I recently came across an interesting article. This was a Harvard Business Review (HBR) article back in Sep 2019 which identified the Top 20 global companies that have achieved the highest-impact business transformations over the past decade.

These are the world’s most transformative companies that excelled in the development of new products, services, and business models while concurrently repositioning its core business to adapt to the rapidly changing world.

In a simple layman analogy, they are definitely not “sitting ducks” waiting for their core businesses to be made irrelevant by the changing of times.

Do you happen to own any of these companies?

Screening method

The research team from HBR screened all the firms in the S&P500 and Global 2000 using three lenses:

- New Growth: How successful has the company been at creating new products, services, new markets, and new business models? This includes the primary metric: percentage of revenue outside the core that can be attributed to new growth areas.

- Repositioning the core: How effectively has the company adapted its traditional core business to changes or disruptions in its markets, giving its legacy business new life?

- Financials: Has the company posted strong financial and stock market performance, or has it turned around its business from losses or slow growth to get back on track? The team looked at revenue CAGR, profitability, and stock price CAGR during the transformation period, which was different for each firm.

The Top 20 most transformational companies of the decade

Netflix – Shifted from DVDs by mail into the leading streaming video content service and now a top original content provider

Adobe – Moved beyond core in creative & document software into digital experiences, marketing, commerce platforms, and analytics, while changing its business model from package software to cloud subscriptions

Amazon – initiated Amazon Web Services to overcome the cost of infrastructure required to conduct operations. AWS has turned into a lucrative profit engine while Amazon has also built an entire ecosystem of products and services enabled by its Prime membership

Tencent – transformed from an online messenger and video game business to an all-around technology business that has a presence in entertainment, autonomous vehicles, cloud computing, and fintech

Microsoft – Transformed from a business model based primarily on selling products, licensees, and devices to a cloud-based Platform-as-a-service (PAAS) business

Alibaba – positioned itself as an innovation powerhouse, having successfully transformed from n internet e-commerce and retail company to a technology business

Orsted – moved from a state-owned oil and gas exploration and production company to stage a 2016 IPO as the largest offshore wind farm company in the world

Intuit – Transformed from a provider of products and services to an online ecosystem of financial services for small and medium enterprises

Ping An – Established as a financial services and insurance company, Ping An transformed itself into a cloud tech business providing fintech and AI-based medical imaging & diagnostic

DBS – Transforming from a traditional regional bank to a global digital platform company, around a cultural vision of a “27,000-person start-up”. In 2018, the company was crowned “Best Bank in the World”

A.O.Smith – Shifting focus from its legacy business in automotive parts and motors to seize growth in water technology through M&A

Neste – a regional oil and gas company transforms into a global leader in renewable biofuels

Siemens – announced Vision 2020 which detailed an organization overhaul, restructuring and strategic shift from energy and industrial manufacturing to digitalization.

Schneider Electric – Pursuing a digital transformation that would shift it from a pure hardware supplier to an energy management provider via an open IoT platform

Cisco – transforming its business from selling networking products and services to become a digital IT solutions provider while also moving into adjacencies

Ecolab– evolved to become a market leader for cleaning and sanitation products as well as a provider of custom solutions for energy and water conservation

Fujifilm – transformed from a photography-centric firm to a healthcare products and medical imaging company

AIA Group – transformed from a health insurance provider into a collaborator with consumers by creating AIA vitality – a major wellness and prevention business

Dell – shifted from being a hardware company to being a cloud business integrating EMC’s storage management

Philips – split it lighting core from its healthcare growth business, transforming itself into a healthcare technology company

All these transformational companies exhibit some key behaviors:

Seizing digital opportunity via new platforms

I was pretty surprised to see DBS Bank ranking as a Top 10 candidate in the list, to be honest. The company made the list because of its effort in building new digital platforms. One of the keys to that success was not just going digital but opening up a digital platform that others can play on.

For example, DBS launched the world’s largest application protocol interface (API), where financial and retail partners can invisibly integrate DBS’s capabilities into their systems. By late 2018, DBS showed that its digital customers are at least twice as profitable as traditional customers.

Similarly, AIA Group ventured into a new global growth area with its digital Vitality platform providing wellness and prevention knowledge, tools and motivation to AIA members which lead to a business that contributed 10% of Group’s total revenue and growing at an 85% rate in 2018.

Netflix mines audience data to create an astonishing range of new shows. By analyzing the data they collected from users’ viewing behavior, they have fundamentally changed the way decisions are made pertaining to the development of new shows.

They are ranked the No. 1 company in this list not just because they are the market leader in terms of just being a pure digital content distribution. They come out with their own Netflix Original Content that is Emmy and Grammy winners.

