Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Pure Play AI Stocks to buy

The hype on Artificial Intelligence or AI for short is gaining traction, following the introduction of ChatGPT, an AI Bot developed by OpenAI, where Microsoft has publicly announced a $10bn long-term partnership with the AI start-up.

ChatGPT has taken the world by storm, setting the record to reach 100 million monthly active users in a short span of just 2 months after its launch. The company is now offering a premium subscription of $20/month to monetize its existing user base.

Not to be outdone, Google just announced its own AI Bot, Bard A.I. in response to ChatGPT. This is shortly after it announced a US$400m investment into Anthropic

The race for AI is heating up and while many believe the AI story to be a structural growth theme good for the next decade, some investors/traders are capitalizing on the short-term momentum seen in some of these pure play AI stocks.

In this article, I will be highlighting some pure play AI stocks. This is definitely NOT a recommendation to be buying the pure play AI stocks highlighted here, as many of them are in a loss-making status and the risks associated with buying these stocks are extremely high.

Their payback, however, if you get their timing right, could be significant.

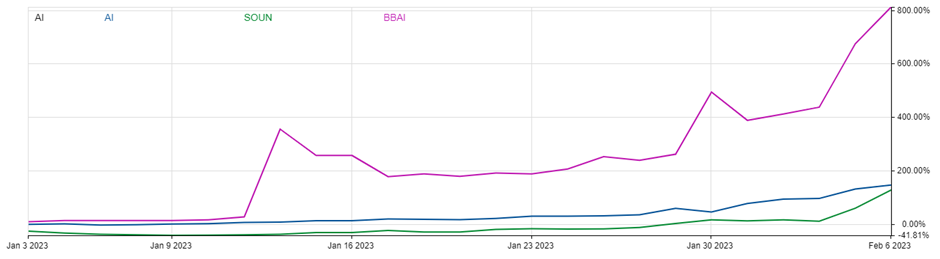

3 Stocks with “AI” in them are soaring

The current AI-hyped is reminiscent of the meme-stocks, cannabis, and crypto/blockchain rally back in 2021. For investors expecting those stocks with a sexy story to shortly “rocket to the moon”, they sure have been disappointed.

AI-related stocks, especially those of penny status, are currently exhibiting the very same bullish sentiments. Is there going to be a happy ending for these stocks? Only time will tell.

Amid the current positive sentiments for all things AI, stocks with “AI” in them are soaring. The largest and most well-known of them is C3.AI (AI)

C3.AI currently boasts a market cap of $3bn and this company is seen as a pure play AI stock, with its first product being an enterprise search that allows companies to use chat-like functionality to search across all data systems in the company.

Google has also name-checked C3.ai as one of several partnerships using Google Cloud for scalability.

Another stock with AI in its name is Soundhound AI (SOUN), which saw its price sky-rocketed by 207% since the start of the year. This is a penny stock, last traded at $4.03/share and with a market cap of just ~US$800m.

The counter focused on AI speech recognition tools. The company has got a 100% buy rating from analysts covering the counter and analysts put its potential average upside at 31%.

The 3rd counter with AI in its name is BigBear.AI (BBAI) which has appreciated by a mind-boggling 740% since the start of the year.

While still of a penny status with its share price trading at $6.11/share, its market cap has ballooned from < $100m to $770m as of this writing. The counter was trading at < $1 on the day ChatGPT was launched.

The company offers “AI-powered” decision support software and came public via a merger with a SPAC back on Dec 21 at $10/share.

Both SOUN and BBAI have taken advantage of the rallies in their shares to sell more stock – SOUN sold $25m of preferred stock in January, while BBAI sold $25m of stock-and-warrant units at $1.80/share.

Is there going to be a fairy-tale ending for these pure play AI stocks that are still all loss-making in nature? If history is to repeat itself, the answer is NO.

Nonetheless, that is not to say that these stocks cannot continue to rally over the near term.

Investors/traders should however be mindful of the high-risk nature of such pure play AI stocks and only invest/trade money that you can afford to lose.

Case in point, all 3 counters have been heavily sold off yesterday (7 Feb 2023). AI was down 11%, SOUN was down 11% and BBAI was down 20%.

These stocks are not for the weak-hearted! I will look to propose other “safer” alternatives in the later segment.

