Top 3 Singapore Condos for Rent. Where are the most rentable condos in Singapore?

I have been curious about the rentability nature of condos here in Singapore and thus decided to dig a little deeper to uncover condos in Singapore that are worth looking at from a rental income standpoint.

Which are the condos in Singapore that can generate the highest amount of monthly net rental income, which is derived after deducting for one’s mortgage payment.

However, do note that having the highest net rental income does not necessitate that property being the best investment choice since I am not taking capital appreciation into account.

A property generating a high net positive rental income might be inferior to one where its monthly rental income is insufficient to cover its mortgage payment as a result of slower price appreciation potential for the former.

The ideal investment property is thus one where you generate a positive monthly capital inflow (rental income > mortgage payment) while concurrently enjoying strong capital appreciation from your property.

Is there such an ideal condo in Singapore out there?

Before I disclose the Top 3 most “rentable” condos in Singapore (based on certain assumptions and criteria), let’s look at some interesting statistics on the condo market in Singapore.

For my research, I focus on condos in Singapore that has a development size of at least 100 units since the project’s TOP from 2010 onwards. Thus, for developments below 100 units, they are being excluded from this list (this list is hence not all-encompassing).

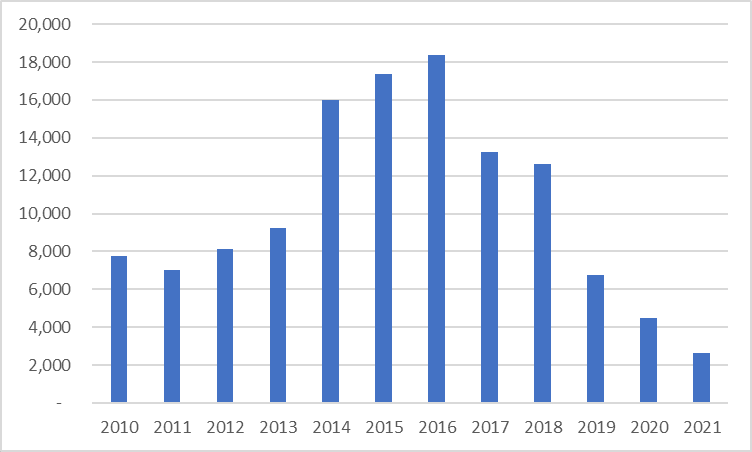

From 2010 to YTD2021, the total cumulative number of condo units (project size > or equal to 100 units) that came into the market was over 123,000 units.

As can be seen from the chart below, the average number of condo units that came into the market from 2010 to 2013 was approx. 8,000 units per year.

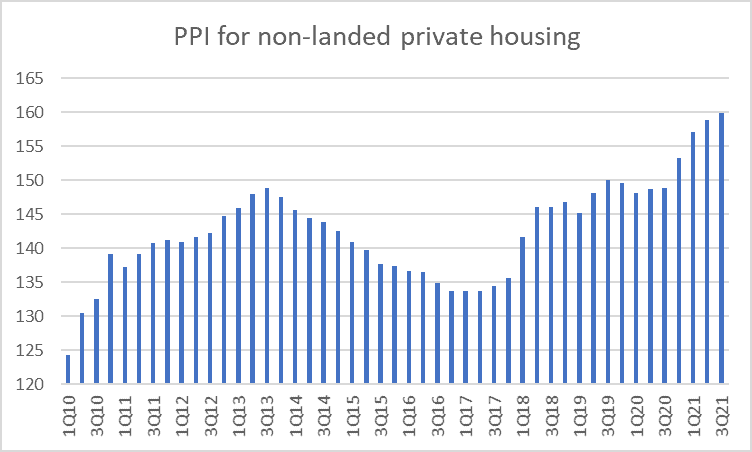

That figure ballooned to approx. 17,000 units per year from 2014 to 2016. The significantly large number of condo units coming into the market from 2014 to 2016 also coincided with the downturn in the private property sector in Singapore during the same period where the market peaked in 3Q13 (as represented by the property price index for non-landed private housing) and only found a bottom in 2Q17.

From 2017 to 2018, the number of completed projects declined to an average of about 13,000 per year, still significantly higher than the average level of completed projects at the start of the decade.

