NET WORTH UPDATES – 2019

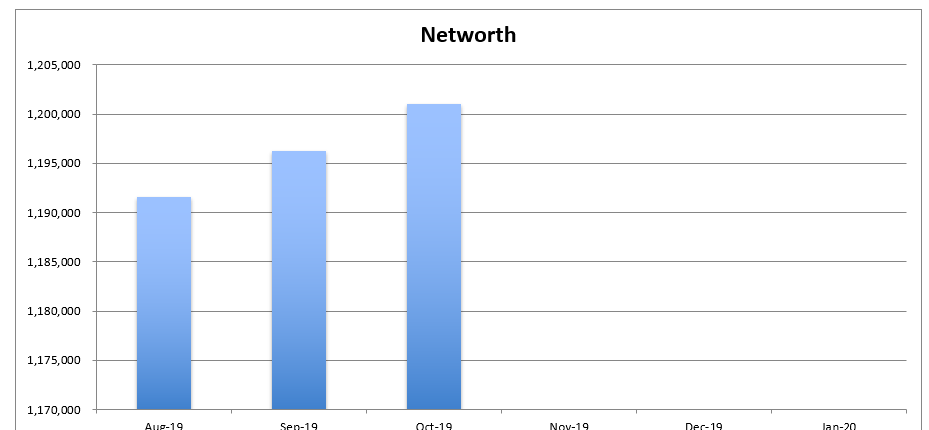

Net worth updates October, 2019 – $1.201m (+0.4%)

Hi all. Welcome to New Academy of Finance first portfolio and net worth report!

This is where we look to provide transparency in terms of our financial well-being. To be honest, its a little scary disclosing to the world what my household net-worth is like. I tend to be a pretty private person.

But since I have decided to embark on a new financial journey with the birth of this blog, me and the missus decide to challenge ourselves to provide as much financial information as possible as a means of accountability and HOPEFULLY inspiration to others.

September will be the very last month which I will be getting an income from my previous job, hence I am prepared for our Net Worth to take a hit over the coming months.

Ideally, we will like our net worth to be buffered by stronger investment performance. Due to the nature of my previous job (I am an equity analyst), I am not able to participate actively in the capital market as a result of compliance-related issues.

Hence most of the stocks currently in my/missus portfolio are legacy counters. There will be major changes over the coming months as I look to increasingly deploy more capital into the market.

Having said that, I remain extremely cautious of where the current global equity market stands.

OCTOBER STOCK PORTFOLIO UPDATE

There has not been much changes to the portfolio. I have not been spending much attention on restructuring my portfolio in the month of October. This is all set to change in November, where I will be looking to introduce various portfolio milestones in the quest to generate more passive income.

What to expect from November onwards

Starting RSP (Passive investing)

I will be gradually increasing my passive stock allocation through Regular Savings Plans. It will not be a significant amount at the start but I look to gradually increase my exposure in this area to eventually hit approx. 60% of my total portfolio allocation.

Me and the missus will be looking to further increase our RSP allocation to S$700/month (vs. S$200/month currently), allocated to the following assets: 1)ABF Singapore Bond ETF (S$300), 2)Nikko AM Singapore ETF (S$300) and 3)Robo advisor – International equity fund (S$100).

I have written extensively on passive income investing through a DIY approach and I believe the above set-up is one which is relatively low-cost in nature (<1.0% ALL-IN expenses) as well as provide a certain degree of portfolio diversification, in terms of both asset class and geographical allocation.

Increase exposure to local dividend-generating stocks (Active Investing)

I will be looking to increase my exposure to dividend-generating stock ideas (which I will also be blogging about) in a bid to generate recurring passive income. This is an area which I have been really lagging behind many savvy investors who have over the years build up a stream of recurring income from dividends.

This portfolio will comprise mainly of high dividend yielding stocks as well as REITS.

I am setting my first milestone of S$50K exposure which I hope to achieve by the end of 2019.

Increase exposure to foreign stocks (Active investing)

Through my Buffett series of stock analysis, I will also be looking to invest in foreign/US stocks for the long-term. The main goal is to achieve long-term capital appreciation of 7-8% (after inflation return) for this portfolio.

I will not be too focus on high-yielding stocks for this segment of the portfolio due to the high withholding taxes involved.

