22 Cheapest Stocks to buy

With the current market at its all-time high, stocks with high valuations are not hard to find. However, there are still stocks that seem like a bargain in today’s context. Even in the “pricey” technology sector which is currently trading at a forward multiple of c.27x relative to its 4-years median multiple of 18.3x, there are still pockets of opportunities to pick up some bargains.

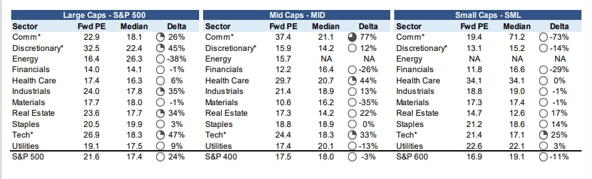

Which are the cheapest stocks to buy now? In this article, we will be highlighting the valuation of the various sectors of the US stock market based on forward Price-Earnings Ratio (PER) data from Morgan Stanley and thereafter, highlighting the 22 stocks (2 from each of the 11 sectors) from the S&P500 which are the cheapest stocks to buy in their respective sectors.

Valuation of the US stock market by sectors

As can be seen from the table above, valuations are not cheap at the moment, with most of the 11 major sectors of the US market trading at a premium (in terms of forward PER ratio) relative to their 4-years historical median multiple.

Of the large-cap (S&P 500 counters), the sector with the largest premium relative to its historical median ratio is, unsurprisingly, the Tech sector at a premium of 47%, followed closely by the Consumer Discretionary sector at a premium of 45% and the Real Estate sector rounding up the Top 3 highest valuation sector, at a premium of 35%.

The cheapest sectors remain the Energy sector which is trading at a 38% discount in terms of forward PER multiple. Both the Financials and Materials sectors are currently trading at a marginal discount of 1% relative to its historical median PER ratio.

Turning to the mid-caps market, the communication sector is currently the most pricey, followed by Health care and Tech while Financials, Materials, and Utilities remain relatively inexpensive.

Lastly, on the small-caps, the scenario looks drastically different with several sectors still looking “cheap”, with the communication sector current forward PER multiple at a hefty 73% discount relative to its 4-year historical median PER ratio.

Financials and Discretionary looks cheap as well for the small-cap plays, the latter a drastic difference vs. its large and mid-cap counterparts where the discretionary sector is currently trading at a premium for the larger cap names.

We will look to find some of these small caps value gems in a subsequent article. I hope that I have provided a quick and nice summary of the overall valuation status of the US market based on sectors.

With that, let us check out the 22 cheapest stocks to buy in each of these sectors of the S&P 500.

Cheapest stocks to buy in the S&P 500 (based on sectors)

Communication

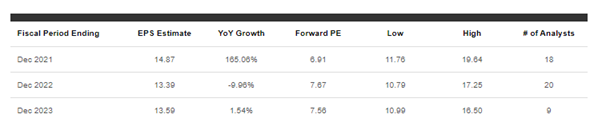

Within the communication sector, the 2 large-cap stocks that are the cheapest currently are AT&T (T) as well as Discovery (DISCA). While the current sector multiple is at 22.9x, both T and DISCA are trading at just 9.4x and 9.5x forward 2022E PER respectively.

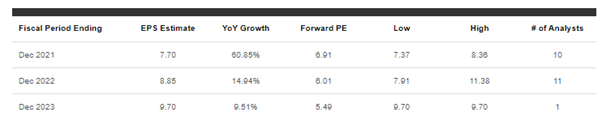

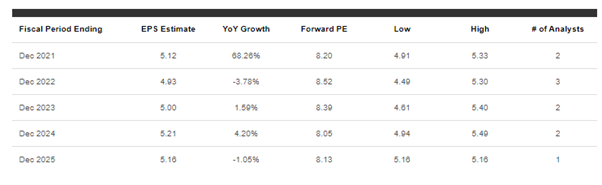

As can be seen from the EPS estimate done by the street, most expect T to see lower earnings for 2021-2023, only recovering from 2024 onwards which is based on a lower number of analysts’ estimates.

The same is expected for DISCA with an expected 12% YoY decline in its earnings in 2021, but followed by a swift recovery in 2022.