However, the decline in the number of condos entering the market from the previous 3 years (from 2014 to 2016) was sufficient to help alleviate some of the oversupply concerns which resulted in a recovery in prices seen in this segment of the property market.

A new peak was achieved in 3Q19 and following the minor price “blip” as a result of COVID-19 in 2020, the non-landed private housing saw a strong price surge from 4Q20 onwards with this segment prices currently at an all-time high (as represented by the PPI almost hitting 160 as of end-3Q21)

The strong pricing since 2019 was likely also the result of completed projects (projects with 100 units and more) falling to just 6,700+ units in 2019 and continued to decline to 4,470 units in 2020 and projected completion units of less than 3,000 in 2021 as the year comes to a close.

The stark contrast in terms of completed condos over the past 2-3 years vs. 2010-2018 could be one reason why property prices have performed well. A supply glut is no longer that evident and with COVID-19 hampering the time taken for condo projects to be completed as a result of manpower shortages, we might be seeing a couple more years of bullishness in property prices before supply starts flooding the market, triggering a property downcycle once again, in my humble view.

While the supply of new condo completion has fallen drastically over the past few years, this is partially negated by falling demand from foreigners/expatriates as a result of restricted entry into the country due to COVID-19.

2021 is likely to mark the bottom in terms of new “mega” project completions (at less than 3,000 units). According to preliminary data from SRX, the number of units coming online from projects with more than 100 units is expected to be approx. 7,000+ in 2022. This gels with the en-bloc fever which took place back in 2017/18, with many of those associated projects now coming to the tail-end of their development.

Is this going to mark the start of a new supply cycle potentially driving prices down in the coming years?

Where have completed condos been located since 2010?

Next, let’s take a look at where some of these “mega” projects are located since 2010.

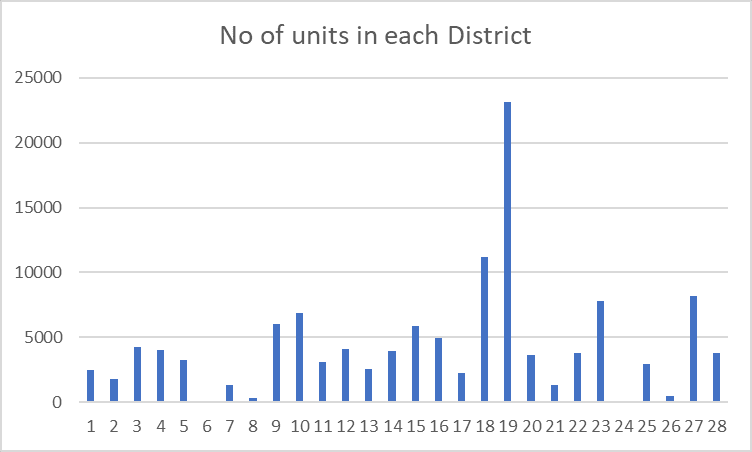

As can be seen from the chart above, the largest number of completed condos since 2010 can be found in District 19, with more than 23,000 new condo units made available since 2010.

This is not all that surprising considering that District 19 encompass relatively new towns such as Punggol and Sengkang where there are many existing HDB dwellers who wish to upgrade to a private property while remaining in a familiar vicinity.

District 18, another popular residential area comprising Pasir Ris and Tampines, is the second-highest with approx. 11,000 completed condos over the past decade and District 27 (Sembawang/Yishun) rounding up the Top 3 in terms of completed mega condo projects in this list.

2 districts have had zero mega project completions over the past decade. They are District 6 (City Hall/Clarke Quay) and District 24 (Lim Chu Kang/Tengah).

This could be the reason why the latest condo that was launched, Canninghill Piers, located in the Clarke Quay area, saw strong take-up rates over its launch weekend as a result of its “rarity”, with average prices going at a mind-boggling $3,000/psf.

The big question is: should one be investing in properties where supply is relatively “low” such as in District 1-8 when looking from the rentability angle?

Which District has the best rentability?

