Table of Contents

Syfe Income+

Syfe recently launched a new product called Income+, to provide clients with a higher-yielding product that can generate passive income every month.

Yes, this product is structured to potentially payout monthly for clients who wish to receive a steady stream of regular income. There is also an option to reinvest those monthly payments (more on that later).

This product has been offered in consideration of the current high inflationary environment and Syfe believes its latest higher-yielding product can help clients partially mitigate ever-rising prices.

Is Syfe’s latest product offering a better solution vs. alternatives such as Singapore Savings Bonds (SSBs), Treasury Bills (T-Bills), or Fixed Deposits?

For those who are interested, here are my previous Syfe review articles that I have written:

- Guide to Syfe and how to open an account in less than 10 minutes

- Syfe Equity 100 Review: does this portfolio make sense to you?

- Syfe Review: Which of its portfolio offering will I select?

- Syfe Review: Is this now the most comprehensive Robo Advisor in Singapore?

- Syfe Trade Review: Fractional Investing Suited for Beginner Investors

- Syfe Review: My Favorite Feature of this Robo Advisor

Before I comment on that and give my 5 cents view, here are the core features of Syfe Income+.

Syfe Income+ Salient Features

In partnership with Pimco

For the first time, Syfe is offering an actively managed product, in partnership with PIMCO, which is quite unlike its other management offerings that have been focused predominantly on ETFs (except for Cash+).

Syfe believes that when it comes to bond assets, an actively managed solution, where the fund managers can engage in frequent optimization to achieve yield maximization or capital protection, is superior to a passive approach through a bond ETF, for example.

Syfe will make these recommendations to clients on a semi-annual basis for changes in terms of portfolio allocation. Clients can choose to accept those recommendations or stick to their current asset allocation weighting.

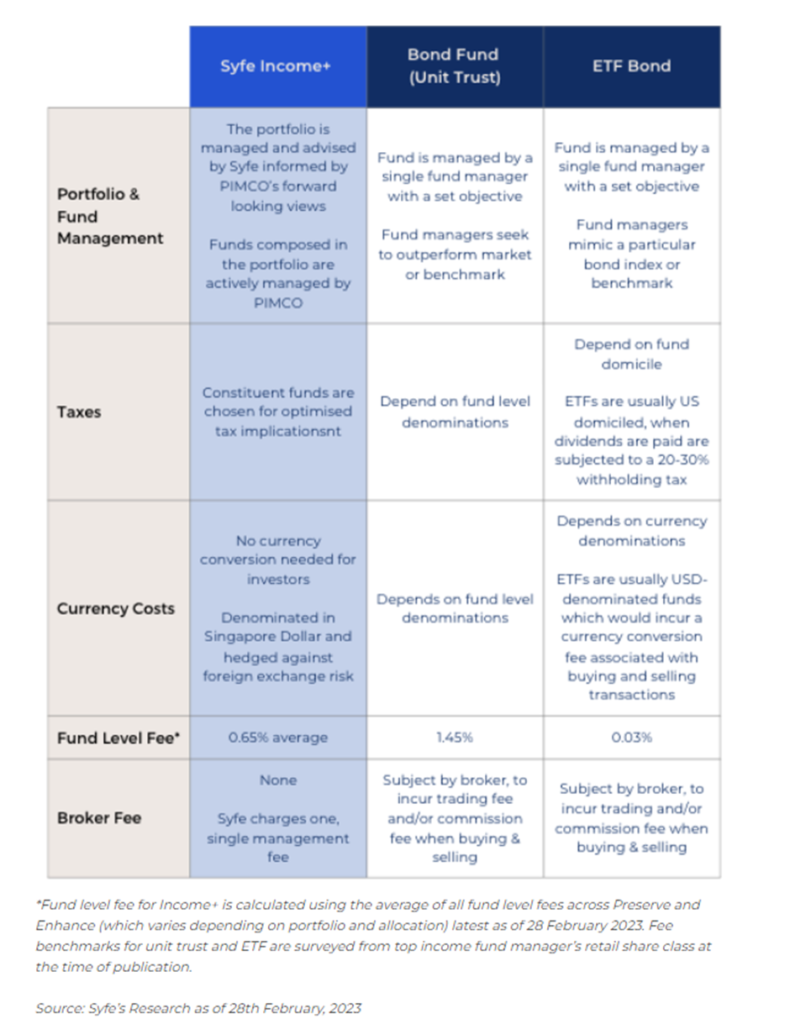

The table below is taken from Syfe’s website, which highlights the differences between its Income+ offering vs. a bond fund (unit trust) vs. Bond ETF.

