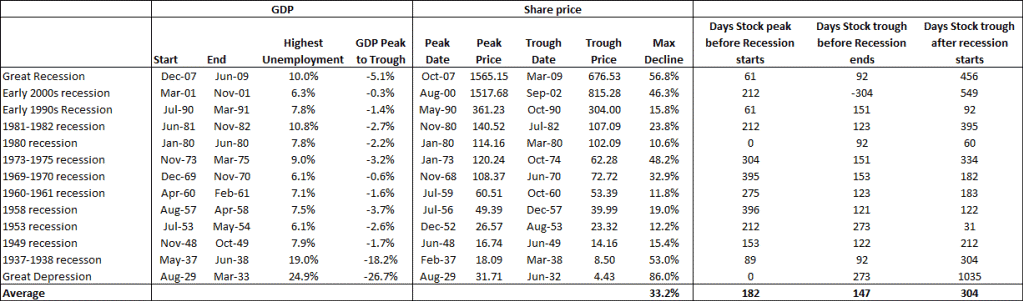

How to become a millionaire even with the worst market timing

Worst market timing: Why that does not matter Some NAOF readers are expressing their concerns over the current state of the stock market. The mismatch between economic “reality” and the

Worst market timing: Why that does not matter Some NAOF readers are expressing their concerns over the current state of the stock market. The mismatch between economic “reality” and the

Stock market to crash in 2021? 2020 has been an eventful year, to say the least. When COVID-19 strikes, we witnessed the stock market entering into a bear market territory

Investor Education Series: Stock market bubble According to famed value investor, Jeremy Grantham of GMO fund, the long long bull market since 2009 has finally matured into a full-fledged epic

Investment thesis: Coupa Software is the widely recognized leader in business spend management, with a cloud-native platform that has allowed it to become a leader over larger incumbents. An acceleration

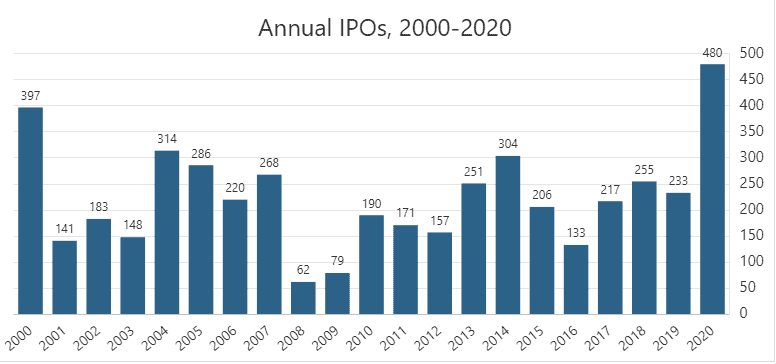

Investor Education Series: What is a Special Purpose Acquisition Company (SPAC)? Special Purpose Acquisition Companies or SPACs for short seems to be the new buzzword in the world of IPO.

SG Momentum stocks to buy now When one talks about investing or trading in general, the usual norm is to buy low and sell high. While such an investing philosophy

We are just a few days left to the end of 2020. 2020 is likely to come down as one of the most “unforgettable” years for many, in both a

With only a few days left to the end of 2020, it might be useful to take some time off and reflect on this question: Where to invest in 2021?

Getting started on Investing This post is slightly different from my usual content. We are coming to the end of 2020 and I will like to take this opportunity to

Syfe Review: REIT+, Equity100 or Global ARI? I have written about Syfe REIT+ portfolio as well as Syfe Equity100 portfolio previously. I believe that these two portfolios are structured to

Sembcorp Industries Stock: Buy, Sell or Hold? On 7 December, Sembcorp Industries announced profit guidance which seems to become the norm. In the past, the key focus was on Sembcorp

Leveraging on Tiger Brokers platform I have talked about using the Tiger Brokers platform in this comprehensive review of the up-and-coming fintech brokerage player that is looking to “revolutionize” low-cost

Bitcoin prediction: 2017 vs 2020 Bitcoin seems to be getting a resurgence in interest of late. One might recall the asset class spectacular rise back in 2017, followed by an

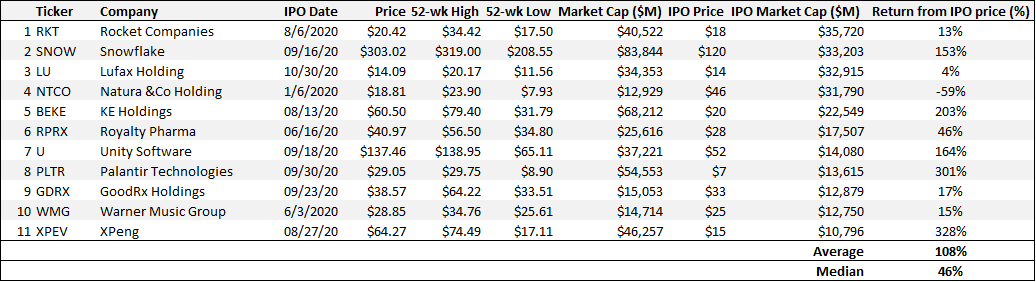

Plus 5 New IPO stocks in December 2020 worth looking at IPO stocks tend to be risky plays and not for the faint-hearted. 2020 looks to be a blockbuster year