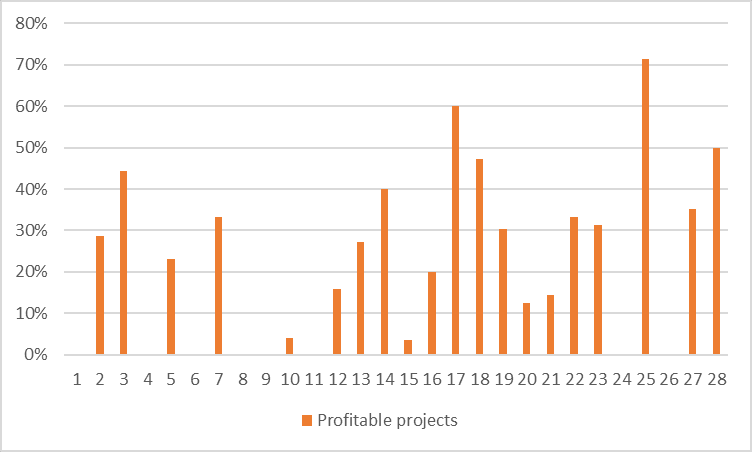

The definition of rentability here is from the angle of generating a net positive rental income. It is not about how high the unit can generate in terms of rental price/psf. Properties in the core central region will be able to command the highest rent/psf. However, that comes with a hefty price tag on the property and consequently a high mortgage payment as well.

The result is that these properties might not generate sufficient rental to be able to cover one’s monthly mortgage payment.

On the other hand, a condo located in the heartland such as in Punggol, will not be able to command a high rental amount on a psf basis vs. its CBD counterpart but because of its more affordable pricing, such a unit could generate a net positive rental income.

Before I disclose which are the districts with the best rentability, here are some assumptions that I used in my analysis:

- Rentability can be assessed based on a rental yield basis (gross rent/property price) or a net rental income basis (gross rent – mortgage payment). Most analysis is done on a rental yield basis where one derives a certain %. However, that does not demonstrate if one generates a monthly inflow or outflow. Hence, for greater clarity, I am adopting the net rental income basis although the conclusion (if similar assumptions are used) should be similar.

- The net rental income does not take into consideration the monthly maintenance fees of the condos in question.

- The assessment of rent is based on the smallest sized unit available in the condo. This is typically the 1-bedder unit which also commands the highest rent price/psf vs. other larger size units. Figures for rent/psf are based on current estimates provided by PropertyGuru and might not be representative of the actual scenario due to possible limited transactions.

- The monthly mortgage repayment amount is estimated based on the figure provided by PropertyGuru for the associated selling price, loan tenure (all at 30-years), and interest rate (all at 2%). For example, a 1-bedder unit going at $730,000 will require a total loan amount of $547,500 (75% of purchase price). Assuming a fixed loan tenure of 30 years and an annual interest rate of 2%, the monthly mortgage repayment is approx. $2,024.

- Net rental income is calculated as (rent price/psf * size of the unit in psf – monthly mortgage repayment)

Finding the rentability of the unit based on the above method might not be relevant for all since it is based on a repayment duration of 30 years at an assumed interest rate of 2%/annum. The alternate method as earlier mentioned is to look at the rentability from a yield angle.

On average, properties generating a gross yield of 3.3% and above will typically see a positive net rental income in today’s context.

Again, do note that the assessment here is done on the smallest sized units of the project (since we are coming from an investment angle) and the rental situation might not be representative for the larger sized units in the development.

Based on the initial data collated, the district with the highest number of “profitable” projects, aka projects where the net rental income is positive can be found in District 25 which is the Admiralty/Woodlands area. Close to 70% of condos in this area can generate positive net rental income.

Second in the list with the highest number of profitable projects in District 17 (Changi/Loyang) with 60% of condos generating positive net rental income and in third place is District 28 (Seletar/Yio Chu Kang) with approx. 50% profitable projects.

Projects closer to the Central Business District (CBD) are typically highly “unprofitable” from a rental income basis. While they typically command the highest rental price/psf, that is insufficient to offset the substantial mortgage cost as a result of the high purchase price/psf (which is typically north of $2,000/psf).

As can be seen from the earlier chart, condo projects in District 1-11 which are closer to the CBD have a very low profitability rate from a rental perspective. However, that is not to say that these properties make for bad investment options as their capital appreciation potential might be substantial.

