Best Sector Stocks in 2021

2021 has been the year where investors have been introduced to unique investment themes, notably special-purpose acquisition companies or SPACs for short and Cryptocurrencies, being the two key investment asset classes that have garnered the most attention, particularly at the beginning of 2021.

Both SPACs and Cryptos have since lost some steam (and interest) with their prices correcting substantially from their peak in 1Q21.

It is alright in my opinion to have a small portion of one’s portfolio being allocated to such “high-risk, high returns” investment assets but ideally, an investor should build a diversified portfolio with exposure across a wide variety of sectors.

While there will always be the next fad and hot trade, it is important to hold a core portfolio of stocks that can withstand all sorts of economic conditions. Typically, one can divide up the market into 11 key sectors. They are 1) Communication Services, 2) Consumer Discretionary, 3) Consumer Staples, 4) Energy, 5) Financials, 6) Health Care, 7) Industrials, 8) Information Tech, 9) Materials, 10) Real Estate, and lastly 11) Utilities.

Which are some of the best stocks to buy in each of these sectors? We look to screen for these blue-chip stocks (in the S&P 500) using the Stock Rover screener where these stocks are ranked in the Top 2 Decile (out of 10) of their respective sectors based on the following criteria: 1) Profitability, 2) Growth, 3) Quality and 4) Sentiment.

Profitability: Finding companies with the highest Return on Assets and Return on Equity values

Growth: Finding companies with excellent growth prospects, based on their 5-year history and also the forward estimates for EBITDA, Sales, and EPS growth

Quality: Find high-quality companies by comparing profitability and balance sheet metrics. The computation includes ROIC, net margin, gross margin, interest coverage, and debt/equity ratio values

Sentiment: Find companies that the market favors by comparing short interest ratios, returns over several periods within the last year, Price vs. 52-week high, days since 52-week high, and MACD signals.

I further screen for these stocks to ensure that they are consistent outperformers vs. the S&P 500, where every single one of them has outperformed the S&P 500 over the past decade (YTD, 1-year, 3-year, 5-year, 10-year). Do note that despite these stocks’ historical track record of outperformance, it is never representative of their future price behavior.

Here are the best stocks to buy in the 8 different sectors. The Energy, Real Estate, and Utilities sectors have been excluded as there are no viable candidates that met the stringent screening criteria set out above.

Best sector stocks in Communication Services: Alphabet

Alphabet’s Google is a stock that needs no further introduction and this blue-chip behemoth has generated excess returns of 34% YTD vs. the S&P 500 which is huge considering its mega-cap size and most pundits are betting that this stock will be the 3rd 2-trillion dollar market cap stock after Apple and Microsoft.

Google Search is the world’s most popular search engine, Google Chrome is the world’s most popular browser and YouTube is the third-most profitable streaming service, behind Disney and Netflix. Alphabet’s market-leading position in these areas has enabled the company to collect troves of consumer data, propelling Google to the forefront of the digital ad industry, another hyper-growth industry of the coming decade.

Alphabet has also been actively investing in the Artificial Intelligence industry through its stake in DeepMind and Waymo. While neither of the business is currently profitable, if they achieve success in the future, that could dramatically transform Alphabet’s business over the coming decade.

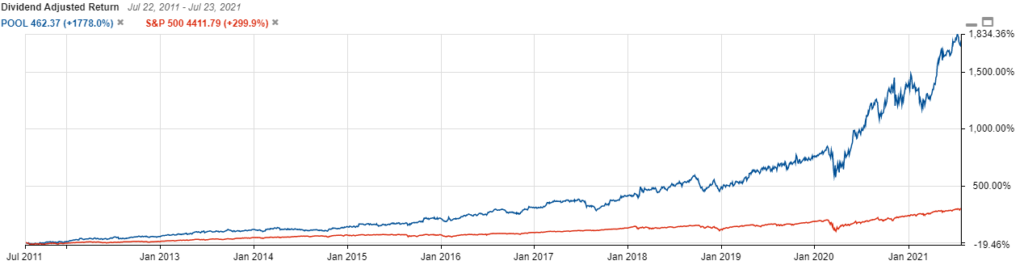

Best sector stocks in Consumer Discretionary: Pool

Pool is a consumer discretionary stock that I have previously highlighted as one of the best blue-chip growth stocks that have 10 years of earnings growth track record and consistently outperform the S&P 500.

