Table of Contents

Which are the Best Country ETFs?

When it comes to selecting a country ETF to invest in, there is none more popular than investing in a US-linked ETF such as the SPDR S&P 500 ETF (SPY). This is not surprising, given the liquidity and popularity associated with US-linked ETFs.

For an equal-weighted ETF that is linked to the USA, one might wish to check out the iShares MSCI USA Equal-Weighted ETF (ticker: EUSA). However, the EUSA ETF has underperformed the SPY ETF (market-cap weighted) historically, as large-cap stocks outperformed their smaller-cap counterparts.

I recently wrote an article to highlight the performances of the various country ETFs. On a YTD 2023 basis (as of 4th May 2023), the best-performing country ETF is none other than the Global X MSCI Nigeria ETF, which has returned almost 30% since the start of the year.

However, this country’s ETF also has got one of the worst 10-year price performances.

For those who are interested in tracking the performance of the various country ETFs, you can look to bookmark this page.

A notable exclusion from this list, however, is the EDEN ETF, the iShares MSCI Denmark ETF.

Most Consistent Country ETF

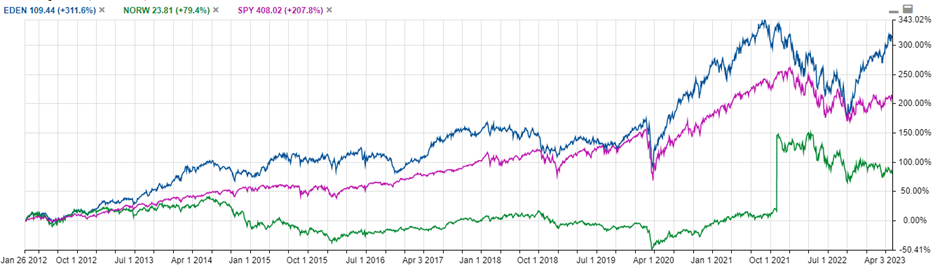

On a YTD basis, the EDEN ETF returned approx. 12% vs. the SPY YTD 2023 performance of 7%.

However, the EDEN ETF did not just outperform the SPY ETF on a YTD basis. It is possibly the ONLY country ETF that has consistently outperformed the SPY ETF on all time horizons (short, medium, and long term)

No other country-linked ETFs has come close to outperforming the SPY ETF with such consistency. The only other country ETF that has outperformed the SPY over a 10-year horizon is that of the NORW ETF, the Global X MSCI Norway ETF. However, the NORW has underperformed the SPY ETF over the past 1-year, unlike the EDEN ETF, which spots a 16% outperformance vs. SPY in this time horizon.

EDEN ETF Holdings

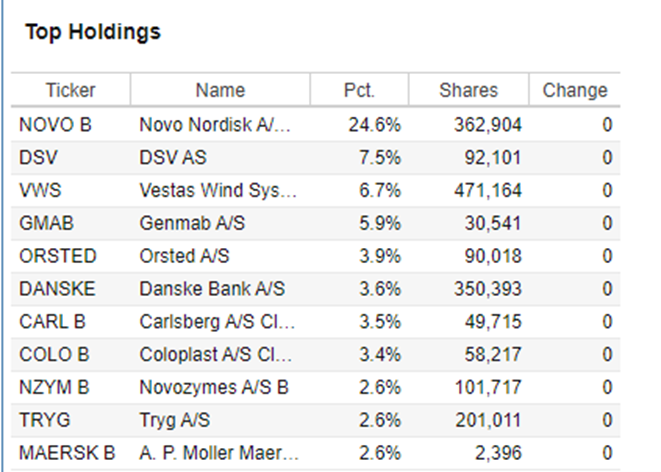

The table above shows the top holdings of the EDEN ETF. Many of the counters in this list are likely unfamiliar names for most investors.

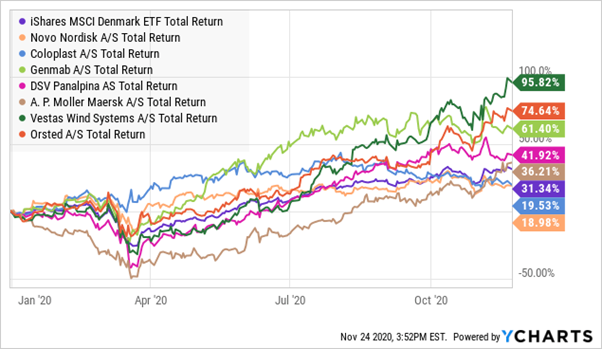

The strong performance of EDEN ETF is likely the result of its overweight position on Novo Nordisk (NVO), which has been one of the best-performing stocks of all time.

This is a stock that generated a +20% return in 2022 when the SPY declined by 20% and that outperformance has continued into 2023.

Novo Nordisk’s core business is in the pharmaceutical industry, with a large presence in diabetes care. Some of its biggest competitors include the likes of Abbott Laboratories (ABT) and Amgen (AMGN).

Novo Nordisk is currently also identified as an Alpha Blueprint Stock due to its strong fundamentals.

Some of the other top holdings in the list include:

- DSV AS: a transport and logistic company offering global transport services by road, air, sea, and train as well as logistic solutions

- Vestas Wind: manufacturer, seller, installer, and servicer of wind turbines

- Genmab: Biotechnology Company

- Orsted: Multinational energy company. Largest offshore wind farm company in the world

How to invest in EDEN ETF

One can buy into the EDEN ETF through most brokerages that offer US stock trading. Do, however, note that this is not a widely traded ETF.

It has a relatively small market cap of just $238m. Investors will also need to note the annual expense ratio of this ETF which currently stands at 0.53. This is partially offset by the dividend yield of 1.3%.

For those who have the Syfe Robo Advisor account, this ETF is offered under their Syfe Trade platform. However, do note that fractional investing is not offered for this ticker and one will need to purchase at least 1 share (or a minimum dollar commitment of USD$110).

Is EDEN ETF right for you?

Most people will not be aware that the EDEN ETF has been the most consistent price performer over the past decade.

No other country ETF has ever come close to besting its price performance over a medium and long-term horizon.

Do note the potential concentration risk when investing in the EDEN ETF, however. The Top 10 holdings of this ETF, which I showed earlier, encompass approx. 67% of the fund weighting. Its exposure to Novo Nordisk is a hefty 25% and any significant price retracement in NVO’s price could have a sizable impact on EDEN’s price as well.

Nonetheless, this is an interesting ETF that might fit well as part of a diversified portfolio that includes another country, sectors, or thematic ETFs, for example.

I might consider an approach to purchase X shares of EDEN on a monthly recurring basis using Syfe Trade, which offers investors 3 commission-free trades each month.

For those who are interested to learn more about the different ETFs that you can use to construct your portfolio, be it with an SG-focus, US-focus, UCITS-focus (tax savings), thematic-focus, etc do check out this FREE ETF Video tutorial that I have done up for you guys.