Bitcoin and cryptocurrencies are some of the hottest asset classes of 2021. Is it a mega bubble waiting to POP or can its red-hot momentum continue into 2022? We that discussion to another day. In this article, I will like to highlight what the Grayscale Bitcoin Trust, or GBTC for short, and how its transition into GBTC ETF could allow you to purchase Bitcoin at a discount right now.

Is GBTC an ETF?

Before we dive into the details, let’s first be clear that Grayscale Bitcoin Trust is NOT an ETF. Or at least not yet.

For a normal ETF, they have “authorized participants” that can trade the underlying assets for shares they represent at market value. The role of these participants, which is to create or redeem shares, ensures that the market price of the ETF is trading in line with its net asset value.

GBTC on the other hand is different. It allows investors to buy and sell shares in the secondary market but there are no authorized participants or market makers to ensure that the price of GBTC and the value of the bitcoin held in its private trust are the same.

The lack of a market maker is the major reason why GBTC’s price is highly dependent on demand for its shares and explains why that share value can deviate substantially from its net asset value.

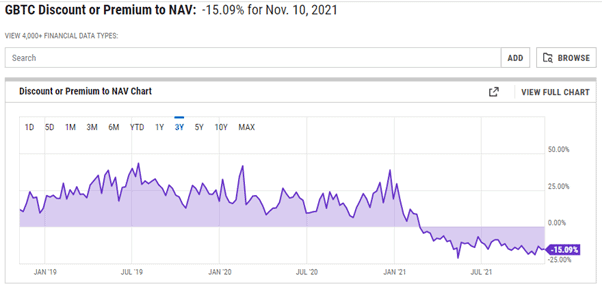

As can be seen from the chart above, GBTC, which has been trading at a substantial premium to its NAV before 2021, is now trading at a 15% discount. Investors are now paying $0.85 to hold $1 worth of bitcoin.

This is unlike in 2020 where GBTC has typically been trading at a premium. This allows for arbitrage opportunities where a hedge fund could borrow bitcoins, exchange them for GBTC shares and after their lock-up period, sell them in the secondary market to pocket the difference.

However, the availability of other bitcoin instruments such as the ProShares Bitcoin Strategy ETF (BITO) reduces the demand for GBTC and pushed arbitrage traders to exit their positions.

This has led to an imbalance of supply (too much) and demand (too little with traders exiting), resulting in GBTC price falling and is now trading at a discount to its bitcoin holding value, since there is also the lack of any market maker to redeem excess shares in the market.

GBTC ETF vs. BITO ETF

GBTC, back in mid-October, filed for an application to convert itself into a spit ETF. This begins a 75-day review period by the Securities and Exchange Commission (SEC).

While there is already an existing bitcoin ETF, the ProShares Bitcoin Strategy ETF or BITO, this ETF does not hold actual Bitcoins, unlike GBTC. Instead, BITO owns derivate contracts linked to Bitcoin which are traded on the Chicago Mercantile Exchange, rather than actual bitcoin itself.

This might result in additional costs associated with the purchase of BITO such as costs involved in rolling these derivative contracts etc, in addition to its typical expense ratio.

GBTC ETF, if it does get SEC approval, represents an investment that is backed by bitcoins, not derivatives tied to it.

This isn’t the first time that GBTC tried to convert itself into an ETF. Back in 2017, it applied to be an ETF but was rejected by the SEC as the latter indicated it wasn’t yet comfortable with the bitcoin market.

With the bitcoin market booming and the presence of a bitcoin futures ETF, the thinking is that regulators should also be comfortable with the underlying market and approve GBTC ETF application.

What happens if the GBTC ETF application goes through or gets stalled?

If GBTC’s request to convert into an ETF is accepted by the SEC, market makers will be able to arbitrage deviations to market valuation. This will mean that its current 15% market value discount to its NAV will disappear.

So by purchasing GBTC today and waiting for the private trust status to be converted into an ETF, one could potentially gain an extra 15% even if the price of bitcoin remains stagnant. Based on the 75 days-timeline, this could happen by end of Dec 2021 or early Jan 2022, meaning you could realize this gain in a relatively short period.

The risk is of course if the SEC doesn’t approve the conversion, which is still a possibility. This is because an ETF backed by a physical asset such as the GBTC ETF would also be subjected to market manipulation and counterparty risk in crypto markets that are completely outside of the regulator’s direct control.

If no approval is given, there is no guarantee that the discount will not further expand, which could result in additional losses, even if bitcoin prices stagnate.

In addition, if bitcoin prices are to plummet, holding onto GBTC will also result in losses.

Conclusion: Should you be buying the GBTC ETF?

There is no guarantee that GBTC, which is still under a private trust status, will ultimately revert to an ETF status. If the approval goes through, the discount to its Net asset value will likely disappear, allowing one to realize that “additional” 15% upside.

However, if approval is withheld, then that discount could remain or potentially even widen.

For those who do not have direct exposure to cryptocurrencies and prefer to purchase crypto-linked ETFs for the ease of such purchases (as easy as buying stocks), I believe buying GBTC remains a viable alternative vs. BITO (where derivatives are involved, which could mean higher transactional costs although BITO’s expense ratio is currently half that of GBTC), one where the potential benefits could outweigh the risks.

It is also useful to note that futures-based ETFs do not provide returns that directly track the underlying asset and there could be wide disparities at times between the two due to the contango effect as well as the cost of carry.

One should be mindful and avoid taking too large an exposure to cryptocurrencies. It is fine to have a small exposure as a portfolio diversification strategy but over-leveraging into bitcoins or other hot cryptocurrencies is likely not the best investing strategy for the faint-hearted.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best commodity asset of the decade and why Bitcoin might prosper in 2020

- Bitcoin Prediction: 5 reasons why its rise this time round might be sustainable

- Beginners Guide to CryptoCurrencies and how to get started in 2021?

- Why you should invest in coinbase stock and how you can get a free Disney share while doing it

- Selling Put Options: Sell Puts to win in any market scenario

- Hedging with options: How to hedge using puts