Pool distributes swimming pool supplies and related products. A very simple business model that sells national-brand and private-label products to approx. 120,000 customers. The products include non-discretionary pool maintenance products like chemicals and replacement parts as well as pool equipment like packaged pools (kits to build swimming pools), cleaners, filters, heaters, pumps, and lights.

The company’s main target consumers are pool builders and remodelers, independent retail stores, and pool repair and service companies.

COVID-19 has been a boon for the company as stay-at-home measures and social distancing have encouraged a boom in discretionary spending on the home and garden segment. Naturally, investors are concerned that the strong growth seen in 2020 will fade away in 2021 as reopening takes shape.

However, the company reported a torrid 57% YoY revenue growth in 1Q21 even as the pandemic recedes in the US, which management believes that the trend of work-from-home is here to stay. This is one “work-from-home” company that is likely under-mentioned by the street.

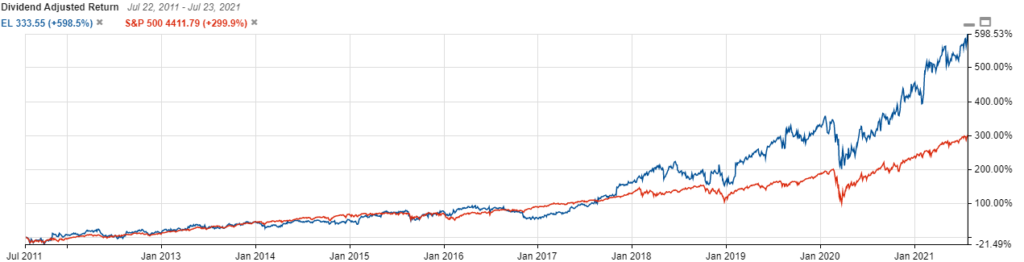

Best sector stocks in Consumer Staples: Estee Lauder

Estee Lauder is the world leader in the global prestige beauty market, participating across skincare (52% of 2020 sales), makeup (33%), fragrance (11%), and haircare (4%) categories, with popular brands such as Estee Lauder, Clinique, MAC, La Mer, Jo Malone, Aveda, Bobbi Brown, Too Faced, and Origins.

The firm operates in 150 countries, with 26% of revenue stemming from the Americas, 44% from Europe, the Middle East, and Africa, and 30% from Asia-Pacific.

The company sells its products through department stores, travel retail, multi-brand specialty beauty stores, brand-dedicated freestanding stores, e-commerce, salons/spas, and perfumeries.

While COVID-19 has resulted in its earnings performance taking a hit in 2020, the company’s earnings have rebounded strongly in 2021, with growth driven by consumer spending in Asia as well as its online foray. The company is expanding virtual try-ons and live streams of tutorials led by make-up artists and brand ambassadors. Such strategies are leading to greater consumer engagement and conversion.

Another innovation driving online sales is EL’s introduction of ingredient glossaries for some of its popular brands such as Aveda.com which increase product awareness and consequently translating to consumers spending 3x longer on Aveda.com than on average.

This is one consumer staples stock that will be a survivor even if the COVID-19 situation takes a turn for the worst (hopefully not). Which ladies don’t like to look good?

Best sector stocks in Financials: T-Rowe

T-Rowe is a company that provides asset management services for individual and institutional investors. It offers a broad range of no-load US and international stock, hybrid, bond, and money market funds. At the end of 2020, the firm had close to $1.5trn in managed assets, composed of predominantly equity (61%), balanced 928%) and fixed-income (11%) offerings.

Approx 2/3 of the company’s managed assets are held in retirement-based accounts which provides T- Rowe Price with a somewhat stickier client base than most of its peers.

The asset manager has a few key competitive advantages that investors should know about:

T. Rowe Price is an active manager, although back in Aug 2020, the Group ventured into the ETF space by launching 4 new ETFs: the Blue Chip Growth, Dividend Growth, Equity Income, and Growth Stock ETFs.

