Finding efficient companies using the profit per employee metric

The Fortune 500 is an elite club of the biggest American businesses, which combined to generate over $31.7trn in revenue, based on the last survey done by Fortune. While it is Walmart that takes the pole position when it comes to generating the largest amount of revenue in a single financial year ($559bn), it is Apple which is the most profitable of them all (based on net income), generating a net income of $57bn (in 2019), according to data from Fortune.

While most companies measure their success primarily by the amount of revenue or profit, they generate, to get an even better idea of these companies’ efficiency, it will be interesting to see which of these companies are generating the most profit per employee.

Doing so shows us which companies are truly getting the best returns and which sectors have the most efficient employees.

Have these efficient large-cap companies also been consistently beating the S&P 500 in terms of their price-performance?

Profit per employee

Profit per employee is calculated by dividing the last twelve months of a company’s net income attributable to shareholders by the company’s number of full-time employees. A higher profit per employee ratio shows that a company is efficient in translating employee headcount and productivity into profitability, which makes profit per employee a good metric for measuring company success.

Without further ado, here are the Top 10 companies which generate the most net income on a trailing 12 months basis relative to the number of employees that they employ. (List from lowest net income/employee to highest)

I will also briefly look at the counter’s share price performance vs. the S&P 500 to evaluate if such efficiency has translated to greater price outperformance.

Most efficient company based on profit per employee #10: Everest Group (RE)

Trailing 12-months net income: $829m

Number of employees: 1,746

Net Income / employees: 474,800

Business Description

Everest Re, through its subsidiaries, underwrites an array of reinsurance and insurance products. Reinsurance is an arrangement whereby one or more insurance companies (the reinsurer) agree to indemnify another insurance company (the ceding company) for all or part of the insurance risk underwritten by the ceding company.

Reinsurance can provide a ceding company with several benefits, including a reduction in net liability on individual risks or classes or categories of risks; reduced exposure to losses from large-scale or catastrophic events; and/or assistance in maintaining acceptable financial ratios.

The company underwrites reinsurance through brokers and directly with ceding companies. It underwrites insurance principally through general agent relationships and surplus lines brokers.

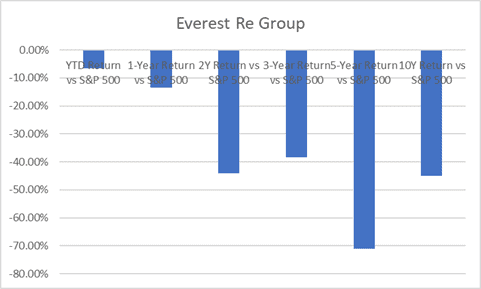

RE price performance vs. S&P 500

As can be seen from the table above, RE has consistently underperformed the S&P 500 in terms of share price despite the company being one of the most efficient blue-chip companies in the world.

This is likely due to the nature of its business (reinsurance) and the fact that its net income generation has been pretty “haphazard” over the past decade.

Most efficient company based on profit per employee #9: Aflac (AFL)

Trailing 12-months net income: $5.806bn

Number of employees: 12,003

Net Income / employees: 483,712

Business Description

Aflac offers voluntary insurance policies in Japan and the United States that provide a layer of financial protection against income and asset loss. AFL Japan sells voluntary supplemental insurance products, including cancer plans, general medical indemnity plans, medical & sickness riders, care plans, living benefit life plans, ordinary life insurance plans, and annuities.

Aflac U.S. sells voluntary supplemental insurance products including products designed to protect individuals from depletion of assets (accident, cancer, critical illness/critical care, hospital intensive care, hospital indemnity, fixed benefit dental, and vision care plans) and loss-of-income products (life and short-term disability plans).

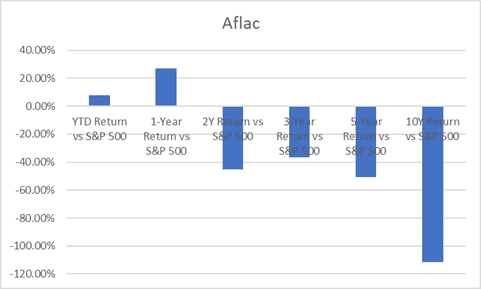

AFL price performance vs. S&P 500

While the performance of AFL has been rather credible over the past 1 year, outperforming the S&P 500’s returns by more than 20%, over a longer-term horizon, its underperformance remains pretty evident.

The recent strong outperformance could be a result of greater consistency in net income generation. While both AFL and RE operate in the insurance business, AFL has much higher earnings visibility than RE.