DISCA looks like the cheaper stock of the 2 based on the expected recovery in its earnings profile in 2022.

Discretionary

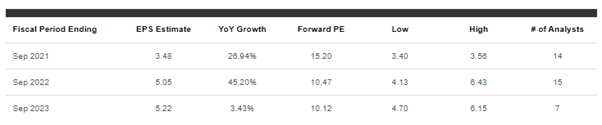

The Discretionary sector is currently one of the most-pricey sectors in the S&P 500 in terms of current forward PER multiple vs. its 4-year median ratio. The 2 cheapest stocks to buy in this category are PulteGroup (PHM) and Lennar (LEN) which are currently trading at just 6.2x and 7.4x forward PER multiple respectively when the sector PER ratio is at 33x.

For those who are not familiar with PulteGroup, they are homebuilders in the US, and with the boom in US housing, they are looking cheap at present.

The street is looking at a 61% growth in EPS for PHM in 2021, moderating to a still robust 15% YoY EPS growth in 2022.

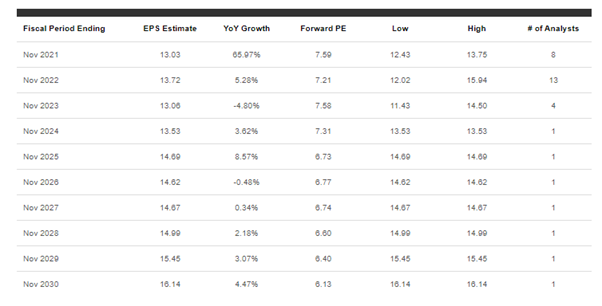

The same story can be seen for LEN, with growth rates of 66% in FY2021 but a more moderate growth of 5% in FY2022.

Homebuilders are a cheaper way to play the strong rise in house prices seen in the US, many of which have seen its share prices lagged the overall rise in home prices since 2013. For those who are not comfortable buying into individual stock counters, one can invest into an ETF such as ITB to buy into a basket of homebuilder stocks to diversify out your risk.

Energy

Energy has been a huge laggard in 2020 as a result of COVID-19 but is playing strong catch-up in 2021 as the global energy demands recover from the devastating effect of this global pandemic. The worst is not yet over but we are seeing light at the end of the tunnel at present. The cheapest stocks to buy in this sector are Diamondback Energy and Devon Energy, both trading at a forward PER multiple of 7.6x and 8.8x respectively, relative to the sector forward PER of 16x, which in itself is a huge discount to its 4-year median multiple of c.26x.

Diamondback Energy (FANG) and Devon (DVN) are both upstream companies that are focus on exploring and drilling for oil predominantly in the US. With the steady rise in US oil prices, their earnings are expected to witness a substantial rebound in 2021.

Energy is one sector that will also benefit from the rise in inflationary pressure, being the dominant commodity asset class to benefit if inflation takes shape.

One other key reason why the street is generally positive on energy stocks such as FANG and DVN is that they have been a lot more disciplined in terms of Capex spending, choosing to return excess cash to shareholders in terms of dividend payments as well as more aggressively pare down their debt levels as compared to spending on Capex, which is what led to the demise of many small-mid US oil drillers over the last 4-5 years where they “leverage up” to chase production.

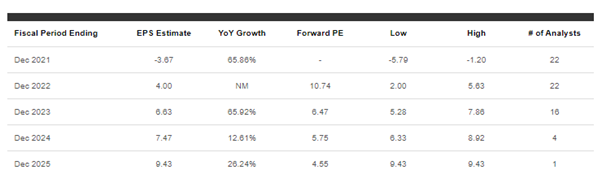

For FANG, the street is expecting a 184% YoY EPS growth in 2021 followed by a still robust 36% EPS growth in 2022, translating to a forward 2022 PER multiple of just around 7.6x

Similarly, for DVN, EPS is expected to turn hugely positive in 2021 vs. losses in 2020 and continue to grow by 33% in 2022, translating to a forward PER multiple of just 8.8x.

Both stocks could see the rally in their share prices continue if oil prices continue their upward trajectory.