As an active manager, the Group also has a fantastic track record of beating both its peers as well as the indexes. Its active management prowess should lead to more inflows and revenue in 2021. Already, its 1Q21 revenue is up a solid 25% on a YoY basis and that should set it on course to yet another record-breaking year in terms of top-line performance.

The Group has a pristine balance sheet, with almost no long-term debt and has $2.8bn in cash and cash equivalents as of 1Q21. Its great balance sheet has enabled the company to maintain its status as a Dividend Aristocrat, with 35 years of consecutive dividend increase.

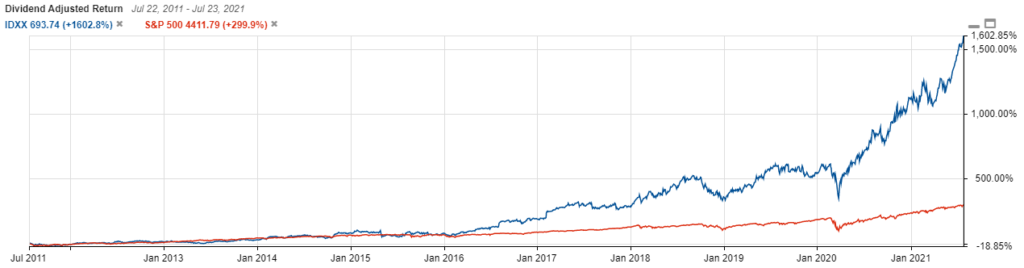

Best sector stocks in Healthcare: Idexx Laboratories

IDEXX laboratories primarily develop, manufacture, and distribute diagnostic products, equipment, and services for pets and livestock. Its key product lines include single-use canine and feline test kits that veterinarians can employ in the office, benchtop chemistry and hematology analyzers for test-panel analysis on-site, reference lab services, and tests to detect and manage disease in livestock.

Essentially, IDEXX offers an all-in-one suite of products that handle everything from workflow management to blood and chemistry analyzers, even offering outside reference labs for smaller practices that wish to get accurate and timely results in 2 days or less.

IDEXX makes money when pet owners visit their veterinarians and run diagnostic tests. COVID-19 initially hurt its business, where the onset of the pandemic had people running scared to bring their pets in for treatment. But initiatives taken subsequently such as curbside pet drop-off made the visits safer.

IDEXX is also one of the 8 outperforming stocks I highlighted back in May 2020 which investors should consider getting into.

This is one pet stock that is treating its shareholders well and should continue to maintain its outperformance vs. the market in the coming decade.

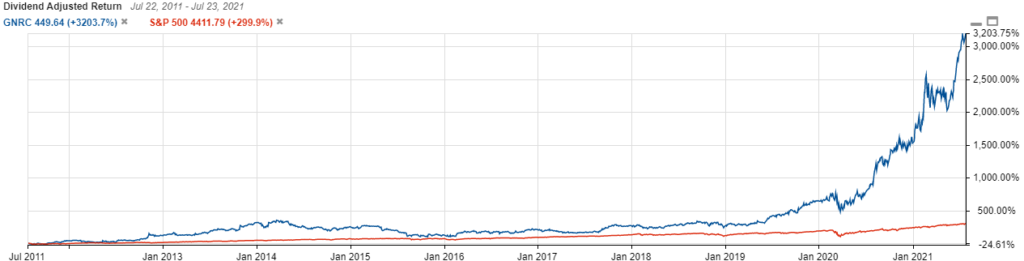

Best sector stocks in Industrial: Generac Holdings

Generac Holdings is a name that most would likely not be familiar with, despite the company sporting a market cap of c.$28bn.

Generac Holdings Inc designs and manufactures power generation equipment and other engines- powered products serving residential, commercial, oil, gas, and other industrial markets. It offers standby generators and portable and mobile generators for a variety of applications. In addition, the company offers lighting, heating, pumps, and outdoor power equipment.