Most efficient company based on profit per employee #8: Bio-Rad Laboratories (BIO)

Trailing 12-months net income: $4.045bn

Number of employees: 8,000

Net Income / employees: 505,625

Business Description

Bio-Rad Laboratories, Inc. manufactures and supplies life science research, healthcare, analytical chemistry, and other markets with a range of products and systems used to separate chemical and biological materials and to identify, analyze and purify their components.

The Company operates through two segments: Life Science and Clinical Diagnostics. The life Science segment markets and develops manufactures and markets approximately 6,000 reagents, apparatus, and laboratory instruments.

Its products are used in research techniques, biopharmaceutical production processes, and food testing regimes.

The clinical Diagnostics segment designs, manufactures, sells, and supports test systems, informatics systems, test kits, and specialized quality controls that serve clinical laboratories in the global diagnostics market.

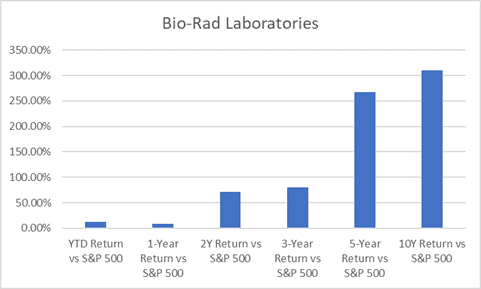

BIO price performance vs. S&P 500

BIO consistently generated strong outperformance vs the S&P 500 over the past decade. Besides its strong efficiency in terms of generating net profit per employee, the company has also been rather consistent in generating higher net profit since 2016.

That might be one major reason to explain its strong price performance vs. the market.

Most efficient company based on profit per employee #7: Visa (V)

Trailing 12-months net income: $10,864bn

Number of employees: 20,500

Net Income / employees: 529,951

Business Description

Visa Inc. (Visa) is a payments technology company that provides digital payments across more than 200 countries and territories. The Company connects consumers, merchants, financial institutions, businesses, strategic partners, and government entities to electronic payments. The Company operates through the payment services segment.

The Company’s transaction processing network, VisaNet, facilitates authorization, clearing, and settlement of payment transactions and enables it to provide its financial institution and merchant clients a range of products, platforms, and value-added services.

The Company is a retail electronic payment network based on payments volume, number of transactions, and number of cards in circulation. Its products/services include transaction processing services, Visa-branded payment products, including credit, debit, prepaid, and cash access programs for individual, business, and government account holders.

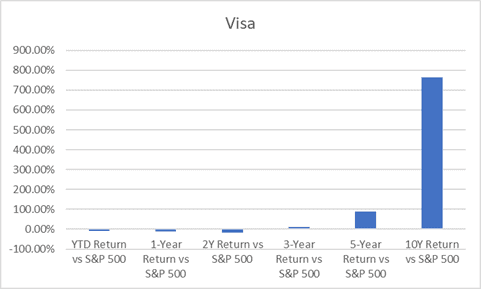

V price performance vs. S&P 500

Despite COVID-19 ravaging the tourism sector which is a major business segment for Visa, the company only marginally underperformed the market over the past 2 years which is pretty commendable. Over a 10-year horizon, this counter has been a massive outperformer vs. the S&P 500.

Most efficient company based on profit per employee #6: Cincinnati Financial (CINF)

Trailing 12-months net income: $2,856bn

Number of employees: 5,266

Net Income / employees: 542,347

Business Description

Cincinnati Financial Corporation is an insurance holding company. It operates through five segments: Commercial lines insurance, Personal lines insurance, Excess and surplus lines insurance, and Life insurance and Investments.

Its Commercial Lines Insurance Segment provides five commercial business lines: commercial casualty, commercial property, commercial auto, workers’ compensation, and other commercial lines.

Its personal lines property insurance segment writes personal lines coverage in accounts that include both auto and homeowner coverages, as well as coverages that are part of its other personal business line.

The excess and surplus lines Insurance segment covers business risks with characteristics, such as the nature of the business or its claim history that are difficult to profitably insure in the standard commercial lines market.

The life insurance business lines include term life insurance, universal life insurance, worksite products, and whole life insurance.

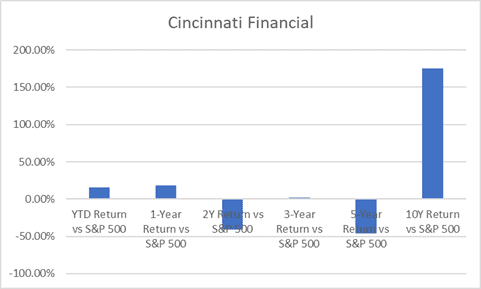

CINF price performance vs. S&P 500

Compared to fellow insurance companies in this list (RE and AFL), CINF has witnessed much stronger price performance over the past 1-year as well as a 10-year horizon.

