HDB BTO Guide

Properties have always been a hot topic in Singapore and many view them as an investment more than a home! Despite the pandemic, prices have been rising steadily across all residential properties. This might be attributed to many factors such as the low-interest-rate environment to possible cooling measures being implemented. In Q4 of 2020, HDB resale prices recorded their biggest quarter on quarter (QoQ) increase in 9 years at 2.9%! With increasing prices, BTOs are an attractive option for first-time buyers.

Being a large purchase intertwined with regulations such as the Minimum Occupancy Period (MOP), it is essential to pick the right flat for your own stay while giving yourself the best chance of capital appreciation!

Wondering how do you go about your BTO process? We got you covered with some tips!

1. Brief Introduction to properties in Singapore

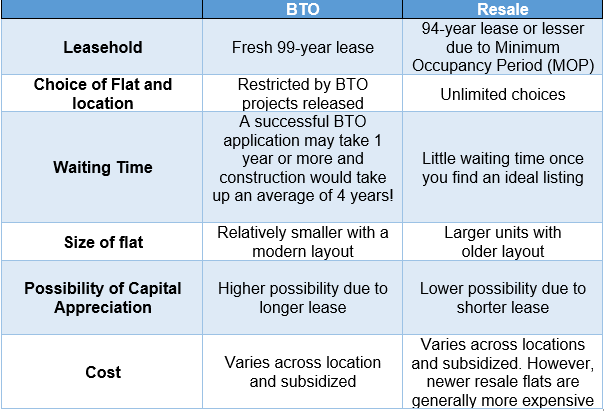

HDBs in Singapore are classified as public housing that runs on a 99-year leasehold. With land scarcity in Singapore, houses are generally an effective hedge against inflation! There are two ways for one to purchase an HDB flat in Singapore – Resale or BTO.

Wonder what’s the best option for you? Here’s a comparison:

With a longer leasehold and a higher possibility of capital appreciation, I believe that BTO is the better choice as long as you are eligible and have the luxury of time to wait! But how does one know their eligibility?

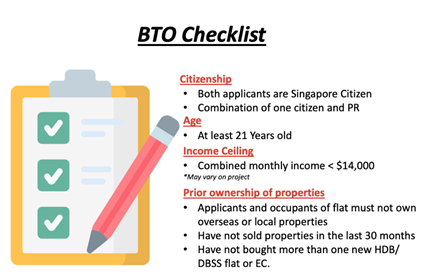

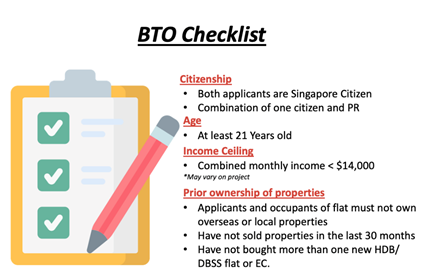

2. Requirements for BTO

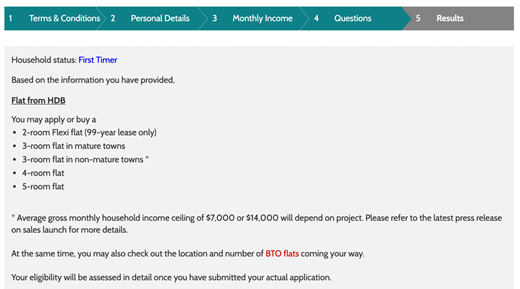

To apply for a BTO, the above shows the requirements you have to meet! But what if you’re still unsure? HDB provides an e-service to check our eligibility by keying in the details here! I’ve personally tried the service and was able to learn about my eligibility in less than 5 minutes. The snapshot below shows the screen I received from it!

Other Eligibility requirements

The above checklist is a typical one for a Singaporean couple looking to apply for their BTO. However, if you are a single or a citizen with a non-citizen spouse, that does not mean you are not eligible for application.

- For singles, you need to be aged 35 and older and only eligible for 2-room flats in non-mature estates. Alternatively, you can be a single aged 35 and older but also applying for a flat with up to 3 single citizen co-applications (also only eligible for 2-room flat in non-mature estates)

- If you are a citizen with a non-citizen spouse (on a visit or work pass), you are eligible for applying a 2-room flat in non-mature estates as well.