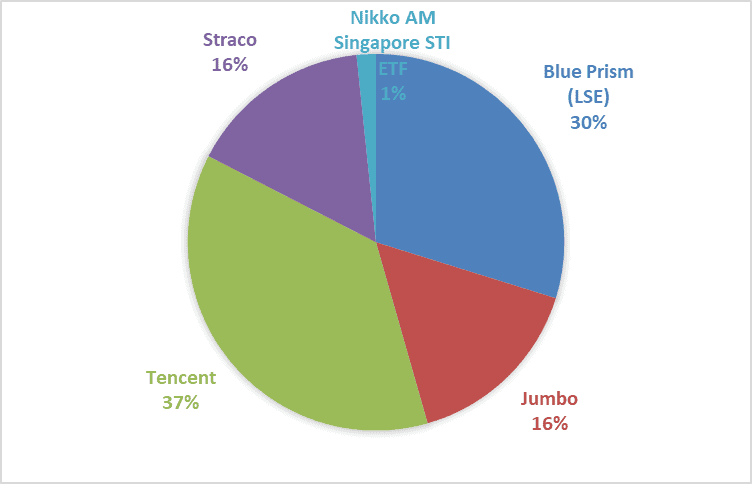

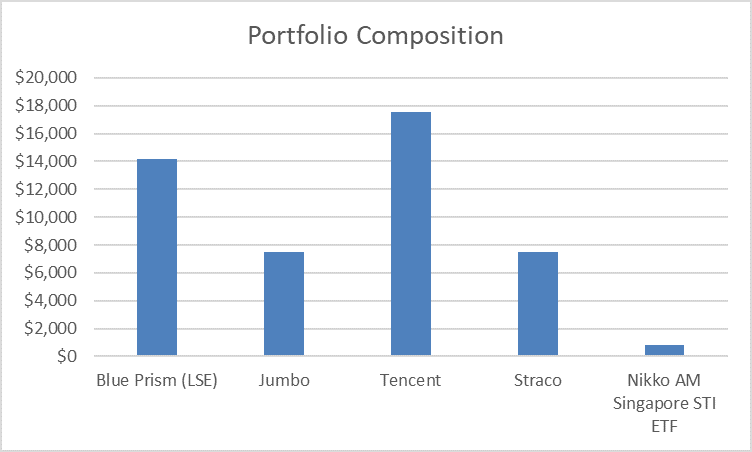

Existing portfolio

I will be looking to keep my ownership of Straco, Tencent and Jumbo for the time being. These are stocks which I am relatively comfortable of holding for the long-term.

On the other hand, we will be looking to divest our stake in Blue Prism over the coming month to reinvest the proceeds to higher yielding counters.

OCTOBER NET WORTH UPDATE

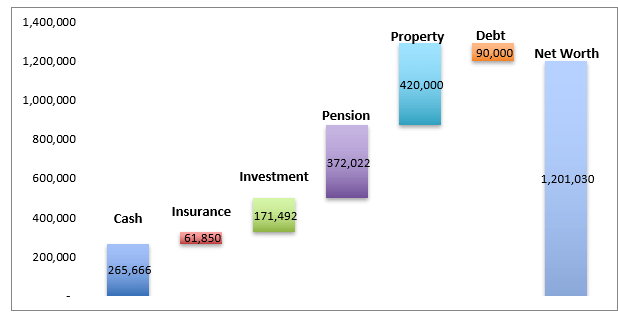

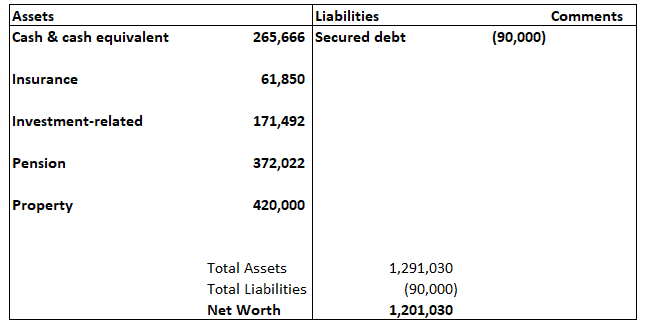

Our household net worth increased by 0.4% from the previous month to hit S$1.201m. This is despite not really benefiting from the equity bull trend seen in October.

The key contributing factor for the increased net worth this month is due to higher savings, particularly from the missus.

While the investment-related segment has seen a substantial increment, most of it remains as cash sitting un-deployed at foreign brokerage accounts, with the intention to increase my exposure to foreign related stocks in due time.

With that i wrap up my maiden Portfolio and Net Worth update for September.

Appreciate all who visits New Academy of Finance and I hope that this website can ultimately be a wonderful source of personal finance inspiration.

Till the next time!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=