One area which I like to bring to readers’ attention is that of tax savings.

Tax efficiency

The issue with US-domiciled bond ETFs, in my opinion, is that investors based here in Singapore are often subject to a 30% dividend withholding tax. This greatly reduces the appeal of a dividend-focused or yield-focused strategy using US-based investment products.

On the other hand, the funds used in the Income+ portfolios are domiciled in Ireland, which makes that more efficient with respect to dividend withholding tax for a Singaporean investor, where the taxes might be from 0-15% (depending on the type of assets held in the various PIMCO funds)

SGD-Hedged

This provides greater payout visibility for investors as they are not directly affected by the negative movements seen in foreign currencies, mainly USD. In an unhedged USD-denominated ETF, for example, a substantial decline in the US dollar vs. SGD will result in a lower payment after translation. This could cause disruptions in the ongoing income needs of clients.

Portfolio Composition

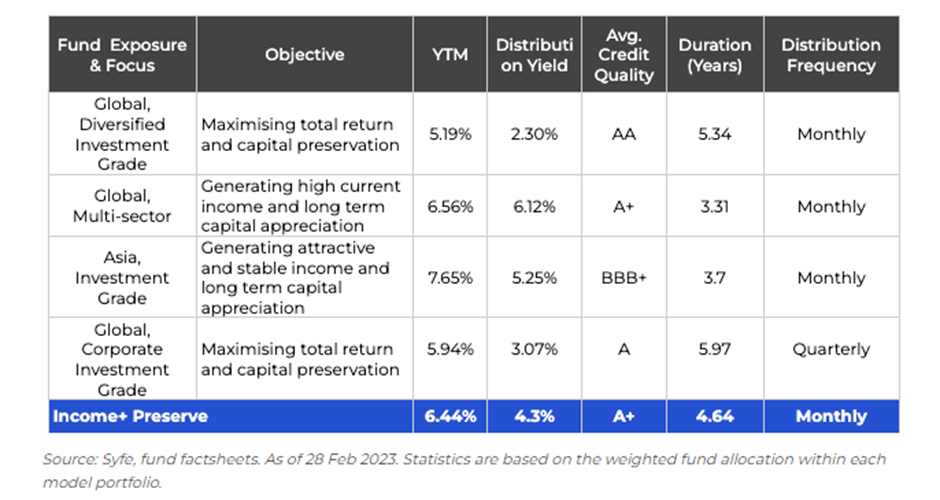

Income+ Preserve

This is the more “conservative” offering, with a YTM of 6.44% and a forecasted distribution yield of 4.3%. The YTM figure (6.44%) can only be achieved when a bond investor holds the bond fund in question to maturity and there are no defaults by any of the entities in that bond fund (aka credit risks).

The distribution yield, as estimated by Syfe and PIMCO, is a much lower figure at 4.3% to reflect the actual dividend payments received by the fund based on the historical distribution amount.

This distribution yield would likely have already taken into consideration the fund level fee that PIMCO charges to manage the fund (this is, however, dependent on fund and share class).

The distribution yield is the figure that investors should use to gauge the approx. monthly payout received.

