New IPO Stocks: Does it make sense to invest in them?

Record stock prices in the US have resulted in a boom in initial public offerings or IPOs for short as companies capitalize on the market euphoria to get their companies listed. As of 8th October, traditional IPOs have raised approx. $155bn YTD, up 184.7% from a year ago, according to US News.

There have been more than 200 new IPO stocks listed in 2021, of which the largest of them all is Coinbase Global (COIN) with a current market cap of slightly over $52bn. The company debuted on the Nasdaq exchange in mid-April with an initial market cap of approx. $86bn, based on its first-day closing price of $328/share. Its shares opened at $381 and quickly shot as high as $429. Alas, its first day “high price” was also the highest that it has ever gone.

Based on its current price of $248, investors who bought into its hype on the very first day of its listing would have seen an unrealized loss of 24% at present, not exactly the kind of returns expected for a “hot stock” like Coinbase which had garnered strong media attention due to the company being one of the fastest-growing crypto exchange in the world.

Would investors have made money if they invested in some of the hottest new IPO stocks in 2021?

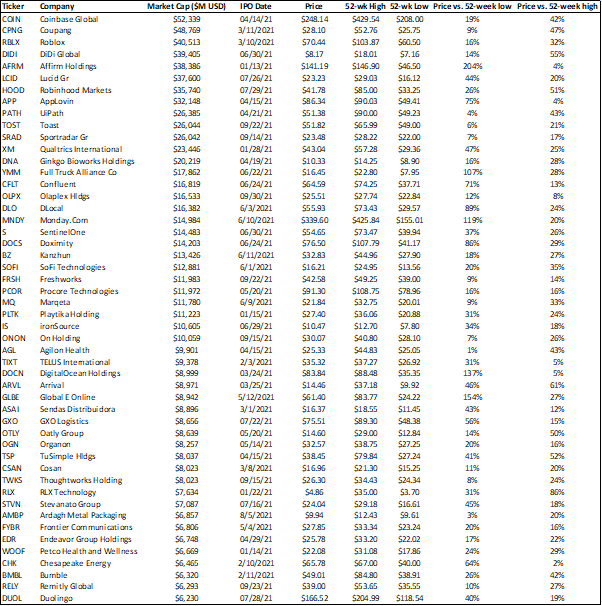

The table below shows the Top 50 new IPO stocks in 2021, screened based on their current market cap and their respective 52-weeks low and high prices.

The Top 5 largest new IPO stocks in 2021 are:

1) Coinbase Global, (first day close: $328, current price $248.1)

2) Coupang, (first day close: $49.3, current price $28.1)

3) Roblox, (first day close: $69.5, current price $70.4)

4) DiDi and (first day close: $14.1, current price $8.2)

5) Affirm (first day close: $97.2, current price $141.2)

Among the top 5 new IPO stocks ranked by current market cap, only Affirm Holdings and Roblox are trading above their first-day IPO price, the latter just marginally higher.

When compared against their 52-week price range, most of the new IPO stocks, particularly the “hot” ones which were hyped up by the media such as Coinbase, DiDi, Robinhood, etc are currently trading at a price closer to its 52-week low vs. its 52-week high.

Hence, at first glance, it doesn’t seem like a wise strategy for investors to be buying into popular new IPO stocks.

I have previously done a youtube video on Oatly Group (OTLY) when its price was around US$20/share, commenting that this is a super-growth stock but not necessarily a wise investment at that juncture, with a relatively high probability that its share price will fall back after its initial IPO “euphoria” is over, similar to what happened to one of its closest competitor, Beyond Meat (BYND).

OTLY is currently trading at $14.60, with its 52-week low at $12.84. Might it make sense to buy into OTLY now at a much cheaper price? This will probably be an article or video for another day.

Many of the other popular new IPO stocks in this Top 50 list which we might be aware of is Bumble, SoFi Technologies, Kanzhun, and UiPath. Most of these stocks have performed relatively poorly vs. their first-day closing price.

The ones that have done relatively well are Affirm, AppLovin, Olaplex Holdings, TELUS International, DigitalOcean Holdings and Chesapeake Energy, which are counters currently trading close to their 52-week high prices (single-digit percentage differences)

The ones that are the worst-performing are Coupang, UiPath, Toast, Sportradar Gr, Freshworks, On Holding, Agilon Health, Thoughtworks Holding and Ardagh Metal Packaging, which are counters trading close to their 52-week low prices (single-digit percentage differences)

Which are the popular new IPO stocks that have just been listed or are expected to be listed in the coming months? Should investors be partaking in them?