Owner and Essential Occupier structure

A little-known fact among Singaporean couples when they apply for a HDB is that your spouse, regardless of citizenship, can be listed as an essential occupier instead of a co-owner. For example, the husband can be listed as the owner while the wife can be listed as an essential occupier.

The “beauty” of such a structure is that it allows the couple to purchase a private property without having to sell their current BTO after the 5-years MOP period. There will also be non incursion of Additional Buyer Stamp Duty (ABSD) which saves you up to 12% of your next property value (do note that essential occupiers are also subjected to the 5-years MOP rule).

This is knowledge that is not often known by couples applying for their BTO. However, there are certain “downsides” to such a structure. First, the onerous of financing the downpayment and mortgage loan of the BTO falls onto the owner of the flat as an essential occupier cannot borrow and contribute to the mortgage.

Second, the essential occupier also has no legal rights to the property unlike in a joint tenancy. This might raise complications in the event of a divorce or in the event of the owner’s passing (where the flat is subject to the distribution of the will or the intestate law and not automatically transferred to the spouse)

This structure might be an interesting proposition for certain couples where one party has the financial ability to fund the BTO’s downpayment and subsequent mortgage loans by himself/herself. This frees up the opportunity to subsequently purchase a private property (under the essential occupier) for own-stay and lease out their HDB flat for rental income.

3. How much does a BTO cost?

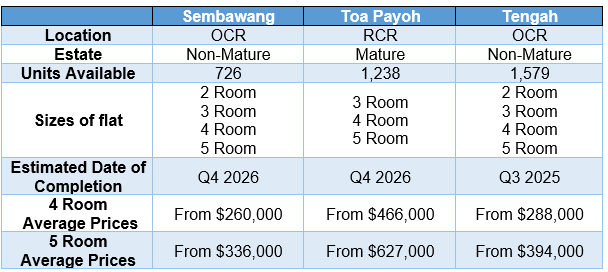

The prices generally vary based on three factors – Location, Estate, Size of Flat.

Location

The URA has divided Singapore into three key regions, Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR). Houses in Core Central Region are located around town which is home to most high-end properties in Singapore.

Estate

Properties in Singapore can also be further classified into mature and non-mature estates. Estates that are around for more than 20 years would often be classified as mature. These properties will fetch a higher price as they would have more amenities available for residents!

Mature estates include the likes of Bishan and Toa Payoh while non-mature estates are places like Tengah and Punggol!

Size

The HDB offers 2 to 5 room flats in BTO exercises they have. However, the offerings vary on a project basis and the size has a positive correlation to price.

Putting together the factors, here is the comparison for last year’s BTO releases:

As you can see, the location plays a big part in the price you’re paying! For a new estate like Tengah, it’s almost half the price of Toa Payoh! However, if we were to take a step back and look at the cost of housing, it is still a sizable amount especially if you’re just starting your adulthood!

The honest truth, however, is that most couples cannot afford to be “choosy” when it comes to selecting their first BTO. Due to demand for BTOs substantially outweighing supply, it is often not possible to select the BTO based on your ideal location. Most will “grab” whatever that is on offer as long as they are not situated in “ulu pandan”.

However, with the development (completed and planned) of non-mature estates over the years and in the coming decade, selecting a BTO in these locations is not a bad choice after-all, in my view, especially when considering the lower entry points of these non-mature estate BTOs which makes it more affordable for a young Singaporean couple.

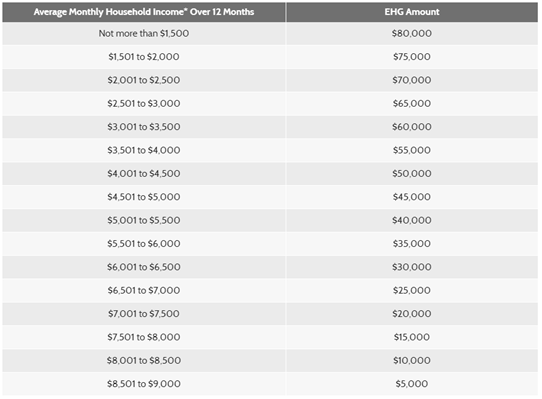

4. Housing Grants available for BTO

If you are a first-timer, the HDB provides an Enhanced CPF Housing Grant to ease your financial burden. You can get up to $80,000 worth of Enhanced CPF Housing Grants based on your monthly gross income!

