Table of Contents

Syfe Review: REIT+, Equity100 or Global ARI?

I have written about Syfe REIT+ portfolio as well as Syfe Equity100 portfolio previously. I believe that these two portfolios are structured to cater to 2 specific types of investors.

For Syfe REIT+ portfolio, it appeals to the yield-loving crowd while the Syfe Equity100 portfolio is structured for those who wish to have a 100% equity composition with a high concentration in tech-plays (currently) in their portfolio.

Allow me to do a summary of Syfe REIT+ and Syfe Equity100 portfolio before I proceed to discuss its Global ARI portfolio today and benchmark it against my very own NAOF portfolio structure.

Which of the three portfolios is my preferred selection?

For those who are interested, here are some of my Syfe review articles that I have written:

- Guide to Syfe and how to open an account in less than 10 minutes

- Syfe Equity 100 Review: does this portfolio make sense to you?

- Syfe Review: Is this now the most comprehensive Robo Advisor in Singapore?

- Syfe trade Review: Fractional Investing Suited for Beginner Investors

Syfe Review: REIT+

This is a portfolio that allows an investor to partake in a portfolio of REITs. It has 2 structure:

- 100% REIT: The entire composition consists of individual REIT stocks. The selection of these REITs looks to track the iEdge S-REIT Leaders Index. The key benefit of the 100% REIT structure is that an investor gets to partake in the largest S-REIT stocks directly which incurs no additional fees vs. buying into a REIT ETF where there will be an additional expense ratio charged.

- REITs with Risk Management: This structure adds the bond component alongside REITs (min 50% weightage) to give that additional protection in the event of a market sell-off where returns from the bond assets can offset that of the losses from the REITs component. While bonds tend to have a negative correlation with the general stock market as well as REITs assets, there is however the risk that both assets CAN be sold off in a market sell-down.

I currently have portfolios in both structures but have no special preference for either. The 100% REIT structure tends to have a higher yield while the REITs with Risk Management structure offer more downside protection.

To be honest, I am not sure if its ARI structure (which is how Syfe allocates one’s capital between REITs and Bonds (with risk management)) is working well.

It tends to veer towards a greater % in REITs when the market is generally positive (low volatility) while providing greater % allocation to bonds in a market sell-off when volatility is high

The market has been trending higher for the past few months and I would have expected the allocation for the REITs % to trail higher. However, that % remains fairly constant at 50.1% vs. bonds at 48.4%.

One explanation previously given by management is that the volatility index remains elevated and hence, the ARI structure took that into account and consequently maintains a high % in the bond allocation. However, the Volatility Index has trended much lower compared to its March peak and I would have expected a significant change in my portfolio structure, with an increasing greater allocation to REITs vs. Bonds.

However, that does not seem to be the case.

I am rendering a guess but one possible explanation could be that the REIT segment remains lackluster and hence, Syfe’s ARI took that into account perhaps?

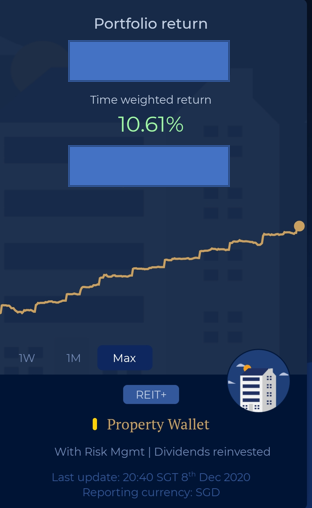

From 27 Feb to YTD, my REIT with management portfolio generated a time-weighted return of 10.6% vs. the iEdge S-REIT Leaders -9% decline so I am not complaining although it is not a like-for-like comparison as I dollar cost average (DCA) into my Syfe portfolio.

Syfe REIT+

The easiest way to own a portfolio of the 20 largest and most liquid REITs in Singapore. Even better, you can start investing cheaply on a recurring basis every month using the Syfe Robo Advisor platform

Syfe Review: Equity100

Syfe Equity100 provides an investor with a full 100% equity exposure and subscribe to factor-based investing. Factor-based investing itself is nothing new and this strategy was conceptualized by two University of Chicago professors, Eugene Fama and Ken French, in 1993 as an extension of the Capital Asset Pricing Model (CAPM).

Equity100 looks at 3 different factors: 1. Growth, 2. Large-Cap and 3. Low-volatility.