5 New IPO stocks to watch out for

Warby Parker

IPO date: 29 Sep 2021

Estimated IPO valuation: $10bn

Current market cap: $4.6bn

Warby Parker is an eyewear company that was recently listed although that listing did not live up to its hype. The company had an estimated pre-IPO valuation of $10bn but is currently trading at less than half that valuation.

A key to success has been the loyal customer base. The company’s Net Promoter Score, which measures customer willingness to recommend a brand using a range from -100 to 100, is a high 83 – better than Apple or Netflix. Warby Parker boasts a 50% sales retention rate within 24 months of first purchase and nearly 100% for over 48 months.

This is a company that is growing its top-line at a 50% rate, with sales of $270.5m reported for 1H21. With an addressable market of $140bn globally, there is still plenty of growth for the company, although fending off competition from the thousands of eyewear companies globally is always going to be a major concern.

Instacart

IPO date: Fall 2021

Estimated IPO valuation: $40bn

Current market cap: N/A

Instacart is a grocery delivery and pickup service. The app allows customers to select their groceries from many retailers and then deliver them to customers all at once, which is a huge convenience and time saver.

Due to the positive buzz, Instacart managed to attract $265 million in March in its latest funding round, giving it a valuation of $39 billion.

The only thing that could slightly go against the firm is that the economy has reopened, and there could be a negative impact online-sale. However, the shift to digital from physical stores is likely a secular trend that is here to stay.

There could be momentary blips along the way, but the general trajectory is up.

There is no specific date for the IPO of Instacart. It might also go the route of a direct listing. Whichever listing route it chooses, this is a retail-focus stock that is likely to gain lots of attention when it does finally list.

Discord

IPO date: Fall 2021

Estimated IPO valuation: $15bn

Current market cap: N/A

Discord, which allowed for instant messaging, video and voice calls, was popular with gaming communities on Twitch and Reddit in the early days.

The system was released in 2015 and by 2018, Microsoft’s Xbox had agreed to integrate the platform with Xbox Live accounts.

In 2020, Discord announced a concerted effort to expand beyond gaming. To help with this, the company raised $100 million late last year at a valuation of $7 billion.

More recently, Microsoft made overtures to acquire the company for at least $10 billion. But the deal fell apart and the next step now appears to be an IPO which is currently slated to be at the end of 2021.

The company now has over 150m monthly active users, generating the company $130m in revenue in 2020. Just recently, it netted $500m in its latest fundraising round led by Dragoneer Investment Group, leading to a $15bn valuation.

Rivian Automotive

IPO date: Nov 2021

Estimated IPO valuation: $80bn

Current market cap: N/A

Rivian Automotive is an electric pickup truck startup backed by Amazon and could be the largest market cap stock to be listed over the past year, with an estimated valuation of $80bn. This valuation places it ahead of Ford.

It is not hard to see the appeal: Americans love pickup trucks and the Rivian’s R1T looks like an awesome-looking pickup truck to own if you ever need to own one.

Some investors might think Rivian has missed the boat on the EV show, with demand for EV-related stocks slowing down drastically since the start of the year.

Nonetheless, this counter will likely still be a beneficiary of government initiatives to tackle climate change issues.

Rivian has the backing of Amazon, the latter committing to purchase 100,000 electric delivery vans till the end of 2030.

Stripe

IPO date: Uncertain

Estimated IPO valuation: $95bn

Current market cap: N/A

Stripe is an Irish-American payment processor that has been a huge beneficiary of the COVID-19 pandemic, as a result of the massive growth in e-commerce.

The success of Stripe is all down to its business model. It encompasses everything you want in a payment processor. The company started as just a payment processor.

However, it has now expanded into a point-of-sale device called Terminal and offers lending and risk management services. When you have all of these solutions under one roof, it reduces the churn rate.

Private equity has also taken notice. Stripe managed to raise $600 million in its latest funding round, lifting its valuation to an eye-watering $95 billion.

Whenever the IPO takes place, expect shares to skyrocket.

Conclusion

Investing in IPO stocks can be a mixed bag. However, more often than not, many of these highly “hyped” stocks fail to live up to their IPO expectations, resulting in a massive correction in their share prices from the first day of listing.

Mot investors should not be “jumping on the bandwagon” on the very first day that these new IPO stocks trade but should wait for a substantial pullback before “getting their feet wet”.

Even if you choose to invest in these IPOs, make sure to allocate no more than a small percentage of your portfolio to it.

While 2021 has been a bumper year for new IPO stocks, that does not guarantee a profit when it comes to investing in these IPO counters, many of them being loss-making in nature. For new IPO stocks that are scheduled to make their debut in 4Q21 or 2022, the most popular one is undoubtedly Stripe.

The company is still keeping everyone under suspense in terms of its listing date but when that time comes, you can bet that it is going to be a stock that everyone wants to get their hands on. Should you be one of them?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only