Generac reports sales in multiple divisions: residential, commercial and industrial, and others. The company can produce a wide range of engine products from certain stationary generator solutions to much larger multimegawatt systems. Sales generated in the United States currently account for the majority of total sales.

This company is seen as a long-term play on the rise of renewable energy such as solar energy. The energy transition from traditional fuel to renewable creates demand for energy storage as the variable nature of renewable energy means backup generators which Generac Holdings provide, have a crucial role to play.

While the counter is undoubtedly “richly” valued currently, this is one stock that scores well in all areas of growth, profitability, quality, and investors’ sentiments.

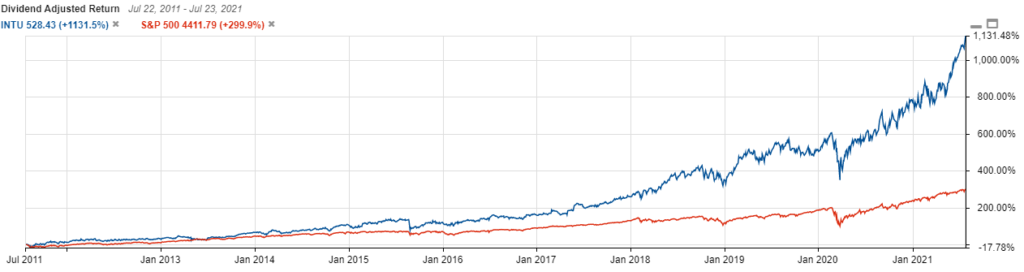

Best sector stocks in IT: Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of the U.S. market share for small-business accounting and DIY tax-filing software.

The stock has outperformed the market by > 20% YTD, likely the result of a solid earnings report in late May driven by one of its core products TurboTax. Intuit is also showing encouraging progress at selling complementary services such as its “premier” brand that is targeted at investors.

The company’s recent acquisition of Credit Karma has shareholders excited about a brand new revenue stream in the niche software services sector.

One of the key value propositions of Intuit is its high cash balance. The company is a cash cow, gushing out consistently higher operating cash and building up its cash hoard to the tune of over $4bn. This also enabled the company to continue growing its dividend payment which has been rising consistently over the past 10-years.

Considering that extra income and the fact that the company could be driving sales higher by 30% in the coming fiscal quarter, this is a consistent price outperformer that will likely maintain its solid track record for the rest of 2021.

Best sector stocks in Materials: Sherwin-Williams

When people think of materials, they tend to think of mining. That’s a tough game in terms of profitability. With an iron or gold miner, there’s usually a boom and bust cycle that doesn’t always turn out well for investors.

Nonetheless, miners are slowly gaining favor among investors as these corporates start focusing on returning excess cash to shareholders in the form of dividend payments vs. Capex spending.

Sherwin-Williams gives investors exposure to materials without the nasty volatility. Paint may not be a sexy trade to be in, but it sure is profitable. Sherwin-Williams has built a great business model as well. It has a huge network of retail locations, and it pairs that with strong partnerships with local painting contractors.

Sherwin-Williams can charge attractive prices for its paint because its professional customers know they’ll get a reliable product and excellent customer service. Business is currently on an upswing, thanks to the surging housing market and this trend seems likely to continue in the foreseeable future.

Regardless, Sherwin-Williams’ stock has gone up tenfold over the past decade, as its business tends to prosper in all weather. This might also be because the company has been a strong dividend grower over the past decade. The company grew its dividends from $0.49 in 2011 to $1.79 in 2020 (after accounting for stock split). This payment is expected to further increase to $2.20 in 2021.

I have also highlighted SHW as one of the 6 dividend growth stocks to invest in that can help one achieve millionaire status over 20 years.

Conclusion

These are some of the best stocks to buy in their respective sectors that are ranked favorably by the Stock Rover screener and have also demonstrated consistent outperformance vs. the S&P 500.

All of these stocks are large-cap blue-chip names that have continued rewarding shareholders over the past decade. Investors who are interested to diversify their portfolio across different sectors could consider these names as potential investment candidates.

This is by no means an inducement to buy or sell the stocks highlighted in this article and I will also like to highlight once again that past performance is by no means representative of their future performance.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only