Table of Contents

It has been quite a while since I look at Singapore Oil & Gas stocks. Some of my NAOF readers would be aware that I used to be a Sell-side analyst, covering the oil & gas industry. Not a pretty sight in the past decade if I may be honest.

However, things have been looking brighter of late, with the gradual improvement in oil prices as well as stronger supply/demand dynamics seen within the offshore O&G industry.

Might there be opportunities in some of these offshore-related plays within the Singapore context?

Marco Polo Marine: The Devil Lies in the Details

I took a brief look at Marco Polo Marine this morning when it reported its 1HFY2023 financials last evening (11 May 2023).

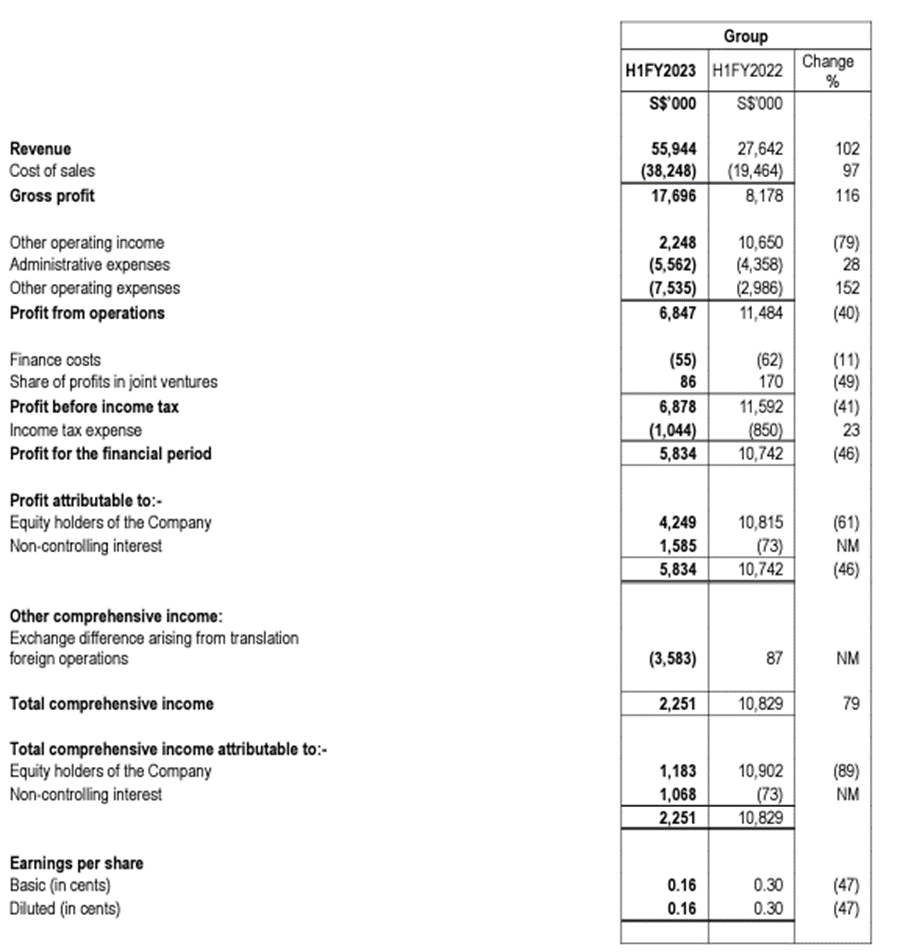

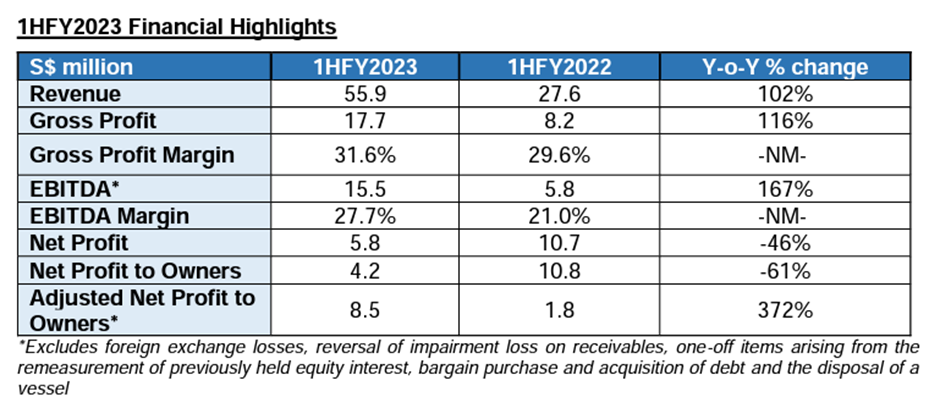

The reported numbers weren’t pretty. Despite the company generating strong revenue growth, up 102% YoY to S$55.9m in 1HFY2023 vs. S$27.6m in 1HFY2022, net profits attributable to equity holders were down by 61% to S$4.3m.

What is going on over here? Why did revenue double but profits more than halved in its latest 1H results?

I took a closer look at its financial statements and found that the “devil lies in the details”. Its results were pretty strong, to say the least.

Here is how I reconcile the numbers:

Revenue growth of 102% (as highlighted earlier) is very strong and could be a prelude to demand returning to the offshore space.

Due to strong cost control, its gross profit grew by a stronger 116% YoY to S$17.7m. So far so good.

But beyond the gross profit figure is where the numbers start looking “uglier”.

First “issue”

Other operating income saw a massive drop from S$10.7m in 1HFY2022 to just S$2.2m, a 79% decline. On closer inspection, this is attributable to some “one-off” income generated last financial year amounting to S$9.3m. Removing this one-offs effect will see the 1HFY2022 figure moderating from S$10.7m to S$1.4m.

Other Operating Income: 1HFY2023: S$2.2m vs. 1HFY2022 S$1.4m. The normalized performance now isn’t all that bad.