The fund’s largest holding is in Invesco QQQ ETF which comprise 100 of the largest US and international non-financial companies listed on Nasdaq, with some of its top holdings vesting in Apple, Microsoft, Amazon, Facebook, and Alphabet, all very large-cap names and are likely falling within the classification of “growth” stocks.

It also selects ETFs which has a focus on low volatility stocks, such as those in the consumer staples, healthcare, utilities, and materials industry. This sector ETFs collectively generate the highest-risk-adjusted returns for the lowest amount of volatility on a portfolio basis.

The unique feature of this portfolio is that it is supposedly able to capture the “turn in the tide”.

According to Syfe, the portfolio is rebalanced when the “smart beta” factors that drive the portfolio’s performance reach the end of their respective cycles. The rebalancing cycle is relatively long and hence they do not expect to rebalance Equity100 more than twice a year.

Dynamic Smart Beta is thus key to Equity100’s outperformance in the long-term. By being able to recognize that the tide has turned on some factors and it is hence time to “jump ship” and move onto the next voyage, this is where I think Syfe’s real value proposition is.

How is Syfe’s dynamic smart beta able to recognize that the tide has truly turned? I cover that in this article.

Overall, it remains early days to assess Equity100’s performance. I will like to see how the factors tilt (if they ever do) in the future and the rationale and structure behind that tilt.

Syfe Equity100

With just one portfolio, gain access to over 1,500+ stocks in the world’s best companies. Syfe’s Equity100 portfolio is designed for investors who want maximum exposure to global equities.

Syfe Review: Global ARI

I am not going to talk about Syfe’s ARI structure in-depth but just like to re-emphasize that this structure focuses on risk management first, returns second. What I will like to do in this article is to compare 1. Syfe Global ARI, 2. a second “customized Global ARI version” which I termed as Global ARI+ against my own 3. NAOF portfolio structure and benchmarked all of them against the S&P 500.

The reason is that they both have similar asset composition: 1. Equity, 2. Bonds and 3. Gold.

The only asset class lacking in Syfe Global ARI’s portfolio vs. NAOF portfolio is the REITs asset class which I can look to combine Global ARI with 100% REIT to come out with the Global ARI+ structure.

The NAOF structure consists of: 20% Equity, 20% LT Bonds, 40% REITs, 20% Gold

In this article in which I highlighted the best portfolio allocation structure, the NAOF portfolio comes out tops when compared against popular portfolio structures such as the “All Weather Portfolio”, “Permanent Portfolio” etc when it comes to both long-term returns as well as high portfolio withdrawal rate.

I use the below US ETFs to represent the respective asset classes

Equity: VTI (20%)

LT Bonds: TLT (20%)

REITs: VNQ (40%)

Gold: GLD (20%)

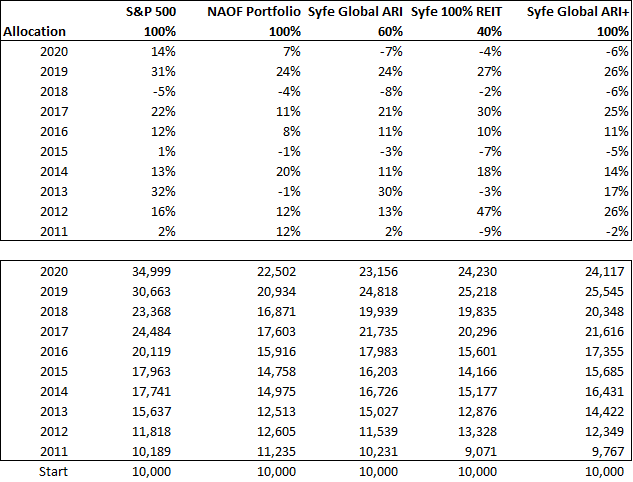

I select to compare the NAOF Portfolio structure – 100% allocation vs. Syfe Global ARI highest risk structure (25% downside risk) – 60% allocation + 100% REIT portfolio – 40% allocation. I call this latter portfolio Syfe Global ARI+

The below table illustrates the performance of how the respective portfolios will look like, based on data provided by Syfe as well as portfoliovisualizer.com. I also illustrate the ending value of a portfolio which consists of $10k at the start.

Clearly, in the last decade which is one primarily dominated by the bulls, the 100% S&P 500 is the strongest performer due to its 100% equity allocation.

