Table of Contents

Small-cap semiconductor stocks

The semiconductor market has always been a cyclical industry with its fair share of ups and downs. When conditions are favorable, chipmakers have trouble keeping up with demand. This typically leads to over-investment in capital expenditure which will ultimately translate to supply exceeding demand and the resultant fall in chip prices and a scale-back in manufacturing and CAPEX. The cycle then repeats itself.

In this article, I will give a quick description of the semiconductor industry and identify 5 small-cap semiconductor stocks that have significantly outperformed the market in 2023. What have been the critical factor or factors that drove their share price performance this year and can that outperformance continue into 2023?

Additional Reading: Global semiconductor supply chain: Where are the opportunities?

Additional Reading: Valuations of different Semiconductor Industry Stocks?

What are semiconductors and why are they so important?

Semiconductors are substances with properties between that of a conductor (conducts electricity) and an insulator (does not conduct electricity). So, it conducts electricity better than an insulator such as glass, but less well than a pure conductor such as copper. Silicon is the most common semiconductor material used.

Semiconductors are so important because they are a requirement in products that we use every day such as our smartphones and laptops, electrical appliances, gaming hardware, and medical equipment, etc.

They also underpin massive emerging trends such as cloud computing, 5G wireless networks, and artificial intelligence.

That is why the US is so particular about gaining an edge over the semiconductor supply chain. In 2022, Joe Biden, President of the United States, signed the CHIPS Act to help boost domestic US semiconductor manufacturing ($52.7bn committed funding), an area that has been lagging semiconductor manufacturing powerhouse, Taiwan.

This is all in a bid to achieve semiconductor self-dependency.

2 main types of chips

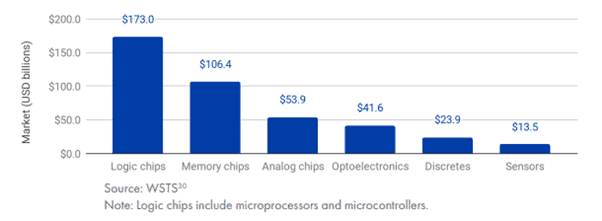

Semiconductors fall into 2 main product categories, memory chips, and logic chips although there are other categories such as Analog chips, Optoelectronics, Discretes, and sensors.

Memory chips

Memory chips store the digital data on which logic devices perform calculations. These chips are essential components in computers and electronic devices in which memory storage plays a key role. A popular memory chip acronym is DRAM (Dynamic Random Access Memory) as well as the term NAND that is often associated with flash drives.

DRAM provides storage of data while a computer operates but loses it when the computer powers down. By contrast, NAND flash memory stores data permanently.

Both these chips comprise 98% of the memory chip market which is estimated to have a $106bn market size in 2019. South Korea, the US, and Taiwan are the market leaders in the supply of memory chips while China is looking to play catch-up in this arena.

Logic Chips

The logic chip market is a fast-growing market that currently has an estimated market size of $173bn in 2019. Logic chips perform calculations on digital data (zeros and ones) to produce outputs.

They include microprocessors (CPUs), Graphics processing units (GPUs) often used for gaming, field-programmable gate arrays (FPGAs), and Application-specific integrated circuits for artificial intelligence (AI ASICs) where the likes of your Google, Tesla, and Intel are the dominant players in this field.

Types of semiconductor companies

Beyond the technicalities associated with semiconductor companies, with many new investors finding it difficult to differentiate between the thousands of semiconductor companies in the world, they can be broadly categorized into three main groups:

- Chip-equipment makers

- Foundries and integrated device manufacturers (IDM)

- Fabless chip companies

Chip equipment makers

The chip equipment makers are the ones who provide the equipment for chip manufacturing by the foundries to take place. Demand for their products is currently in high demand due to the shortage of chip manufacturing capacity.

This has benefited equipment makers such as Applied Materials, ASML, KLA, Lam Research, and Teradyne which are among the largest chip equipment maker in the world.

Foundries and IDMs

The chip equipment makers supply their manufacturing products to foundries such as TSMC or IDMs such as Intel. A foundry is a fabrication company that makes chips that are designed by 3rd party customers while an IDM is a company that makes chips out of its design.

The biggest foundries in the world are the likes of your TSMC, Samsung, Global Foundries, SMIC, UMC, Powerchip, and Hua Hong

The biggest IDMs are the likes of Intel, Samsung, SK Hynix, and Micron.