Second “issue”

Other operating expenses saw a 152% YoY increment to S$7.5m in 1HFY2023 vs. S$3m registered in 1HFY2022. Again, on closer inspection, this is mainly attributable to a huge increase in net foreign currency exchange loss of S$4m in 1HFY2023 vs. S$0.5m in 1HFY2022.

Now, foreign currency losses, or FX losses in short, are typically a non-cash item and are often the result of holding foreign-denominated currency (like USD) that saw a decline in its value vs. SGD currency.

This was what happened in the latest financial period.

However, FX losses are typically “non-cash” in nature and will only become a major problem if, for example, the USD continues to depreciate against the SGD over a prolonged duration.

Typically, one will look to exclude FX losses when “reviewing” the operating performance of the company.

Hence, removing the impact of FX will see other operating expenses normalizing to 1HFY2023: S$3.5m & 1HFY2022: S$2.5m, a 40% increase. This increase is largely attributable to higher depreciation expenses in this financial period due to a correspondingly higher fixed asset.

Normalized Operating Profit

Now, if one removes both these two “issues” from the reported figures, there will be a very different conclusion.

The company would have generated an adjusted operating (EBITDA) income of S$15.5m in 1HFY2023 vs. S$5.8m in 1HFY2022, on the company’s calculation.

This is a massive improvement of 167% YoY in normalized operating profits!

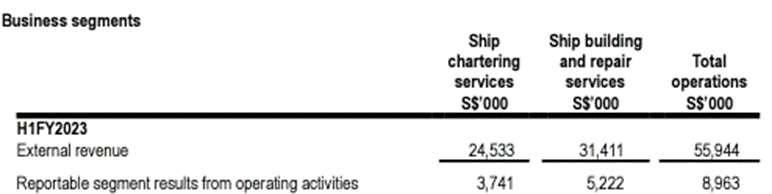

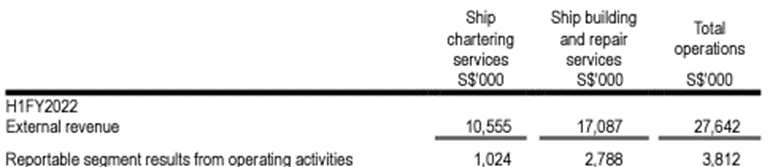

This is also reflected in their reported business segment comparison for 1HFY2023 and 1HFY2022 where segment profits grew from S$3.8m in 1HFY2022 to S$8.9m in 1HFY2023, a 135% YoY growth.

According to the company’s press release statement, its adjusted net profit would have been S$8.5m in 1HFY2023 vs. S$1.8m in 1HFY2022, when adjusted for FX and one-offs. This is a 372% YoY growth vs. the reported 61% YoY decline in net profits attributable to shareholders in 1HFY2023.