Financials

Another popular sector in 2021 has been the Financials sector where bank stocks have staged a huge rebound in 2021 and one of the most preferred sectors to play amid rising interest rate expectations. The cheapest stocks to buy in this sector are Unum Group (UNM) and Lincoln National (LNC), both large-cap names with a market cap of $5.7bn and $11.2bn respectively, but names that most investors are probably unfamiliar with.

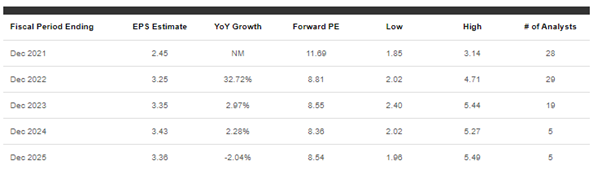

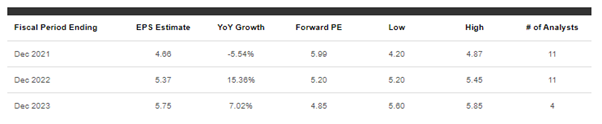

UNM I trading at a forward PER multiple of just 5.2x according to the street estimate, where a 5.5% EPS decline in 2021 will be swiftly followed up by a 15% growth in 2022.

This counter is also currently yielding 4% which makes it an interesting yield play as well. The counter has significantly outperformed the S&P500 on a YTD basis and that trend could well continue if value counters remain the flavor of the year.

LNC is showing stronger EPS growth potential in both 2021 and 2022, rising by 109% this year followed by 17% in 2022. The counter is trading at a forward 2022 PER multiple of just 5.7x which is cheap compared to its historical average PER multiple of 10x and the sector’s average of 14x currently.

HealthCare

Often seen as a rather resilient sector, the healthcare sector currently sports a PER multiple of 17.4x which is a slight premium to its 4-year median multiple of 16.3x. The 2 cheapest stocks to buy in the healthcare sector are Viatris (VTRS) and Organon (OGN), both trading at a paltry forward PER multiple of just 3.9x and 5x respectively, according to the street’s 2022 earnings forecast.

VTRS is a $17bn market cap stock that develops, licenses, manufactures, markets, and distributes brand and generic drugs worldwide. This is not a growth company with a declining EPS profile which is expected to drop further in 2021 and recovering marginally in 2022. In a sense, while the stock is cheap in terms of forward PER, that “cheapness” could continue if this stock becomes a value trap.

OGN is a $7.6bn market cap stock focusing on the women’s health market that was recently listed from a spin-off from Merck & Co and is lightly covered by the street with only 2 analysts giving a forecast for 2021 and 5 analysts in 2022. Growth is expected to be weak at best which explains why this healthcare stock is also trading at such a low forward multiple of just 5x 2022 PER.

Industrials

The Industrial sector has recovered strongly in 2021 and is currently trading at a forward PER multiple of 24x vs. the median PER of 17.8x, a significant premium. The 2 cheapest stocks to buy in this sector are Delta Airlines (DAL) and Alaska Air Group (ALK), both aviation counters that have been battered in 2020 but expected to recover strongly in 2021 and beyond.

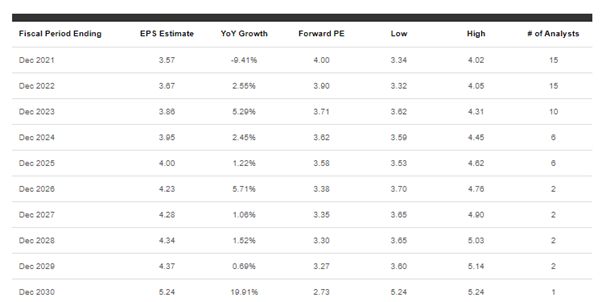

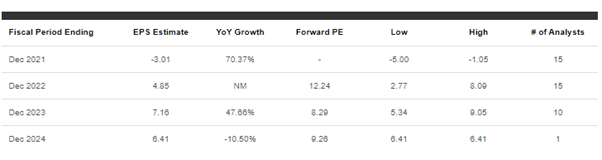

For Delta Airlines, while its 2021 EPS are still expected to be negative, losses have declined substantially from 2020 levels and the street is forecasting EPS to grow to positive $4/share in 2022, translating to a forward 2022 PER of 10.7x. That is followed by equally robust growth expectations in 2023 and beyond.