Fabless chip design companies

A fabless chip design company such as Advanced Micro Devices (AMD) is one where the company designs its chip for sale but does not do the actual fabrication work. Instead, it outsources that work to a foundry company such as TSMC.

Some of the biggest fabless chip design companies include AMD, Nvidia, Qualcomm, Broadcom, MediaTek, and Apple, etc.

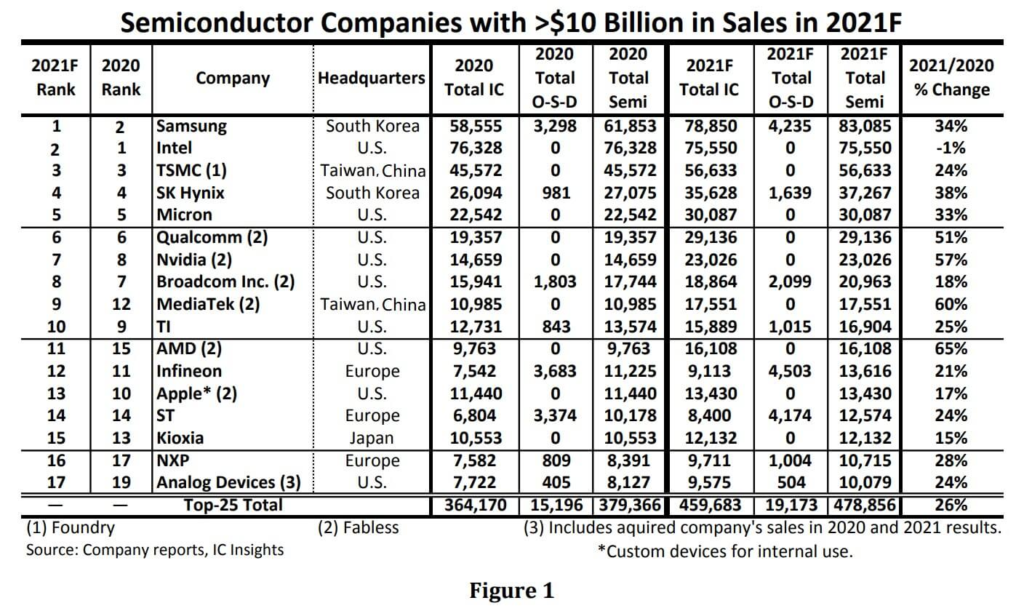

The table below illustrates the Top Semiconductor sales leaders in 2021

The above is a simple introduction to the semiconductor industry which can be a lot more complicated vs. the simplified version that I seek to explain.

With that basic introduction, let us take a look at which are the 5 small-cap semiconductor stocks to buy that you likely would not have heard of but have generated relatively strong returns in 2023.

Additional Reading: ASML. Is it too late to buy this top semiconductor stock?

Top small-cap semiconductor stocks #1: Axcelis Technologies (ACLS)

Market Cap: $4.2bn

YTD 2023 returns: 61%

ACLS is a company that designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips, an important element in the semiconductor manufacturing process. In addition to equipment, the company provides aftermarket lifecycle products and services, including used tools, spare parts, equipment upgrades, maintenance services, and customer training to other semiconductor manufacturers.

ACLS is essentially a company that falls under the broad category of chip equipment manufacturers, competing against the likes of market leaders such as ASML, AMAT, Lam Research, etc. Needless to say, this particular sub-industry has witnessed strong demand from foundries and IDMs expanding their capacity in 2022.

The company is one of the top firms when it comes to high-voltage ion implantation, with other players in this category being AMAT, SMIT (Japan), and CETC (China).

Most covering analysts (just 6) are bullish on the counter with an average target price of $145.33 vs. its current price of $128.

Top small-cap semiconductor stocks #2: Camtek (CAMT)

Market Cap: $1.2bn

YTD 2023 returns: 24.5%

CAMT is engaged in the manufacturing of metrology and inspection equipment and is a provider of software solutions serving Advanced Packaging, Memory, (complementary metal-oxide semiconductor) CMOS Image Sensors, (micro-electro-mechanical systems) MEMS, RF, and others.

Geographically, it derives maximum revenue from the Asia Pacific followed by the United States and Europe. The company’s products and services include Surface Inspection, Bump Inspection Metrology, and others.