If you were to look at the resale market, you will be entitled to the Family Grant (up to $50k) and Proximity Housing Grant (up to $30k). The maximum theoretical total grants could be as high as $160k!

For more information on the various housing grants available you can refer to the HDB site.

Do note that housing grants are disbursed into your CPF to help assist in your CPF downpayment. When the property is subsequently sold, the full grant received + accrued interest will have to be returned to your CPF and cannot be “cashed out”.

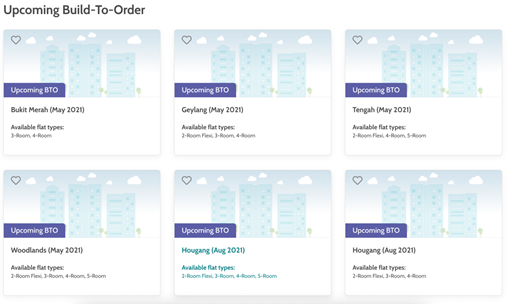

5. Upcoming BTO projects and past analytics

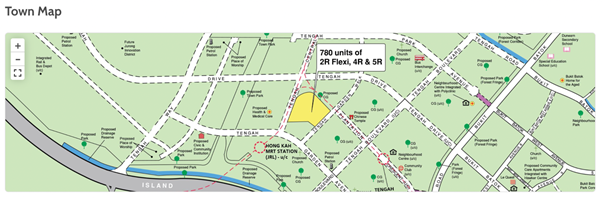

After sorting out your budget and area of preferences, you’re one step closer to your first ever home! Just this year, HDB has upgraded their HDB Flat portal for you to search for upcoming projects. You can find the link here! After assessing the site, you should be able to see the screen below. The platform shows you all the upcoming projects for May 2021 and Aug 2021!

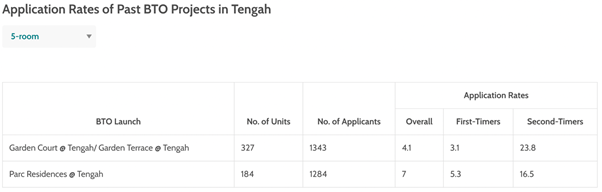

By clicking into any of the upcoming BTO projects, you’ll be brought to the screen seen below. The platform shows you the location of the proposed project as well as the previous supply and application rates of past projects in the area. By looking at the application rate, it allows you to gauge your chances of getting your desired flat!

Do note the risk of selecting a popular BTO to ballot. If you are allocated a number that entitles you to choose only low-floor units which are not your preferred choice and hence you decide to forfeit that selection, it is considered as a “wasted” chance.

The following is a step-by-step guide to your BTO application

6. Step-by-Step guide to your BTO application

When you’re ready to apply for your BTO after your research and budgeting, here are the procedures to take!

Step 1: Submitting your BTO Application

BTO launches are normally held in February, August, and November! Once the project is launched, you’ll have 7 days to complete your application online or at any HDB branch. This will come at a fee of $10 per application. You can check out the upcoming sales launch in this link.

Step 2: Checking the outcome of your Application

About a month after the application closes, you’ll be able to learn about the outcome of your ballot! For first-timers, you’re given a higher chance to compared to other applicants. You should receive a queue number attached to your application if your application went through! You’ll only be able to select any leftover flats when it reaches your number. It is better to get the lowest number possible!

Here are the “chances” that you are entitled to:

Normal/Public application

1st Time application: 2 Chances

2nd Time application: 1 Chance

Married Child Priority Scheme (Staying NEAR parents)

1st Time application: 4 Chances

2nd Time application: 2 Chances

Married Child Priority Scheme (Staying WITH parents)

1st Time application: 6 Chances

2nd Time application: 3 Chances

Step 3: Deciding on your housing loan

Congratulations if you have gotten a good queue number for your flat selection. The next step will be to decide on how to finance your housing loan before you think about putting your pen to paper and sign your life away.

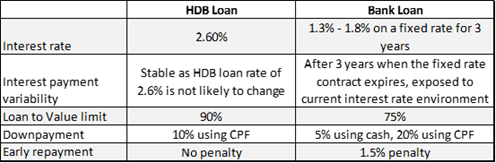

There are two avenues for you to obtain a housing loan. You can either get financing through HDB or Banks! The amount paid for down payments and interest rates vary on the two options and you can a comprehensive analysis about it here.