The other cheap counter to buy in this sector is another airline, Alaska Air group where the counter is expected to trade at a forward 2022 PER multiple of 12x as a result of a strong rebound in EPS.

Airlines are a group that has a lot more uncertainty, in my opinion, in terms of assessing its “cheapness” based on the forward PER ratio as the COVID-19 situation is very fluid and the Delta variant could result in another massive spike in COVID-19 infection in the US.

Materials

The material sector is currently trading pretty much in line with its 4-year median PER ratio and is probably an attractive sector to look at in-lieu of inflationary pressures. The 2 cheapest stocks to buy in this sector are LyondellBasell Industries (LYB) and West Rock (WRK), both trading at a 7.7x and 10.5x 2022 PER respectively. A special mention is Freeport McMoran (FCX) which is the 3rd and a better-known stock, trading at a forward 2022 PER multiple of 10.6x.

Material stocks tend to be highly cyclical and their EPS performances highly dependent on certain commodity prices. For LYB, its EPS has been on a decline since 2018 and is expected to rebound in 2021 due largely to a strong rebound in its revenue vs. 2020 which was significantly impacted by COVID-19.

WRK’s sales, which is focused on selling paper and packaging solutions, have not been as significantly impacted by COVID-19 vs. LYB. The street is expecting a robust rebound in EPS for 2021, growing 27% followed by a stronger 45% growth in 2022.

While both LYB and WRK look attractive on a forward PER basis, my preferred play in this sector is FCX which is one of the largest copper miners in the world and an indirect way to play the rise in copper demand and consequently its prices over the next decade.

Real Estate

Real Estate is also one of the most expensive sectors at the moment, trading at a forward PER multiple of 23.6x vs. its 4-year median multiple of 17.7x, a 34% premium. Nonetheless, there are still some cheap counters available in this sector, with the 2 cheapest stocks to buy in this sector being Simon Property Group (SPG) and Weyerhauser (WY).

We look to evaluate counters in this sector by funds from operations or FFO for short instead of the standard EPS. Real estate stocks currently trade at close to 24x P/FFO whereas both SPG and WY trades at a forward P/FFO multiple of 12.6x and 12.9x respectively.

SPG is one of the largest mall operators in the US and has been badly hit by COVID-19 but its share price has since rebounded strongly and despite concerns that the company will be going under at the height of the pandemic, REIT continues to generate relatively robust earnings and expectations are for that earnings to continue climbing steadily in the coming years.

WY is one of the world’s largest private owners of timberlands and is an indirect play on lumber prices which have been extremely volatile of late. WY’s share price has been relatively more resilient and probably a safer way to play the long-term uptrend in lumber prices if you are a believer in that commodity.

Staples

The cheapest stocks to buy in this sector are Walgreen Boots Alliance (WBA) and Altria Group (MO). Both stocks have seen relatively strong YTD performances, with WBA up 21.5% YTD while MO is up 15.6%.

Trading at a forward 2022 PER multiple of just 9.3x, WBA is the cheapest stock among all the consumer staples companies. However, the company is often seen as a value trap and before its strong price rebound in 2021, its share price has been a huge laggard over the past 5-years.

EPS growth is expected till 2023 based on the majority of analysts’ forecasts and the counter remains very cheap on that basis and should see relatively strong price support at the $40/share level.

MO EPS growth has been more stable than my expectations, with EPS growing from $3.99 in 2018 to $4.36 in 2020 and the street is expecting that growth momentum to continue into 2023.

My favorite tobacco play is PM but PM is trading at a much higher forward PER multiple of 14.9x vs. MO’s 9.9x.