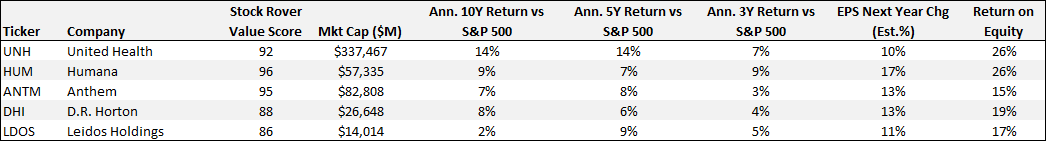

I have written about value investing previously in this article which focused on value investing in Singapore. In that article, I highlighted several value stocks that can be found in

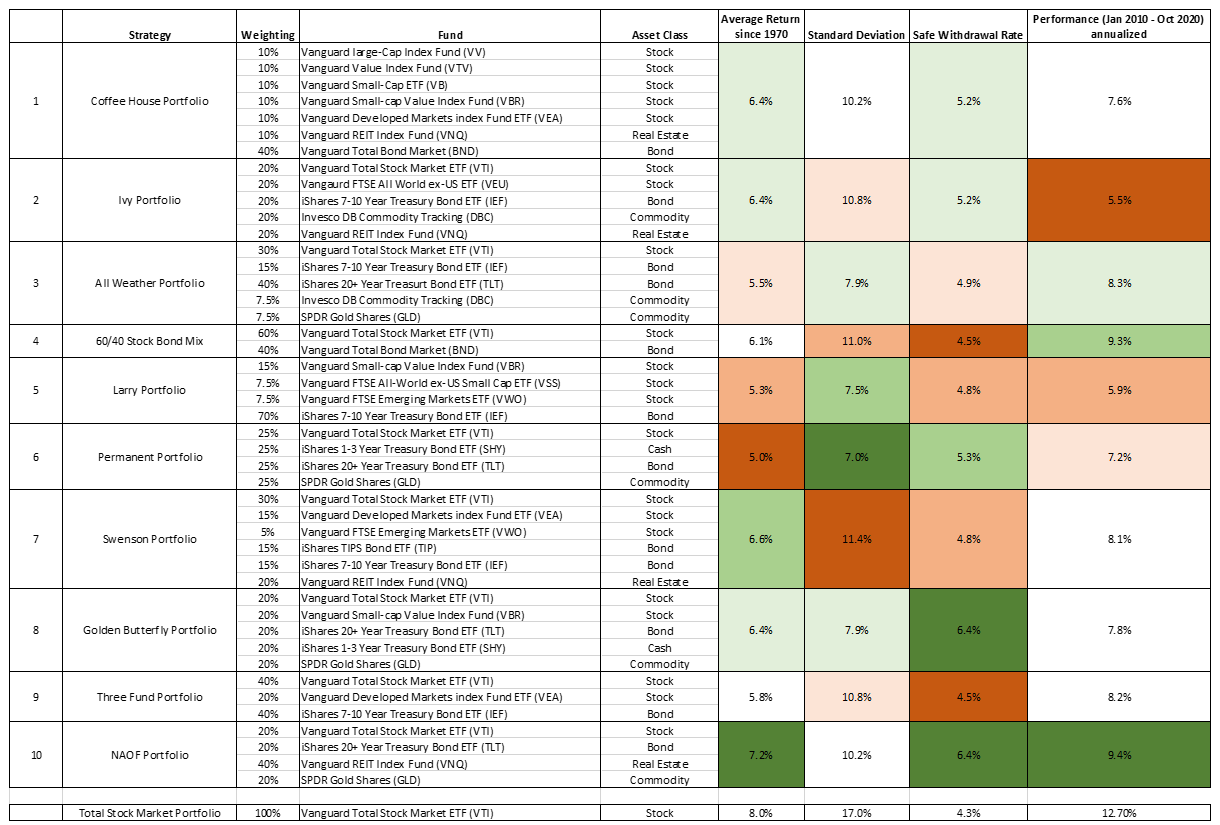

Investor Education Series: Portfolio Allocation Structure A proper portfolio structure is akin to the foundations of a house. It needs to be set right so that what goes on top