Despite earnings volatility which is pretty common with insurance companies, CINF has been able to grow its free cash flow generation consistently over the past decade. The company has also been a steady dividend payer. That might be why CINF’s share price has been relatively more resilient vs. peers.

Most efficient company based on profit per employee #5: Vertex Pharmaceuticals

Trailing 12-months net income: $1,992bn

Number of employees: 3,400

Net Income / employees: 585,882

Business Description

Vertex Pharmaceuticals Incorporated is engaged in discovering, developing, manufacturing, and commercializing medicines for serious diseases.

The Company is focused on developing and commercializing therapies for the treatment of cystic fibrosis (CF) and advancing its research and development programs in other indications.

The Company’s marketed medicines are ORKAMBI and KALYDECO. ORKAMBI (lumacaftor in combination with ivacaftor) is approved as a treatment for patients having two copies (homozygous) of the Delta-F508 (F508del) mutation in their cystic fibrosis transmembrane conductance regulator (CFTR) gene.

KALYDECO (ivacaftor) is approved for the treatment of CF patients having the G551D mutation or other specified mutations in their CFTR gene.

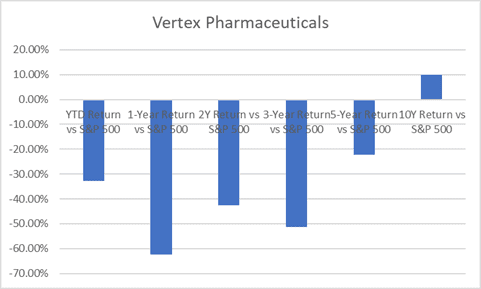

VRTX price performance vs. S&P 500

While the company has outperformed the market over the past 10-year horizon, its share price has been underperforming over a shorter horizon, as a result of earnings concern over its key product Trikafta.

Most efficient company based on profit per employee #4: Apple (AAPL)

Trailing 12-months net income: $86,802

Number of employees: 147,000

Net Income / employees: 590,490

Business Description

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company’s products include iPhone, Mac, iPad, and Wearables, Home, and Accessories.

iPhone is the Company’s line of smartphones based on its iOS operating system. Mac is the Company’s line of personal computers based on its macOS operating system. iPad is the Company’s line of multi-purpose tablets based on its iPadOS operating system.

Wearables, Home and Accessories includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories. AirPods are the Company’s wireless headphones that interact with Siri.

Apple Watch is the Company’s line of smartwatches. Its services include Advertising, AppleCare, Cloud Services, Digital Content and Payment Services.

Its customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets.

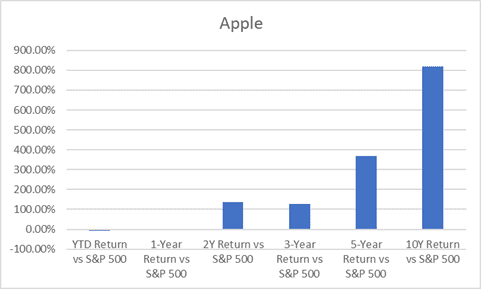

AAPL price performance vs. S&P 500

The largest market cap stock in the world, Apple is also currently the most profitable company in the world in terms of trailing 12-months net profit. The company also ranks as #4 in terms of efficiency when it comes to net profit generation per employee.

The stock’s 10-year outperformance vs. the market has been fantastic although that outperformance has tapered of late.

Most efficient company based on profit per employee #3: Facebook

Trailing 12-months net income: $38,957

Number of employees: 63,404

Net Income / employees: 614,425

Business Description

Facebook, Inc. is focused on building products that enable people to connect and share through mobile devices, personal computers virtual reality headsets, and in-home devices.

The Company’s products include Facebook, Instagram, Messenger, WhatsApp and Facebook Reality Labs.

Facebook enables people to connect, share, discover and communicate with each other on mobile devices and personal computers.

Instagram is a place where people can express themselves through photos, videos, and private messaging, and connect with and shop from their favorite businesses and creators.

Messenger is a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices.

WhatsApp is a messaging application that is used by people around the world to communicate and transact privately.

Its Facebook Reality Labs offers augmented and virtual reality products, which include Oculus virtual reality technology and content platform.