Tech

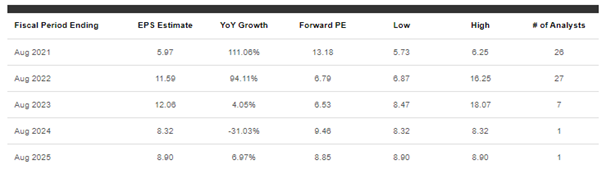

The tech sector is undoubtedly one of the most expensive sectors to be in at present, trading at an average forward PER multiple of 26.9x vs. its 4-year median multiple of 18.3x. Nonetheless, there are still some cheap stocks to be found and the 2 cheapest stocks to buy in this sector are none other than Micon Technology (MU) and Hewlett Packard Enterprise (HPE)

MU is expected to witness a 111% EPS growth in 2021 and that EPS is expected to continue growing by 94% in 2022 to hit $11.59/share, translating to 2022 PER multiple of just 6.8x. I believe the current chip shortage environment has a large part to play pertaining to its strong EPS growth potential over the coming 2 years.

The good times are not expected to last with analysts forecasting its EPS growth to drop drastically in 2023 but with the advent of 5G, it is still too early to predict if MU’s EPS is going to be as cyclical as what some expect it to be.

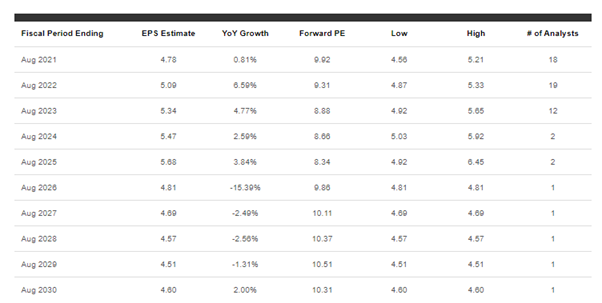

HPE is less cyclical than MU and its EPS is expected to grow more steadily over the next 2-3 years, with 2022 EPS hitting $1.96. At its current price, that translates to a forward 2022 PER multiple of just 7.5x. HPE remains one of those value stocks that has stayed cheap for a very long time, with its 5-years share performance at -23%.

The company lacks the rapid sales growth and wide profit margins that many of the tech sector’s Software-as-a-service (SaaS) leaders boast. The company will need to prove that it can continue to maintain its revenue and EPS growth trend to justify a higher valuation multiple.

Utilities

The last sector is the utilities sector, currently trading at a forward multiple of 19.1x vs. its 4-year median multiple of 17.5x. The cheapest stocks to buy in this sector are NRG Energy (NRG) and Edison International (EIX).

NRG is currently trading at a forward 2022 PER multiple of 8.5x. This is a stock that is very lightly covered by the street. Nonetheless, it has been a very steady performer, generating a return of 178.5% over the past 5 years and also yielding 3.1% at present.

EIX has been a much weaker performer vs. NRG, with its 5-years price performance at -25.4%. Surprisingly, this stock is covered by more than 20 analysts on the street, with most expecting the counter to generate a steady rise in its EPS over the coming years.

Based on an estimate of 2022 EPS at $4.73, the counter is trading at a forward PER multiple of 12.3x.

Conclusion

The US stock market is not cheap when valued on a forward PER basis for the large-cap counters. However, there are still value gems that can be found among the rough as can be seen from this list of 22 cheapest stocks to buy based on their respective sectors.

However, buying into these cheap stocks might result in falling into the “value-trap” dilemma where these stocks which appear to be cheap, remain very cheap for a prolonged period.

My preferred way to play these names is to sell a Put Option on the counter and collect premiums along the way.

Among this list of 22 stocks, there are just a couple of names that I have my eyes on from a trading angle. First up is NRG Energy which could be looking to test its all-time high level of $43.65/share and the counter currently has a positive BUY signal from the TGPS platform, a trading platform that identifies stock to purchase in the early stage of a trend.

The second stock that is on my trading watchlist is LEN, which is still a distance away from its all-time high level of $110.3/share but also has a positive BUY signal from the TGPS platform.

Once again, I hope that this article has been informative to readers of NAOF in terms of finding the cheapest stocks to buy in the individual sectors.

I might look to follow up on this article with some of the cheapest names one can find in the small-cap arena, particularly in the communication sector which is trading at the largest discount in terms of forward PER potential relative to its 4-year median multiple.

What I will like to find are small-cap stocks that are still trading under the radar, those whose EPS growth is highly sustainable in the coming years, so stay tuned for that.

The Systematic Trader

The Systematic Trader is an easy to use trading platform that highlights when is the RIGHT time to be buying the RIGHT stock

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only