Syfe 100% REIT portfolio is a distant second, followed closely by Syfe Global ARI+ in 3rd place.

The original Syfe Global ARI portfolio comes in 4th while my NAOF portfolio structure comes in at 5th place (last).

The last decade is one that did not benefit the NAOF structure due to its GLD holdings which generated a CAGR of just 1.9% over the period.

Some key observations

- The S&P 500 has rebounded strongly from the March/April selldown and generated a total YTD return of 14%. However, the original Syfe Global ARI (25% DR) remains in negative territory.

- The Syfe Global ARI portfolio has not outperformed the S&P500 index (represented by SPY) in any single given year since 2011.

- Syfe 100% REIT portfolio seems to rebound back strongly (double-digit returns) after every down year (coincidence?)

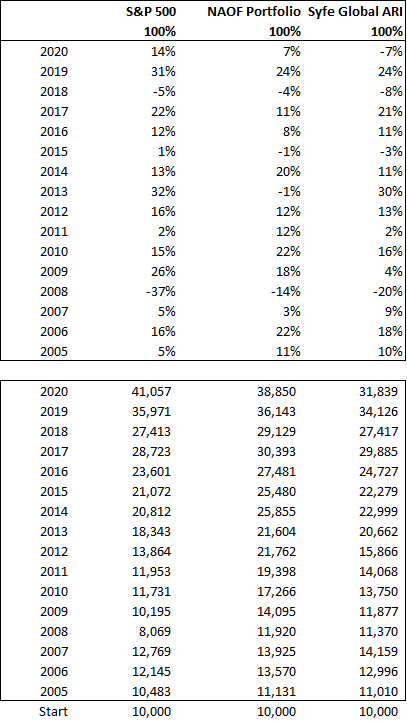

Do note that the above investment horizon is too short to generate meaningful conclusions. If I extend the comparison period from 2005 to YTD 2020, the S&P 500 portfolio remains the best performer, followed by NAOF in 2nd place and Syfe Global ARI in 3rd place. There is no available data for Syfe 100% REIT portfolio.

Syfe Global ARI portfolio seems to “outperform” the S&P 500 significantly only in a bear market environment such as in 2008 where it can cap the downside risk of the portfolio below the stated 25% max risk. However, its returns are slow to rebound when the market turnaround swiftly such as in 2009 and 2020.

Conclusion

Based on the data above, there is little evidence to demonstrate that Syfe Global ARI strategy is superior in terms of returns. While it might better “cap” the downside risk potential (key-value proposition), such a structure might mean a slower subsequent rebound, one which might not benefit from a strong market reversal.

The NAOF portfolio performed strongly during the market meltdown in 2008, with relatively strong performance post-GFC (2009-2012) as well. The only year in which it underperformed drastically was in 2013 when both the bond and gold market collapsed.

Overall, I would still stick to Syfe’s 100% REIT offering as well as its Equity100 offering.

I find its 100% REIT structure an easy and convenient way to hold a 100% REIT DCA portfolio where the overall cost (Syfe’s platform fee of c.0.65%) is relatively acceptable and comparable vs. using a DCA approach by investing in a REIT ETF such as the Lion Phillip S-REIT ETF (which incur expense ratio) through a brokerage platform like POEMS (which incur commission charges).

Syfe also provides periodic rebalancing functions for users.

For those who wish to have 100% equity exposure (especially for young investors with a long investment horizon), its Equity100 offering might be a viable solution, one which looks to partake in dynamic factor investing through the selection of key trending factors.

How dynamic that solution is remains a “mystery” for now.

If one will like to engage in thematic investing, I have written about OCBC Roboinvest which allows an investor to partake in thematic investing the easy way.

Last but not least, I will likely give its Global ARI structure a miss as its key value proposition, one that banks on a strong downside risk management control does not appeal to a risk-taker like myself.

It will, however, be more suitable for a risk-averse investor who places strong importance/focus on portfolio downside risk control.

Syfe has kindly reached out to NAOF readers and you can choose to sign up through this affiliate link where I may receive a share of the revenue from your sign-ups.

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.

Whether you decide to use my link to get started on the Syfe Robo Advisor, you are invited to access my FREE Video Tutorial Robo Advisor Guide which will highlight to you the best Singapore Robo Advisors to use based on your investing style (passive, dividend income, international etc).

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.