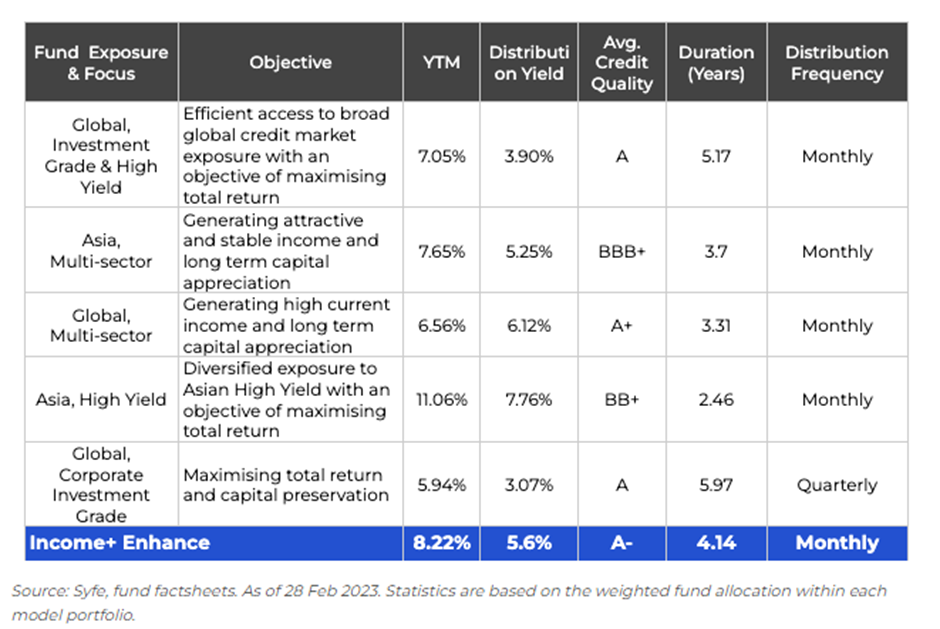

Income+ Enhance

The Income+ Enhance has a higher yield vs. Income+ Preserve due to the presence of various high-yield funds.

Higher Yield = Higher Risk. So, while investors get to enjoy the higher distribution yield of 5.6% for Enhance vs. 4.3% for Preserve (do note that these are all projected distribution yields and not fixed or guaranteed in any way), there is a higher element of credit risks involved here where riskier bonds that the fund holds might default.

In such a scenario, not only will the distribution payment be affected, but the overall net asset of the fund will also be negatively impacted if the principal payment is at risk.