Is the worst over for Marco Polo Marine?

From an ex-analyst perspective, its adjusted aka normalized figures are painting a “rosier” picture than what its reported figures depict.

Investors reading financial statements should often look beyond just the reported figures and evaluate the “finer details” and come to a fairer conclusion on its financial performance.

While the numbers look good, I am not implying here that the worst is over for Marco Polo Marine and that the counter is a STRONG BUY at this level. This is not an article construed to recommend a Buy or Sell. Please do your due diligence work.

Positive Charter Outlook Ahead

Nonetheless, based on the comments of some of the market leaders operating in this industry, it does seem like the prospect in the offshore segment is improving, with better utilization and charter rates for offshore support vessels.

Take, for example, this article from Splash, which highlighted that Clarksons cross-segment rate index is up 32% to a level of 84, the highest since 2014.

“Many of the themes (commodity prices, upstream investments, dented supply side, a shrinking order book, and a substandard laid-up fleet) underpinning the uplift in utilization and earnings across all segments in 2022, are unlikely to retreat this year.”

Joshua Belo-Osagie, market analyst at Maritime Strategies International (MSI)

Fearnley Offshore Supply also commented that with a minuscule injection of newbuild tonnage within the OSV sector for several years now, the tightening of vessel supply in the market is set to drive the increase in day rates in 2023.

Focus on Offshore Wind

Marco Polo Marine is looking to tap into the growing offshore wind market by offering products such as its Commissioning Service Operation Vessel (CSOV), where demand is set to grow alongside higher installed offshore wind turbines.

Its construction of its CSOV is currently 13% completed and is on track for completion by 1Q2024.

Valuations

Now let us make some assumptions here to determine if the current valuation of Marco Polo Marine warrants a deeper look.

Assuming that 1HFY2023 adjusted net profit of S$8.5m can be extrapolated on an FY basis (might not happen though), that will mean that the company could see FY2023 profits hitting S$17m.

Its current market cap is S$152m. Stripping out its net cash position of $50m, its valuation net cash is S$102m.

That means that the company is operating on a 2023E P/E multiple of just 6x. Rather undemanding, assuming that its 1HFY2023 core growth can be extrapolated for the full year.

Using the Koyfin platform, I took a look at its current forward P/E multiple relative to its historical average. As can be seen, the company is trading at a forward P/E multiple of 11.3x (not adjusted for net cash), which is close to the -1 SD level of 10.9x and significantly below its average P/E multiple of 16.6x.

MPM’s stock price has been increasing since late-2021 and despite its higher share price, its valuation (using forward P/E) remains quite undemanding due to an improvement in its fundamentals.

Risk

While MPM’s outlook and fundamentals look to be improving rather significantly, it will be only fair to assess the risk involved here.

While credit risk has been substantially mitigated due to previous rounds of equity funding and the company is now in a solid net cash position of S$50m, it is still extremely critical that the company focus on its cash generation profile and not over-invest on capex and fixed assets.

In addition, the company might not be able to replicate its strong 1HFY2023 operating performance for the 2H.

The offshore industry remains a rather volatile one and while clearer skies seem to be ahead, the lessons from previous years should not be forgotten.

Conclusion

Again, I am not implying or making any recommendations on MPM. However, investors might be missing out on the strong improvement seen in its operating performance if they are purely focused on just the reported numbers here, which can depict a very different story altogether.

Its adjusted operating figures do imply that the worst could be over for this offshore survivor.

A sustained improvement in utilization and charter rates for offshore support vessels seems to be the current market consensus, and this bodes well for MPM’s charter business ahead.

A successful penetration into the offshore wind farm industry might be MPM’s next big break, and this could all begin with its maiden CSOV construction.

1 thought on “Marco Polo Marine: Taking a Look Beyond its 1HFY2023 Reported Numbers”

CSOV are complex. Vessels and even in more established yards, which have been consistently building more sophisticated vessels than what Marco polo has built in recent years, construction from start to end takes more than 18 months.

Marco Polo is reporting target completion in about 13 months – rushing to meet a deadline required for the charter of the vessel to Vestas.

vessel is currently self-funded and the company appears to be casting around for investors in this vessel

Would this be a completion risk?