Which are the Top 3 projects based on rentability?

Based on my data collated (which I am in no way guaranteeing its accuracy and is subjected to the various assumptions used. Please do your due diligence when it comes to making your property purchase decision), the Top 3 profitable projects from a rental income perspective are as such:

Best Singapore Condo for Rent #3: Principal Garden

According to the data collated, #3 in this list out of a total of 338 condo projects which TOP since 2010 (projects with > 100 units) is Principal Garden

Nestled in a quiet enclave overlooking the Alexandra Canal, Principal Garden sits on the frontier of the embassy district (District 10), Bishopgate, Alexandra and the Chatsworth Park Good Class Bungalow estate.

The development comprised of 663 units set over 4 elevated towers. Its novel “80-20 garden living” concept creates a green and tranquil environment despite Principal Garden Residents being able to be in the CBD – via car, MRT or bicycle in 20 minutes.

The development also comes with many facilities, including a tennis court, half basketball court and a 50-meter lap pool.

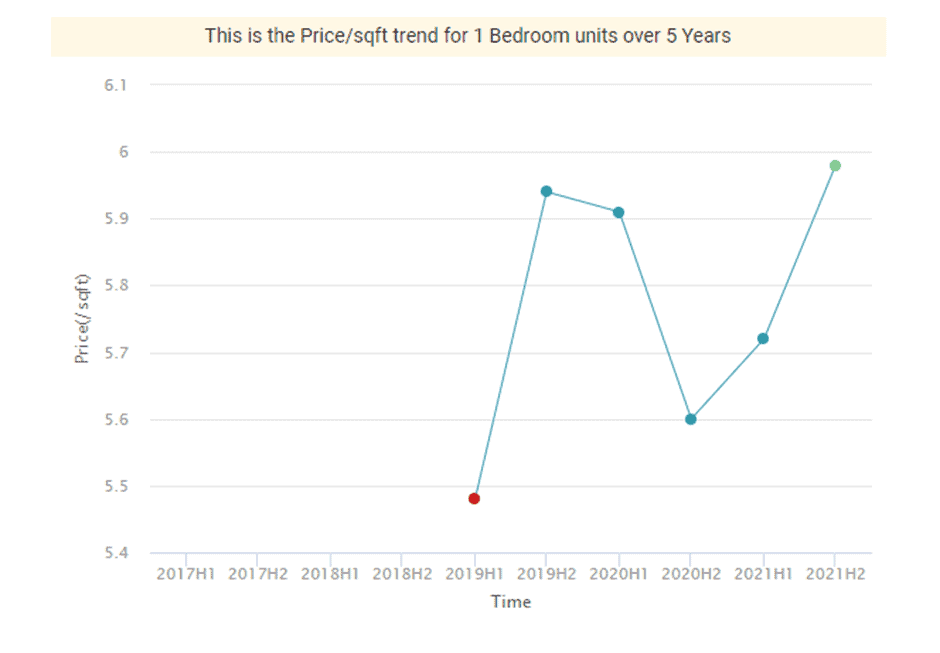

For our assessment, we looked at the project’s 1-bedroom unit which commands a rental price of $5.98/psf, according to data from PropertyGuru.

In terms of rental transactions, most of the 1-bedder rents have been transacted at monthly rental prices of between $2,600-$3,100. In our analysis, we are looking at a 484 sqft 1-bedder with a rental price of $5.98/psf. This translates to a gross rental yield of close to $2,894/month which falls within the range of recently transacted prices.

For a 484 sqft apartment, we assumed a purchased price of $1,840/sqft, translating to an absolute amount of $890,000. When it was first launched back in 2015, 1-bedders had an initial starting price of $770,000, translating to a psf price of approx. $1,590-$1,600/psf.

Assuming that one can command a gross rental income of $2,894/month, the net rental income is approx. +$427, using a monthly mortgage repayment amount of $2,467.

Based on these prices, the unit has a rental yield of approx. 3.9%.

Best Singapore Condo for Rent #2: Skysuites@Anson

Number 2 in this list is a project right smack in the CBD area. Skysuites @ Anson is a leasehold condominium development that is located at Enggor Street in District 2. The project was completed in 2015 with a total of 360 units available for sale or rent.