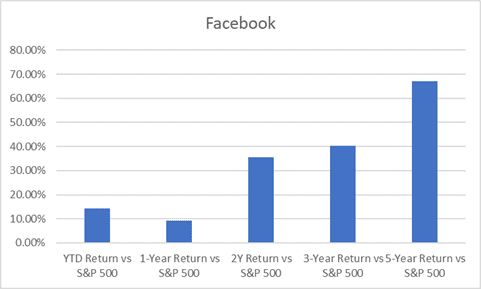

FB price performance vs. S&P 500

Facebook has been a serial price outperformer and the counter remains one of the cheaper big-tech stocks in the market currently. This is largely the result of earnings consistency where the company has managed to grow its earnings every single year (except 2018) over the past decade.

The counter ranks No. 3 in this list in terms of generating net profit for every employee.

Most efficient company based on profit per employee #2: Altria Group (MO)

Trailing 12-months net income: $4,536

Number of employees: 7,100

Net Income / employees: 638,873

Business Description

Altria Group, Inc. is a holding company. The Company’s segments include smokeable products, oral tobacco products and wine.

The Company’s subsidiaries include Philip Morris USA Inc. (PM USA), which is engaged in the manufacture and sale of cigarettes in the United States; John Middleton Co. (Middleton), which is engaged in the manufacture and sale of machine-made cigars and pipe tobacco, and UST LLC, which, through its subsidiaries, including U.S. Smokeless Tobacco Company LLC (USSTC) and Ste. Michelle Wine Estates Ltd. (Ste. Michelle), is engaged in the manufacture and sale of moist smokeless tobacco products, snus products and wine.

Its other operating companies include Philip Morris Capital Corporation, a subsidiary that maintains a portfolio of financial assets. The Company also owns an interest in Helix Innovations LLC, which is engaged in the manufacture and sale of oral nicotine pouches. Other subsidiaries include Altria Group Distribution Company and Altria Client Services LLC.

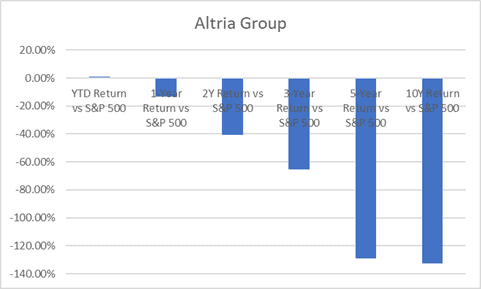

MO price performance vs. S&P 500

MO has underperformed the market every single year despite being ranked highly in this list, coming in at No. 2. The major reason for its underperformance is the weakness seen in its earnings, one which has been coming down consistently since 2016 as a result of margin reduction seen in its tobacco products.

Most efficient company based on profit per employee #1: Prologis (PLD)

Trailing 12-months net income: $1,544

Number of employees: 1,945

Net Income / employees: 793,830

Business Description

Prologis, Inc. is a real estate investment trust (REIT) company. The Company is involved in the logistics real estate business. It is engaged in the ownership, acquisition, development and management of logistics.

It invests in real estate and other entities through which it co-invests with partners and investors.

The Company’s segments include Real Estate Operations and Strategic Capital. The Real Estate Operations segment consists of ownership and development of logistics properties. The Company’s Strategic Capital segment includes management of unconsolidated co-investment ventures and other ventures.

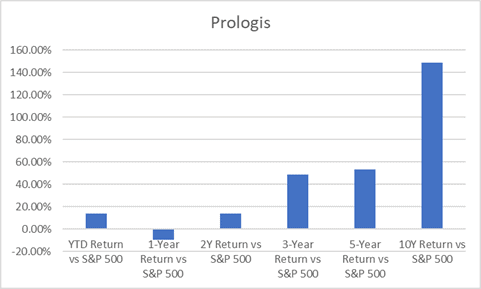

PLD price performance vs. S&P 500

PLD has been a steady market outperformer over the past decade. While earnings have not increased in a straight-line fashion, it is not fair to evaluate the company’s performances solely based on earnings as the company is a REIT, one where its EPS tend to be more volatile vs. operational cash, the latter being a better operational metric to evaluate a REIT’s performance.

PLD’s operational cash (and consequently free cash flow) has been steadily improving over the past 10-years and this has translated into strong share price performance.

Conclusion

Being an efficient company, one which generates a high level of net profit per employee is no guarantee of strong share price performances. In theory, such highly “efficient” companies can ramp up their head-count which should then translate to higher earnings.

However, as can be seen, 3 of the companies in this list are insurance-related companies, one where net profit generation is highly “variable” in nature, depending on the claims being made by the insured in any given year. This is not necessarily the type of business where one can generate higher sales by increasing its employee headcount.

Nonetheless, screening for “efficient companies” using the net profit per employee metric is a good starting point to identify companies that are also less “labor-intensive”. This is critical in an environment where labor cost is continually increasing and might result in margin pressure for an organization.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only