Table of Contents

Undervalued Singapore Small Cap Stocks

Some investors might seek to invest in small cap stocks as this is often where undervalued companies might be found.

When it comes to the term “undervalued”, it can be a somewhat subjective matter. When considering if a company is undervalued in this article, I will be using the financial metric of Forward Price-to-Earnings (next 12 months) multiple (P/E)

What might be music to the ears of value investors, besides investing in a potentially undervalued company? Getting paid while waiting for Mr. Market to realize the stock’s fair value potential.

Hence, we are not just looking for companies trading at a low forward P/E multiple, but one that is also dishing out a hefty dividend yield. This “compensates” an investor for his/her time taken to vest in the stock, with the final goal of achieving capital appreciation.

In this article, I will be highlighting 3 Undervalued Singapore small cap stocks with a dividend yield above 5%.

Screening for undervalued Singapore small cap stocks using Koyfin

Here are the screening parameters which I set up using the Koyfin Platform. I have previously highlighted in an article that this is one of the best free platforms that a Singaporean investor can engage to screen for Singapore stocks.

Screening Parameters:

- SGX Mainboard and Catalist Listing

- Market Cap between USD80m and USD1bn

- Dividend Yield (TTM) >= 5%

- P/E (NTM) <= 5.0x

As can be seen, my definition of “undervalue” in this instance is extremely restrictive, as I would only like to find Singapore small cap stocks that are forecasted to have a P/E (NTM) multiple of less than 5.0x.

For the uninitiated, this ratio measures the Price of a Stock to its Earnings Per Share (EPS). It shows how much investors are willing to pay per dollar of earnings. A low P/E multiple could represent undervaluation while a high P/E multiple could mean that the stock is “expensive” or overvalued.

Screening for a counter with a low P/E multiple is often just the first step. One should next compare this P/E ratio against the stock’s historical multiple to determine if it is indeed undervalued.

Say for example, a stock spotting a current P/E (NTM) multiple of 5.0x might not be seen as undervalued if this counter has a historical P/E (NTM) multiple of 3.0x.

With that said, there are just 3 stocks in the entire SGX mainboard and Catalist universe that fulfill these financial parameters.

Undervalued Singapore Small Cap Stocks #1: Manulife US REIT (SGX: BTOU)

Manulife US REIT (MUST) was Singapore’s first US-focused REIT that was listed back in May 2016 with an offer price of USD0.83. It was subsequently included in the FTSE EPRA NAREIT Global Developed Index in Dec 2019 and its share price ballooned to a high of USD1.06 within a month. That was also the highest price registered.

The REIT, like many others with a focus on commercial properties, was hurt by Work-From-Home arrangements when COVID-19 struck. Its share price started spiraling down since then.

In Dec 2022, after a valuation exercise, MUST’s portfolio was marked down by almost 10% to US1.9bn, causing its aggregate leverage to rise to almost 49% (almost hitting the cap of 50%). This further fuelled the sell-off in the counter.

The latest news pertains to the potential acquisition of the management platform of MUST by Mirae Asset Management as well as the subscription of new units in MUST. This stokes fear of further dilution which resulted in its share price now trading at USD0.17.

While MUST fulfill the screening parameters highlighted above, its high trailing dividend yield of >20% will likely be challenged in the current context and one should not expect such high yields to be sustainable.

With its share price having fallen to US0.17 (the counter declining by 20% over the last 1 month alone), there could be an opportunity here once we get further clarity on the Mirae acquisition plan as well as how the company can continue to de-gear.

Undervalued Singapore Small Cap Stocks #2: China Sunsine Chemical Holdings (SGX: QES)

China Sunsine is a leading specialty rubber chemicals producer, the largest producer of rubber accelerators in the world, and the largest producer of insoluble sulfur in China.

Its products are marketed all over the world, covering North and South America, Europe, Asia Pacific, and China.