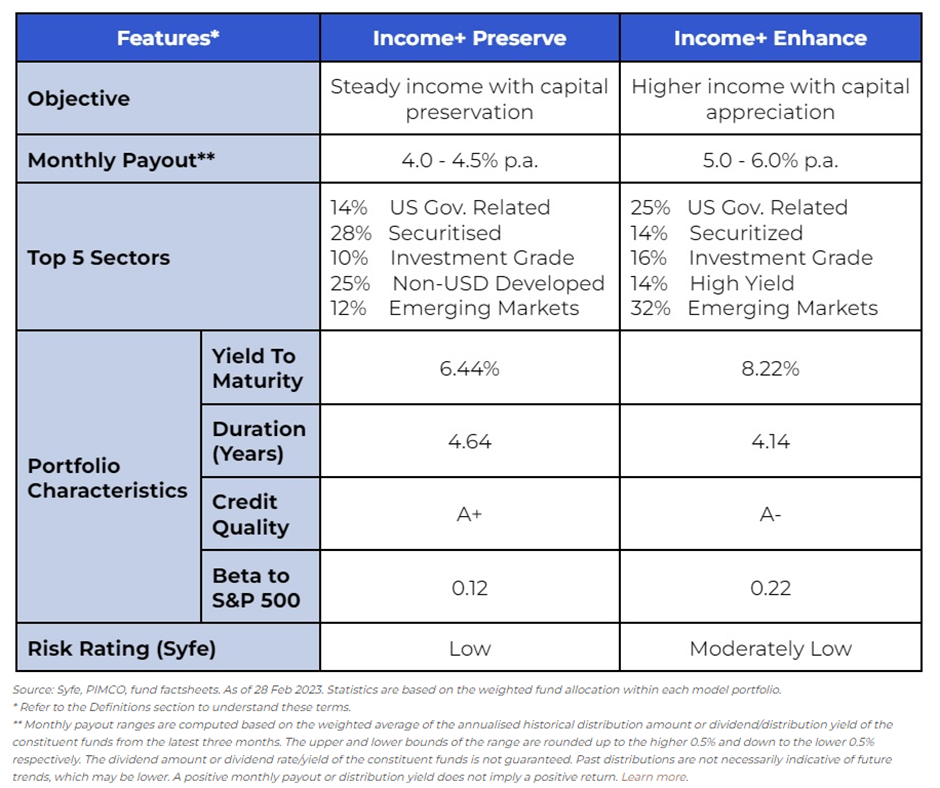

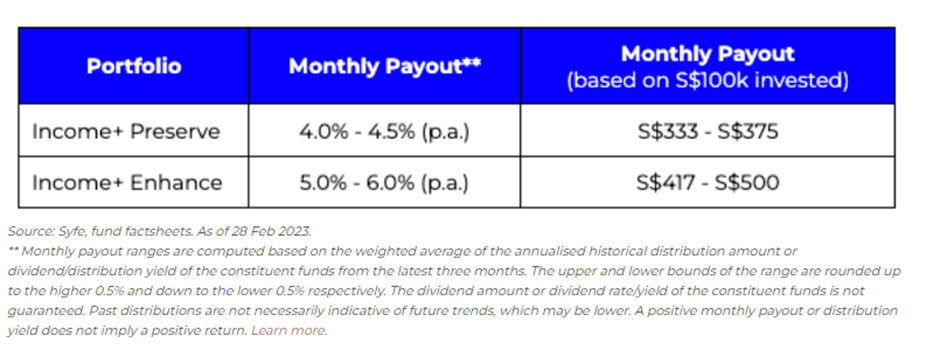

The table provides a quick comparison of the 2 Income+ offerings by Syfe.

Monthly Payouts or Reinvest

Both of the Income+ options aim to pay monthly dividend distributions directly to the client’s bank account.

There is a minimum funding threshold of $5,000 for clients to enable payouts for their Income+ portfolios.

If the funds fall below $5,000, the portfolios will default to automatic dividend reinvestments.

Clients will also have the option to switch between monthly payout and auto dividend reinvestments, depending on their immediate income needs.

The table below shows the projected monthly payout amount based on an assumed investment of $100k

Pricing and Fees

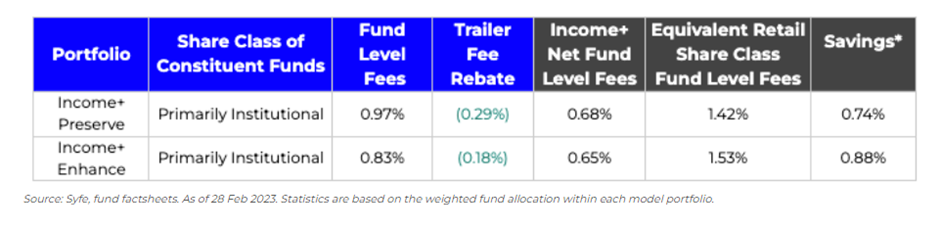

As this is an active portfolio managed by PIMCO, one should expect that the fees charged will be higher than the typical passively-managed ETFs.

In this case, after the rebate, the net fees are approx. 0.65-0.68% for the Income+ products.

However, do note that there is another layer of fees that investors will need to pay: platform/management fees charged by Syfe since this is considered a managed product.

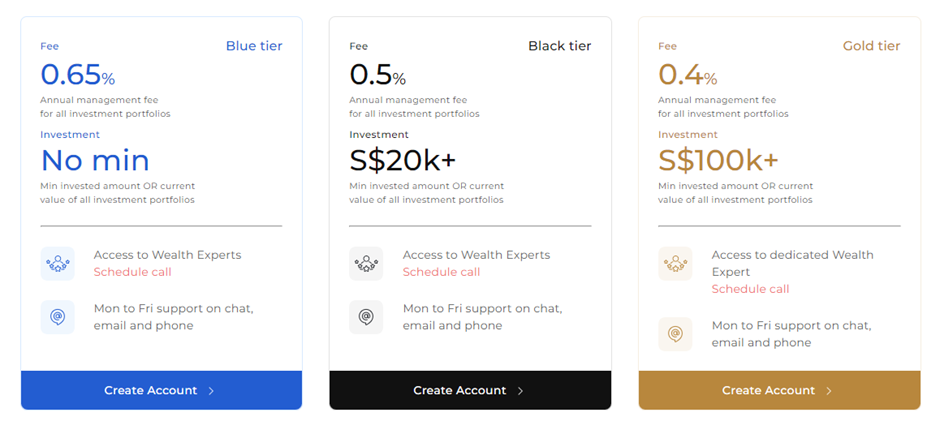

The table below shows the charges that will be incurred depending on the asset you have under management with Syfe.

