Ultimate Guide to Investing Using SRS Account (2023 Update)

Why investing using SRS is critical to help you save on taxes and make your cash work harder for you. Here are the 10 investments you can make.

Why investing using SRS is critical to help you save on taxes and make your cash work harder for you. Here are the 10 investments you can make.

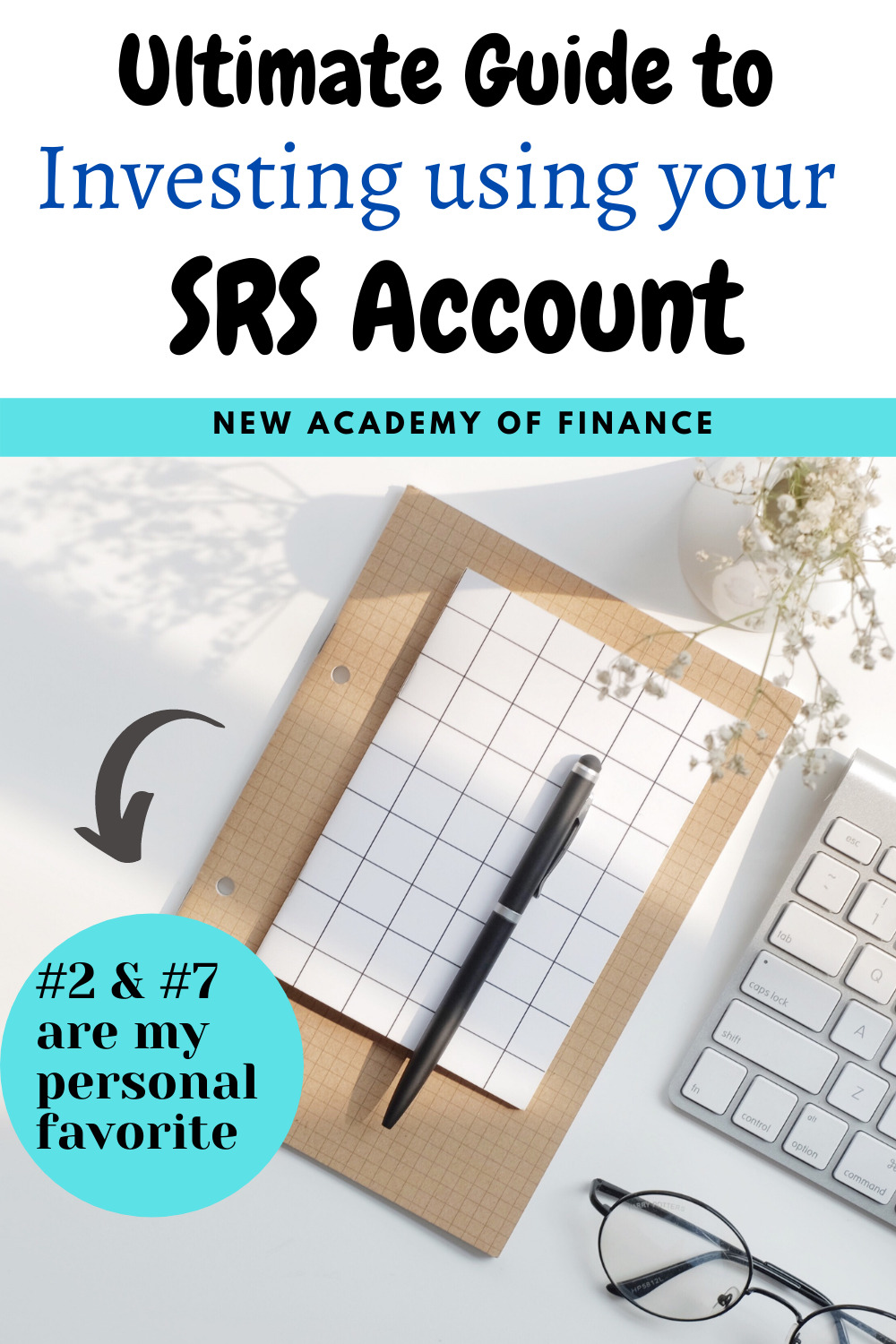

Can a 27-year old hit his Full Retirement Sum at age 55? Back in early 2020, I wrote an article about our CPF Full Retirement Sum or FRS for short,

CPF Shielding Hack: why all the Hoo-ha? SingSaver wrote this post about CPF Shielding Hack which is information that is not exactly “brand new”, but I believe is something that

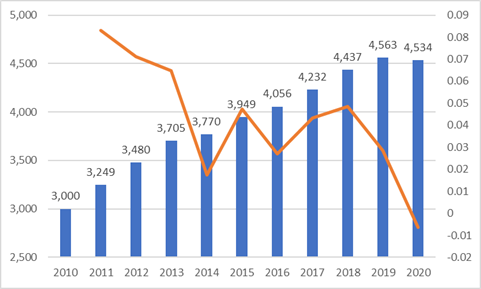

Average Salary in Singapore 2023 The Ministry of Manpower Singapore just formalized the Income statistics of Singaporeans although an earlier tentative report was released back in Dec. The statistics show

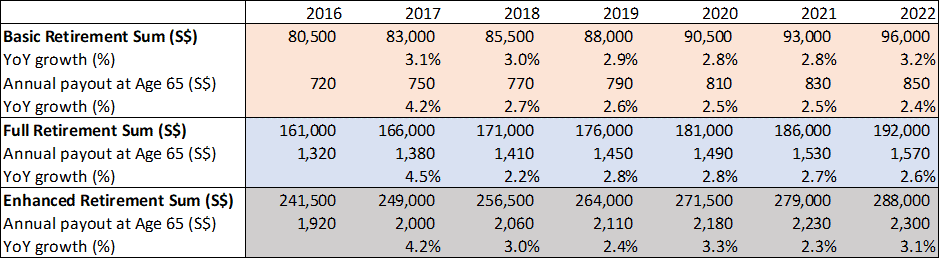

Possible for the average Singaporean to achieve? The Full Retirement Sum (FRS) in 2020 is at S$181,000. This means that if you hit Age 55 in 2020, this is the

Supplementary Retirement Scheme (SRS) Plenty has been written on the Supplementary Retirement Scheme (or SRS for short). This is a voluntary scheme that complements one’s CPF savings for retirement. You

I tried to calculate the math behind the Retirement Sum Scheme and unfortunately, that did not work out for me. I hope that some expert can enlighten me on that.

How much should one have in retirement savings when it is finally the time to leave the rat race? Based on my calculation, a 30-year old will need approx. S$1.5m

While most Singaporeans would be familiar with the Central Provident Fund (CPF), most might still be unaware of the Supplementary Retirement Scheme (SRS). Check out the Ministry of Finance (MOF)

In Singapore, about 80% of the population resides in HDB, the building block for affordable home ownership, often lauded by the government. Well we are not going into the discussion