The condominium development is located close to public transportation that allows residents to move easily from one place to another from the condominium. There are many shops and amenities close to the condominium development which would ease the process for residents and they do not need to go far to find what they need.

The project was developed by Arcadia Development Pte Ltd, a boutique property development company that has built only this project in Singapore.

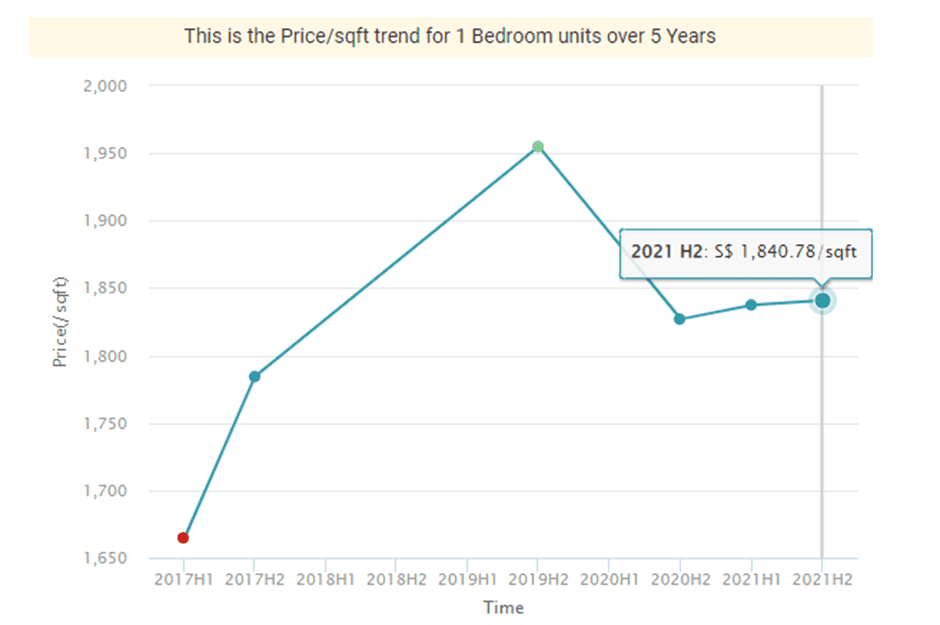

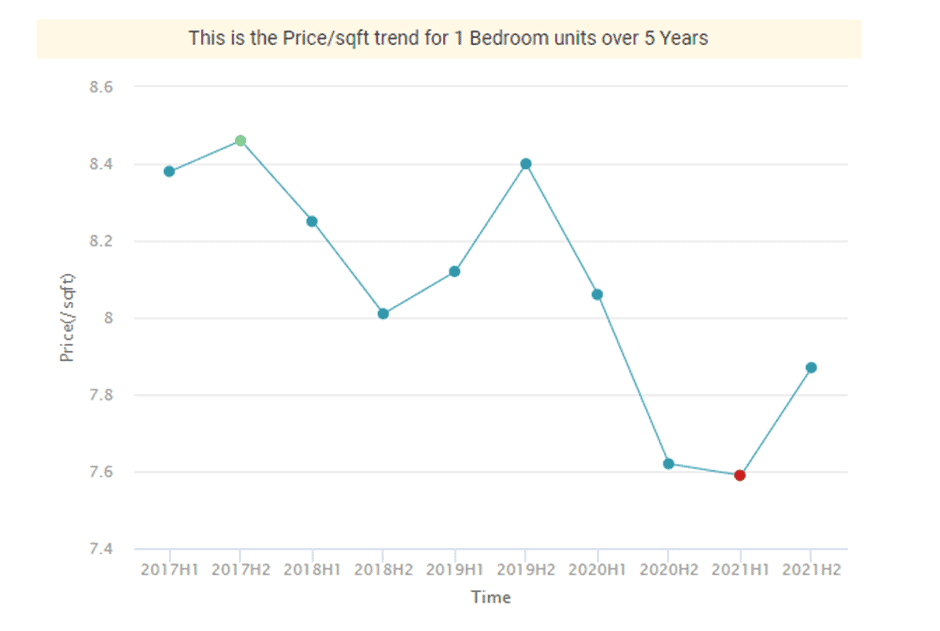

Its 1-bedder unit can command an average rental income of $7.8/sqft which is the highest of all the projects on this list. This is down from the peak back in 2H17 where rent went as high as $8.40/sqft.