As I mentioned earlier, the fund-level fees charged by PIMCO have already been accounted for in the projected distribution yield.

However, Syfe’s management fees need to be accounted for as well and in this case, assuming one falls under the Blue Tier category, the management fee will be at 0.65%/annum.

This will reduce the overall net projected distribution yield after all fees have been accounted for to approx. 3.65% to 4.95% (based on the original projected distribution yield of 4.3% and 5.6%) for Preserve and Enhance, respectively.

Is this still an attractive proposition after net of all fees?

Cash+ vs. Income+

To be honest here, for the risk involved in the Income+ products (which by the way are NOT capital guaranteed), there might be safer alternatives for a similar yield.

Take for example its Cash+ offering, which is Syfe’s cash management solution for clients. The current projected yield for Cash+ is 3.5% (after accounting for all fees). This amount is accrued daily.

The funds held for its Cash+ offering are vested mainly into money market funds and enhanced liquidity funds managed by Lion Global. Suffice to say, the risk level is much lower here vs. Income+ funds, in my view, even if Cash+ is also not capital guaranteed.

And since interests are accrued daily, there is also no need to wait for “monthly” payouts.

If one is to compare Income+ Preserve with Cash+, the former does not offer much more net yield to compensate investors for the risk taken.

One will need to make a judgment if the “riskier” Enhance offering, with a projected net yield of 4.95% after all fees have been accounted for, is a better solution, based on one’s risk appetite.

While funds in Cash+ are unlikely to see substantial capital appreciation when interest rates decline, given that they are mainly money market funds, Income+ could see substantial capital gain when global interest rates start to decline.