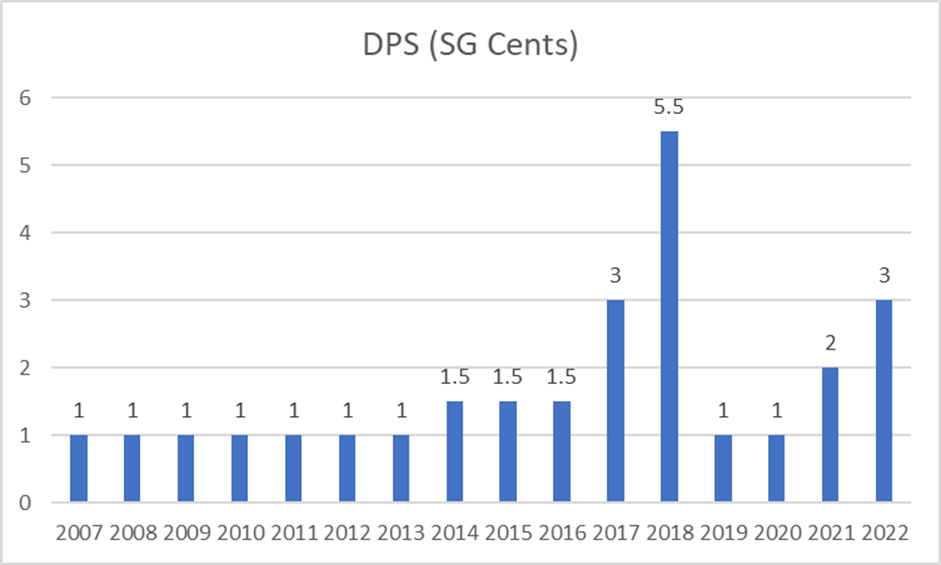

The company has been a consistent dividend payer since its listing in 2007, as can be seen from the chart below.

Dividend payment hit its highest level at 5.5 SG cents back in 2018, in line with the strong profits generated by the company.

Assuming the same DPS of 3 SG cents, that translates to an attractive yield of 7.5% at the current price.

The street has a current EPS consensus of 8 SG cents. Given its current share price of SGD$0.40, that translates to a P/E (NTM) multiple of 5.0x.

This compares positively to its 5-year historical P/E (NTM) multiple of 6.0x as can be seen from the chart below.

Undervalued Singapore Small Cap Stocks #3: LHN Limited (SGX: 41O)

The final undervalued Singapore Small Cap stock in our list is LHN Limited, which is currently listed on the Catalist Exchange. LHN Limited currently operates in 3 key business segments: 1) Space Optimisation, 2) Facilities Management, and 3) Logistics Services.

Within its Space Optimisation business segment, it can be further broken down into a) Industrial, b) Commercial, and c) Residential.

It is in the Residential Space where the company sees the greatest growth potential, spearheaded by its co-living business.

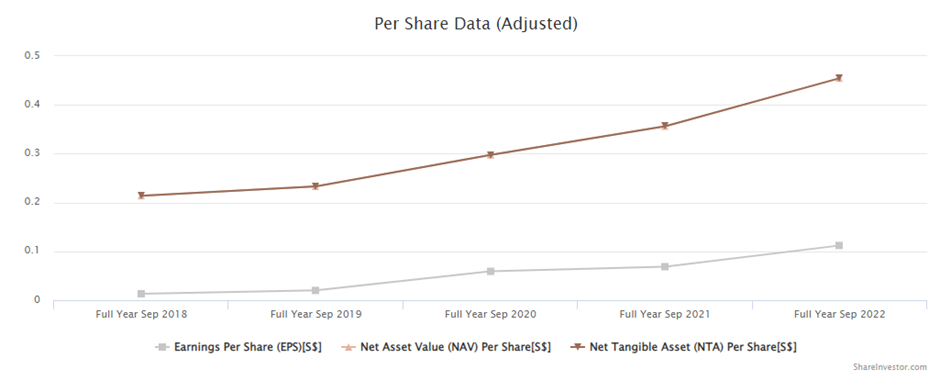

The company has got a pretty good track record of growing its NTA as well as EPS over the past 5 years. Looking ahead, the consensus is for EPS to decline to approx. $0.07. At its current price of $0.28, that translates to a forward P/E (NTM) of about 4x.

This multiple is also a discount to its 5-year historical P/E (NTM) average of 4.5x.

The company has been paying a dividend of 1.75 SG cents over the past 2 years (inclusive of special dividends). This translates to an attractive yield of 6.25% based on its current price.

Which of the 3 might be the most undervalued Singapore small cap stocks?

Manulife REIT is a potential corporate action “play” that could turn out well if the company can successfully resolve its credit-related issues, possibly with Mirae coming into the picture. However, there is also the risk that current shareholders might be diluted as a result of any equity raising exercise to boost its capital.

China Sunsine is more of a commodity play and thus its earnings and price action might be closely associated with the price movement seen in its key commodity. Nonetheless, this counter might still be worth a closer look just solely based on the consistency of its dividend payments, which have not been halted for any single year since its listing.

Lastly, LHN Limited could be the most undervalued Singapore small cap stock, given its undemanding valuation at present, coupled with an attractive yield of 6+% (assuming DPS remains at 1.75 SG cents).

This company is aggressively growing its co-living portfolio, which is an attractive proposition for foreigners and PRs etc looking at renting an affordable apartment over a medium-term horizon. With rental rates continuing their ascend, LHN could see profits growing substantially from this business segment.