Companies with good management

With the SPH saga unfolding over the past week, you’ve probably seen the word “umbrage” plastered all over the internet. Investing in companies is never straight forward and it’s not always just about the numbers companies produce and their financial statements. At times, the corporate culture and its management team are equally important criteria when selecting the right company to invest in. These factors determine the company’s growth trajectory and ultimately the share prices.

Unfortunately, the focus often ain’t on management but the financial numbers. Some might say that both are inter-link. A capable management running the company will ultimately translate to good financial performance. That is true to a certain extent.

However, would you select to invest in a “grossly” undervalued company that looks to be run by an incompetent management team?

There has been quite a fair bit of debate over the valuation of SPH since it decided to spin off its media business and so “generously” capitalize it. While many believe that the main “for-profit” SPH entity remains grossly undervalued based on its asset valuation, would one remain comfortable with the “captain” and his team of crew, who have been steering the organization “clearly” in the wrong direction (as evident from its share price performance over the past 5 years?)

What’s good management?

Management is an integral part of any company and they bear the responsibility of making strategic decisions. Depending on the management, it can steer the company in the right or wrong direction. But why does this matter? As shareholders, how the management performs can impact your capital gains or losses.

Although it is not easy to measure how “good” the management is within a firm, investors can look at these five-pointers to guide their judgment!

a) Experience and Tenure

The resume and performance of management can be a key litmus test when assessing their fit with the firm. There are several metrics we can use to gauge the potential of the company under one’s stewardship:

- What prior experiences does he/she bring to the role? It makes more sense for someone with banking or fintech experience to helm a digital banking firm instead of one who had years of experience in sports science.

- Does the management have a good track record? You should invest in companies with CEOs who can consistently outperform analyst’s targets. It shows an ability to maneuver through market challenges over the years.

- Ability to deliver success? Under the stewardship of the CEO, has the company shown an increase in revenue, market share, or even share prices?If the company can fend off competitors, it will be an added advantage to investors.

b) Interviews Conducted with Management

At times, looking at how the management team conducts themselves can be a tell-tale sign of what to expect. I tend to look at both articles and videos of interviews carried out by the management to see how they manage questions and what media they are speaking to. It allows me to:

- Understand the mission and vision the CEO has for the company.

- Learn about how well the CEO is regarded in the space they’re operating. For example, if the CEO of a local firm is speaking to international media such as Bloomberg or CNN, it tells me that he/she is widely regarded in the industry.

c) Insider Trading and Share Buyback

Insider trading refers to employees purchasing shares of their own companies. Since these employees are involved in the day-to-day operations, they may have insights that are not disclosed to the public. Hence, investors can look for insider trading as it is a positive affirmation of the firm’s performance and direction.

Meanwhile, share buybacks refer to a company reacquiring their shares listed on the market. One of the key reasons why companies do so is the belief that their shares are undervalued. Lesser shares in circulation result in a lower supply and this can elevate your share prices.

Both actions can be seen as a sign of confidence within the firm and investors can look out for them in their assessment of the management.

d) Compensation and Salary

With great responsibilities comes great power and rewards! As decisions of a firm lie on the shoulders of high-level management, employees such as CEOs are often compensated with lucrative packages. Without a standardized remuneration package, it can be challenging to assess them at first sight. However, investors can compare the numbers to industry averages to understand how well they are paid.

Why does it matter? This particular pointer comes into the spotlight especially in times of adversity such as Covid-19. When a company is struggling financially, will the CEO react by receiving his usual salary or take a pay cut to prevent employees from being laid off? It gives investors confidence when a CEO can sacrifice his / her gain for both the company and employees.

For example, Singapore Airlines’ faced groans from the public when it announced its CEO remuneration package last year. Despite retrenching thousands of workings while announcing their first annual loss since inception, their CEO received $4.2million in remuneration. Although the amount may be justified by his contribution, the public’s perception may harm the company’s share price and long-term goals.

e) Culture inculcated within the firm

The culture within the firm can vary across organizations and even countries they operate in. This is often hard to assess as companies tend to upsell their culture while employees might be unhappy within the firm.

There is two key organizational structure that dominates companies – Vertical and Horizontal. Vertical organizations mimic a pyramid as the company follows a rigid hierarchical structure with a well-defined chain of command. Conversely, horizontal organizations are rather flat with a lesser emphasis on hierarchy. They are more team-centric which can breed camaraderie within the firm.

An ideal organizational structure depends on both the employees and the industry it is operating in. To truly understand the effectiveness of culture, investors can look at several mediums available:

- Speak to actual employees of a company to understand their first-hand experience.

- Search online for reviews on both social media and employment platforms.

- Study surveys conducted by companies that rank companies by their popularity among employers.

How do we find insights into management?

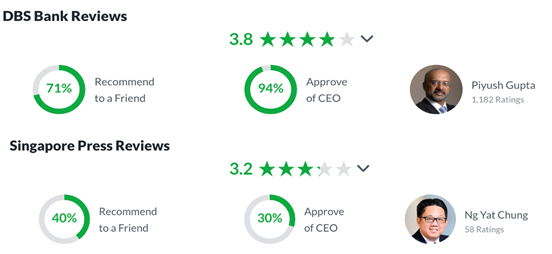

For this example, let’s look at “Glassdoor”, an employment site that provides an insight to companies through employee reviews. This is what I’ve gotten by searching two local firms:

As seen above, the CEO of DBS is much more popular among his employees compared to SPH’s! Assessing these sources allows you to have a general understanding of how the firm is run internally.

By now, all of us should know about the unfortunate incident during SPH’s press conference. SPH’s CEO lashed out at a reporter while stating that he is “no gentlemen” (does that imply he is a hooligan? Why is a listed firm being helmed by someone without basic etiquette? Does he have an illustrious corporate track record to back up his arrogance?)

Digging deeper into DBS, the company was also voted as 3rd best employer in Singapore! Further, their CEO can be found in interviews with large media outlets such as Bloomberg and CNBC. I was also thoroughly impressed by how the company proactively opened bank accounts for foreign workers during our circuit breaker last year! All these actions are a testament to the ratings he’s gotten on the site.

Conclusion

You can think of CEOs as captains of the ship and you’ll always need the right one while entering unchartered waters! Investing in companies with the right management is instrumental in its success and the outcome of your investments!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.