Metrology and inspection which CAMT specializes in falls under the process control market which is dominated by the likes of KLAC and ASML, companies that are the market leaders in this area.

Process control tools monitor wafers, photomasks, and the overall chip manufacturing process to ensure consistency and low manufacturing error rates. Accordingly, they are among the most essential and valuable tools after lithography tools.

Another chip equipment manufacturer, CAMT has seen very steady revenue growth since 2015, increasing its revenue from $69m in that year to $313m in 2022F. While sales growth is expected to decline in 2023, the upward trend could continue from 2024 onwards, based on the street’s estimates.

Most analysts on the street have a neutral to a slightly positive outlook on the counter.

Top small-cap semiconductor stocks #3: Indie Semiconductor (INDI)

Market Cap: $1.4bn

YTD 2023 returns: 82%

Indie Semiconductor Inc is empowering the Autotech revolution with next-generation automotive semiconductors and software platforms.

It focuses on edge sensors for Advanced Driver Assistance Systems including LiDAR, connected cars, user experience, and electrification applications.

These technologies represent the core underpinnings of both electric and autonomous vehicles, while the advanced user interfaces transform the in-cabin experience to mirror and seamlessly connect to mobile platforms.

This is a small-cap name that doesn’t have a long listing history, with a SPAC listing back in 2021. The company generated just $48m in revenue in 2021 but is expected to double that figure to almost $100 in 2022, again doubling to $250m in 2023 and to $400m in 2024, according to the street’s expectations.

This explains why the counter saw strong price appreciation since the start of 2023.

However, do note that this is a loss-making small-cap semiconductor play which could easily see its share price collapse in a big way if forward sales guidance disappoints. The street is however wildly positive on the stock, giving it a close to 50% upside from its current price level.

For investors who are adventurous enough, this is one hyper growth small cap semiconductor stock to add to your portfolio.

Top small-cap semiconductor stocks #4: Kulicke & Soffa (KLIC)

Market Cap: $2.9bn

YTD 2023 returns: 17.3%

Kulicke & Soffa Industries Inc is a United States-based company that is principally engaged in designing, manufacturing, and selling capital equipment and expendable tools that are used for assembling semiconductor devices.

The company operates through two core segments: Capital equipment, which produces and sells a series of ball bonders, wafer-level bonders, wedge bonders, and APS which produces and offers various expendable tools designed for multiple semiconductor packaging applications.

The company generates the majority of its total revenue from the overseas market, mainly in the Asia-Pacific region. It also has an office here in Singapore.

The company has seen sales slowed significantly since peaking at $1.7bn in 2021 and is only expected to generate sales of $800+m this year, growing to $1bn in 2024. Nonetheless, the company is a profitable outfit and is expected to grow its earnings by 20 %/annum on average over the next 5 years.

Top small-cap semiconductor stocks #5: AEHR Test Systems (AEHR)

Market Cap: $0.9bn

YTD 2023 returns: 57%

The smallest cap name in this list, Aehr Test Systems is engaged in test systems for burning-in and testing logic, optical, and memory integrated circuits.

Increased quality and reliability needs of the Automotive and Mobility integrated circuit markets are driving additional test requirements, incremental capacity needs, and new opportunities for the company’s products in package, wafer level, and singulated die/module level tests.

Its share price has done very well in YTD 2023, appreciating 57%. This is likely the result of double-digit sales growth expectations for both 2023 and 2024, and long-term earnings growing at 20%/annum, albeit from a very low base where the company just turned profitable in 2021.

These are the potential small-cap semiconductor stocks for your portfolio consideration. Do, however, note the elevated risks associated with these smaller-cap names. While they could easily double or triple your returns over a short period of time, these stocks could also easily “disappear” in the next semiconductor industry downturn.

Looking at more stable semiconductor stocks?

The semiconductor industry is a fascinating one dominated by a few big and popular names, the largest being TSMC, Nvidia, and ASML. Many of these semiconductor stocks saw their share prices battered in 2022 but recovered strongly in 2023.

I have added to semiconductor names such as ASML, NVDA, Skyworks, TSMC etc in my Stock Alpha Blueprint, a portfolio in which I seek to invest in some of the best blue-chip stocks at the RIGHT time, often when they are being ignored by the street.

For those who are interested to learn a simple stock screening process to find the best blue-chip stocks trading at the right price, do click on the button below for more information pertaining to the Alpha Blueprint Course.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only