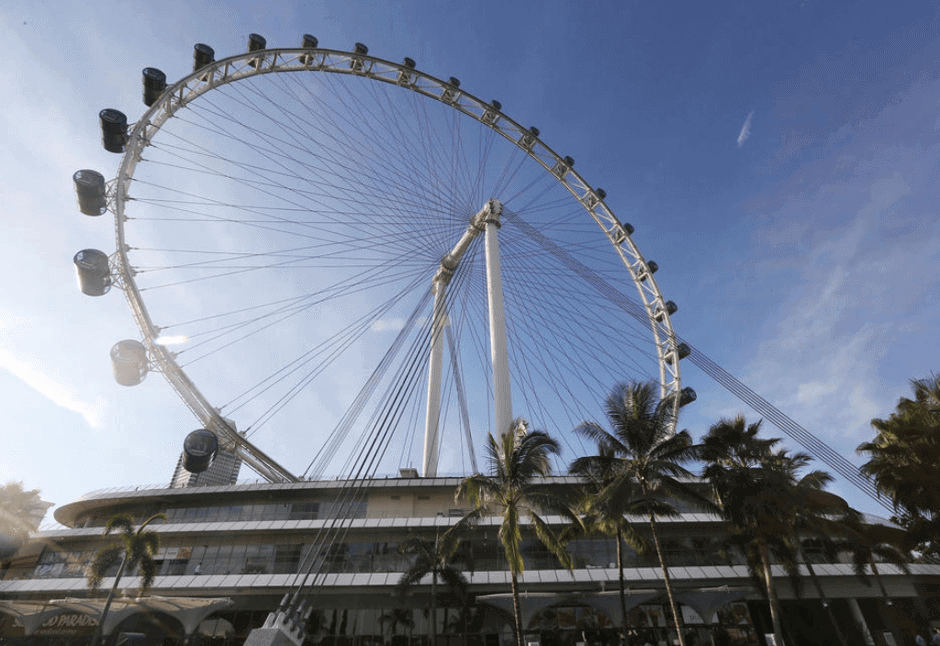

Straco: Perfect storm hits. What to do next?

Straco had just been hit by the perfect storm that will almost certainly impact its upcoming 4Q19 results as well as 1Q20 results. Flyer suspension The bad news started streaming in back in late-Nov 2019 when a spokesperson for the Singapore Flyer said in a media statement on 26 Nov 2019 that the Singapore Flyer