According to CEO Reed Hastings, for the company to be hugely successful, they have to be a focused passion brand such as a Starbucks rather than a 7-Eleven or Southwest Airlines rather than United.

Leveraging core capability to enter new growth markets

A prime example is Fujifilm Holdings, a company that was once synonymous with photographic film, enjoying a near-monopoly market positioning just like Eastman Kodak.

While Kodak filed for bankruptcy in 2012, Fujifilm’s expansive view of its business, investing in medical imaging and leveraging on existing chemical technology and know-how enables the company to launch a full suite of diagnostic equipment for hospitals and other healthcare providers. Currently, 18% of Fujifilm’s $22bn revenue comes from healthcare.

In a similar fashion, Schneider Electric leveraged its ability to create tech platforms to move into creating an Internet of Things data analytics business for energy management. China’s Ping An leveraged its know-how and industry relationships as a traditional health insurance company to launch an online healthcare ecosystem platform called Good Doctor which attracted more than 265m registered users, enabling the company to stage an IPO of the platform as a separate company.

Not afraid of abandoning the past

Intuit sold off five divisions and product lines, including their oldest franchise Quicken which was the original business of the company. The company stopped all investment in non-cloud platforms and instead focus on being a provider of products and services to an online ecosystem of financial services for small and medium enterprises.

Similarly, both Microsoft and Adobe have nearly completely phased out its once-lucrative packaged software businesses to focus on subscription services for the cloud.

A.O.Smith, a company that historically focused on auto parts & motors, decide to completely divest that business to concentrate its investments on innovating its commercial and residential water heaters as well as entering the global water treatment market.

Siemens spin-off its electric power business, one that has been a core business for the past 140 years to invest in Digital Industries and Smart Infrastructure, both divisions now a core of the new Siemens.

Create a higher-purpose mission

Ecolab, a 90-year old firm was growing at 10% annually in the early 2000s, focusing on selling industrial cleansers and food safety solutions. The company started listening to what its customers really want or are concern about: having access to clean water. They hence acquired Nalco in an $8 billion deal back in 2011 to form what is now one of the world’s leading suppliers of hardware and software that helps manufacturers and service firms become more efficient users of water.

Tencent began as an online chat and video game provider catering to the new generation of digital natives in China. The original corporate objective was simply to harness the Internet opportunity. Subsequently, CEO Pony Ma broaden the firm’s outlook by embracing a mission of “improving the quality of life through digital innovation”.

The company invested heavily in growth areas ranging from education and entertainment to autonomous vehicles and ride-sharing to fintech and the industrial internet, areas that now represent 25% of its $46 billion revenue.

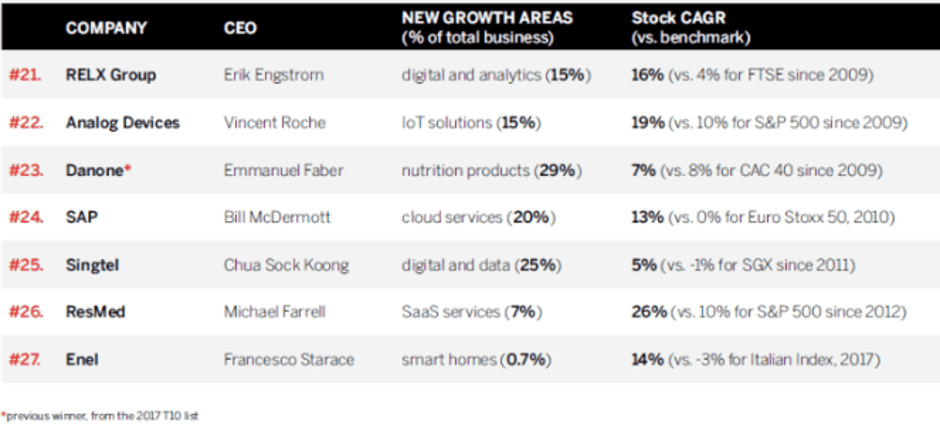

7 transformational companies to keep an eye on

While these 7 companies failed to make the Top 20 list, they remain impressive, considering that more than 95% of public companies haven’t attempted to transform or haven’t achieved measurable new growth.

Singtel makes it into this list for its digital and data focus which now encompass 25% of its total business.

Conclusion

Not making new changes might be the “less-risky” option for companies focusing on solely growing their core traditional business. However, one will need to be mindful if whether the business that we have been so accustomed in executing “day-in-day-out” might one day become irrelevant.

While big moves to execute new changes look risky on the surface, the risk is often capped while rewards can be bountiful, creating a new ecosystem that gives you the opportunity to grow in new areas for a long time to come.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “What do Netflix, Alibaba, DBS, Microsoft have in common?”