Income+ vs. SSBs vs. T-Bills vs. Fixed Deposits

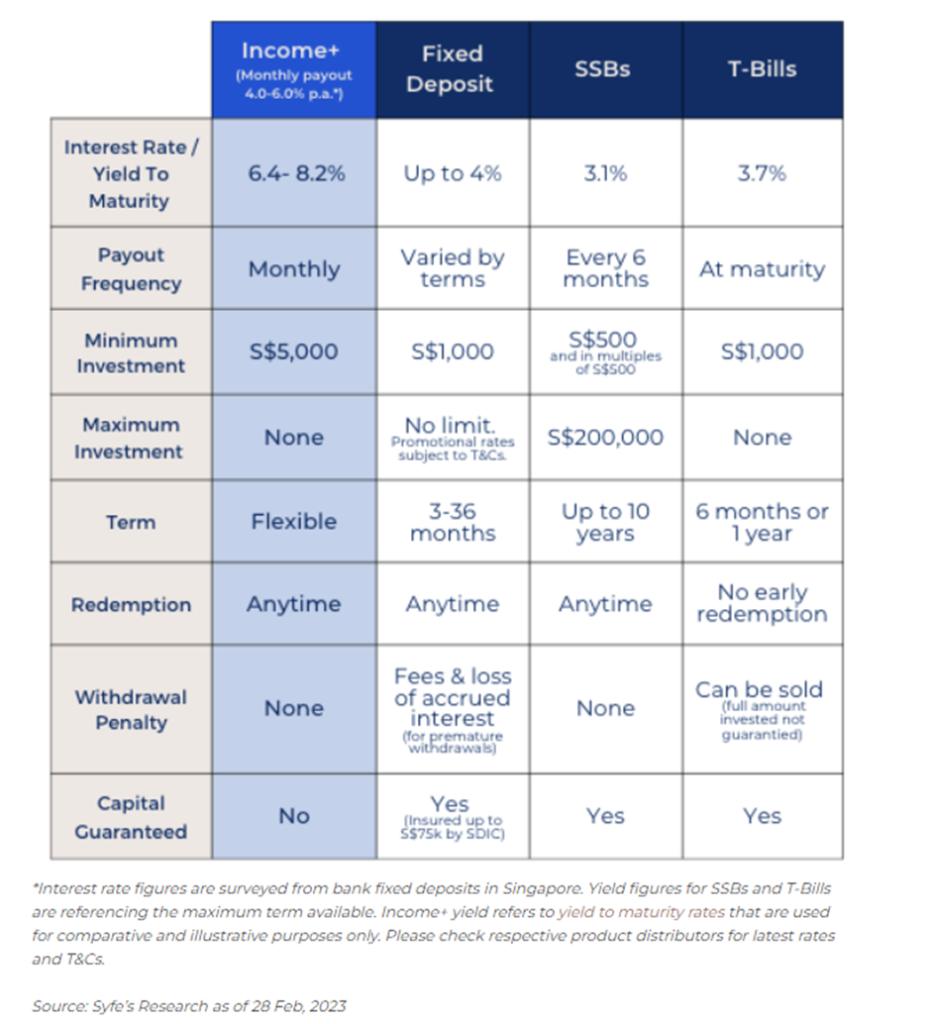

Syfe has done a nice summary on the salient differences between its Income+ product vs. higher-yielding cash alternatives which are increasing in popularity, such as SSBs, T-Bills, and Fixed Deposits.

While it is theoretically not wrong for Syfe to state that its projected Yield to Maturity is 6.4-8.2%, this is unlikely what investors will achieve (in the short term) and the more relevant figures will be the monthly projected distribution yield of 4.0-6.0%.

This, however, has yet to take into account the management fee incurred by Syfe.

One key difference between Income+ and all the other cash alternatives highlighted in the table above is that for the higher yield that Income+ offers, one will need to be ready to take on higher risks.

The risks can be related to interest rate risk such as when rates move higher, bond prices will move in the inverse direction (ie fall). This will reduce the bond value in the fund and consequently a reduction in capital.

The magnitude of the decline is usually measured by the duration of the bond fund. Hence, using Income+ Preserve as an example, if interest rates increase by 1%, one should expect the value of the fund to decline by approximately 4.64%.

The inverse, however, is also true when interest rate declines which will lead to an increase in bond value. This will translate to capital gain.

Another major risk could be credit-related risks where bond assets held by the funds default on their payments or when principal losses occur. This will also lead to capital losses for investors. Since the PIMCO funds invest in high-yield (BB+ = speculative) bond products, this is a risk that cannot be ignored.

Fixed Deposits, SSBs, and T-Bills are generally seen as ultra-safe products with almost zero risk of capital losses.

Another area of difference is that for Income+, the terms are pretty flexible and there is no “lock-up” period. T-Bills for example do not allow for early redemption and while fixed deposits and SSBs allow for early redemptions, it could result in the loss of fees and accrued interests.

Since Income+ pays out monthly, such risks are lower.

No CPF or SRS solution

Unfortunately, for those looking to use one’s CPF or SRS monies to invest in Income+, this solution is not available.

It is highly unlikely that one’s CPF OA/SA funds can be used to invest in Income+ products, in the foreseeable future.

However, there is a possibility that SRS funds might be available for deployment ahead.

For now, investors have to use cash to invest in Syfe Income+.

Is Income+ for you?

It is good that Syfe is taking the initiative to offer clients a higher-yielding solution in the current rising rate + inflationary environment, where we all need to make our money work harder for us.

Is Income+ the right solution for you? Possibly if you are comfortable in taking on higher risks (just like how other high-risk cash solutions are being offered by other Robo Advisory platforms).

However, if one is more conservative and does not wish to risk any form of potential capital losses, then this product might not be that suitable and there are other safer high-yielding cash alternatives, such as Syfe’s own Cash+.

This product will likely appeal to investors who wish to receive a steady stream of monthly income (that can be automatically credited into one’s bank account) while maintaining capital preservation.

One key area, however, that might significantly enhance the attractiveness of Income+ is the potential for substantial capital gain when interest rates drop (current expectations are that interest rates have peaked out).

For those who have a strong opinion that interest rates have indeed peaked and that rate cuts are on the horizon, then this high-yield product might just be the ideal asset for you.

This will, however, be a topic for another day.

Syfe’s Promotion

Syfe currently has a promotion to celebrate the launch of Income+ and will look to rebate clients their management fees based on the amount invested (min amount of $10,000). See the table below:

For more information on the terms and conditions of this new promotion, please refer to their website here.

Sign Up Benefits Through NAOF

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.