HDB loan: Apply for HDB Loan Eligibility Letter

Bank loan: Obtain Approval in Principle (AIP) from your bank You will need to get some kind of loan approval (be it through HDB or through banks) before you can proceed to Step 4 to secure your flat. This is required to be completed before your second HDB appointment (in step 4)

Step 4: Going down for your appointment to select a flat and down payment

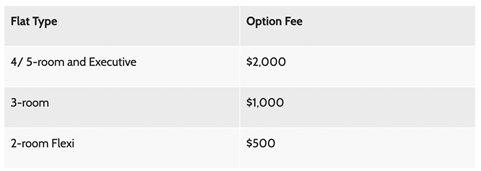

You’ll have 2 appointments in total for your BTO application. The first will require you to head down to select the units available for you (refer to Point 7 for the selection of a good BTO unit). As you’re not the only person selecting a unit on that day, it is advisable to look at the remaining units on the HDB portal and shortlist about 10 units of your choice! At this stage of your application, you’ll be required to pay an option fee according to the size of your flat.

You will also be applying for your CPF housing grants at this point. We have covered that earlier in Point 4. Make sure you download the application forms for Enhanced CPF Housing Grant and bring them along to your flat booking appointment.

Essential items for 1st appointment: ICs + income documents + HDB Loan Eligibility Letter (if you have decided to select the HDB loan)

Your second appointment will require you to sign the dotted lines for your lease agreement to finalize your home! This needs to be completed within 4 months of your first visit when you book the flat. Make sure that you have gotten your loan arrangements in order by that time (Step 3).

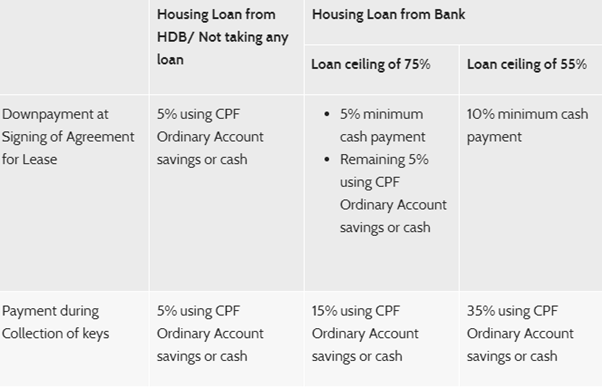

Further, several payments have to be made at this stage. Firstly, your down payment which is highly dependent on the loan you take. For HDB loans, you’ll be required to make a 10% down payment with Cash/CPF while a bank loan will require a higher payment of 25% (5% Cash and 20% by Cash/CPF).

Other fees include your legal fees and stamp duties (mixture of cash and CPF) which are dependent on your purchase price. For ease of calculation, you can refer to the calculator provided by IRS here.

Staggered Downpayment Scheme

Most first-time BTO applicants will tend to select the HDB loan route due to limited capital resources (at that stage) to fork out the higher downpayment of 25% through a bank loan. However, there is also the staggered downpayment scheme which might help ease the payment burden if you so decide to select bank financing which entails a higher downpayment of 25%. For eligibility criteria, you can refer to the link above.

Using the bank loan example, instead of paying the entire 25% on your 2nd HDB appointment in Step 4, you will now only need to pay 5% in cash, 5% in cash/CPF, and the remaining 15% in cash/CPF only during the collection of keys (Step 5).

Given that your key collection (upon TOP) might still be 3-4 years away (might be even longer with COVID-19 situation) from the lease signing, this gives you ample time to accumulate the remaining 15% “downpayment” requirement.

Step 5: Collection of keys (finally)

This is where reality kicks in when you’ve collected your keys! Whether you’re ready or not, you’ve officially taken another bold step towards adulthood with your very own home. It takes an average of four years of waiting time and hopefully provides ample time for you to prepare!

7. Tips for selecting a good BTO unit

Here are some tips for selecting a good BTO unit. Do note that this is just my personal views and such views varies from individual to individual.

Avoid Afternoon Sun

See which are the units that might be affected by the afternoon sun and you might wish to avoid them. Here in sunny Singapore where its practically summer all year round, you don’t wish your living room or bedrooms feeling like a sauna when you are looking to “chill” over the weekends in the comfort of your living/bedroom.

