category, YouTube (online video) and Twitch (live streaming) are absolute winners. They are owned by Google and Amazon, respectively.

Enterprise: No one is bigger than Salesforce when it comes to the Enterprise SaaS category, the pioneer who has build a true partner ecosystem for all enterprises. Salesforce has created a platform where developers can build custom applications on top of it and created a central community where users can build and sell their apps. A growing portfolio of partners with many products available on the platform gives the company a strong edge over its competition.

Operating System: The operating systems that have the most users will tend to attract more developers. Beyond the traditional windows operating system where Windows 10 (owned by Microsoft) is the most popular operating system for desktop and laptop while iOS (Apple) is the most popular tablet operating system, those that power gaming consoles are the ones to watch in the coming decade.

In this aspect, Sony Playstation and Microsoft Xbox are great examples of operating systems that thrive as more users join. This will attract more studio developers to create games for the platforms.

Developer ecosystem: As more companies embrace the PaaS model (Platform as a Service), another fundamental network effect comes into play. One that revolves around developers alone. A perfect example is the communication platform Twilio (TWLO).

Developer ecosystems can exhibit similar characteristics as social networks. As more developers become active users and contributors, the platform becomes more valuable. Many developers are building tools on top of the Twilio platform, building new functional use-cases. However, in terms of mass-market adoption, not everyone can become a developer and thus the pool of users will undoubtedly be smaller vs. social networks.

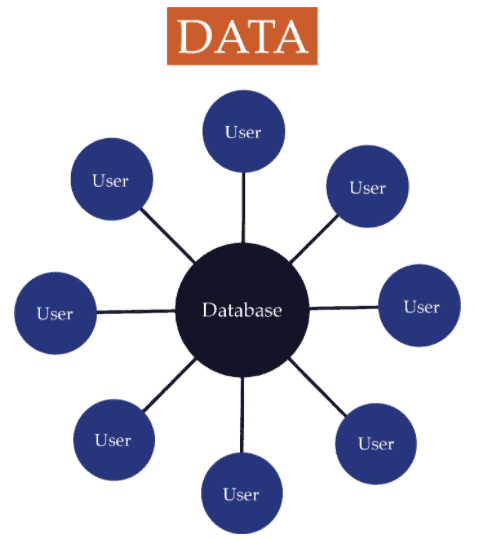

Data network effects

Data network effects occur when a business is gaining a structural advantage by gather user data. When more people use the service, more data can be collated and this will ultimately help to structure products and services that are smarter and more user-friendly.

Big Data: No one is better than Google when it comes to collating big data. As the company gets better and better at using big data, they present the most relevant data to users looking to find an answer to their query. That enhances the user experience and in turn, increases the stickiness of users staying on their platform. That creates a virtuous cycle once again. Also, more agencies are willing to advertise with Google due to their massive user base. With a larger network of advertisers, Google can offer sponsored links with a high degree of relevancy.

APIs: APIs or application programming interface is essentially a connection point. An API specifies how software components should interact with one another. Many SaaS companies offer a set of APIs as part of their solutions to avoid the need to build it from scratch. Think of them as a workshop that has thousands of tools tailor-made for your exact needs. Stripe’s API for example has enabled its payment system to be used on every marketplace within an hour.

AI: AI products tend to inherently exhibit data network effects. Netflix, Spotify, and Amazon all rely on recommendation systems integrated into their user interfaces to recommend new products to their customers. Spotify’s “Discover” weekly playlists are arguably one of the main reasons for its success over marginally different competitors.

Meanwhile, Amazon makes 35% of its annual revenue from recommended products, and 75% of what Netflix users watch is a result of recommendation-driven suggestions, according to McKinsey. It will be interesting to watch the adoption of AI/ML by larger organizations — companies that have a huge corpus of data available to them. This could be a value-add in leveraging successful data network effects compared to startups or smaller organizations.

Personal Data: Beyond the Enterprise world, data network effects can also appear at the personal level. Look at a company like Peloton, collecting the data on the performance of more than 3 million subscribers. The more data they collect about you and other subscribers you may be competing with, the more likely they are to retain you in their ecosystem.

The same could be said of a platform like Pinterest that improves its use-case every time you “pin” something new. Similarly, services like Spotify let you follow other members, create playlists, and save songs you like for later.

After several years of usage, the trove of data built-in can become increasingly valuable for a subscriber. Even a commoditized service can benefit from a data network effect with the right ingredients implemented. However, the key risk is whether such a product/service offering can be replicated by a larger company easily. For example, Spotify’s services might be at risk from bundling efforts by Apple when they provide Apple Music or Amazon when they provide Amazon music. This will discourage many to sign up for a Spotify premium account.

Conclusion

Finding companies with network effect is one of the quintessential “secret sauce” for long term investing success. These companies might seem “expensive” based on traditional valuation criteria and are often shunned by value investors. Take a look at Amazon and Netflix. These are not your typical value stocks, not a decade ago, and not now.

However, note that in today’s dynamic world of rapid technological evolution, having the presence of a network effect might not be a lasting trait in a company. Hence, one will need to continue evaluating the “network moat” present in companies and how they can remain one or multiple steps ahead of the competition by “evolving” their competitive edge.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Value Investing using options: Why value investors should also be option traders

- What is ROE? Which S&P500 stocks have strong ROE ratios?

- Thematic ETFs partaking in the hottest trends

- Best performing ETFs which consistently outperform the S&P500 over the past decade

- Too late to buy Gold? How to play it with Options for >100% annualized ROI

- Philip Morris: How to put its 6% yield on steroids

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Finding great companies with network effect”