Sheng Siong is expected to report its 3Q19 results around 30 October. The company, with its defensive business model, has generally been well-liked by the market, with the exception of Maybank, which currently rates the counter a sell.

Despite current market volatility induced by US-China trade tension, Sheng Siong’s domestic grocery business has been relatively unaffected.

The company’s 1H19 performance had been credible, with net profit of SGD37.8m, 6.8% higher than 1H18 and generally within the street’s expectations.

For 2019, the market is expecting Sheng Siong to generate net profit of between c.SGD75m to c.SGD77m, representing approximately 6-9% YoY improvement.

[UPDATE]: Please see comments section for brief commentary on Sheng Siong’s 3Q19 results which was just released.

What the market might be looking out for in its 3Q19 results

If Sheng Siong manages to generate net profit growth of c.5-8%, that should be generally in-line with market expectations and we should expect the counter’s share price to maintain steady with an upward bias.

However, if the counter demonstrates flat to negative YoY growth, then there could be downside pressure on its current share price of SGD1.14.

According to Maybank, which is the only broker in the street with a SELL call on Sheng Siong, the company is faced with intense competition from online grocery players as well as the shift towards ready meals as a substitution to home-cooked food.

Hence, the analyst believes that sales and profits could disappoint in the coming quarter/year results due to 1) higher food costs that cannot be passed on to consumers due to elevated competition as well as the 2) changing consumer habits to dine out more often/engage food delivery services vs. home-cooked meals.

DBS on the other hand, in its 2Q19 post results report on the company, believes that online grocery retail is not a serious threat to Sheng Siong for now as the company’s target market is less of the millennials who are more open to online grocery shopping.

The broker believes that a potential positive catalysts could be an M&A deal where Sheng Siong is being acquired by the large online players such as Alibaba’s Hema and Amazon (Wholefood).

Below are 4 key areas which we believe the market will be focus on.

1. New stores outlet should continue to drive revenue

Most in the street believes that Sheng Siong’s new stores opening will continue to drive its revenue ahead. 3 new stores that were opened in May 2019 will likely show stronger contributions to the Group’s top-line while the 10 new stores opened back in 2018 should be at the tail-end of their gestation period and will likely start contributing positively to both top and bottom-line of the Group.

The company has also been actively tendering for new stores in 2Q19 (according to CIMB, the company bidded for 6 new stores in 2Q19) and if they are to win at least half of these tenders, it will be viewed favorably by the market in terms of both revenue and earnings visibility as we head into 2020.

2. Same Store Sales Growth stabilising

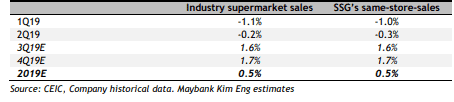

While same store sales growth (SSSG) has been negative over the past 3 quarters, the decline has moderated significantly from -1.0% in 1Q19 to -0.3% in 2Q19.

According to Maybank’s (most bearish broker) forecast, industry supermarket sales is expected to turn positive in 3Q19, registering a 1.6% YoY improvement. This is followed by a 1.7% improvement in 4Q19.

If SSSG can turn positive in 3Q19, that will be another positive trend for the company.

3. Gross Profit margin holding up

Sheng Siong’s gross profit margin (GPM) has been trending higher over the past couple of years (2017: 26.2%; 2018:26.8%) and the consensus is that the company’s gross margins can hold up or continue to show marginal improvement in the years ahead.

Sheng Siong’s GPM was 26.5% in 3Q18. If the company can register GPM closer to the 27% mark in 3Q19, that will be seen as a major positive by the street.

This is possible if product mix starts shifting towards fresh products which commands higher GPM of c.30% vs. c.20% non-fresh grocery products. The current mix is approx. 40% fresh and 60% non-fresh.

4. Expansion into China

The street might also be on the look out for more updates pertaining to its expansion foray into China.

The company’s first store in Kunming has broken even in 1Q19 with a second store already opened in June 2019.

It will be interesting to find out more about the developments in China and if management has plans to be more aggressive.

Despite huge market potential, China tends to be a challenging market for foreign players to venture into. Sheng Siong has taken a cautious approach in its China expansion plan and so far this has pan out well, with losses (if any) well controlled.

Comparatively, Raffles Medical, which has expanded into China in a major way, is now suffering the short-term consequence of earnings draw-down from China losses.

Conclusion:

The market is likely expecting Sheng Siong to announce YoY earnings growth of 5-8% when it reports 3Q19 results around 30 October.

Confirmation of new store wins will be seen as a positive catalyst, given future revenue and earnings visibility.

Stability/growth in GPM (around 27%) will be seen as another positive.

However, Sheng Siong’s share price could tumble below SGD1.10 if results disappoint the street, given that its valuation is currently on the high side.

Based on a market cap of approx SGD1.7bn and with full year 2019 earnings expectation of SGD76m (on average), the counter is trading at a PER of 22.4x, which is currently at 1-SD above its past 5-years trading band.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- VALUEMAX: A RECESSION PROOF BUSINESS BUT WE SEE 1 MAJOR RISK

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

- 46 STOCKS IN BUFFETT PORTFOLIO

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Sheng Siong 3Q19. 4 key areas to look out.”

Sheng Siong recorded a good set of 3Q19 results with its net profit up 16.4% YoY, likely above market expectations of 8%. This is attributable to stronger gross margins of 27.1% as well as new stores contributions, partially offset by still weak same store sales growth.

Management guided that they secured 3 new stores from the recent tenders which will be open progressively from Oct 2019 onwards. This is likely in-line with expectations. Total new stores secured so far amount to 6 outlets which will provide some revenue and earnings visibility in 2020.