North/South orientation units will not have the issue of direct sunlight. If you are someone who prefers some natural light shining into your home, then go for one with a North-East facing where you might get partial morning sun but not the dreaded afternoon sun.

Noise Level

Is your unit facing the expressway or overlooking a main road? If that is the case, you can expect to hear more “vroom vroom” noises as sound travels upwards. This might not be a major issue during the day (and might not be that obvious as well) but when it comes to snoozing time (and you are not an avid air-con user), then it might become a real issue affecting your beauty sleep.

Do not make the mistake of assuming that your unit is at a “high” level and therefore you will not be affected by the traffic.

Floor Level

If you have gotten a good queue number and have the luxury of selecting a floor level of your choice, most will likely go for the highest unit available. High units come with amazing view but do note that these units will likely cost more than comparable lower floor units of the same building. However, you can also likely ask for a higher selling price when it is time to say “adios”.

Higher floor units might be an issue if there is frequent “lift maintenance” which results in just 1 “workable” that everybody is clamoring for.

Lower-level units typically do not command a better view (unless your BTO establishment is already on a hill) but they are usually also cooler. Lift breakdown/maintenance issues are less of a hassle.

One major issue for low floor units is if you unit is situated directly above the rubbish chute. That is definitely going to be a “foul-smelling” experience.

View from and to your apartment

Some people prefer selecting a lower unit with a “sea view” or more aptly put “longkang” view as compared to a higher unit facing your fellow dwellers.

Besides checking out the view from your apartment, do see if it might be an issue if people can actually “voyeur” into your apartment from the common corridor. Look into the floor plan and account for this potential “problem”.

Accessibility

Accessibility might be a problem if your particular block is a distance away from the nearest bus-stop/LRT/MRT as compared to other blocks in the same establishment. This might not be a major issue if you are driving but if you are someone taking public transport on a daily basis, then walking that additional 5-10 minutes to get to the nearest transportation point every day does add up over the years.

Some might see it as another form of exercise though. For those who are always rushing for time, this is a potential consideration when selecting your unit.

This are just some of the considerations to look out for when picking the perfect unit for your BTO.

8. The cost of potential breakup during your application

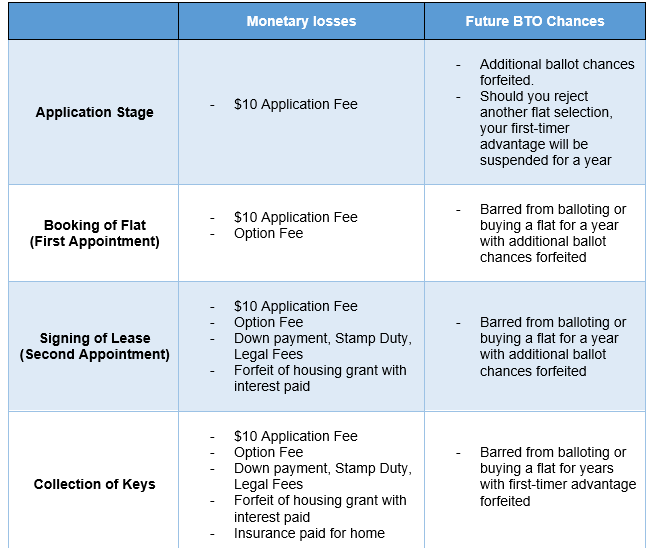

Applying for a flat is a monumental stage of your life and it’s important to be mentally ready for it. One key consideration would be your relationship with your partner as the cost of a breakup *Touchwood* during the application can be high! Not only would you incur monetary losses, but you might also lose out on your future balloting chances!

9. Upcoming BTOs for 2021

Thinking of applying a BTO for yourself after reading the guide? Here are the upcoming projects for the remainder of 2021!

May 2021:

- Bukit Merah

- Geylang

- Tengah

- Woodlands

Aug 2021:

- Hougang

- Jurong East

- Kallang

- Queenstown

- Tampines

Good luck with your application and all the best!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here on this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER STOCKS WRITE-UP

- Early Retirement Plan – A 9-Steps Ultimate Guide

- A step-by-step guide to figuring out your retirement sum

- How much to retire in Singapore?

- The IDEAL Retirement portfolio structure

- Don’t let Sequence of Returns Risk be your retirement pooper

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.