Pricing Power Stocks

Warren Buffett once said: “If you have got the power to raise prices without losing business to a competitor, you have got a very good business. And if you need a prayer session before raising the price by a tenth of a cent, you have got a terrible business.”

What Warren Buffett is referring to is a company’s pricing power, which is one of the best indicators of long-term competitive advantage. It is, however, not always that easy to spot a company with pricing power.

A quick and easy method (but not exactly foolproof) to spot if a company has got pricing power is simply to observe its gross margin trend. When a company can raise its per-unit revenue faster than the associated cost, it does indicate a certain degree of pricing power. This will translate into stronger gross margins over time.

Companies which can do that consistently, ie achieving real pricing power (raising prices above inflation) will be able to navigate an inflationary climate much better than those companies who are held “ransom” by rising costs.

Inflation starting to be a “cause for concern”?

Fed chair Jerome Powell, who has always maintained that the current US inflation status is a “transitory” phenomenon did acknowledge recently in his speech that inflation “is a cause for concern”.

A CNBC report recently highlighted that 2 major factors have popped up that could add to the Fed’s inflation worries.

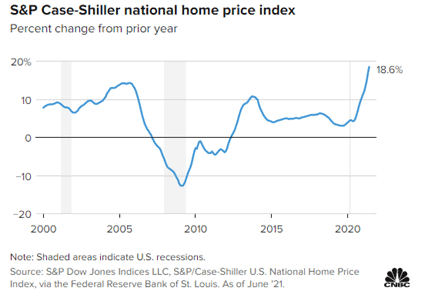

The first is home prices in the US. The S&P/Case-Shiller index, which measures home prices across 20 major US cities, rose 1.77% in June, bring the YoY gain to a staggering 19.1%. That’s the largest jump in the series’ history going back to 1987.

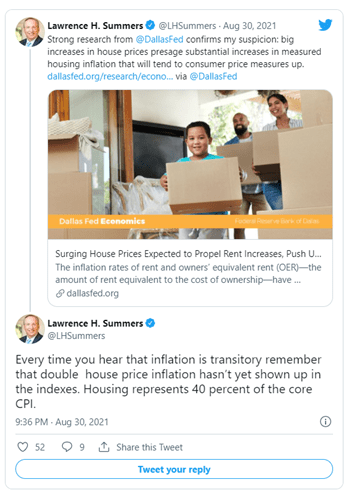

Lawrence H.Summers, former Treasury Secretary and Obama White House economic advisors said in a recent tweet: “Every time you hear that inflation is transitory remember that double house price inflation hasn’t yet shown up in the indexes. Housing represents 40% of the core CPI”.

The second factor is consumer inflation expectations. According to The Conference Board, consumer inflation expectations ticked higher again, with respondents to the survey now seeing the metric running at 6.8% 12 months from now.

Whether inflation is going to be a persistent problem or just a transitory phenomenon, time will tell. However, it makes sense to be prepared if the inflationary scenario does indeed “run out of control”.

There are several ways to get protection from rising inflation, ranging from buying TIPS, getting into commodities such as Gold (which has historically served as a good inflation hedge), buying hard assets with defined supply such as real estate as well as selecting stocks with good pricing power.

We will be focusing on stocks with good pricing power in this article.

Focus on price makers, not price takers

Price makers are companies that can leverage competitive advantages including technological prowess and speed to market, to rapidly adjust prices in ways that keep pace with soaring input costs. Price makers often offer goods or services that are critical, but relatively low in cost compared to buyers’ overall budgets.

Price takers are those that typically have high leverage and the inability to pass through costs, including labor which is the largest factor in most of these companies’ cost structures. Consumer-product companies with unhedged input costs are likely to suffer, as could others with large lower-wage workforces and limited pricing power including retailers and health care services companies.

How to identify companies with strong pricing power

Earlier I highlighted that one can identify companies with strong pricing power by looking at their profitability margin trend, particularly on gross margins.