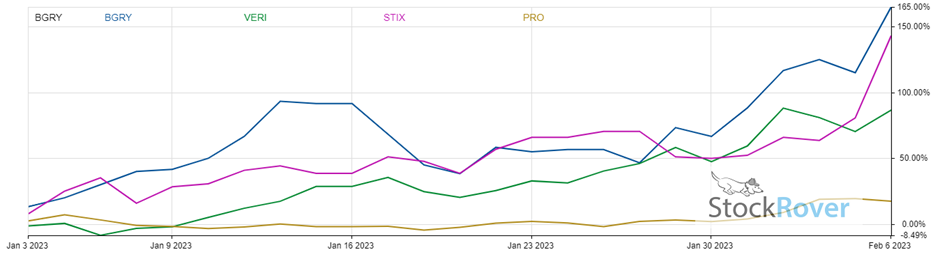

Other Under-the-Radar AI Stocks

Investors who can stomach volatility might wish to also take a look at these other under-the-radar AI stocks.

The first is Berkshire Grey (BGRY) which develops both AI and robotic tech. The company stood out for its high potential price target upside of> 150% and for having a buy rating from all analysts covering the stock (just 2 analysts are covering the stock though).

The second is Veritone (VERI), a company that provides a proprietary cloud-based digital asset management platform focused on leveraging AI technology and its benefits to the client in the media, politics, legal, and law enforcement industries.

The third is Semantix (STIX), a $172m company that focuses on Big Data, Analytics, AI, and Machine Learning. Despite the counter witnessing its share doubling since the start of the year, it is still one of the pure play AI stocks that remain under the radar.

The fourth is PROS Holdings (PRO), a company that provides AI-based software as a service (SaaS platform that optimizes every shopping and selling interaction, enabling companies to deliver personalized offers to buyers with speed, precision, and consistency.

China AI stocks also rallying

Baidu (BIDU) just announced that it is prepping for a ChatGPT-style “Ernie” bot for March and this has fired up some China AI stocks which have soared by double-digits in just a few weeks. For example, Beijing Deep Glint Technology Co (688207), a researcher of computer vision technology and big data analysis, is up close to 705 on a YTD basis.

Hanwang Technology Co (002362), a manufacturer of pattern recognition technology, has seen its share price appreciate by more than 100% YTD.

There has been a fervent pursuit of the ChatGPT concept in China, one of the countries that are most active in championing AI, with many large companies preparing to launch similar products. However, many of these companies are losing making in nature.

Their short-term rally might thus fade unless the price appreciation is supported by material progress by the firms in the coming months.

Where might the “safer” AI opportunities be right now?

Investors who are more risk-averse and do not wish to experience the extreme volatility associated with many of these pure play AI stocks, might wish to consider some of the bigger names leading the AI game, although they are not considered pure plays.

Some of the biggest and most well-known blue-chip stocks that have exposure to the AI theme are the likes of Nvidia, Microsoft, Meta, Alphabet, Baidu, Amazon, etc. These are the companies that are likely to be the biggest beneficiaries of AI in the long-term, just on the premise that they are unlikely to “go under”, unlike many of the loss-making pure play AI stocks in this list.

Microsoft/Alphabet are my personal favorites in this list and also counters I hold in the Alpha Blueprint Portfolio. This is a portfolio where I select high-quality blue-chip stocks that can withstand the test of time.

For those who wish to buy into a basket of AI-related names, one can consider the various AI-linked ETFs out there, 4 of the most popular being:

- Global X Robotics & Artificial Intelligence ETF (BOTZ), (0.68% expense ratio)

- Robo Global Robotics and Automation Index ETF (ROBO), (0.95% expense ratio)

- iShares Robotics and Artificial Intelligence ETF (IRBO) and, (0.47% expense ratio)

- First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT) (0.65% expense ratio)

All of the 4 ETFs above have generated double-digit returns on a YTD basis, outperforming the broader S&P 500 index. The best-performing one out of the 4 is IRBO, with YTD returns of 20.4%.

One can gain insights into some of the “niche” AI stocks by looking at the top holdings of these ETFs. For example, the top 5 holdings of the BOTZ ETF are 1) Intuitive Surgical (ISRG), 2) ABB Ltd (ABBN), 3) Keyence Corp (6861) 4) Fanuc Corp (6954), and 5) Nvidia (NVDA)

Many of those stocks deal with industrial-related automation, which is a subcategory of AI, a safer and fundamentally stronger way to play the AI evolution, in my opinion.

For an easy way to partake in AI-related ETFs, one I method which I deploy is to dollar cost average into a portfolio of thematic ETFs.

I personally use the Syfe Robo Advisor to dollar cost average into a portfolio of thematic ETFs, one of which is the BOTZ ETF.

For those who are interested to learn more about ETFs and which are some of the long-term thematic ETFs to partake in, do check out my FREE ETF Video Guide.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for education and reference only.