Based on a size of approx. 365 sqft for a 1-bedder, that translates to a monthly rental income of $2,843. According to PropertyGuru, rentals for 1-bedder have been transacted at around $2,500-$3,100 over the past months.

We took a brief look at some of the 1-bedder 365 sqft units listed for rental and the asking price ranges from $2,700-$2,900/month for these units.

We assumed a selling price of $2,328/sqft for a 1-bedder studio unit (365 sqft) where multiple units are currently listed for around that price. The notional property amount will translate to $850,000.

Based on the projected loan amount of $637,500 for 30 years at an annual interest rate of 2%, the monthly mortgage repayment is approx. $2,356/month.

This will translate into a net rental income of close to $490/month. The projected rental yield will be approx. 4% in such a scenario.

While Skysuites@Anson offers one of the best rental yields in the CBD region, an initial investment back in 2013 when it was first launched and its second-trench of relaunched in 2017 would likely have resulted in capital losses.

Prices for its smallest 1-bedder were priced at a hefty $968,000 starting price when it was first launched in 2013 and even after discounts made in 2017 for its remaining units, 1-bedders were still priced between $860,000-$990,000.

This goes to show that a CBD condo apartment, while it might sound prestigious, is no guarantee of investment success.

Best Singapore Condo for Rent #1: Forestville

The honor of most “rentable” projects in this list of 338 condos goes to Forestville, a leasehold executive condominium development that is located at Woodlands Drive in District 25. The project was completed in 2016 with a total of 653 units available for sale or rent.

The executive condominium development is located close to Woodlands South MRT Line which is on the Thomson East Coast Line and when this line is fully completed in 2024/25, commuters will be able to travel from Woodlands South to Orchard in just 11 stops.

The project was developed by Hao Yuan Investment Pte Ltd, a small-scale property development company held privately, and it has developed about 4 property projects in Singapore.