A rising gross margin trend could indicate that a company can raise its product/service prices in excess of rising costs.

That is a good sign.

Another quantitative factor could be observing a company’s returns on invested capital or ROIC for short. The ROIC metric is one of Warren Buffett’s favorite investing metrics and it shows the efficiency of a company.

The higher the ROIC figure, the more efficient a company is, which could also indicate the presence of pricing power

However, there are several restrictions on the ROIC metric. First, it could become artificially inflated due to cyclical conditions. For example, a cyclical company could be substantially loss-making in a down-market environment, thus driving its shareholders’ equity figure lower. When the cyclical environment turns in its favor, the rebound in profitability could translate to a high ROIC figure that could prove “transitory”.

Second, many other companies now also focus their capital outlays on intangible assets such as software and design, making it more difficult to quantify returns on investment than was the case when companies invested mostly in tangible assets and equipment.

Nonetheless, the trend of the gross margin and ROIC are 2 quantitative methods to easily identify a company with possibly strong pricing power.

Which are the companies with strong and weak pricing power?

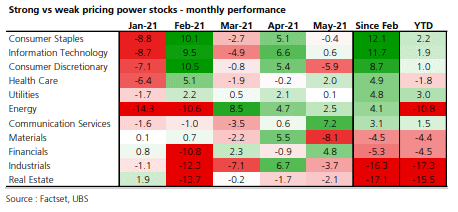

According to a UBS research report (as of June), strong pricing power has performed best in Staples, Tech and Consumer Discretionary as well as in large caps) vs. all caps.

UBS believes that inflation is typically beneficial for equities as a whole. However, when inflation rises too much and the correlation flips from being good to bad for equities, stocks that have greater ability to pass on higher prices should be better positioned to outperform.

UBS screened for stocks that demonstrate 1) strong pricing power and margin momentum and 2) those with weak pricing power and high input cost exposure.

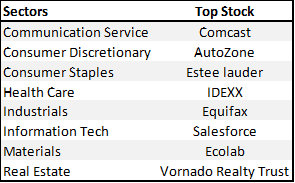

Here are the best stocks in each sector (exclude financials, Energy, and Utilities) with strong pricing power, according to UBS.

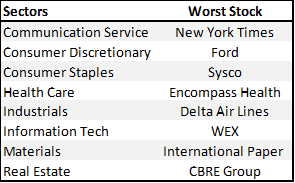

Here are the worst stocks in each sector with weak pricing power.

This is by no means a recommendation to buy or sell any of these counters but a reference point for further investigation.

NAOF strong pricing power companies

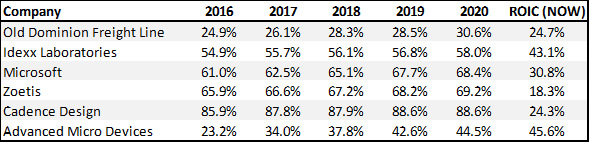

Earlier I highlighted finding strong pricing power companies using 2 metrics: 1) gross margin trend and 2) high ROIC.

I screened for companies with consecutive growth in gross margins over the past 5 years as well as companies with ROIC > of 15%.

6 blue-chip S&P 500 companies were identified in this list as companies fulfilling the criteria of gross margin growth for 5 years consecutively and having an ROIC ratio over 15%.

The 6 companies are:

Conclusion

Pricing power is particularly critical when evaluating if a company can “ride out” a high inflationary environment. Companies that can pass on higher raw material/input costs to their customers in the form of higher product/service prices are those with strong pricing power that one should keep a lookout for during inflationary periods.

While inflation might or might not get worst from here on, the stocks identified in this article as possessing strong pricing power should continue to witness operational improvement in both scenarios.

While there is no certainty that their prices will hold up or continue to appreciate when the inflation “monster” starts spooking the market, one should see it as an opportunity to buy these stocks on “your shopping list” when it is going at a discount.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only