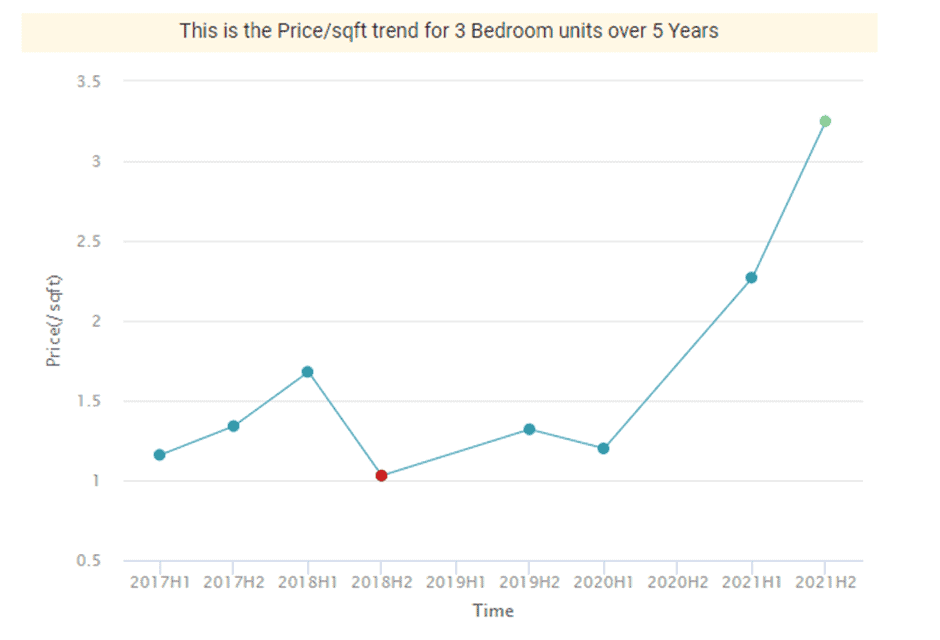

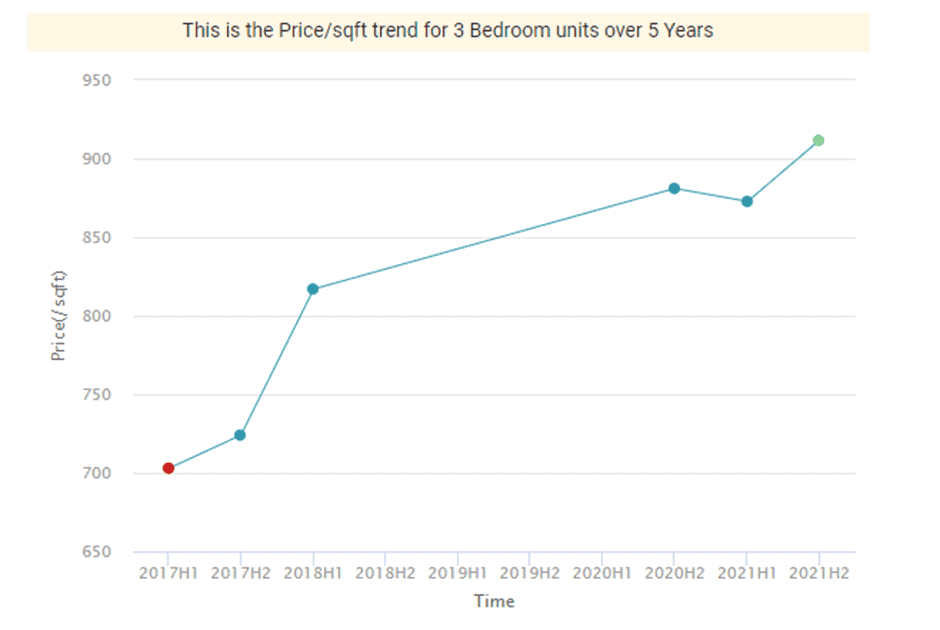

The rental for this project has skyrocketed over the past 5 years, hitting a high of $3.25 /sqft for its 3-bedroom units (smallest in this project which is mainly catered for family-living). For 3-bedders, recent rental transactions have been concluded at approx. $3,200-$3,600.

Assuming a unit size of 1,098 sqft for a 3-bedder unit and a rental of $3.11/psf, that translates to approx. $3,400/month in rental income.

3-bedders in Forestville are currently being priced at $910/psf, up from $700/psf in 2017. Assuming a 1,098 sqft unit can be purchased for that pricing, that works out to a purchase price of $1m and a monthly mortgage loan of $2,772.

With a rental income potential of $3,415, this works out to be a net rental income of $643 after deducting the mortgage loan amount. This project has the highest rental yield of 4.1% in our entire list of condo projects.

Conclusion

This article is meant to be a sharing session on the rentability of condos in Singapore and its accuracy cannot be fully verified since various assumptions are involved, hence for readers of NAOF, please do your due diligence.

The most rentable project in this list, Forestville, is a pretty surprising candidate, one which is developed by a small-scale developer. Nonetheless, this is a profitable project for those who purchased the unit at $700/sqft back in 2017, for a CAGR of 7% during this 4-years holding horizon.

Nearby condos such as Twin Fountains ($1,042/psf) and Bellewoods ($1,125/psf) are transacted at a higher price/psf for similar size units. This could potentially mean greater price appreciation potential for Forestville over the coming years.

Based on my initial assessment, most of the profitable projects from a rental standpoint stem from condos outside of the central region. This is likely due to the lower purchase price point of these projects vs. their CBD/town counterparts which translates to higher rental yield/lower mortgage costs.

While these “heartland” condos might not be as prestigious as their swanky high-end counterparts based in town, they might potentially be better investment candidates as Singapore look to decentralize its office spaces and bring work spaces closer to the masses over the coming decade.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Ultimate HDB BTO Guide and tips for an ideal flat selection in 2021

- Executive Condo Singapore: Which is the best performing ECs of all time?

- 12 Tips To Select A Good Unit At A New Launch Project

- Selling your EC Right after MOP or upon Privatisation? Which is better?

- Is Tengah a good home and investment? A comprehensive guide to Tengah

- The average salary in Singapore 2021: Can you afford a condo with your income?